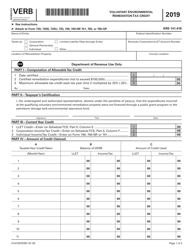

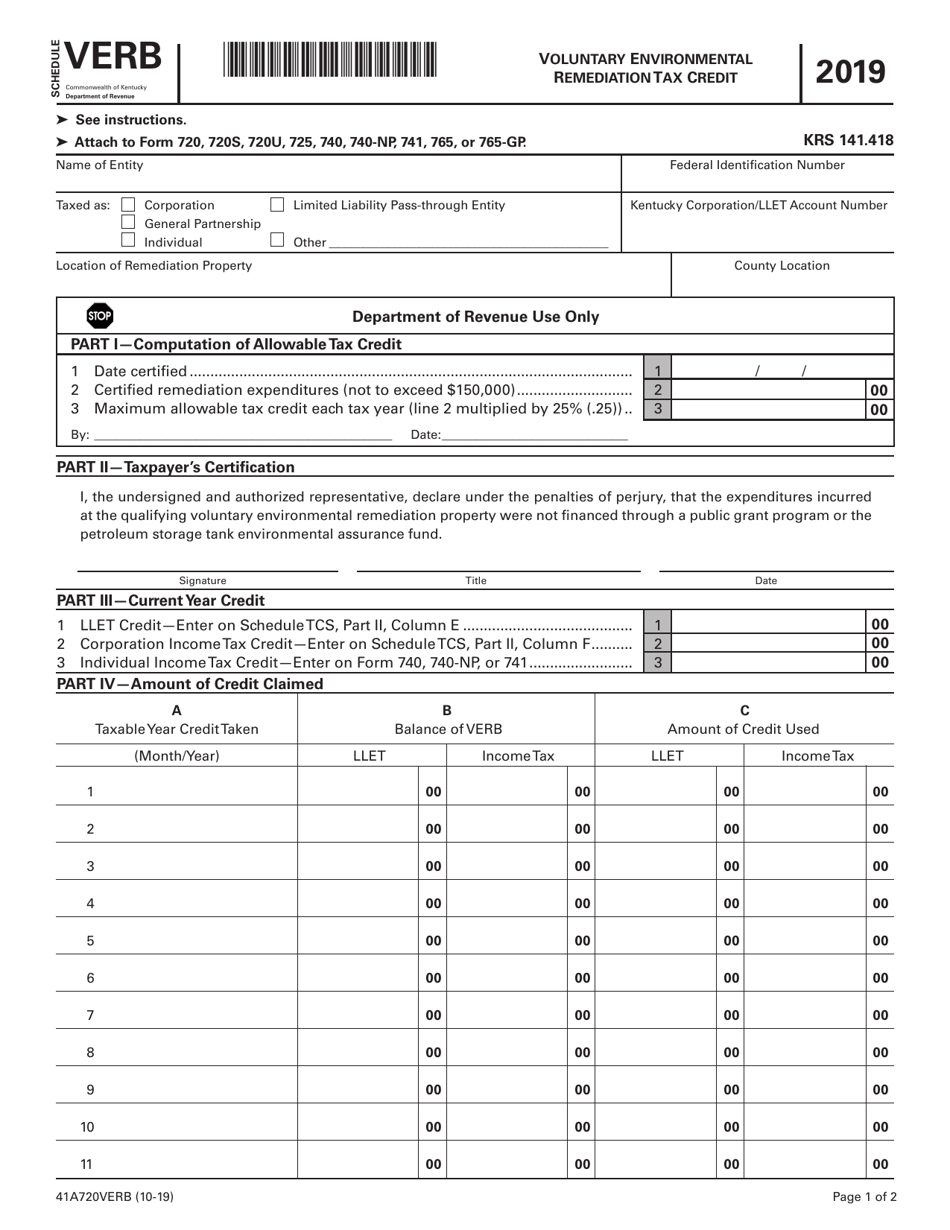

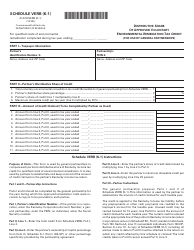

Form 41A720VERB Schedule VERB Voluntary Environmental Remediation Tax Credit - Kentucky

What Is Form 41A720VERB Schedule VERB?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720VERB?

