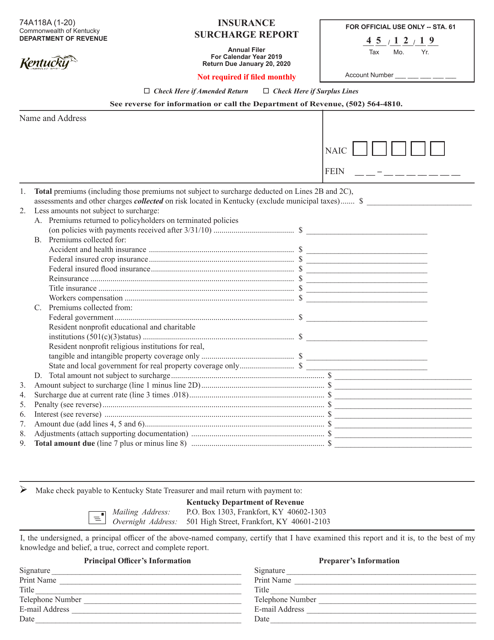

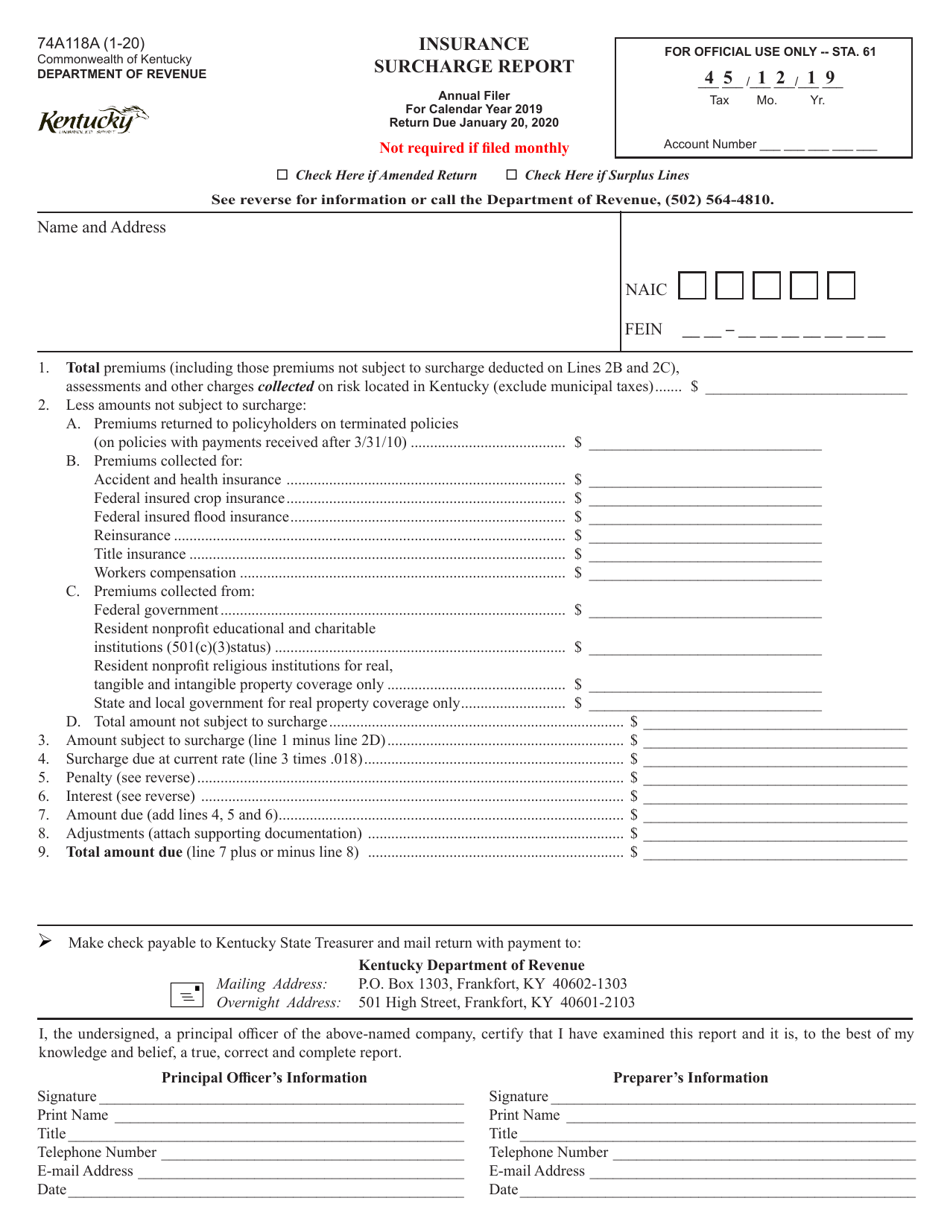

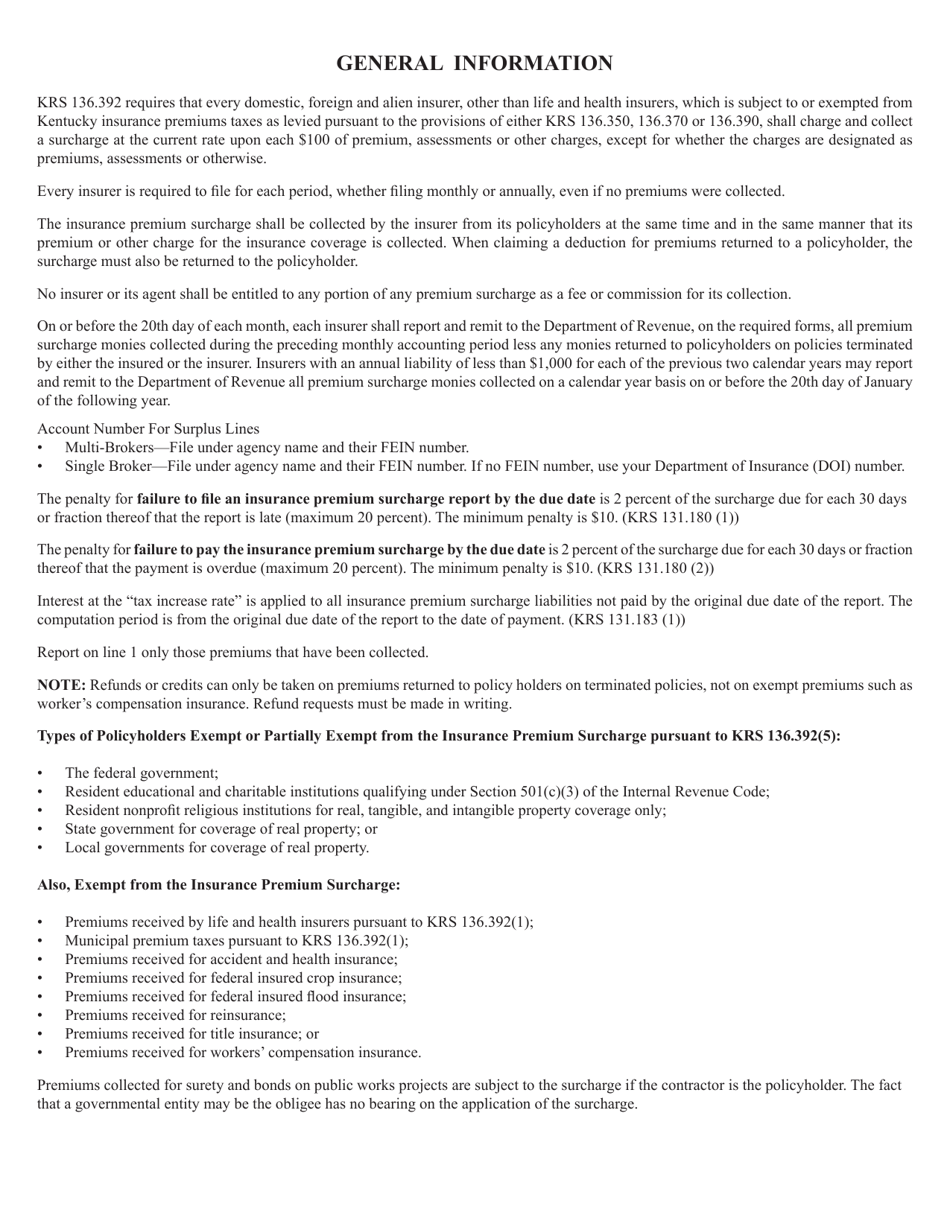

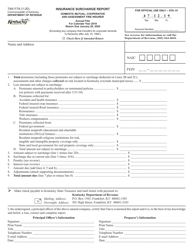

Form 74A118A Insurance Surcharge Report - Kentucky

What Is Form 74A118A?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 74A118A?

A: Form 74A118A is the Insurance Surcharge Report for Kentucky.

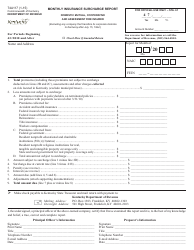

Q: Who is required to file Form 74A118A?

A: Insurance companies operating in Kentucky are required to file Form 74A118A.

Q: What is the purpose of Form 74A118A?

A: Form 74A118A is used to report insurance surcharges collected by insurance companies in Kentucky.

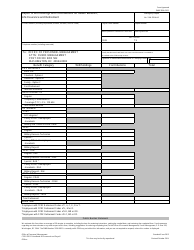

Q: What information is required on Form 74A118A?

A: Form 74A118A requires insurance companies to provide information about the surcharges collected and remitted to the Kentucky Department of Insurance.

Q: When is Form 74A118A due?

A: Form 74A118A is due annually, on or before March 1st.

Q: Is there a penalty for late filing of Form 74A118A?

A: Yes, there may be penalties for late filing or failure to file Form 74A118A.

Q: Are there any exemptions for filing Form 74A118A?

A: There are no specific exemptions mentioned for filing Form 74A118A. The form is required for all insurance companies operating in Kentucky.

Q: Can the form be filed electronically?

A: Yes, insurance companies have the option to file Form 74A118A electronically.

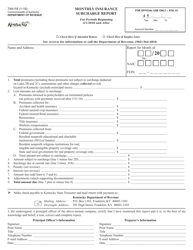

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 74A118A by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.