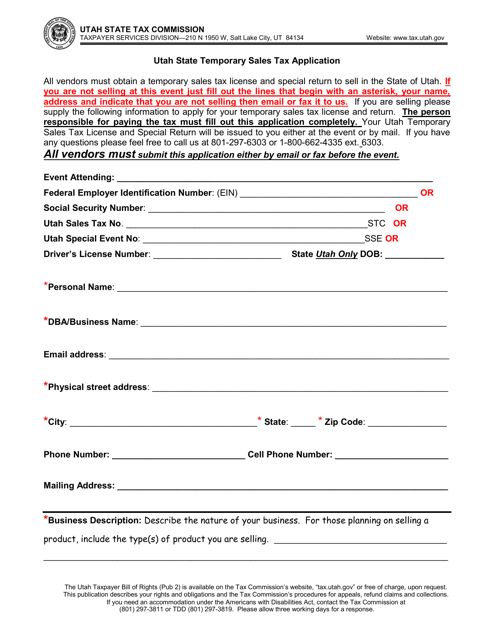

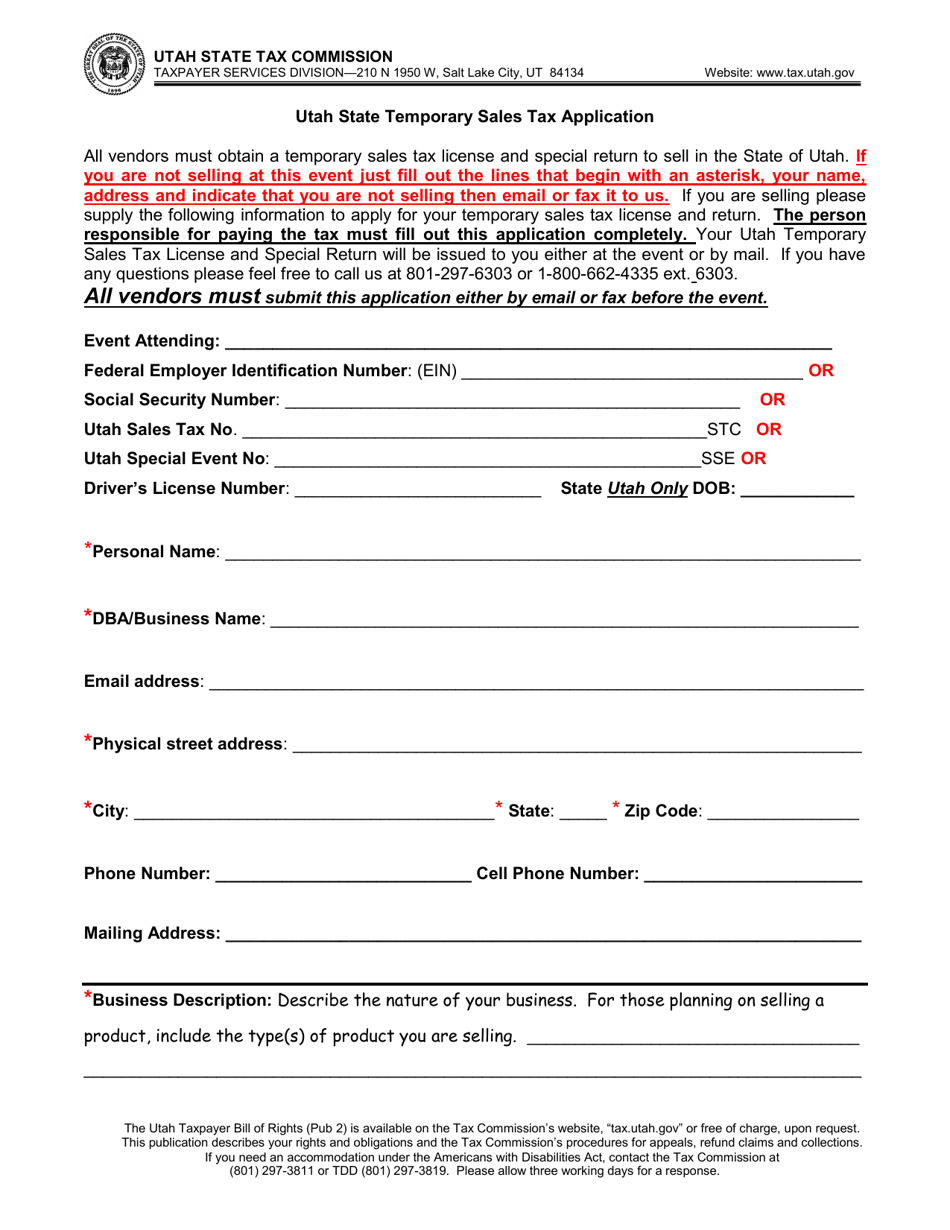

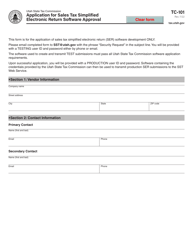

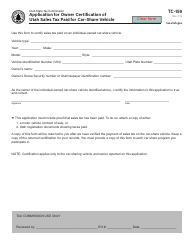

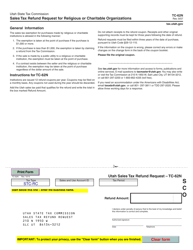

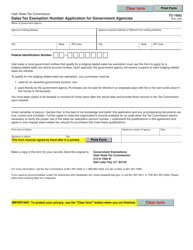

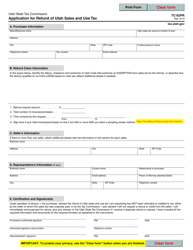

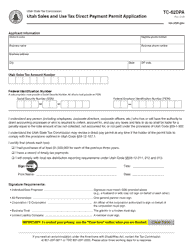

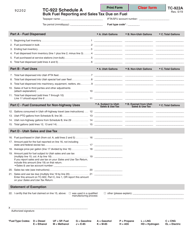

Utah State Temporary Sales Tax Application - Utah

Utah State Temporary Sales Tax Application is a legal document that was released by the Utah State Tax Commission - a government authority operating within Utah.

FAQ

Q: What is the Utah State Temporary Sales Tax Application?

A: The Utah State Temporary Sales Tax Application is a form that businesses need to complete in order to register for a temporary sales tax permit in the state of Utah.

Q: Who needs to fill out the Utah State Temporary Sales Tax Application?

A: Any business that will be engaging in temporary sales in Utah, such as vendors at fairs or conventions, must fill out the Utah State Temporary Sales Tax Application.

Q: Is there a fee to submit the Utah State Temporary Sales Tax Application?

A: No, there is no fee to submit the Utah State Temporary Sales Tax Application.

Q: How long does it take to process the Utah State Temporary Sales Tax Application?

A: It typically takes 7 to 10 business days for the Utah State Tax Commission to process the Utah State Temporary Sales Tax Application.

Q: Is the Utah State Temporary Sales Tax Permit valid for any specific time period?

A: Yes, the Utah State Temporary Sales Tax Permit is typically valid for 120 days.

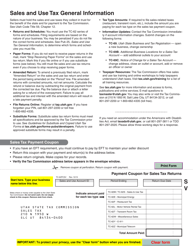

Form Details:

- The latest edition currently provided by the Utah State Tax Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.