This version of the form is not currently in use and is provided for reference only. Download this version of

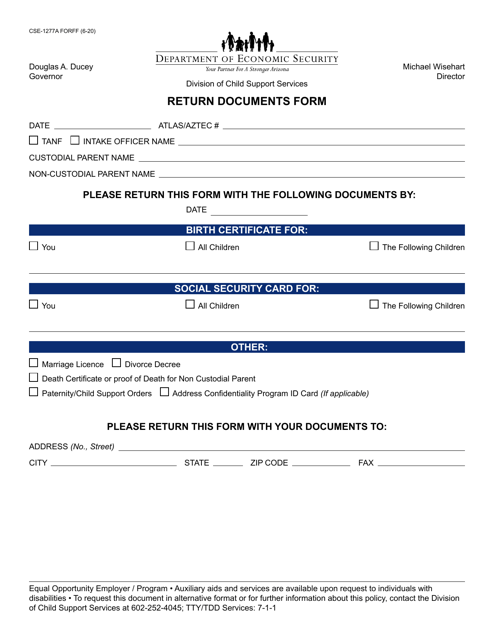

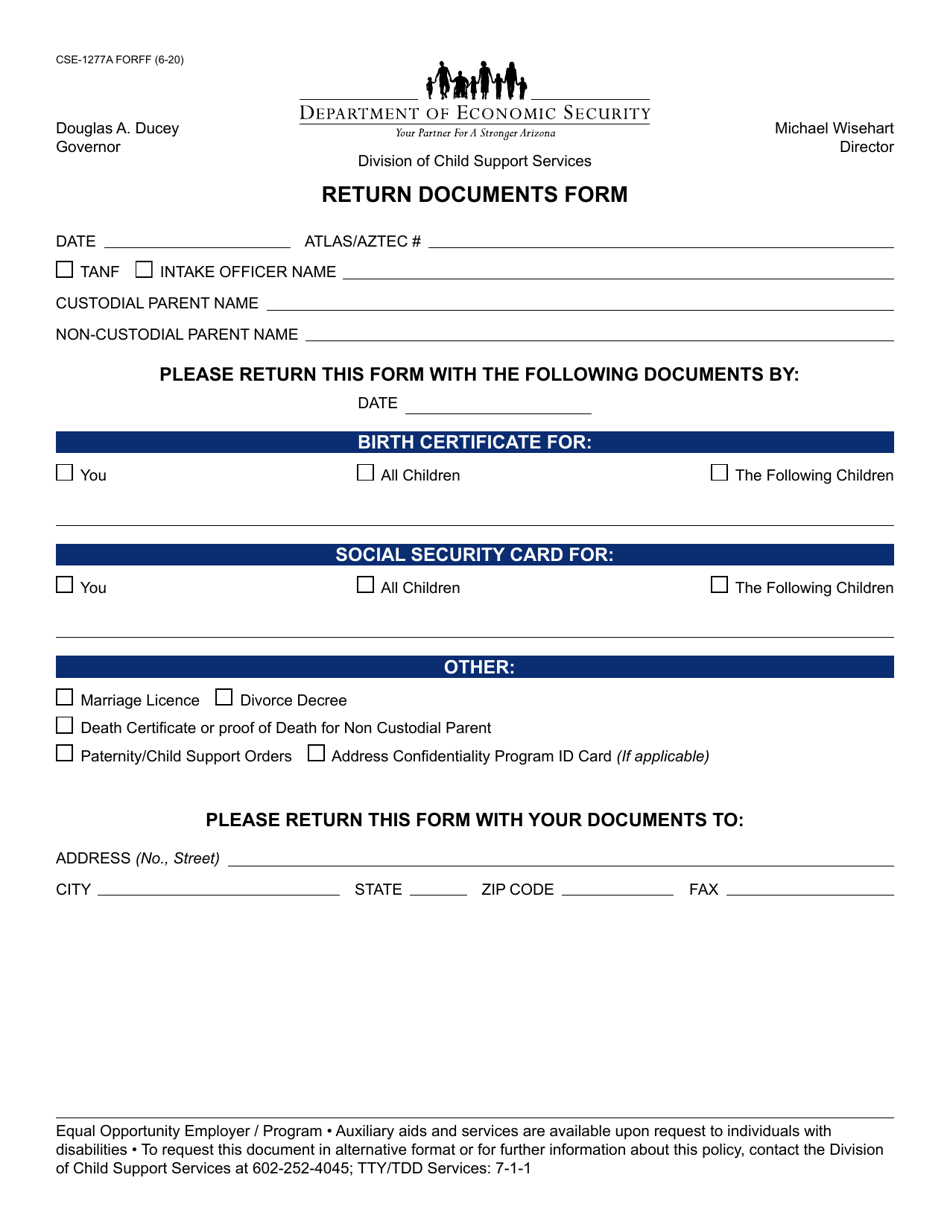

Form CSE-1277A

for the current year.

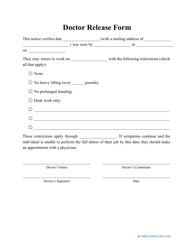

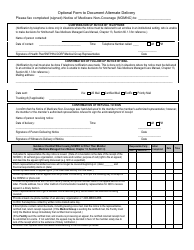

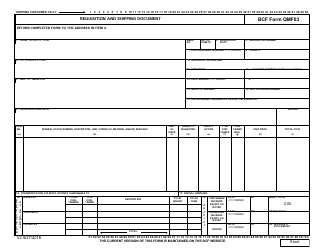

Form CSE-1277A Return Documents Form - Arizona

What Is Form CSE-1277A?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CSE-1277A form used for?

A: The CSE-1277A form is used for filing return documents in Arizona.

Q: Do I need to fill out the CSE-1277A form if I don't live in Arizona?

A: No, the CSE-1277A form is specifically for residents of Arizona.

Q: What information is required on the CSE-1277A form?

A: The CSE-1277A form requires information such as your name, address, and details about your income.

Q: Is there a deadline for filing the CSE-1277A form?

A: Yes, the CSE-1277A form must be filed by the specified deadline, usually April 15th.

Q: Are there any fees associated with filing the CSE-1277A form?

A: There may be fees associated with filing the CSE-1277A form, depending on your specific circumstances.

Q: What should I do if I need assistance with the CSE-1277A form?

A: If you need assistance with the CSE-1277A form, you can seek help from the Arizona government's tax assistance services or consult a tax professional.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CSE-1277A by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.