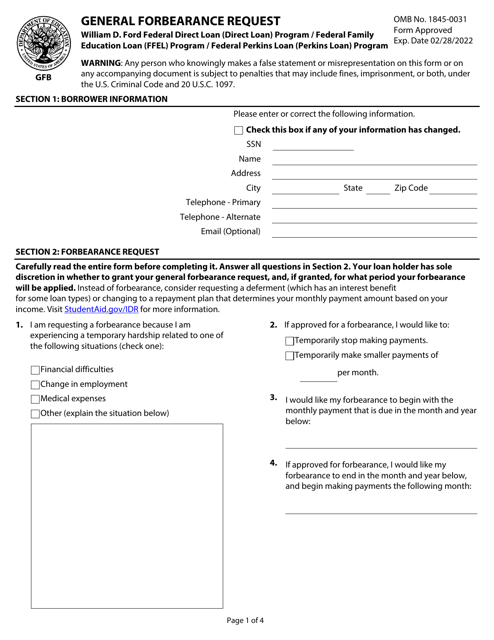

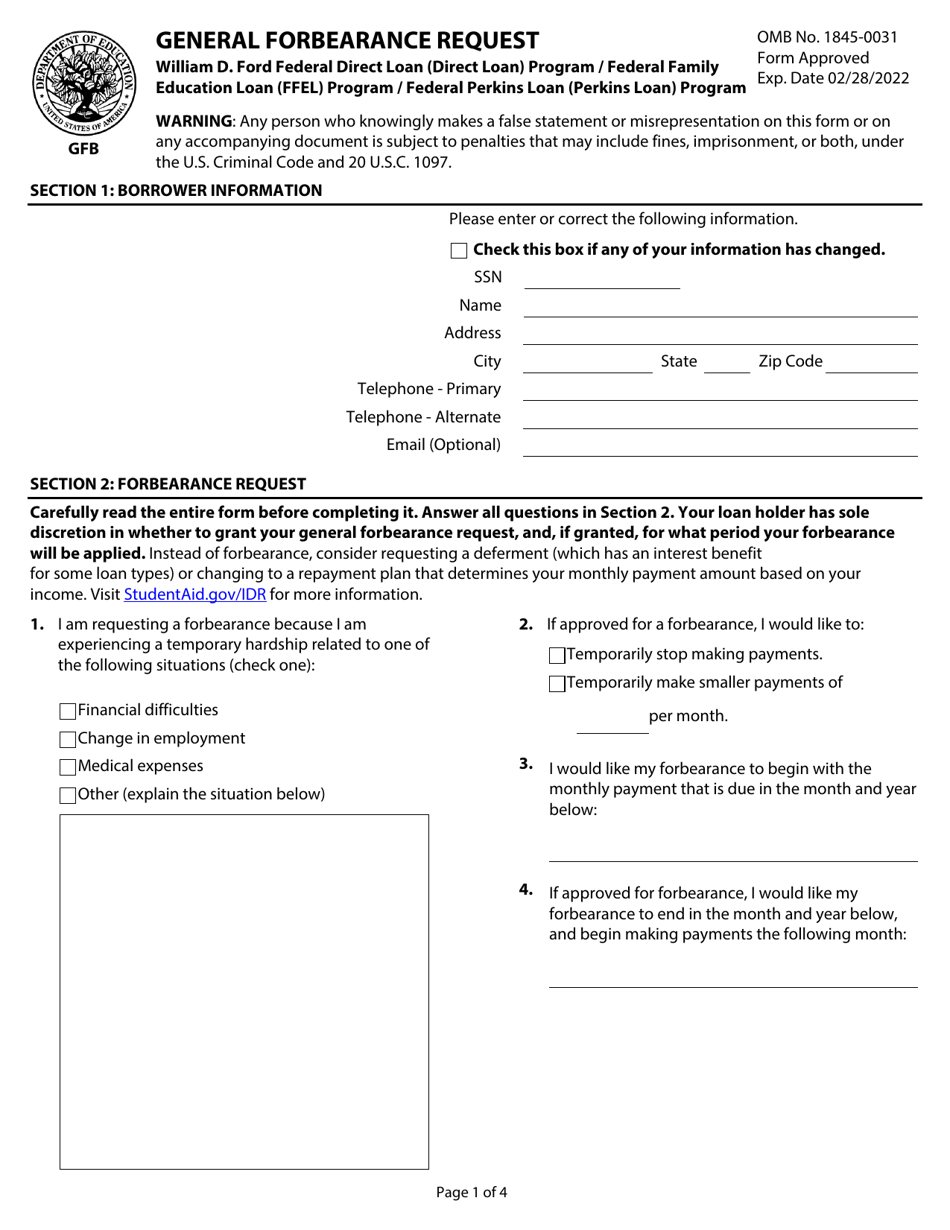

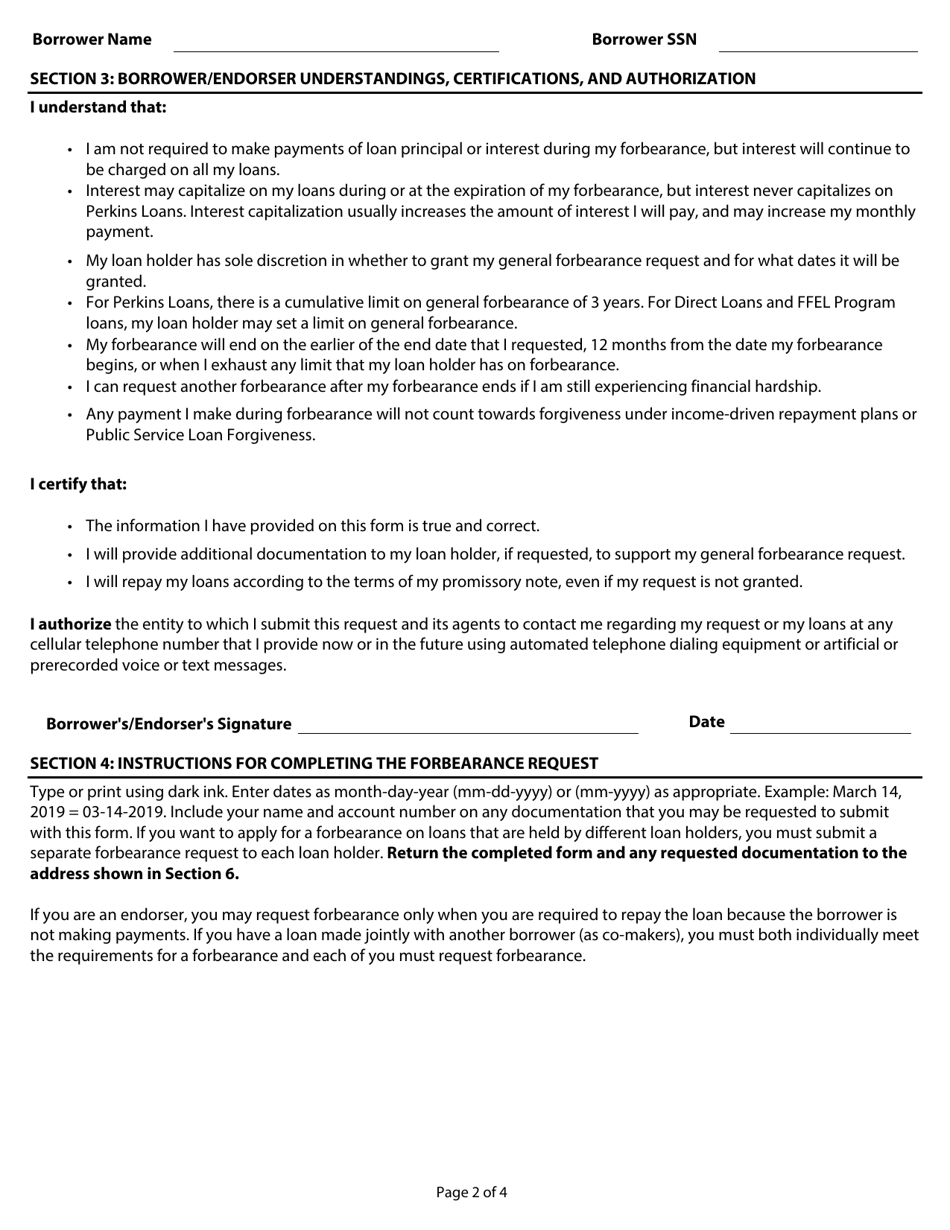

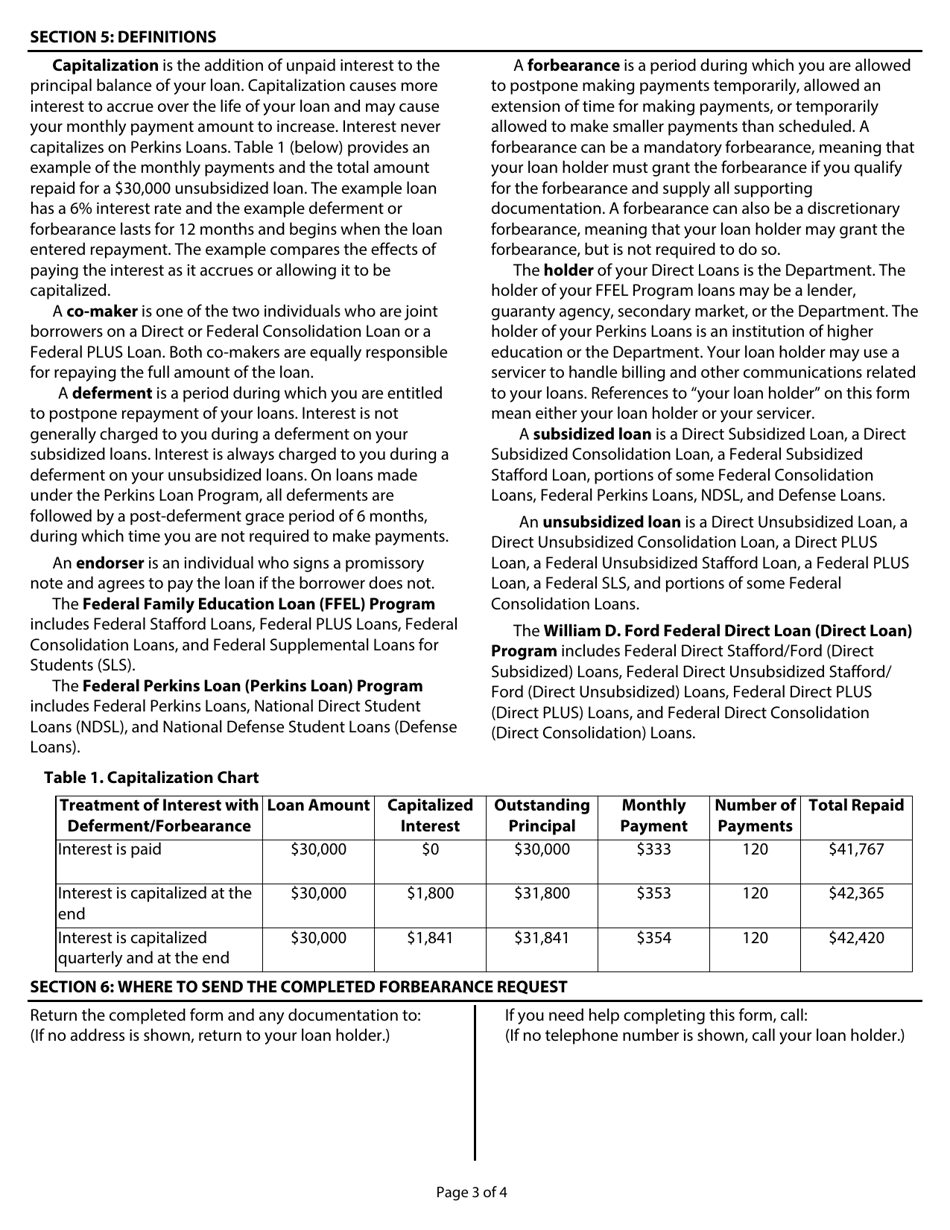

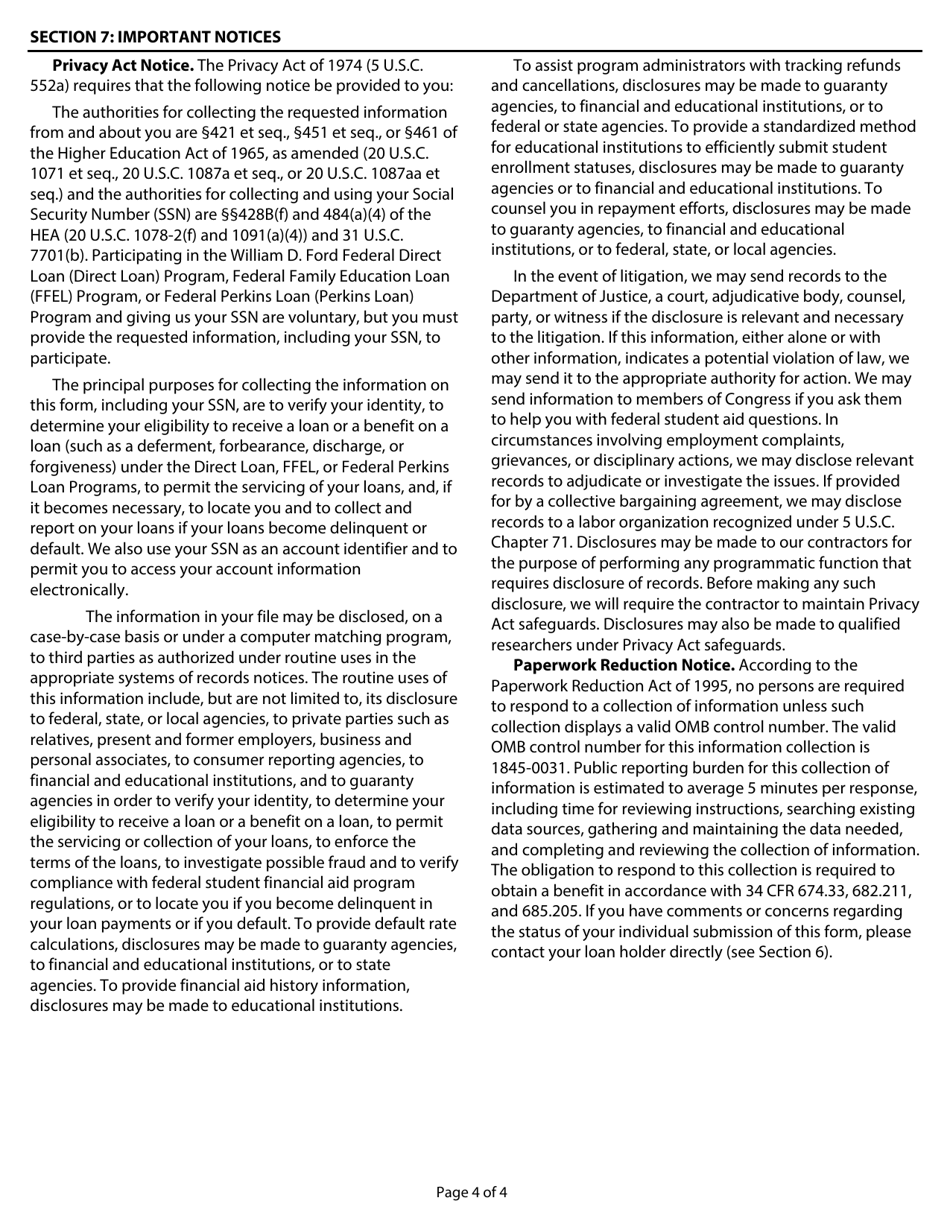

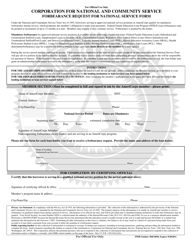

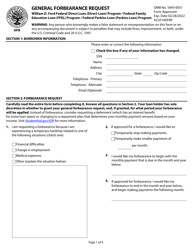

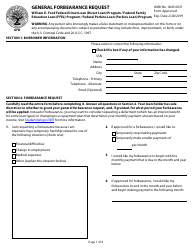

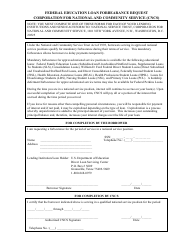

General Forbearance Request

General Forbearance Request is a 4-page legal document that was released by the U.S. Department of Education and used nation-wide.

FAQ

Q: What is a general forbearance request?