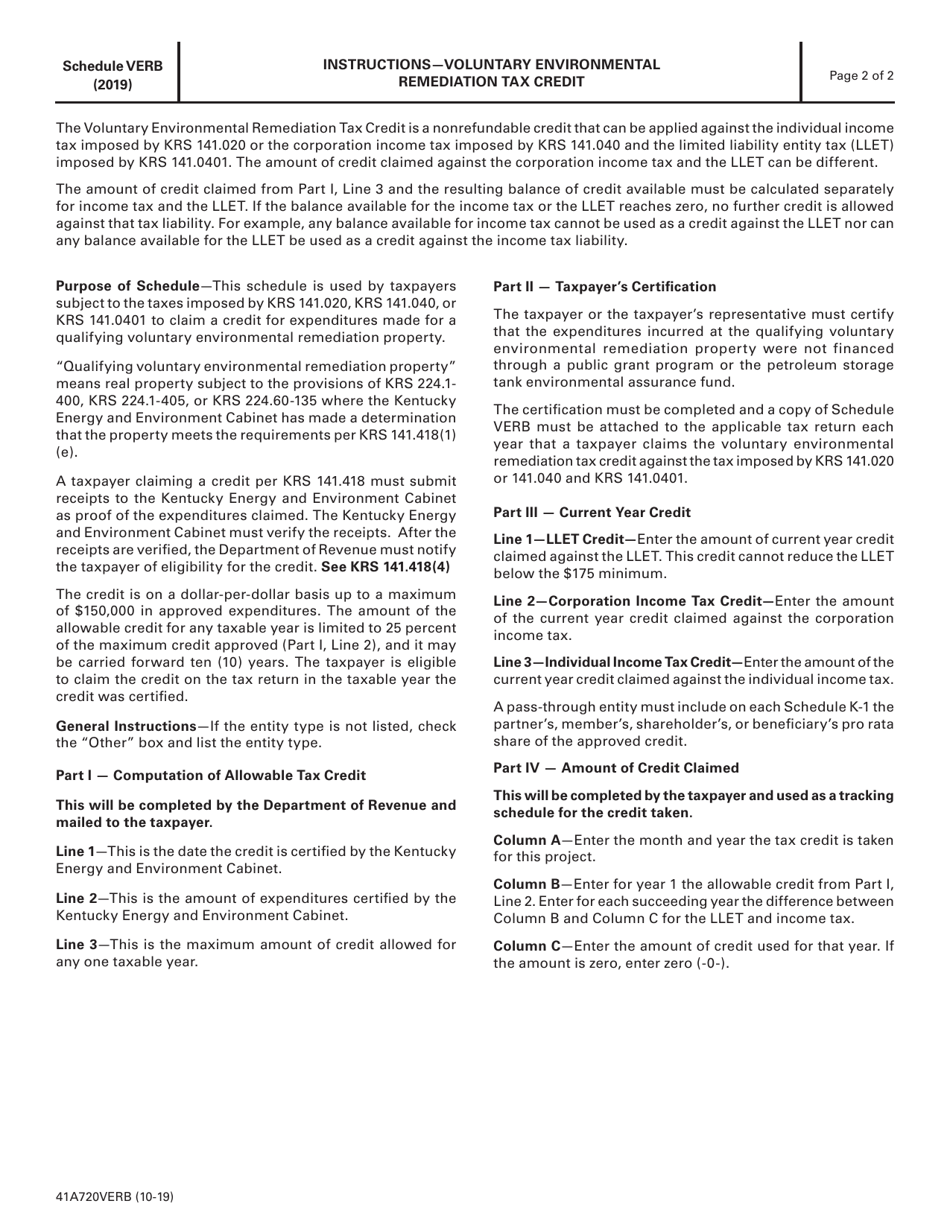

A: Form 41A720VERB is a schedule used for claiming the Voluntary Environmental Remediation Tax Credit in Kentucky.

Q: What is the Voluntary Environmental Remediation Tax Credit?

A: The Voluntary Environmental Remediation Tax Credit is a tax credit available to businesses and individuals who voluntarily clean upcontaminated sites in Kentucky.

Q: How can I claim the Voluntary Environmental Remediation Tax Credit?

A: You can claim the tax credit by filling out Form 41A720VERB and attaching it to your Kentucky tax return.

Q: What expenses are eligible for the Voluntary Environmental Remediation Tax Credit?

A: Expenses related to the assessment, remediation, and monitoring of contaminated sites may be eligible for the tax credit.

Q: Is there a limit to the Voluntary Environmental Remediation Tax Credit?

A: Yes, the tax credit is limited to 50% of the eligible expenses incurred during the qualified remediation period.

Q: Are there any deadlines for claiming the Voluntary Environmental Remediation Tax Credit?

A: Yes, the tax credit must be claimed within 3 years after the date the voluntary agreement is executed or the date the applicable regulatory agency issues a No Further Action Letter, whichever is later.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720VERB Schedule VERB by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.