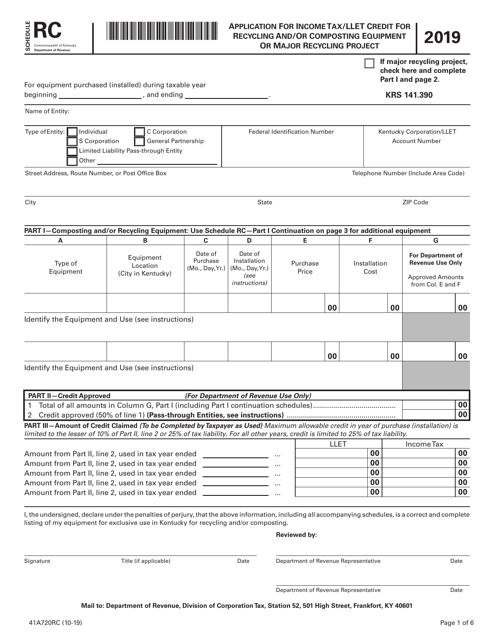

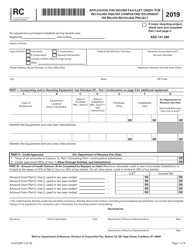

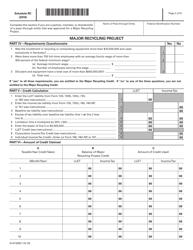

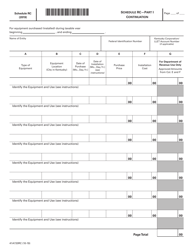

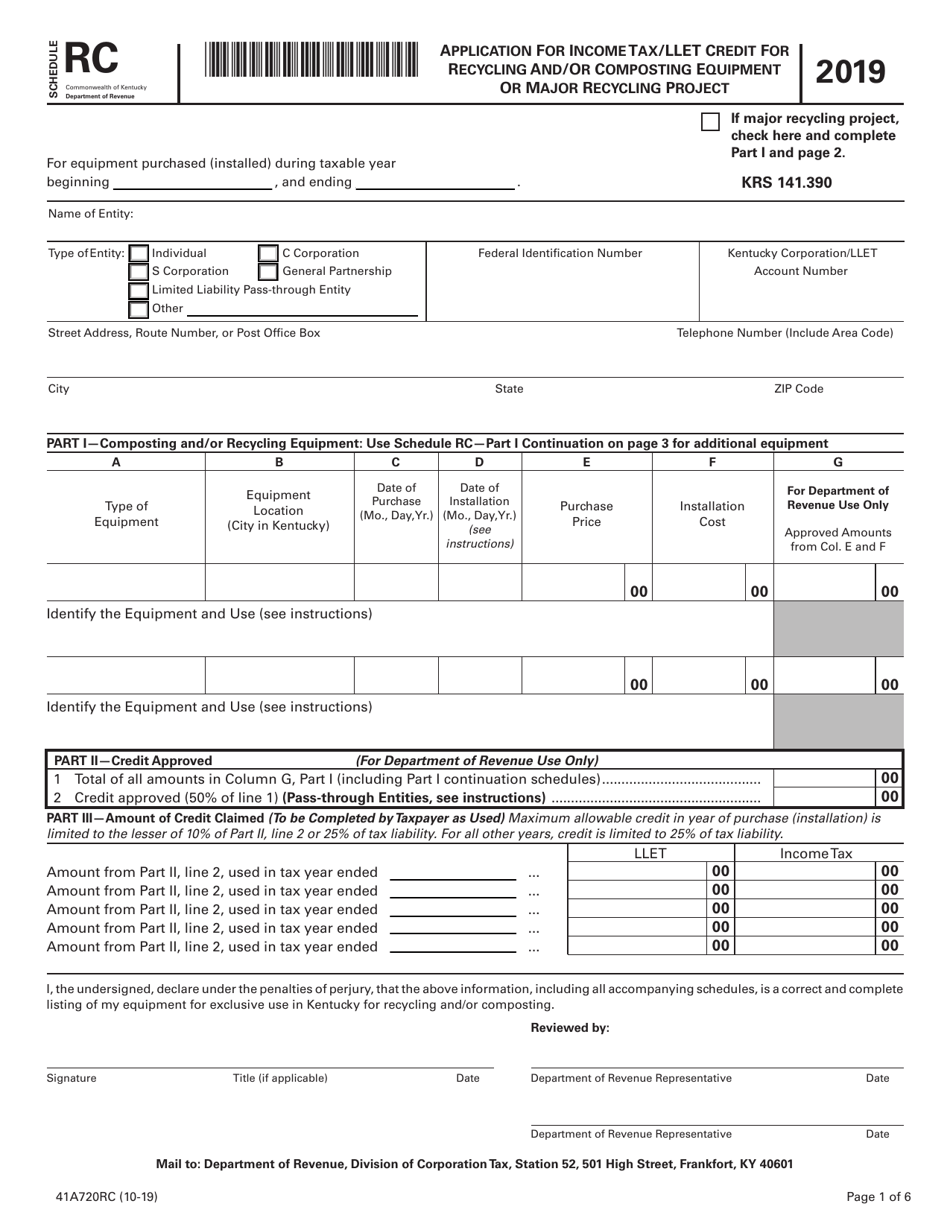

