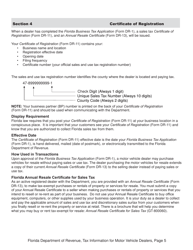

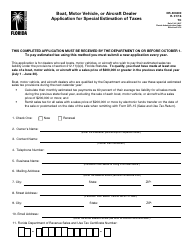

Tax Information for Motor Vehicle Dealers - Florida

Tax Information for Motor Vehicle Dealers is a legal document that was released by the Florida Department of Revenue - a government authority operating within Florida.

FAQ

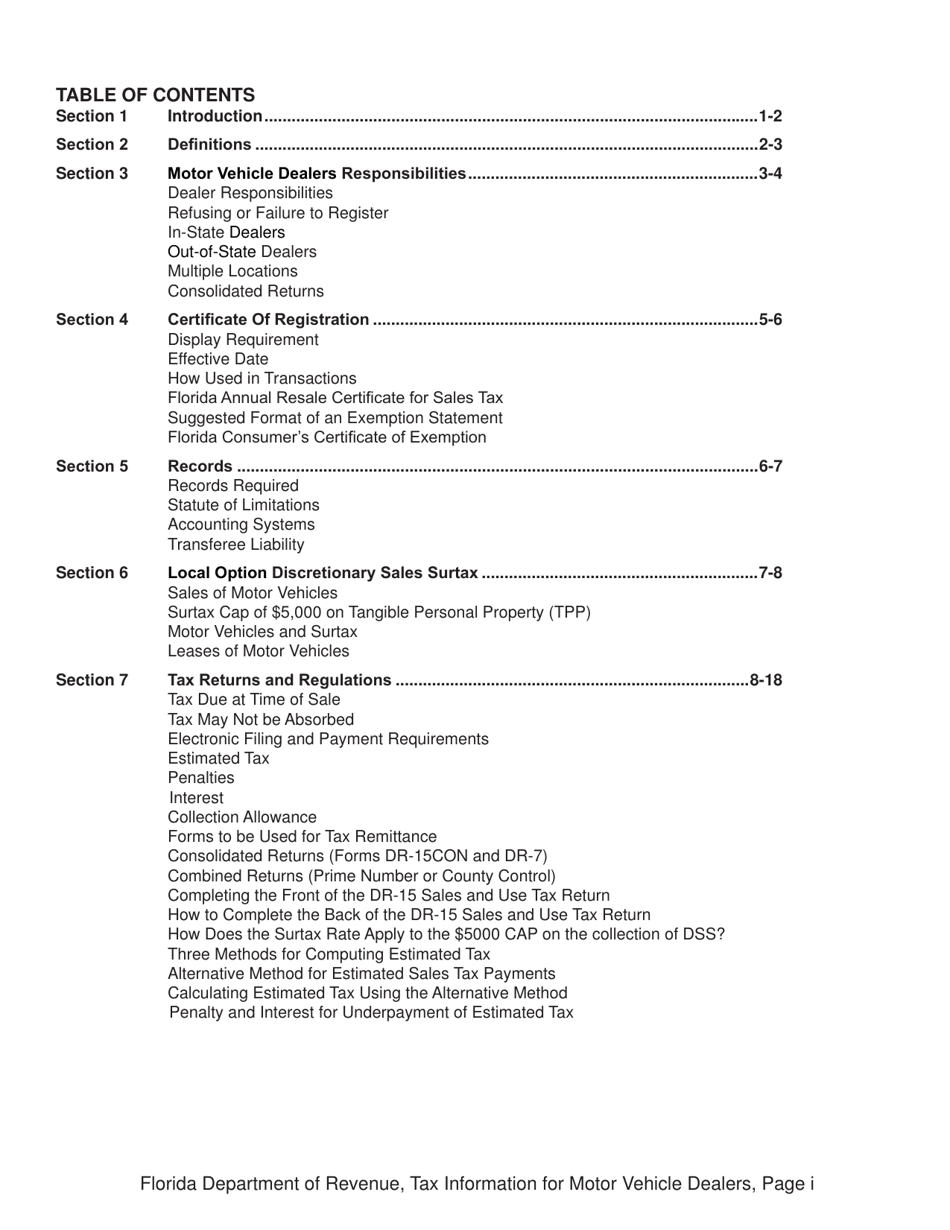

