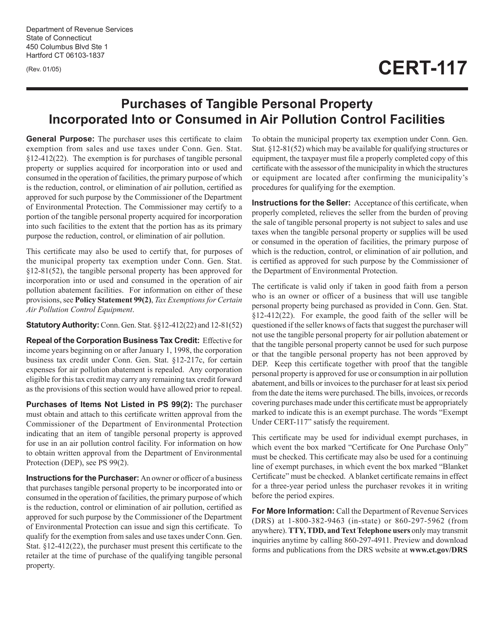

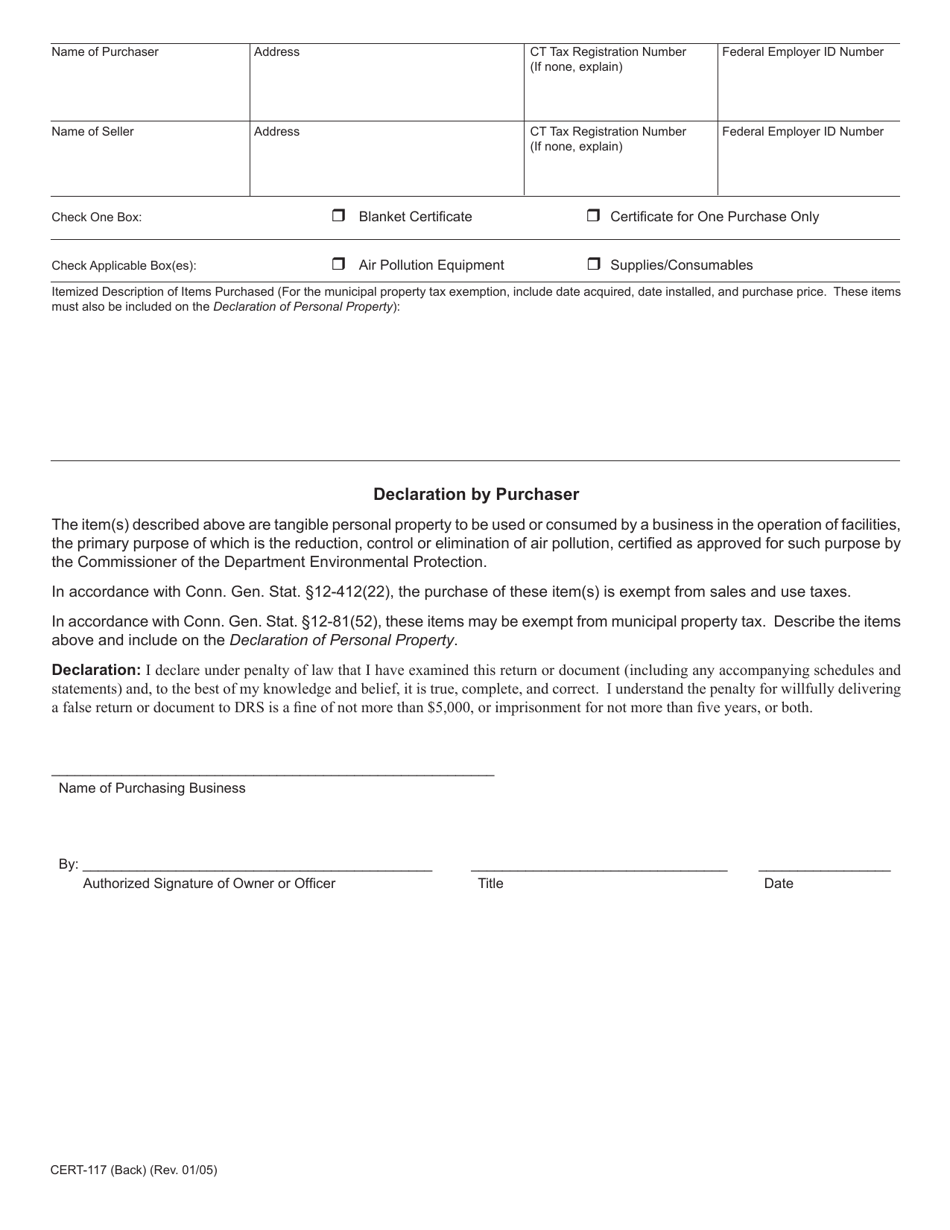

Form CERT-117 Purchases of Tangible Personal Property Incorporated Into or Consumed in Air Pollution Control Facilities - Connecticut

