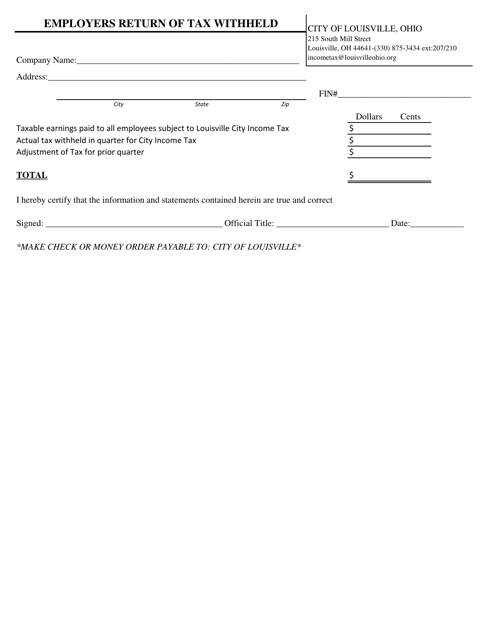

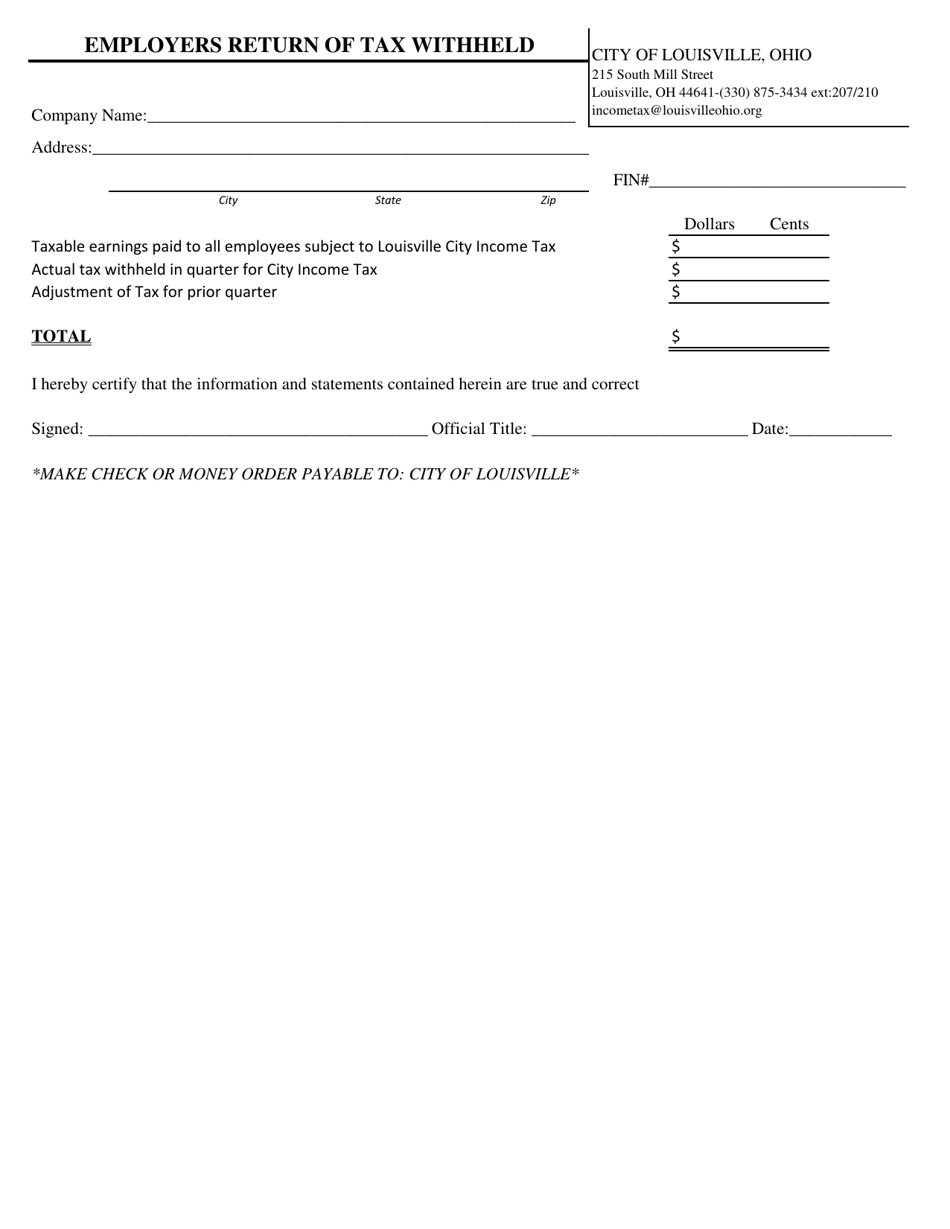

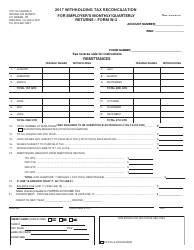

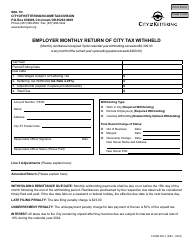

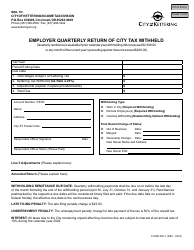

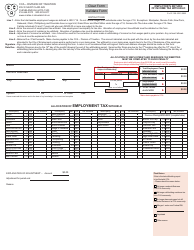

Employers Return of Tax Withheld - City of Louisville, Ohio

Employers Return of Tax Withheld is a legal document that was released by the Income Tax Department - City of Louisville, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Louisville.

FAQ

Q: What is the Employers Return of Tax Withheld?

A: The Employers Return of Tax Withheld is a form that employers in the City of Louisville, Ohio use to report and remit the local income tax withheld from their employees' wages.

Q: Who is required to file the Employers Return of Tax Withheld?

A: All employers in the City of Louisville, Ohio who withhold local income tax from their employees' wages are required to file the Employers Return of Tax Withheld.

Q: When is the deadline to file the Employers Return of Tax Withheld?

A: The deadline to file the Employers Return of Tax Withheld in the City of Louisville, Ohio is typically the last day of the month following the end of the quarter.

Q: What information is required to complete the Employers Return of Tax Withheld?

A: To complete the Employers Return of Tax Withheld, you will need to provide information such as your employer identification number, the total wages subject to local income tax, and the amount of tax withheld from employees.

Q: Is there a penalty for late filing or non-compliance?

A: Yes, there may be penalties for late filing or non-compliance with the Employers Return of Tax Withheld requirements. It is important to file the form on time and accurately to avoid penalties.

Form Details:

- The latest edition currently provided by the Income Tax Department - City of Louisville, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Louisville, Ohio.