This version of the form is not currently in use and is provided for reference only. Download this version of

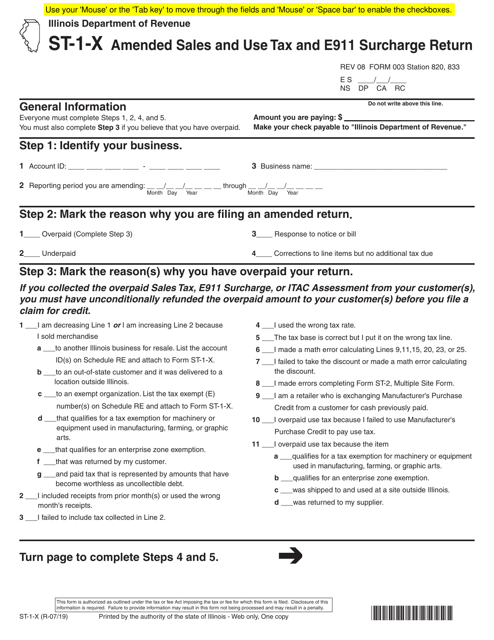

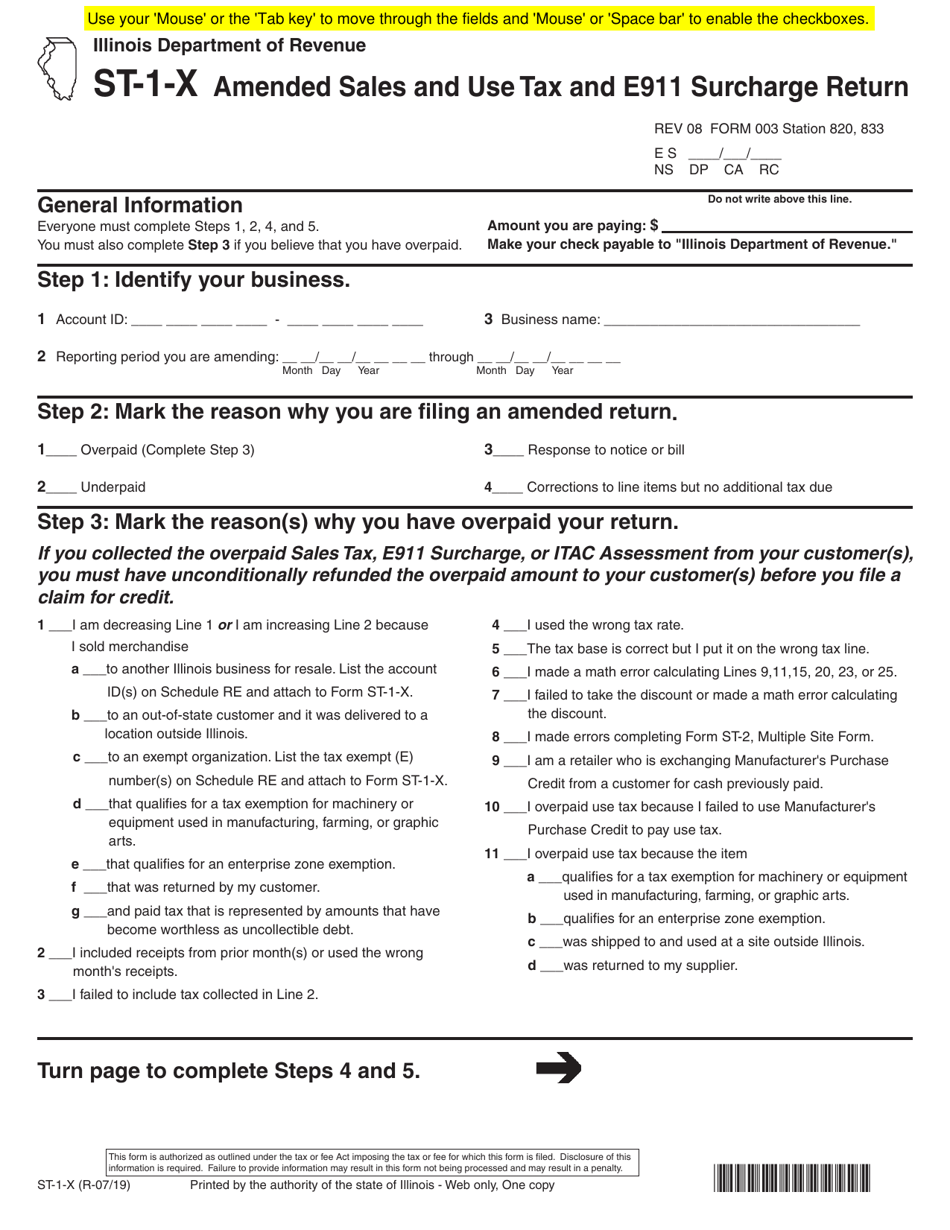

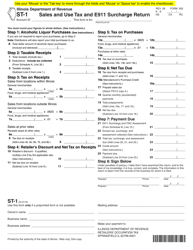

Form ST-1-X

for the current year.