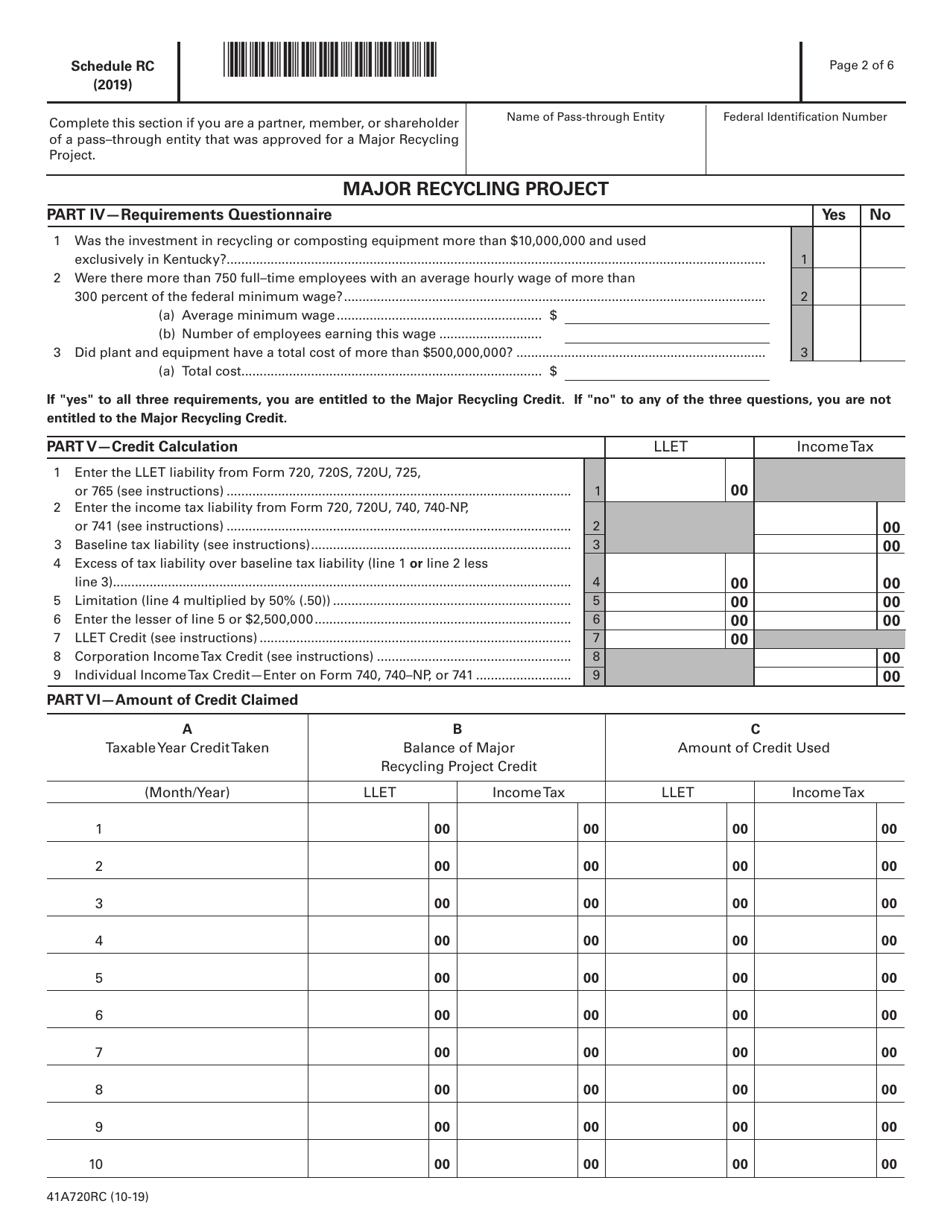

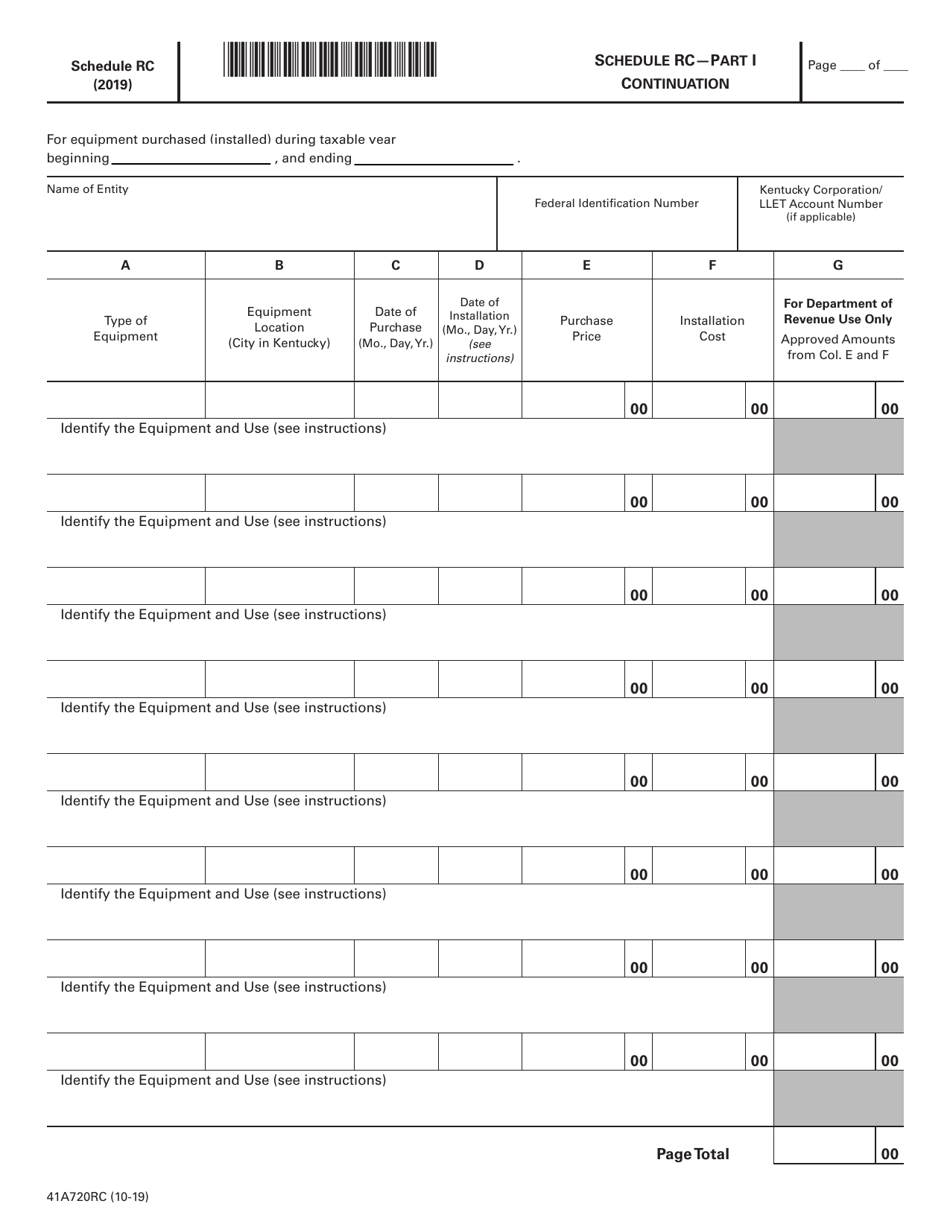

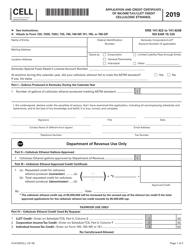

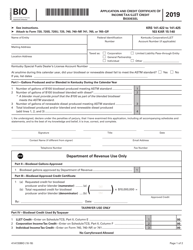

Form 41A720RC Schedule RC Application for Income Tax / Llet Credit for Recycling and / or Composting Equipment or Major Recycling Project - Kentucky

What Is Form 41A720RC Schedule RC?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720RC?

