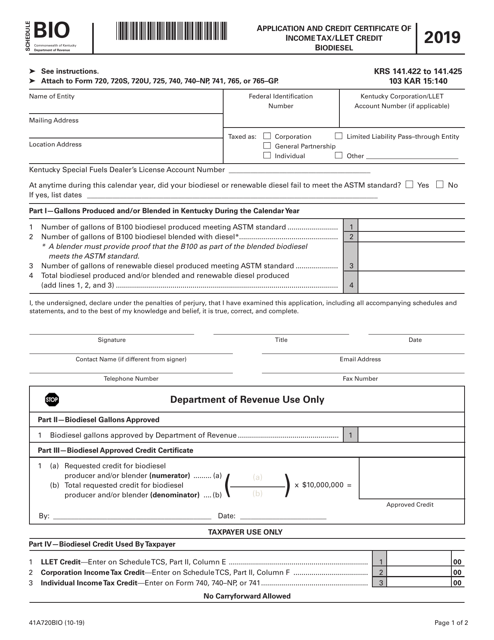

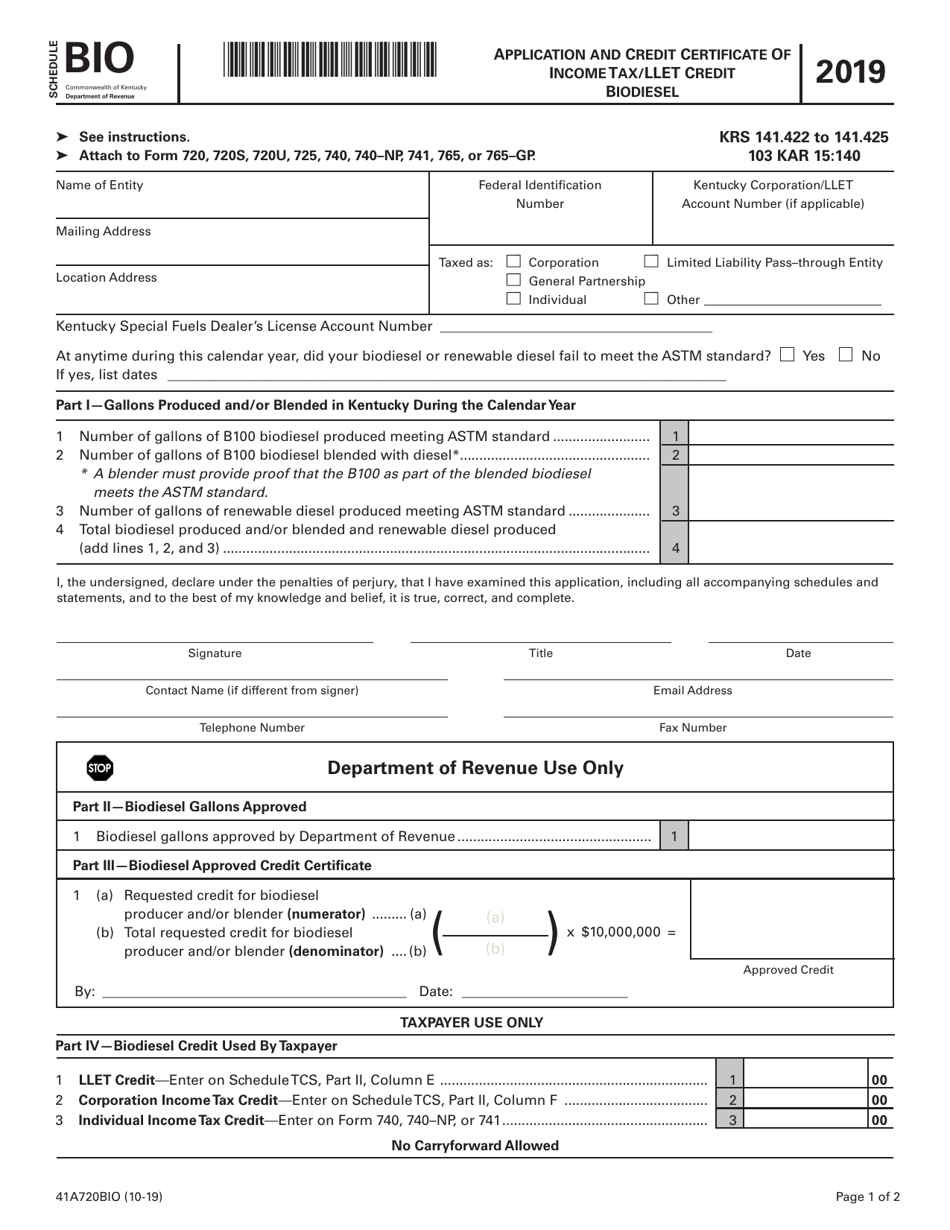

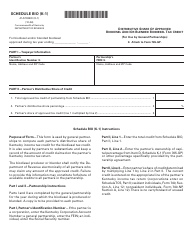

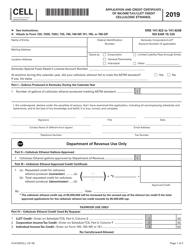

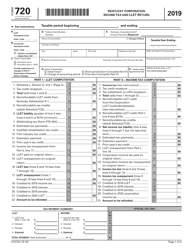

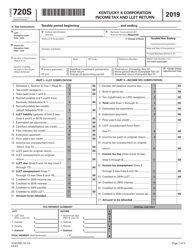

Form 41A720BIO Schedule BIO Application and Credit Certificate of Income Tax / Llet Credit - Biodiesel - Kentucky

What Is Form 41A720BIO Schedule BIO?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720BIO Schedule BIO?

