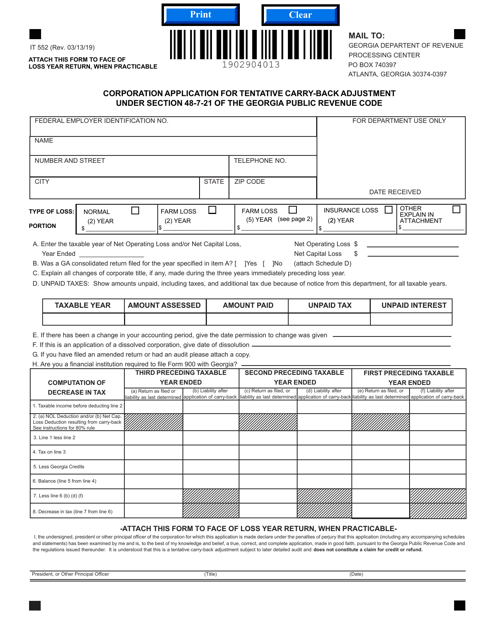

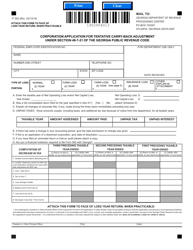

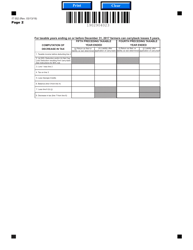

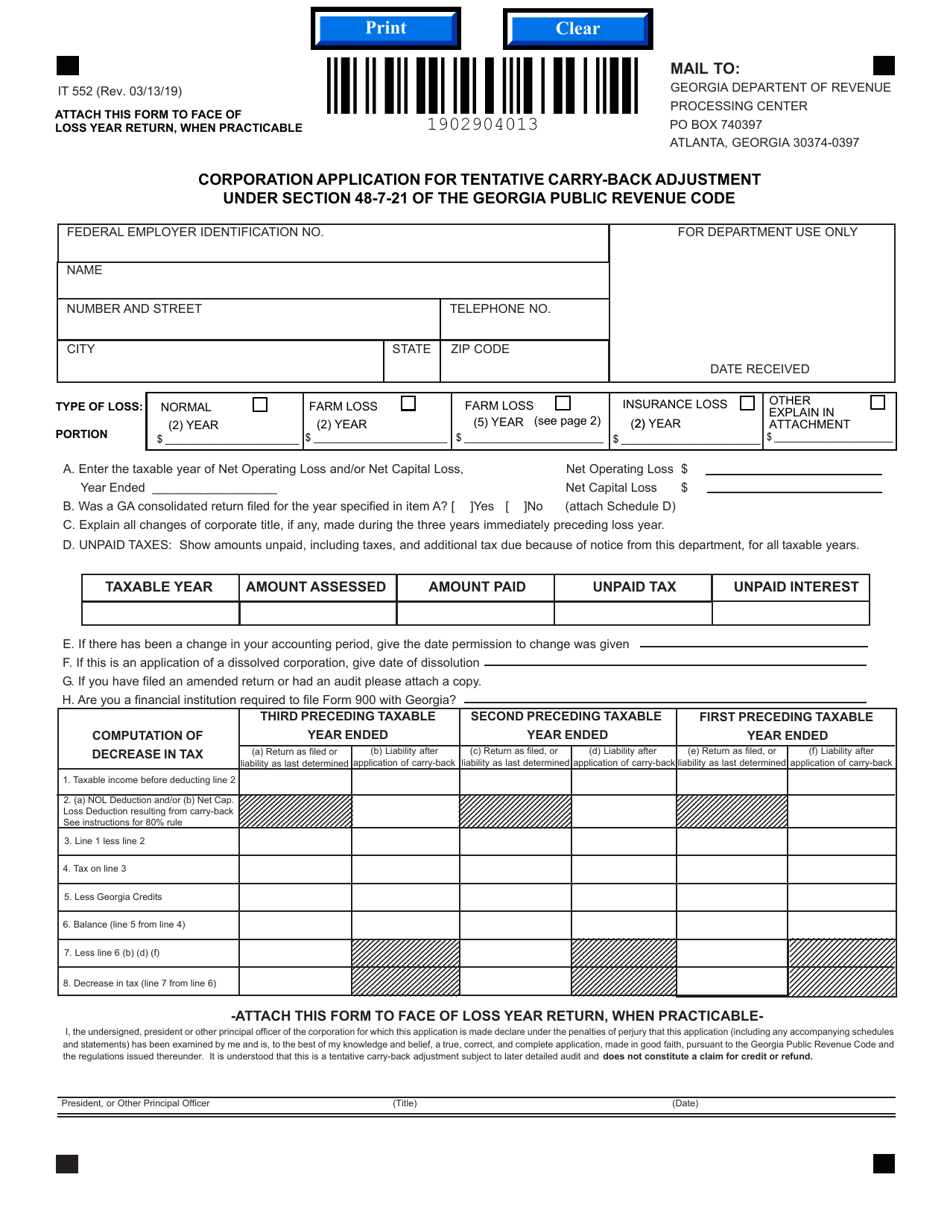

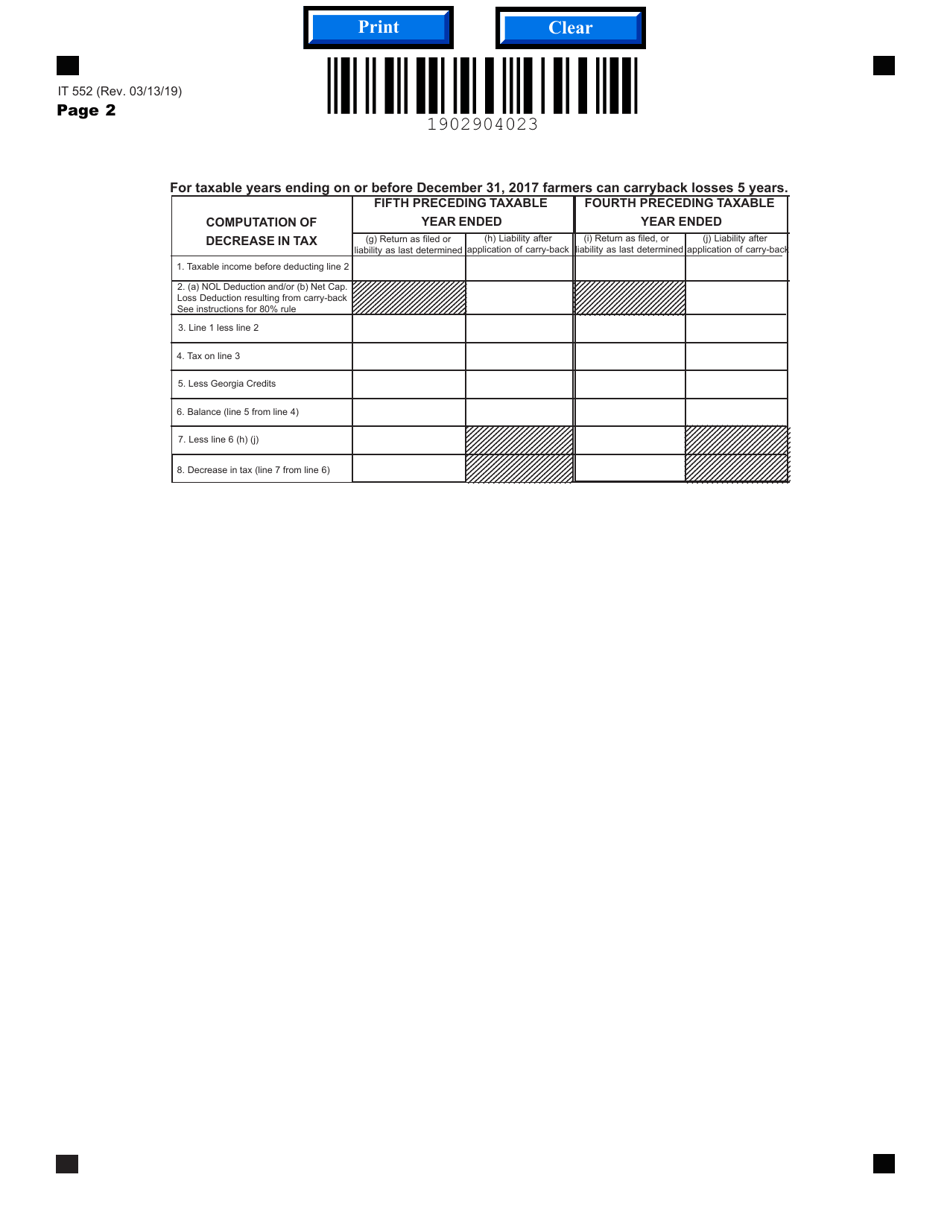

Form IT552 Corporation Application for Tentative Carry-Back Adjustment Under Section 48-7-2 1 of the Georgia Public Revenue Code - Georgia (United States)

What Is Form IT552?

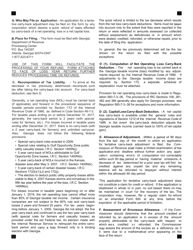

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT552 form?

A: The IT552 form is the Corporation Application for Tentative Carry-Back Adjustment Under Section 48-7-21 of the Georgia Public Revenue Code.

