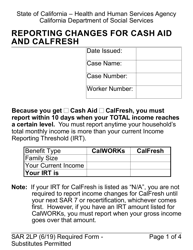

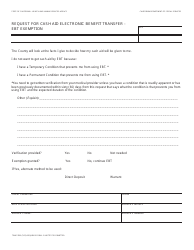

Form SAR2 Reporting Changes for Cash Aid and Calfresh - California

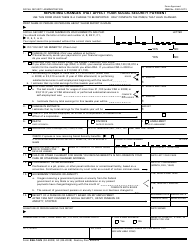

What Is Form SAR2?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

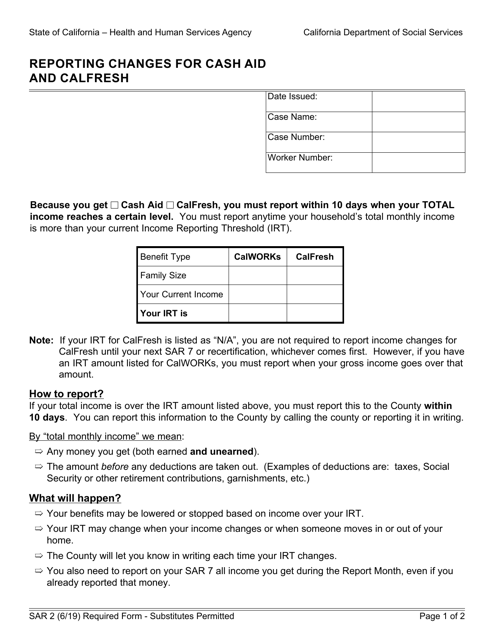

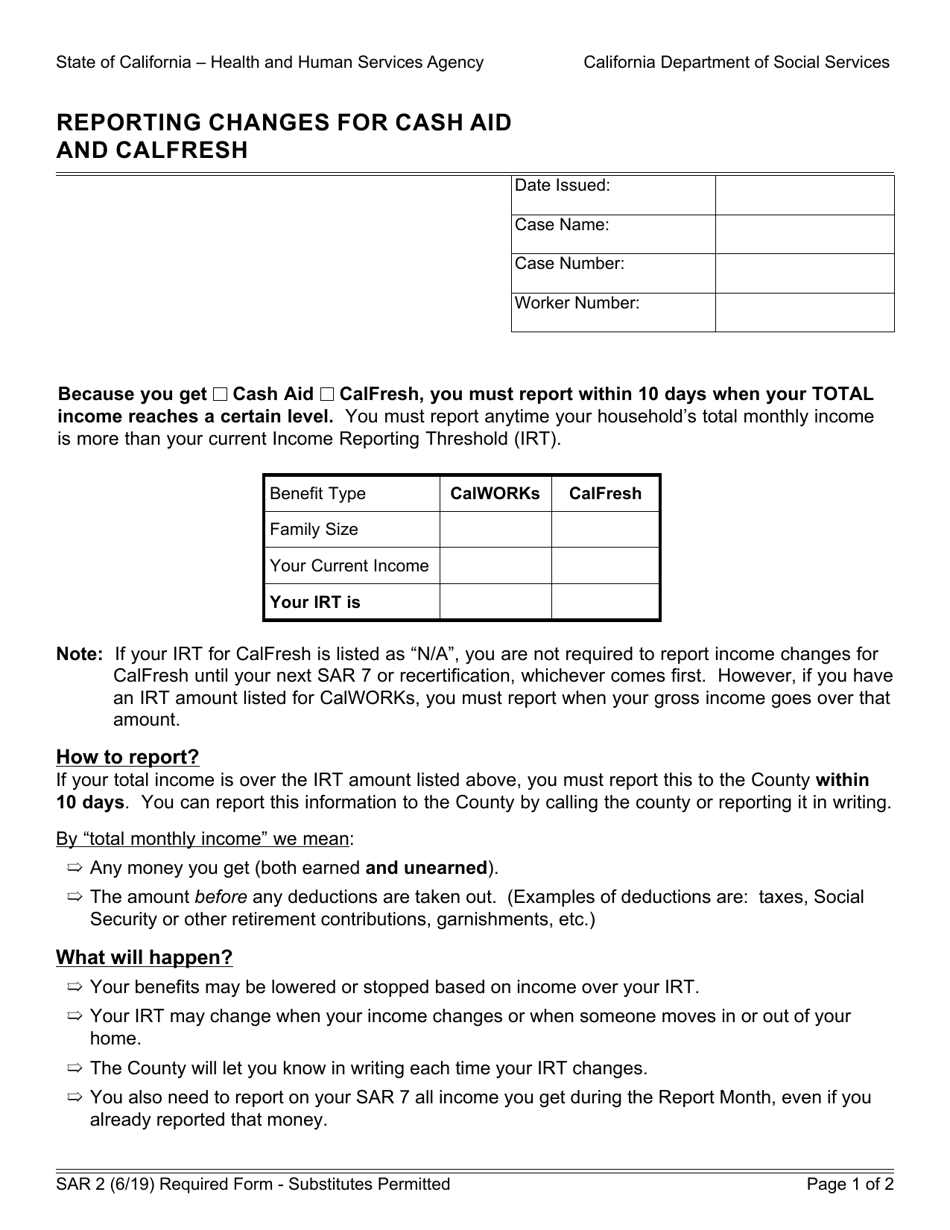

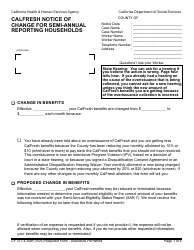

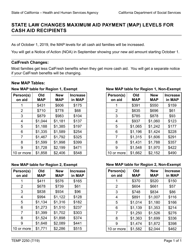

Q: What are the SAR2 reporting changes for cash aid and CalFresh in California?

A: The SAR2 reporting changes for cash aid and CalFresh in California involve updating and providing accurate information about your household's income, household members, and changes in circumstances.

Q: Why do I need to report changes for cash aid and CalFresh?

A: You need to report changes for cash aid and CalFresh to ensure that you are receiving the correct amount of benefits based on your current circumstances and income.

Q: What kind of changes do I need to report?

A: You need to report changes such as changes in household income, changes in household members, changes in address, and any other changes that may affect your eligibility or benefit amount for cash aid and CalFresh.

Q: When do I need to report changes for cash aid and CalFresh?

A: You need to report changes for cash aid and CalFresh within 10 days of the change occurring to ensure that your benefits are adjusted accordingly.

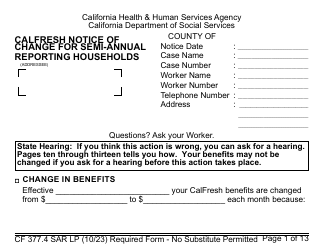

Q: What happens if I don't report changes for cash aid and CalFresh?

A: If you fail to report changes for cash aid and CalFresh, you may receive benefits that are either higher or lower than what you are eligible for, which can result in overpayments or underpayments that will need to be corrected.

Q: Can I be penalized for not reporting changes for cash aid and CalFresh?

A: Yes, if you intentionally fail to report changes for cash aid and CalFresh, you may be subject to penalties such as fines or loss of benefits.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SAR2 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.