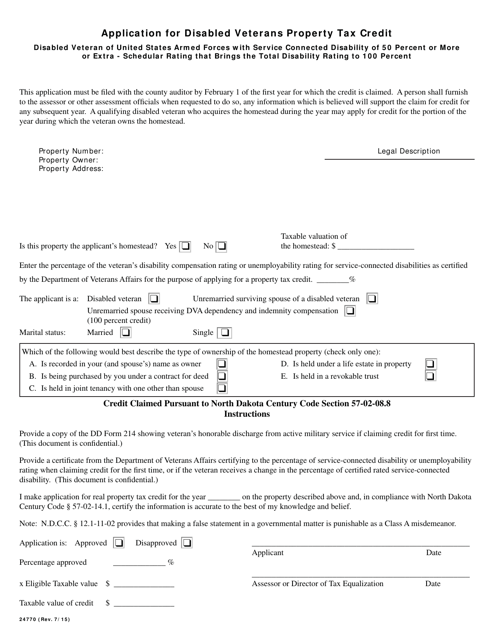

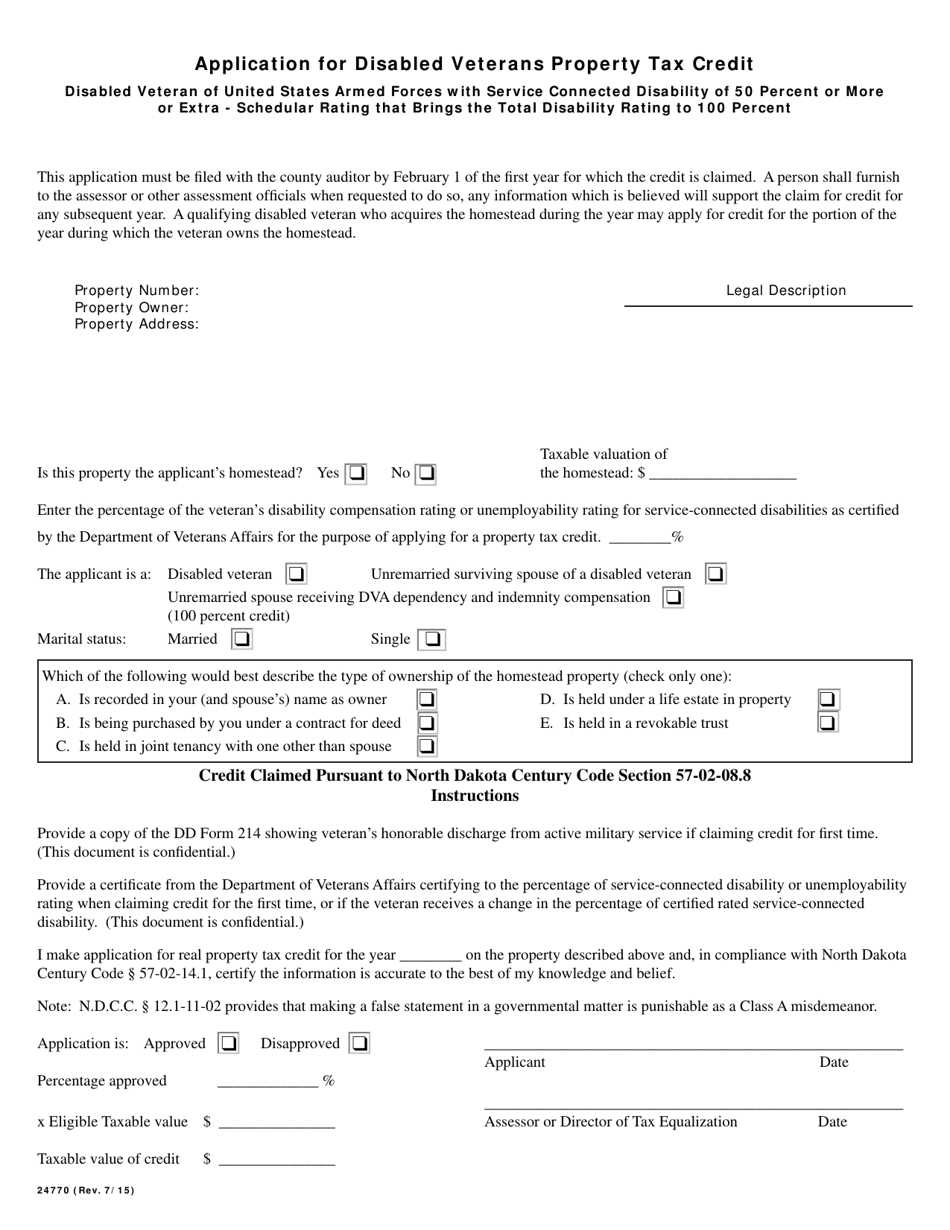

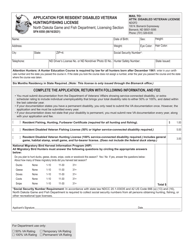

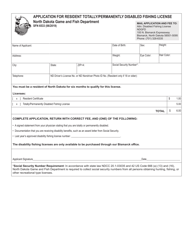

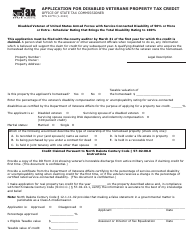

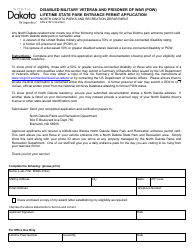

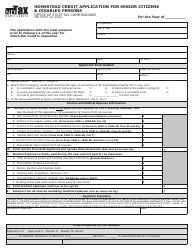

Form 24770 Application for Disabled Veterans Property Tax Credit - North Dakota

What Is Form 24770?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 24770?

