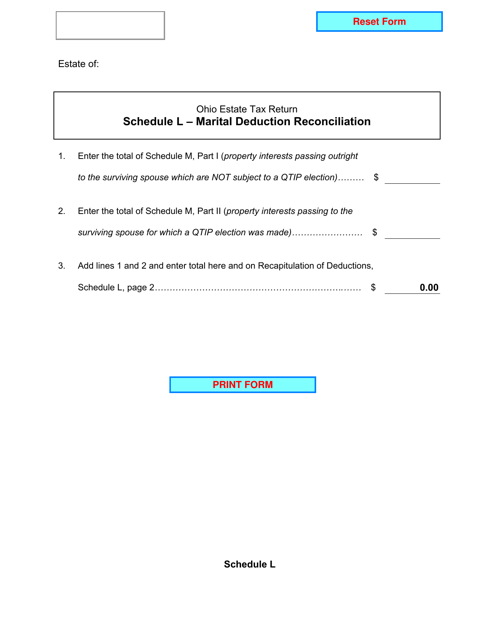

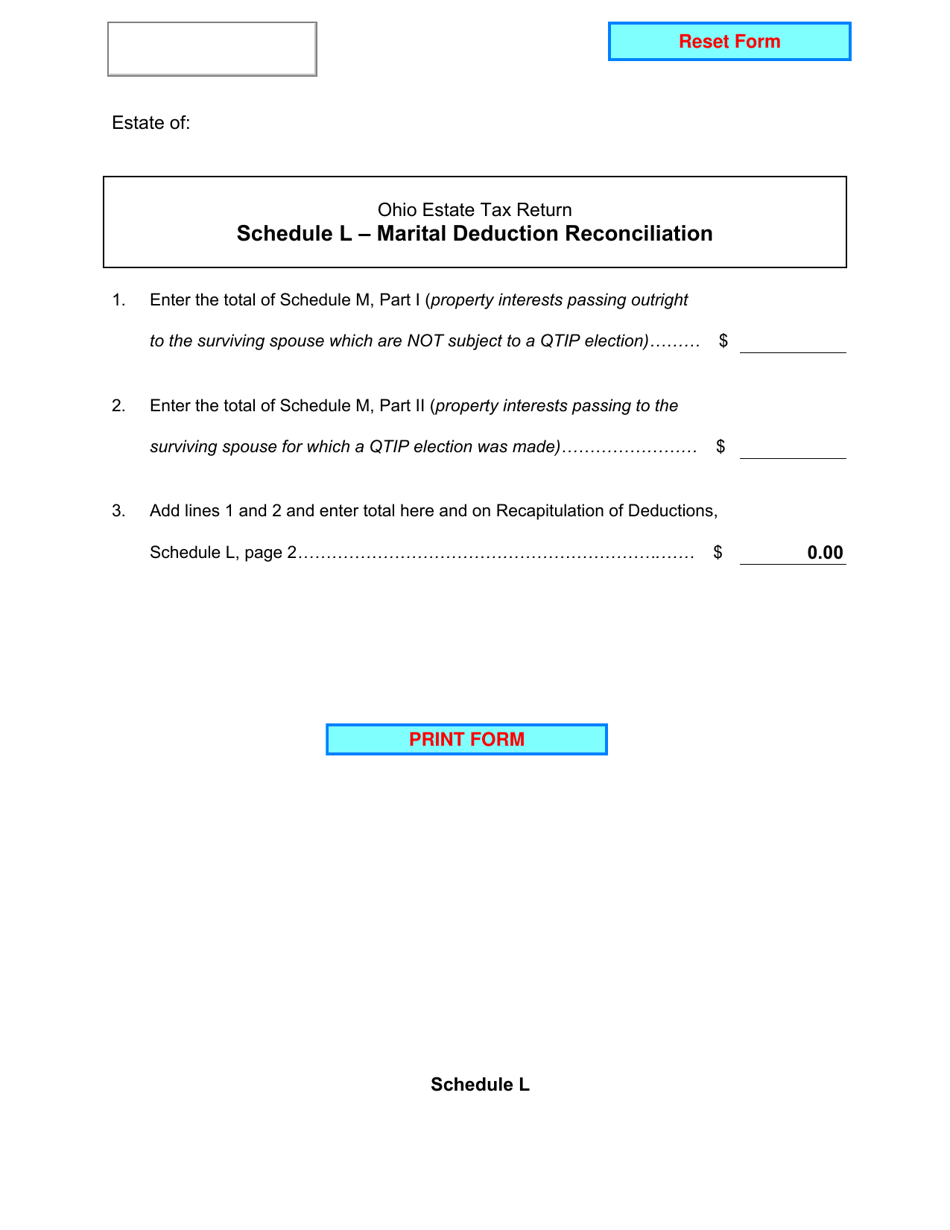

Schedule L Marital Deduction Reconciliation - Ohio

What Is Schedule L?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule L Marital Deduction Reconciliation?

A: Schedule L Marital Deduction Reconciliation is a form used in Ohio to calculate the amount of marital deduction allowed on the federal estate tax return.

Q: Who needs to file Schedule L Marital Deduction Reconciliation?

A: Executors or administrators of an Ohio estate that is required to file a federal estate tax return may need to file Schedule L Marital Deduction Reconciliation if applicable.

Q: How does Schedule L Marital Deduction Reconciliation work?

A: Schedule L Marital Deduction Reconciliation reconciles the allowable marital deduction on the federal estate tax return with the allowable marital deduction on the Ohio estate tax return.

Q: What information is required to complete Schedule L Marital Deduction Reconciliation?

A: To complete Schedule L Marital Deduction Reconciliation, you will need information such as the federal estate tax return data, the Ohio estate tax return data, and any applicable adjustments.

Q: When is Schedule L Marital Deduction Reconciliation due?

A: Schedule L Marital Deduction Reconciliation is generally due on the same date as the federal estate tax return, which is nine months after the decedent's date of death.

Form Details:

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule L by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.