What Is Form CERT-117?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

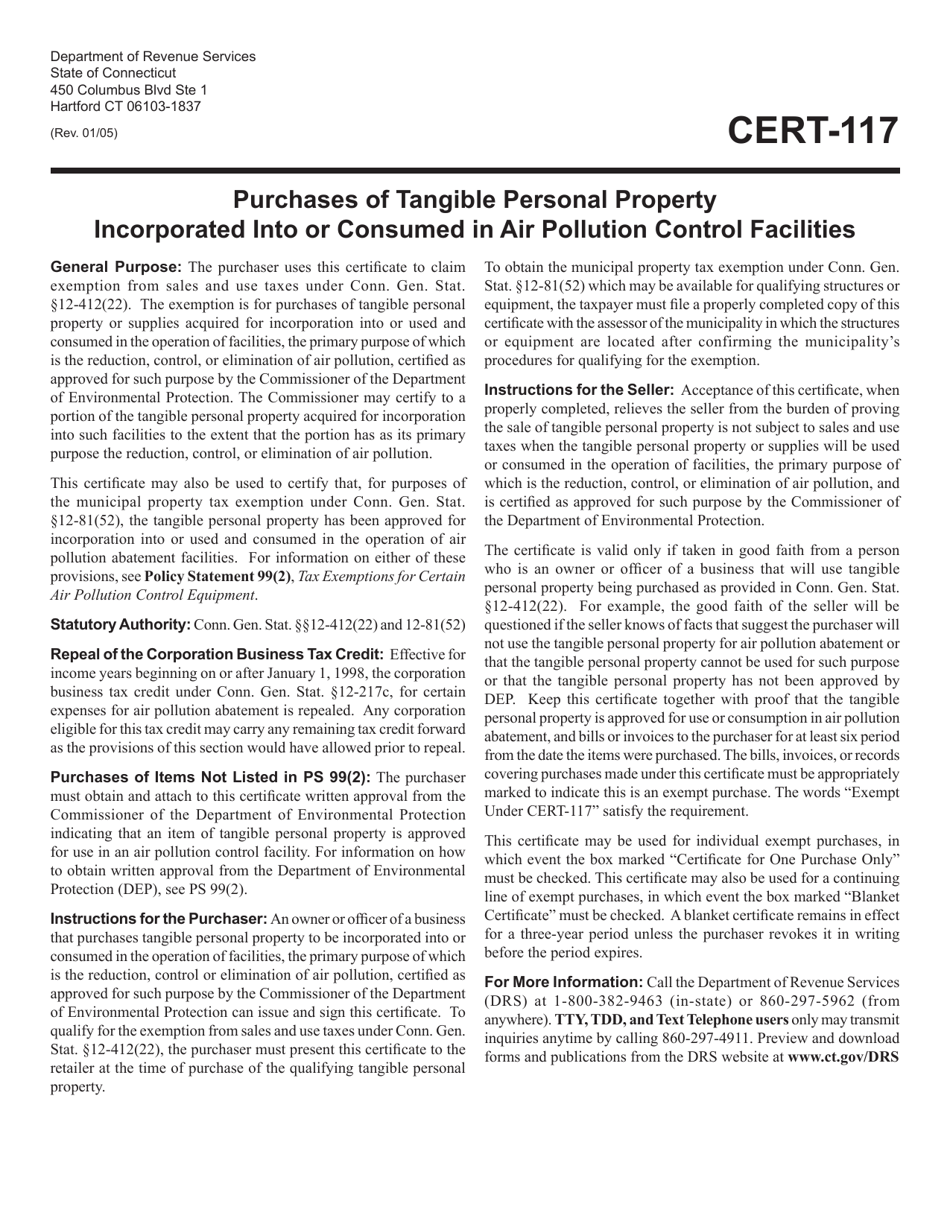

Q: What is CERT-117?

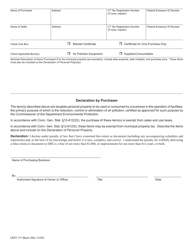

A: CERT-117 is a form used in Connecticut for reporting purchases of tangible personal property incorporated into or consumed in air pollution control facilities.

Q: What is the purpose of CERT-117?

A: The purpose of CERT-117 is to claim sales and use tax exemption on purchases of tangible personal property used in air pollution control facilities.

Q: Who needs to file CERT-117?

A: Any person or business that has made eligible purchases of tangible personal property for use in air pollution control facilities in Connecticut needs to file CERT-117.

Q: How often do you need to file CERT-117?

A: CERT-117 should be filed annually before October 1st for the previous calendar year.

Q: Are all purchases for air pollution control facilities eligible for exemption?

A: No, only certain purchases of tangible personal property that directly relates to air pollution control are eligible for exemption.

Q: Is there a deadline for filing CERT-117?

A: Yes, CERT-117 should be filed annually before October 1st for the previous calendar year.

Q: What happens if I don't file CERT-117?

A: Failure to file CERT-117 may result in the denial of sales and use tax exemption on qualifying purchases for air pollution control facilities.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CERT-117 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.