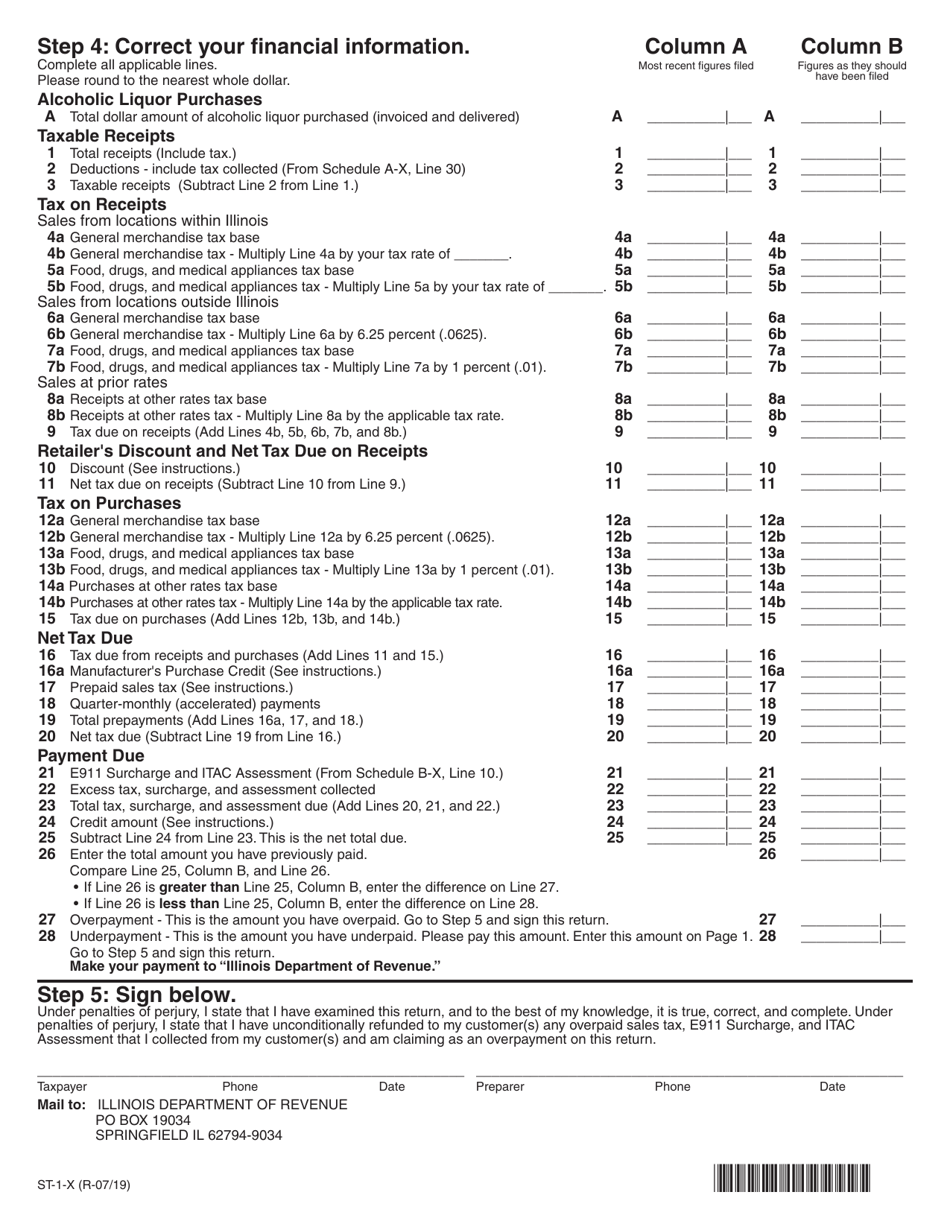

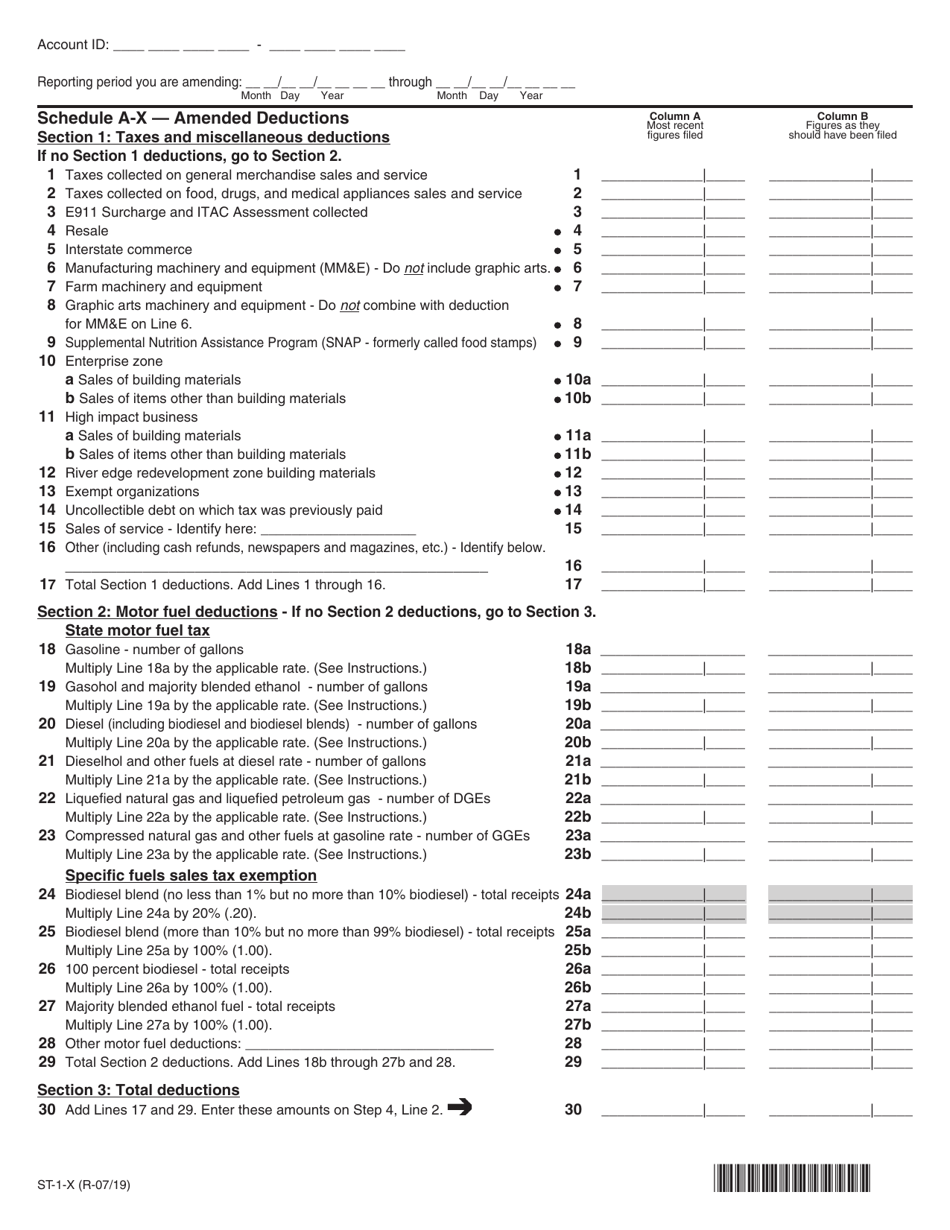

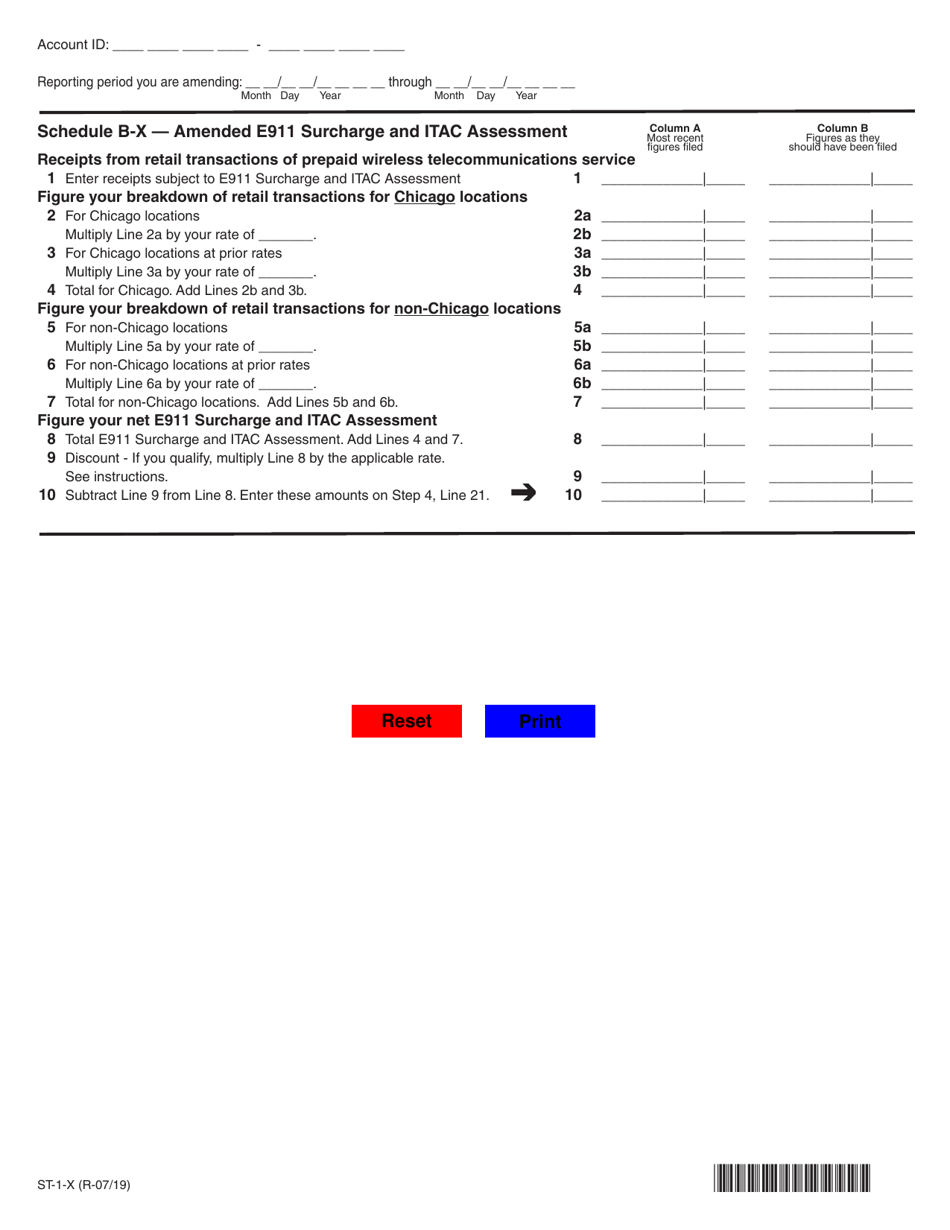

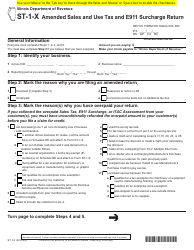

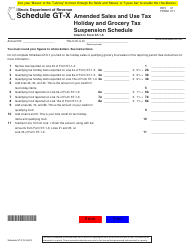

Form ST-1-X Amended Sales and Use Tax and E911 Surcharge Return - Illinois

What Is Form ST-1-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ST-1-X?

A: Form ST-1-X is an amended sales and use tax and E911 surcharge return in Illinois.

Q: What is the purpose of Form ST-1-X?

A: The purpose of Form ST-1-X is to report changes and corrections to a previously filed sales and use tax and E911 surcharge return.

Q: Who needs to file Form ST-1-X?

A: Anyone who needs to correct or update their previously filed sales and use tax and E911 surcharge return in Illinois must file Form ST-1-X.

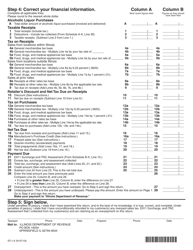

Q: What information is required to complete Form ST-1-X?

A: To complete Form ST-1-X, you will need to provide your business information, original return information, corrected information, and an explanation of the changes.

Q: When is Form ST-1-X due?

A: Form ST-1-X is due on or before the original due date of the sales and use tax and E911 surcharge return that you are amending.

Q: What happens if I file Form ST-1-X after the due date?

A: If you file Form ST-1-X after the due date, you may be subject to penalties and interest on any outstanding tax due.

Q: Can I file Form ST-1-X electronically?

A: Yes, you can file Form ST-1-X electronically using the Illinois Department of Revenue's MyTax Illinois system.

Q: Is there a fee to file Form ST-1-X?

A: No, there is no fee to file Form ST-1-X.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-1-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.