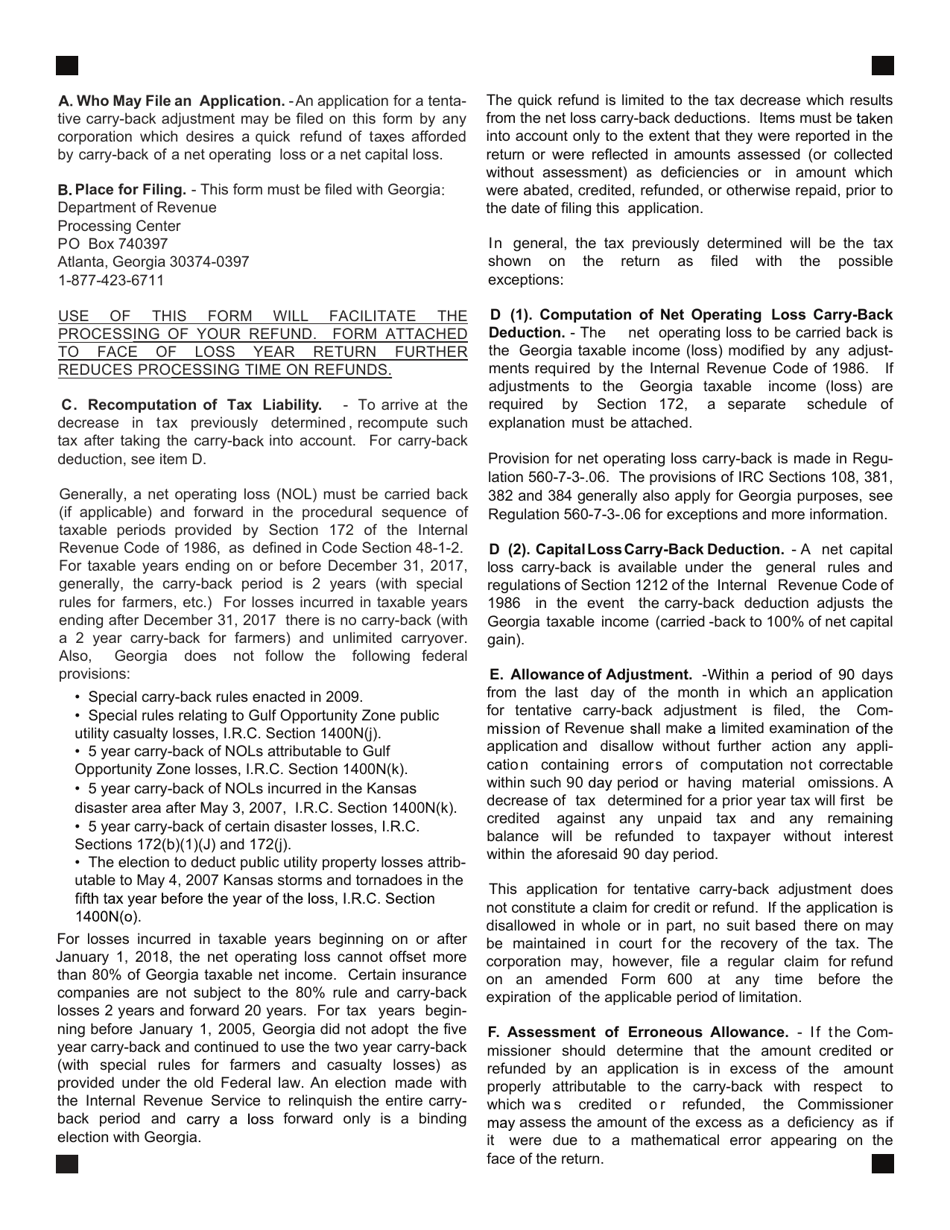

Q: What is the purpose of the IT552 form?

A: The purpose of the IT552 form is to apply for a tentative carry-back adjustment for a corporation's tax liability in Georgia.

Q: Which section of the Georgia Public Revenue Code does the IT552 form refer to?

A: The IT552 form refers to Section 48-7-21 of the Georgia Public Revenue Code.

Q: Who is eligible to use the IT552 form?

A: Corporations in Georgia are eligible to use the IT552 form.

Q: What is a tentative carry-back adjustment?

A: A tentative carry-back adjustment allows a corporation to apply a net operating loss to a previous tax year to reduce its tax liability.

Q: Are there any fees associated with filing the IT552 form?

A: There are no fees associated with filing the IT552 form.

Q: What documents should be included with the IT552 form?

A: You should include supporting documentation such as federal tax return forms and schedules with the IT552 form.

Q: What is the deadline for filing the IT552 form?

A: The IT552 form should be filed within three years from the original due date of the return for the tax year in which the net operating loss occurred.

Form Details:

- Released on March 13, 2019;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT552 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.