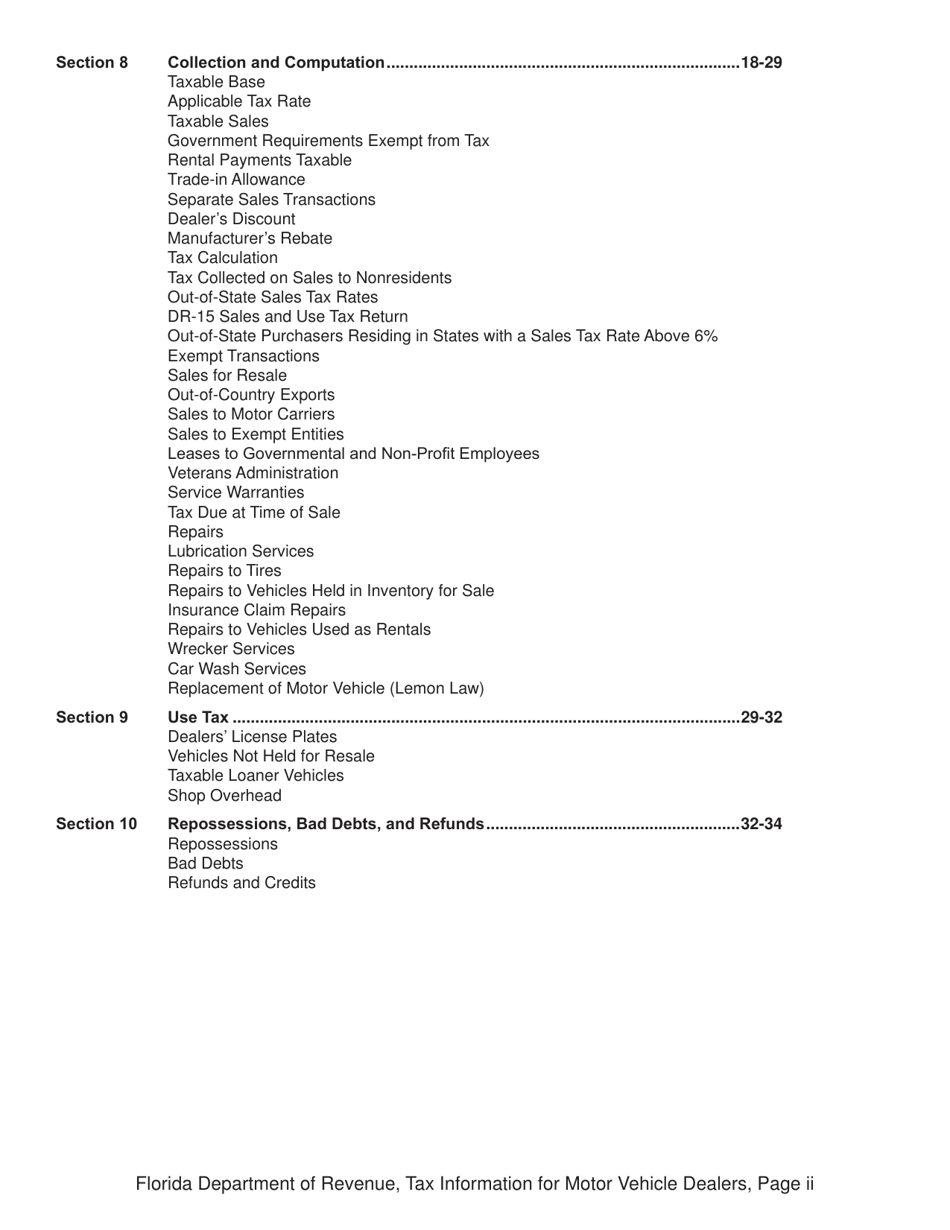

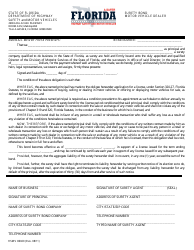

Q: Who needs to pay taxes as a motor vehicle dealer in Florida?

A: Motor vehicle dealers in Florida are required to pay taxes.

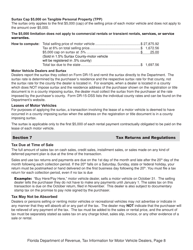

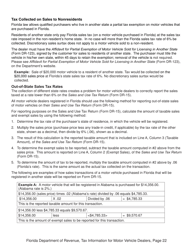

Q: What type of taxes do motor vehicle dealers in Florida need to pay?

