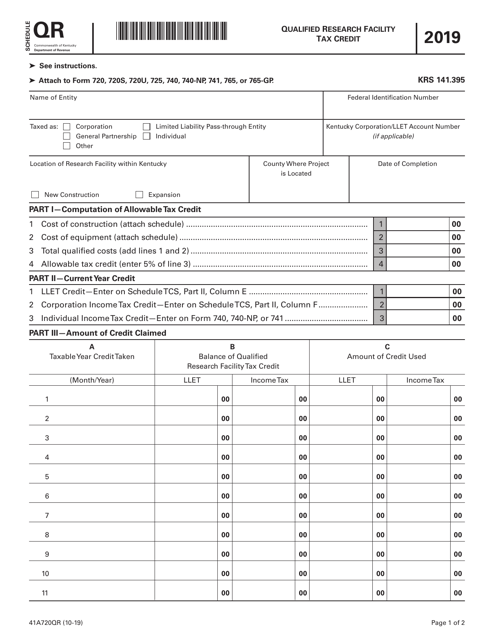

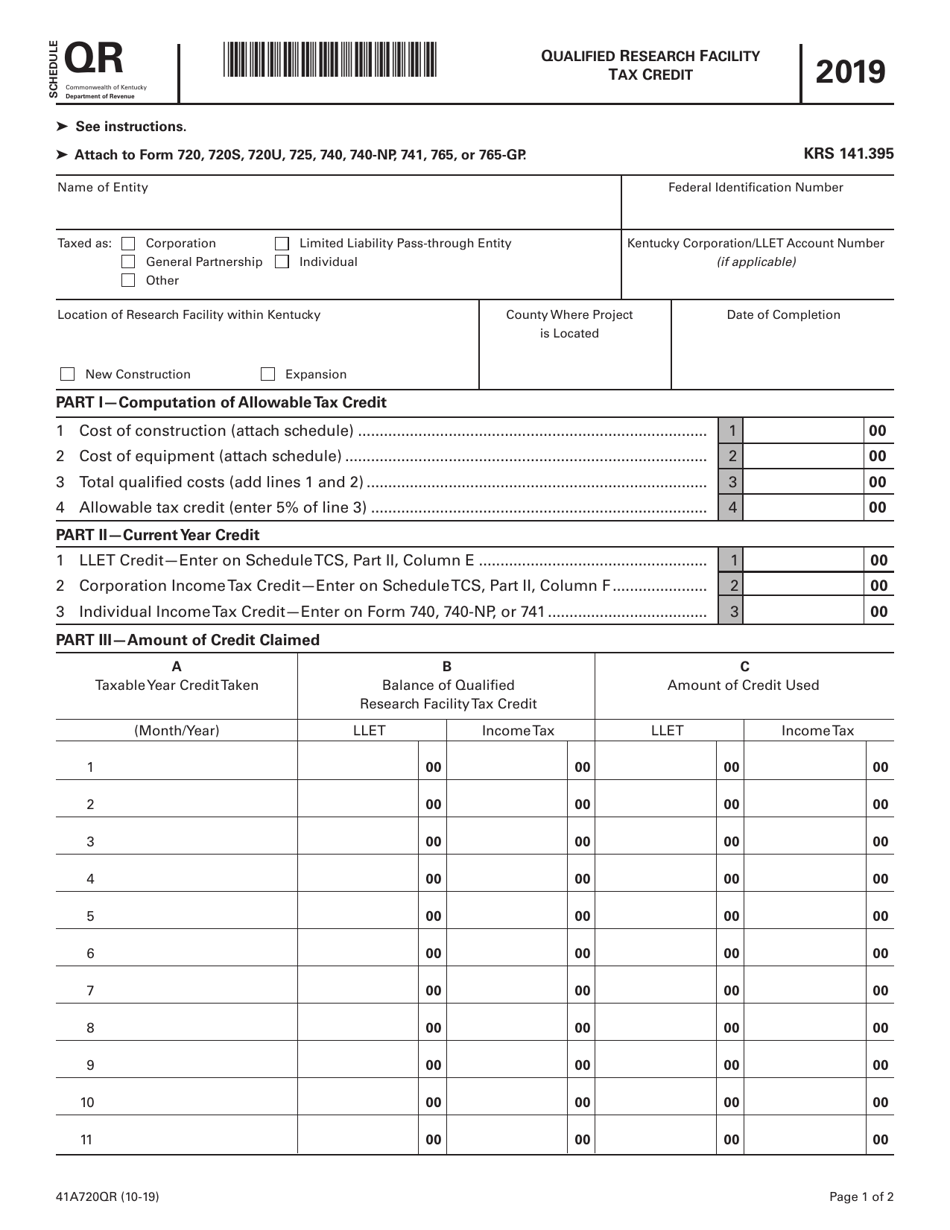

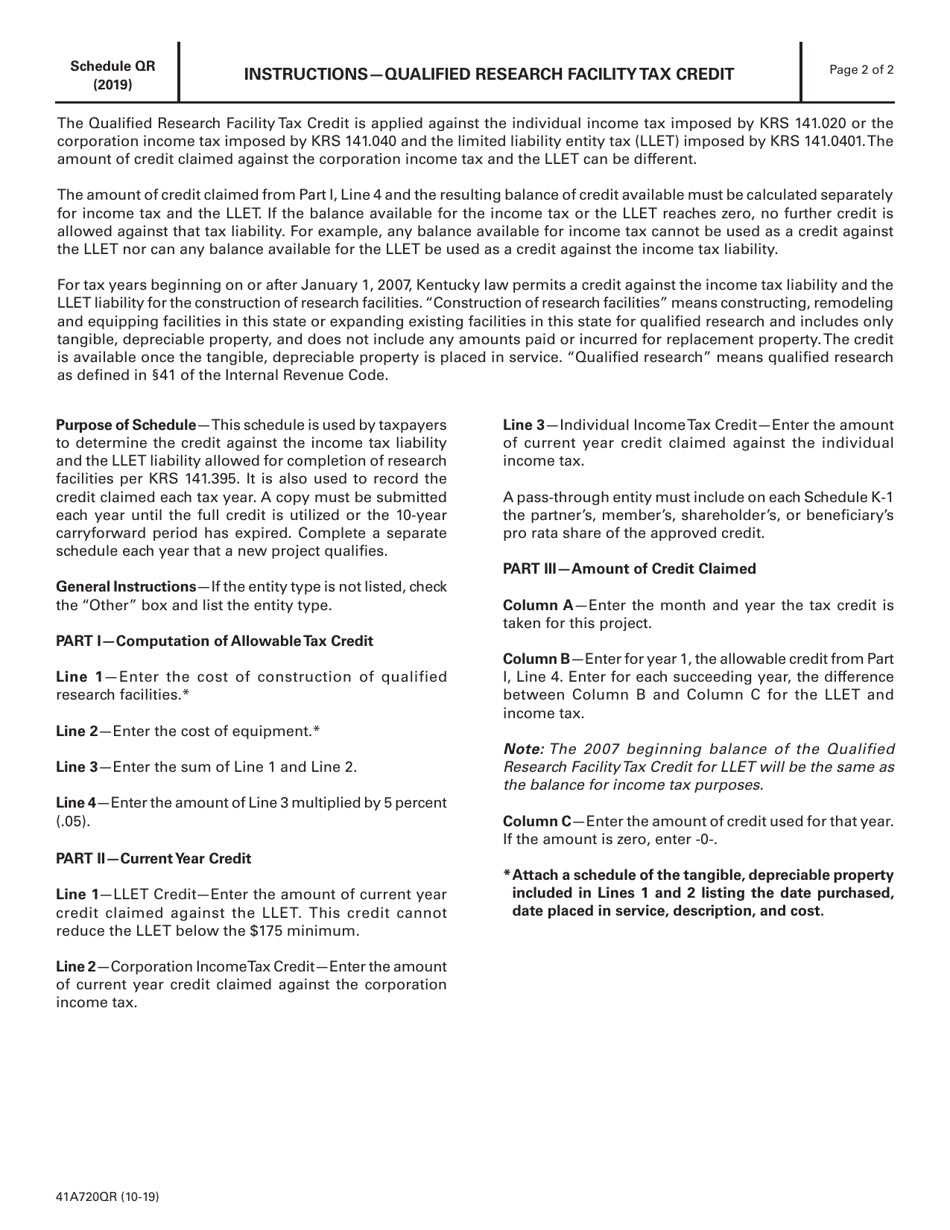

Form 41A720QR Schedule QR Qualified Research Facility Tax Credit - Kentucky

What Is Form 41A720QR Schedule QR?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720QR Schedule QR?

A: Form 41A720QR Schedule QR is a tax form used in Kentucky to claim the Qualified Research Facility Tax Credit.

Q: What is the Qualified Research Facility Tax Credit?

A: The Qualified Research Facility Tax Credit is a tax credit available to companies in Kentucky that conduct research and development activities within the state.

Q: Who is eligible to claim the Qualified Research Facility Tax Credit?

A: Companies in Kentucky that have qualified research facilities and engage in qualifying research and development activities may be eligible to claim the tax credit.

Q: What expenses are eligible for the Qualified Research Facility Tax Credit?

A: Expenses related to the construction, renovation, or expansion of a qualified research facility, as well as expenses related to qualified research and development activities, may be eligible for the tax credit.

Q: How much is the Qualified Research Facility Tax Credit?

A: The tax credit amount varies and is based on a percentage of eligible expenses incurred by the company.

Q: How do I claim the Qualified Research Facility Tax Credit?

A: To claim the tax credit, you need to fill out and submit Form 41A720QR Schedule QR along with your annual tax return in Kentucky.

Q: Are there any deadlines for claiming the Qualified Research Facility Tax Credit?

A: Yes, the tax credit must be claimed in the same tax year in which the eligible expenses were incurred.

Q: Is there any additional documentation required to claim the Qualified Research Facility Tax Credit?

A: Yes, you may be required to submit supporting documentation, such as receipts, to prove the eligibility of your expenses.

Q: Is the Qualified Research Facility Tax Credit refundable?

A: No, the tax credit is non-refundable but can be carried forward to future tax years if not fully utilized.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720QR Schedule QR by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.