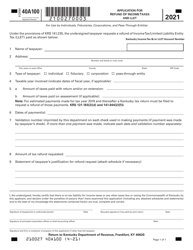

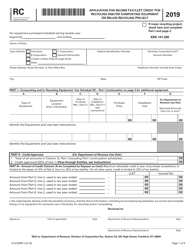

A: Form 41A720BIO Schedule BIO is a tax form used in Kentucky to apply for the Biodiesel Income Tax Credit.

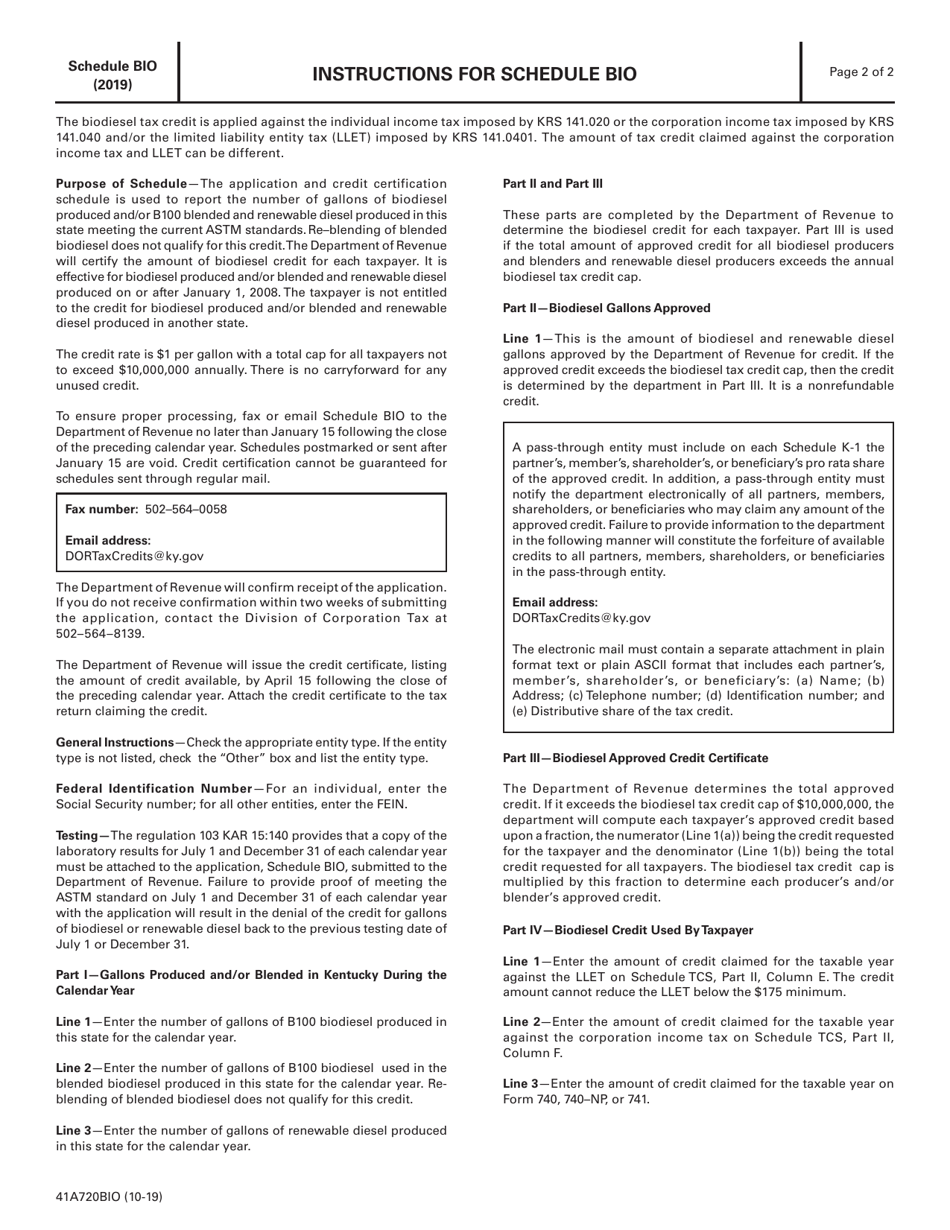

Q: What is the purpose of the Biodiesel Income Tax Credit?

A: The Biodiesel Income Tax Credit is designed to provide a tax credit for individuals and businesses that produce or purchase biodiesel fuel.

Q: Who can use Form 41A720BIO Schedule BIO?

A: Individuals and businesses in Kentucky that produce or purchase biodiesel fuel can use this form to apply for the Biodiesel Income Tax Credit.

Q: What information is required on Form 41A720BIO Schedule BIO?

A: The form requires information about the biodiesel producer or purchaser, the amount of biodiesel produced or purchased, and other relevant details.

Q: Are there any deadlines for filing Form 41A720BIO Schedule BIO?

A: Yes, the form must be filed by the due date of your Kentucky income tax return.

Q: Can I claim the Biodiesel Income Tax Credit if I don't live in Kentucky?

A: No, this tax credit is only available to individuals and businesses in Kentucky.

Q: How much is the Biodiesel Income Tax Credit?

A: The amount of the credit varies depending on the amount of biodiesel produced or purchased and other factors. Consult the instructions for more details.

Q: Can I carry forward any unused Biodiesel Income Tax Credit?

A: Yes, any unused credit can be carried forward for up to five years.

Q: Can I claim both the Biodiesel Income Tax Credit and the Federal Biodiesel Tax Credit?

A: Yes, you may be eligible for both credits, but you should consult a tax professional or the instructions for more information.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720BIO Schedule BIO by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.