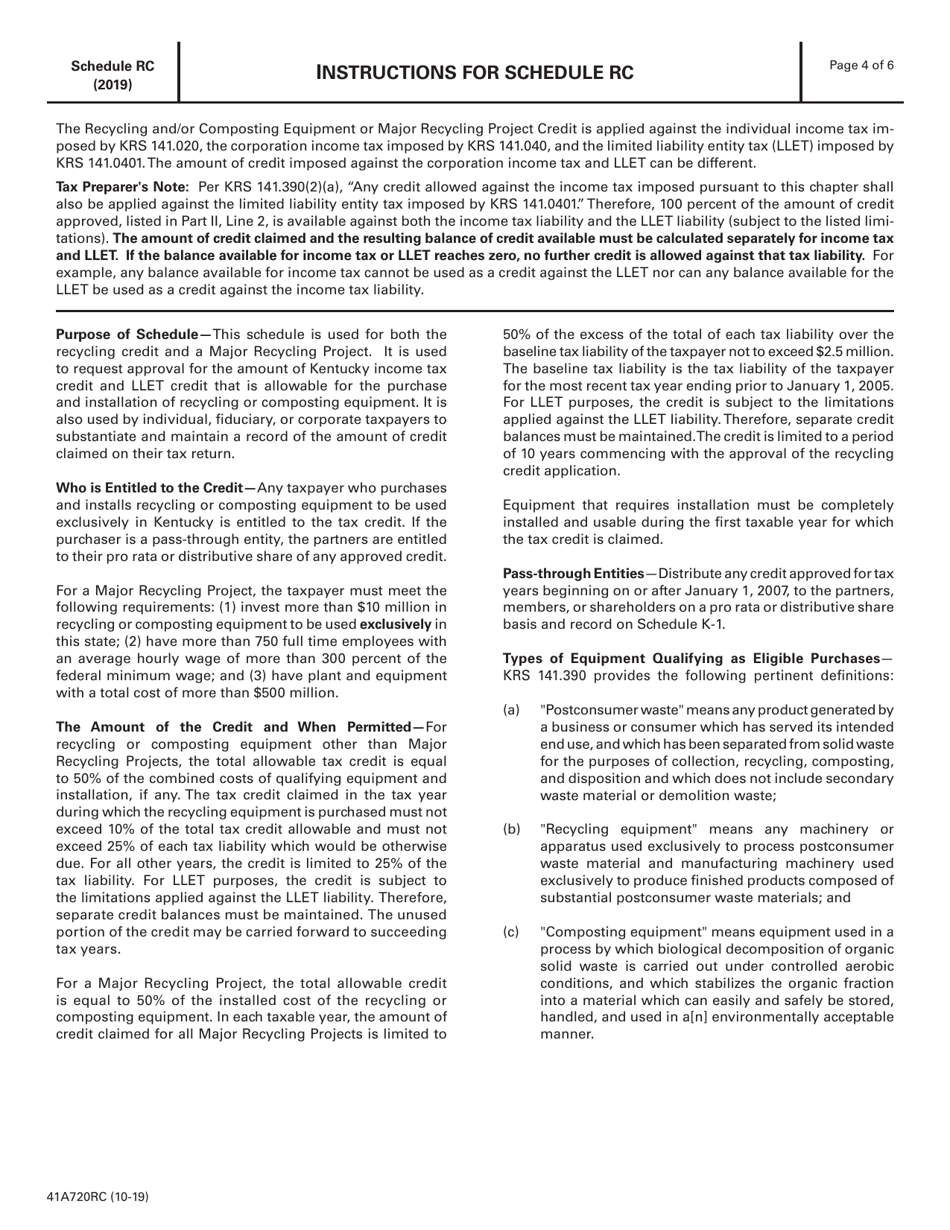

A: Form 41A720RC is an application for income tax credit for recycling and/or composting equipment or major recycling project in Kentucky.

Q: What is the purpose of Form 41A720RC?

A: The purpose of Form 41A720RC is to apply for a tax credit for investments in recycling and/or composting equipment or major recycling projects.

Q: Who can use Form 41A720RC?

A: Kentucky taxpayers who have made investments in recycling and/or composting equipment or major recycling projects can use Form 41A720RC.

Q: What is the benefit of using Form 41A720RC?

A: Using Form 41A720RC allows qualified taxpayers to claim an income tax credit for their investments in recycling and/or composting equipment or major recycling projects.

Q: Are there any eligibility requirements to claim the tax credit?

A: Yes, there are eligibility requirements to claim the tax credit. Taxpayers must meet certain criteria outlined in the instructions for Form 41A720RC.

Q: Is there a deadline to submit Form 41A720RC?

A: Yes, Form 41A720RC must be submitted by the due date of the tax return for the year in which the investment in recycling and/or composting equipment or major recycling project was made.

Q: Can the tax credit be carried forward or transferred?

A: No, the tax credit cannot be carried forward to future years or transferred to another taxpayer.

Q: What supporting documentation is required to be attached with Form 41A720RC?

A: Taxpayers are required to attach certain supporting documentation, such as proof of investment and project details, with Form 41A720RC.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720RC Schedule RC by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.