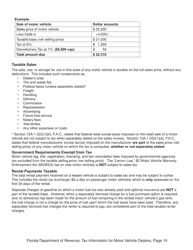

A: Motor vehicle dealers in Florida need to pay sales and use taxes.

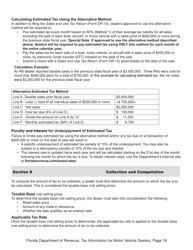

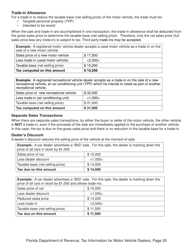

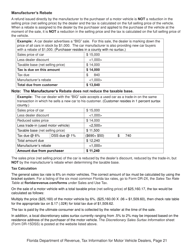

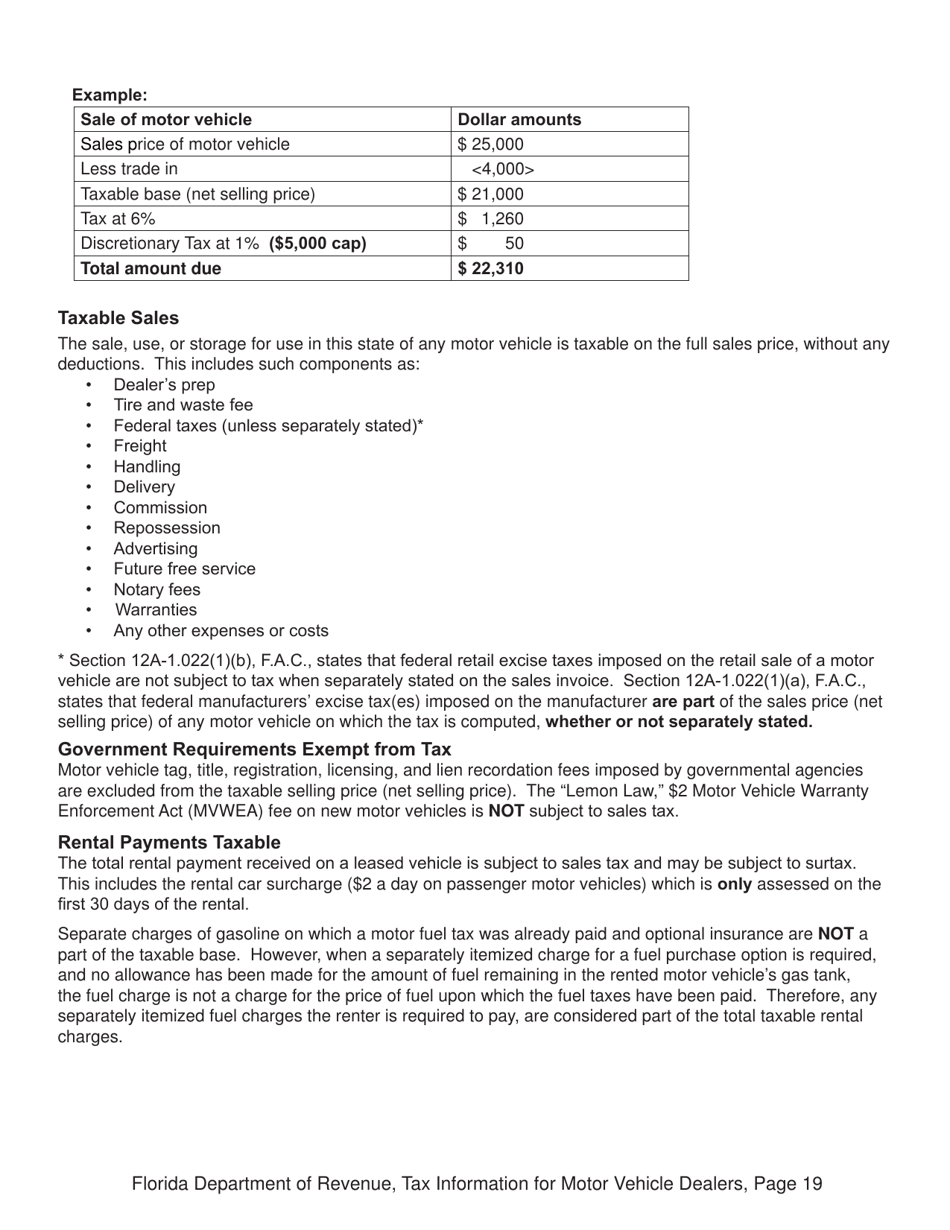

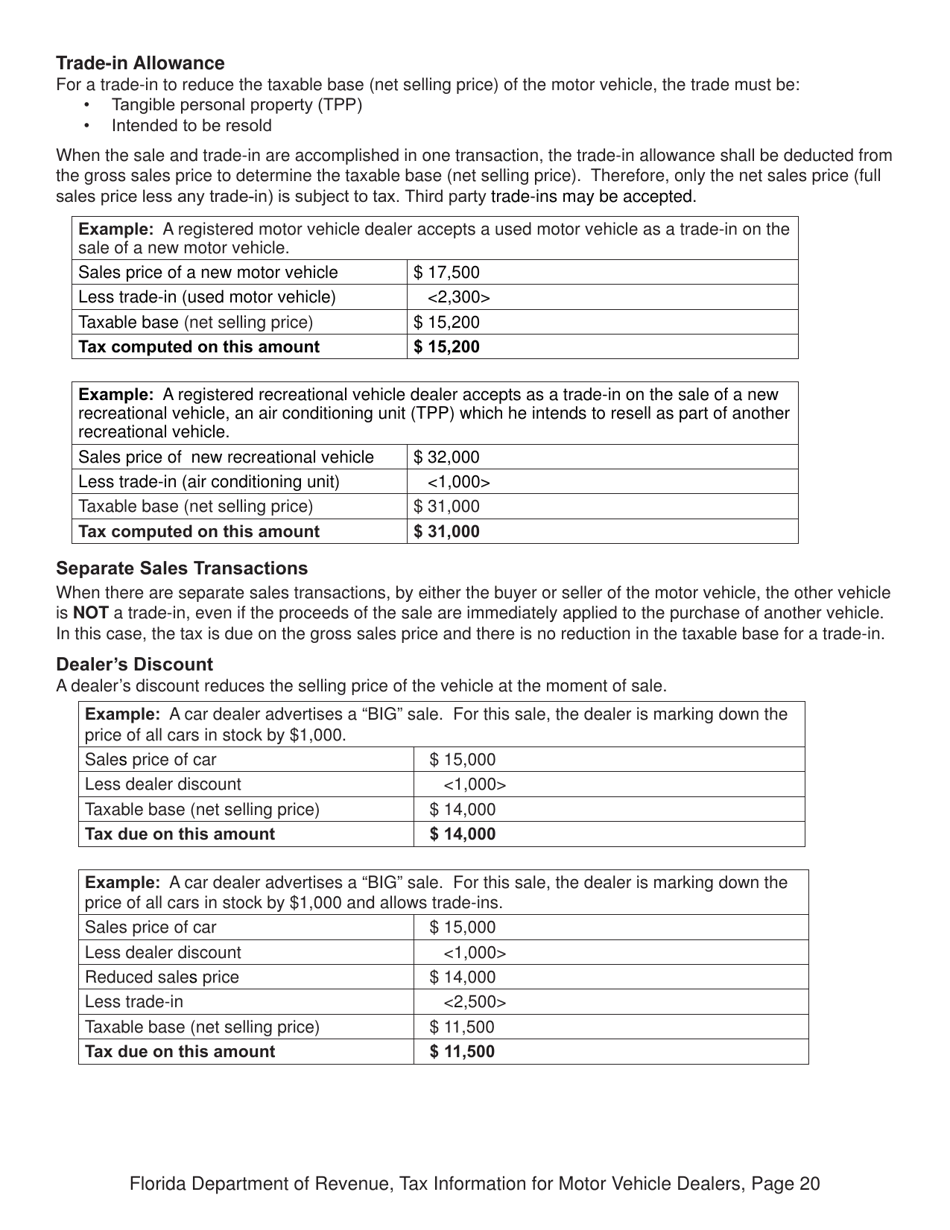

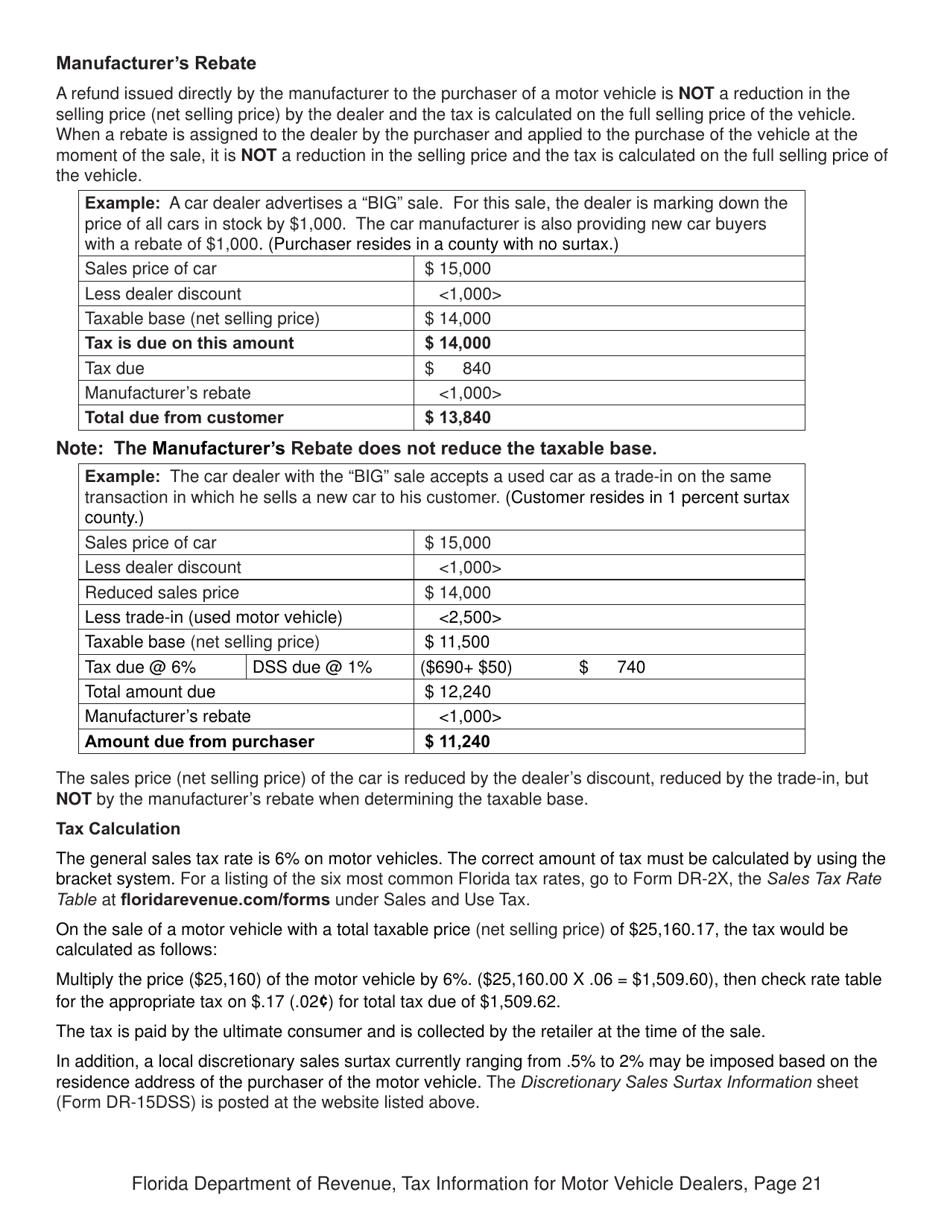