A: A general forbearance request is a request made to temporarily stop or reduce loan payments for a certain period of time.

Q: How long can a general forbearance request last?

A: A general forbearance request can typically last for up to 12 months.

Q: Who can request a general forbearance?

A: Any borrower with eligible federal student loans can request a general forbearance.

Q: How do I request a general forbearance?

A: To request a general forbearance, you need to submit a forbearance request form to your loan servicer or lender.

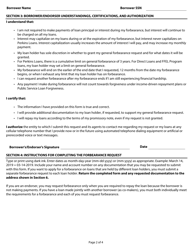

Q: Will interest continue to accrue during a general forbearance?

A: Yes, interest will continue to accrue on your loan during a general forbearance.

Q: Do I need to provide documentation for a general forbearance request?

A: It depends on the loan servicer or lender. Some may require documentation, while others may not.

Q: Can I make payments on my loan during a general forbearance?

A: Yes, you can still make payments on your loan during a general forbearance if you choose to do so.

Q: Can I request a general forbearance if I am already in default on my loan?

A: Yes, you can request a general forbearance even if you are already in default on your loan.

Q: Will a general forbearance request affect my credit score?

A: A general forbearance request itself will not directly affect your credit score. However, if you miss payments before the forbearance is granted, it may negatively impact your score.

Q: Can I request multiple general forbearances?

A: Yes, you can request multiple general forbearances, but the total forbearance period cannot exceed 12 months.

Form Details:

- The latest edition currently provided by the U.S. Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.