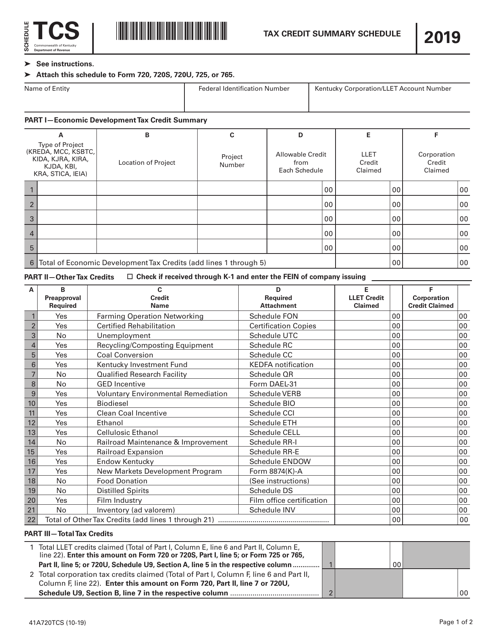

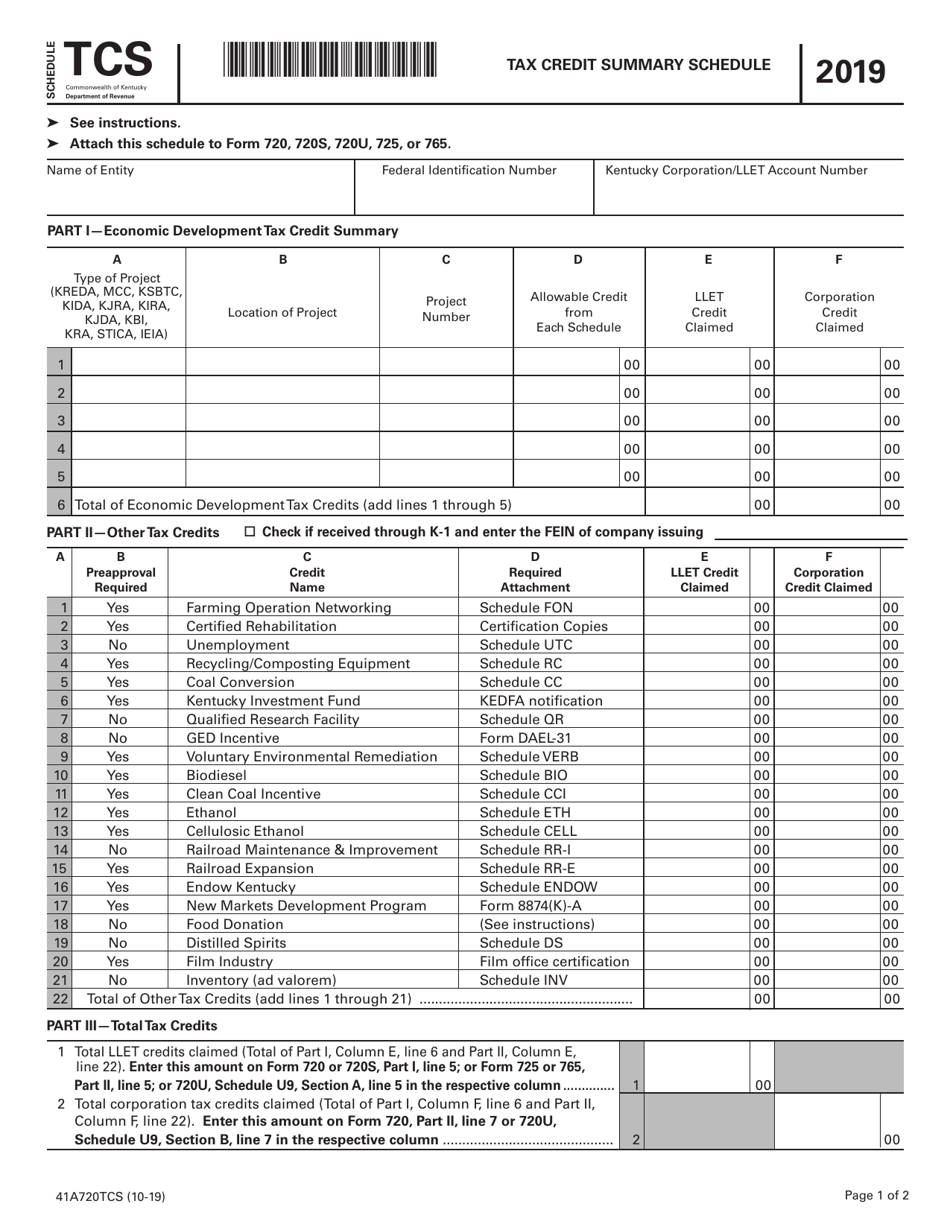

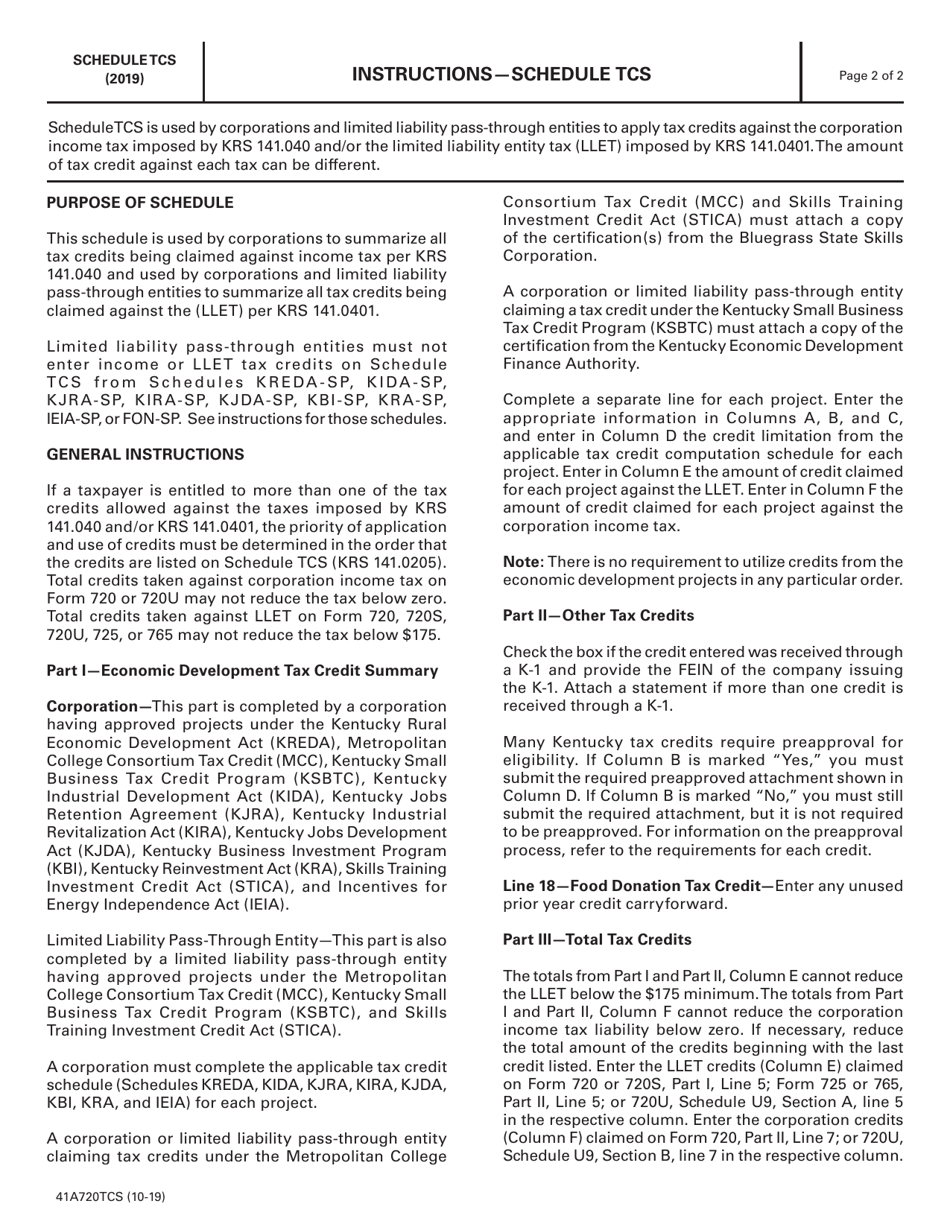

Form 41A720TCS Schedule TCS Tax Credit Summary Schedule - Kentucky

What Is Form 41A720TCS Schedule TCS?

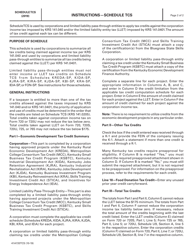

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720TCS?

A: Form 41A720TCS is the Schedule TCS Tax Credit Summary Schedule.

Q: What is the purpose of Schedule TCS?

A: The purpose of Schedule TCS is to summarize the tax credits related to Kentucky's Telecommunications and Video Programming Excise Tax Credit.

Q: Who is required to file Schedule TCS?

A: Taxpayers who claimed the Telecommunications and Video Programming Excise Tax Credit on their Kentucky tax return are required to file Schedule TCS.

Q: Is Schedule TCS specific to Kentucky residents?

A: Yes, Schedule TCS is specific to Kentucky residents who claimed the Telecommunications and Video Programming Excise Tax Credit.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720TCS Schedule TCS by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.