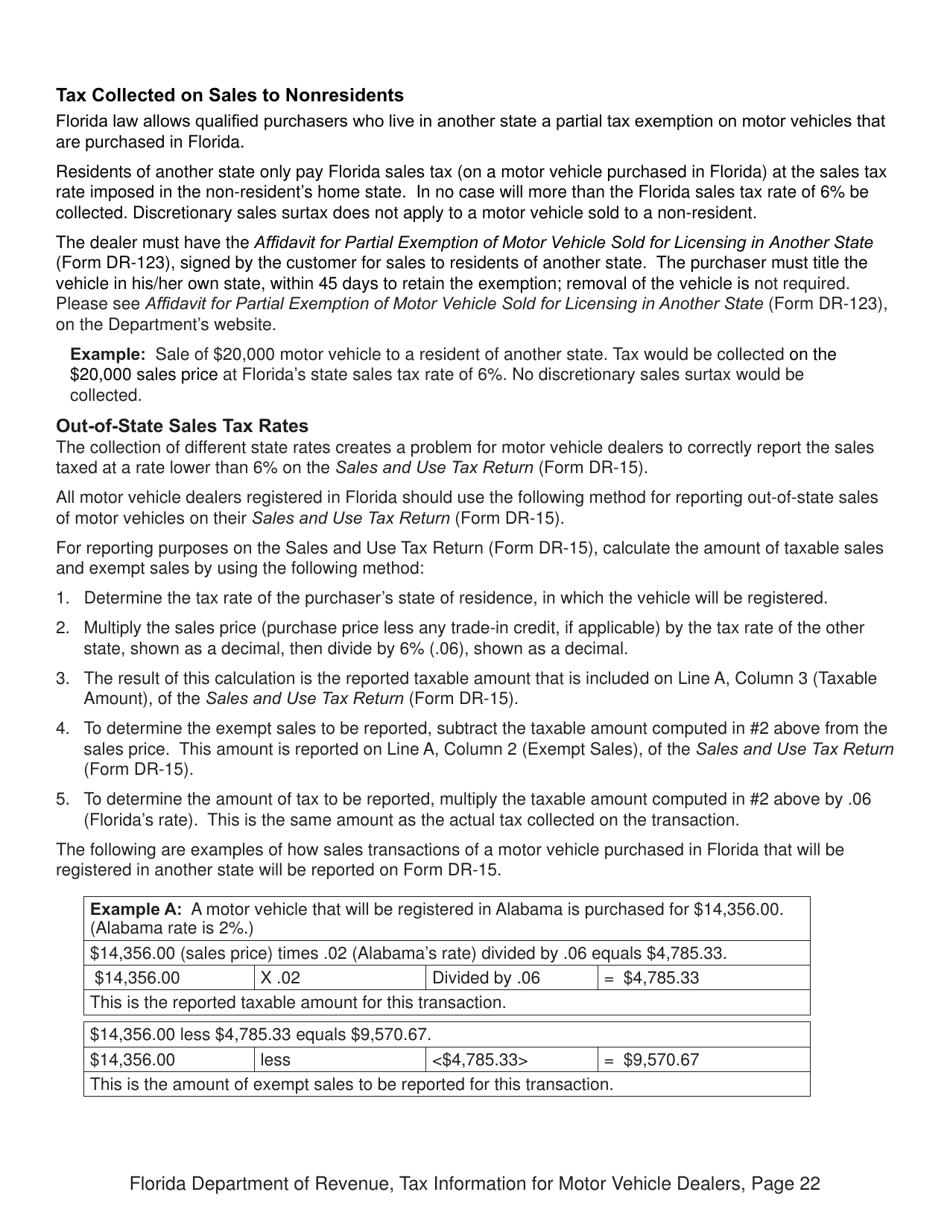

Q: How are sales and use taxes calculated for motor vehicle dealers in Florida?

A: Sales and use taxes are calculated based on the selling price of the motor vehicle.

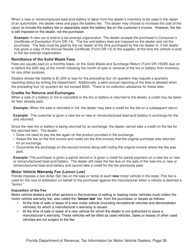

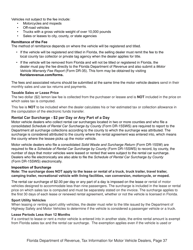

Q: Are there any exemptions from sales and use taxes for motor vehicle dealers in Florida?

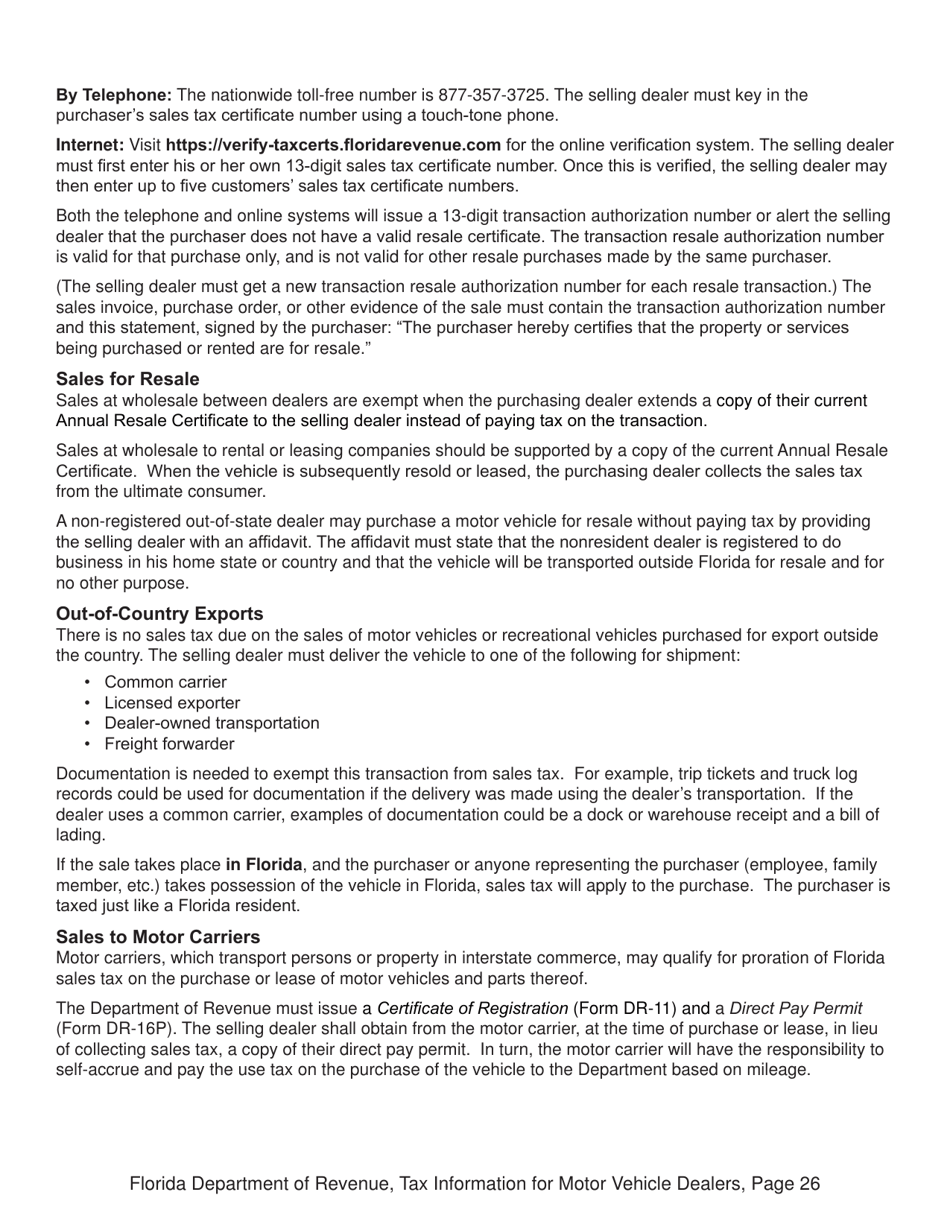

A: Yes, there are certain exemptions available for motor vehicle dealers in Florida.

Q: What are some common exemptions from sales and use taxes for motor vehicle dealers in Florida?

A: Some common exemptions include sales to other motor vehicle dealers, sales to nonresidents, and sales to government entities.

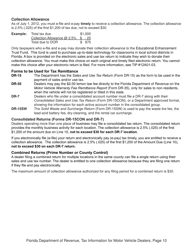

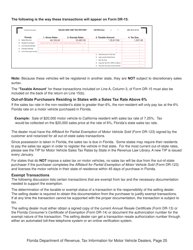

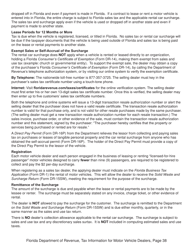

Q: Are there any specific requirements for recordkeeping for motor vehicle dealers in Florida?

A: Yes, motor vehicle dealers in Florida are required to maintain specific records for tax purposes.

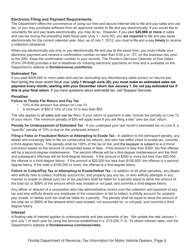

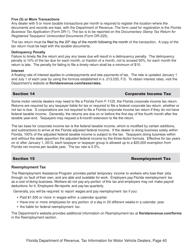

Q: What happens if a motor vehicle dealer in Florida fails to pay the required taxes?

A: Failure to pay the required taxes can result in penalties and interest.

Form Details:

- Released on February 1, 2018;

- The latest edition currently provided by the Florida Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.