A: Form 24770 is the application for the Disabled Veterans Property Tax Credit in North Dakota.

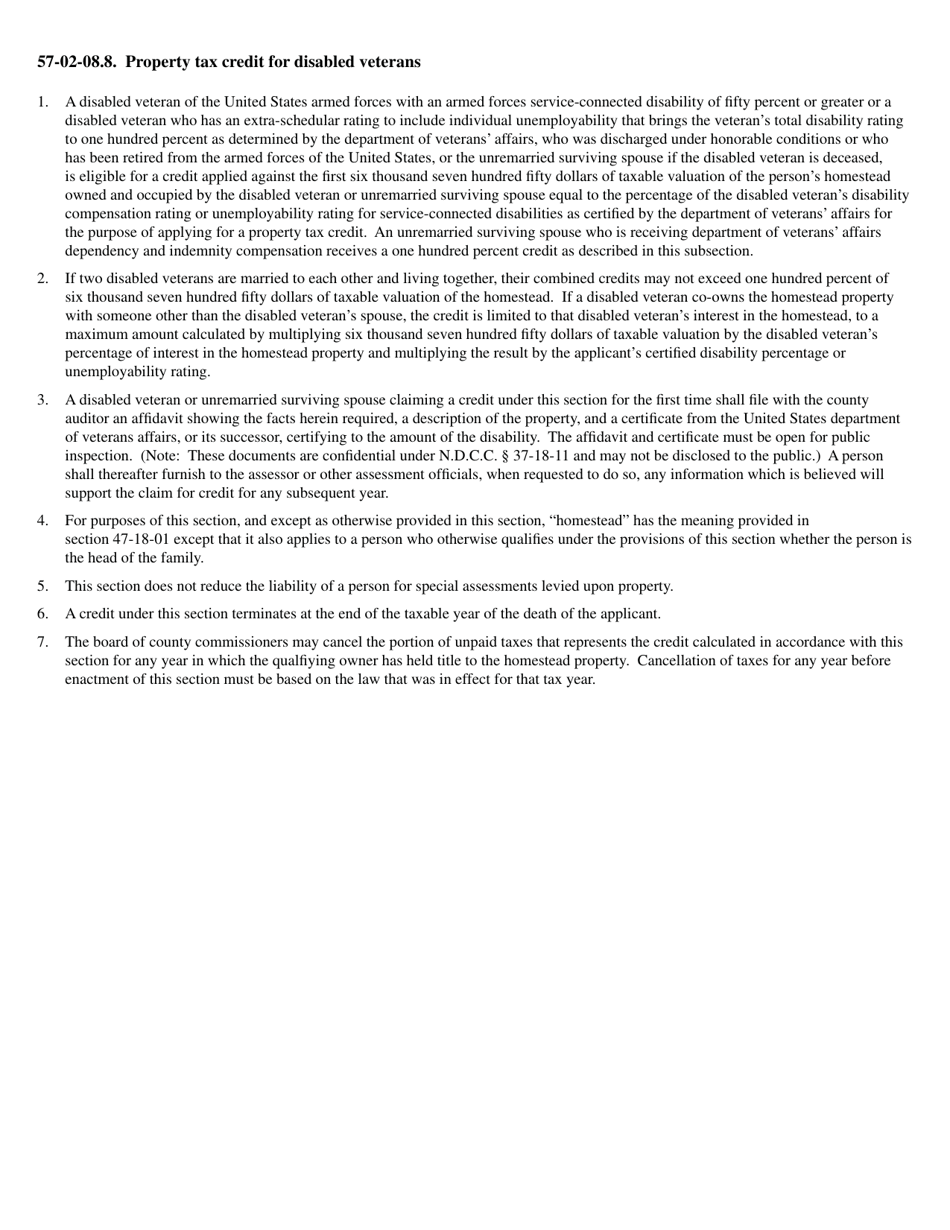

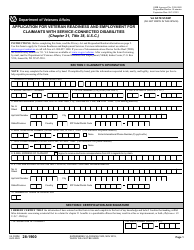

Q: Who is eligible for the Disabled Veterans Property Tax Credit?

A: Disabled veterans who own a home in North Dakota and meet certain criteria are eligible for the property tax credit.

Q: What is the purpose of the Disabled Veterans Property Tax Credit?

A: The purpose of the credit is to provide financial relief to disabled veterans by reducing their property tax burden.

Q: How do I apply for the Disabled Veterans Property Tax Credit?

A: You can apply for the credit by completing form 24770 and submitting it to the North Dakota State Tax Commissioner's office.

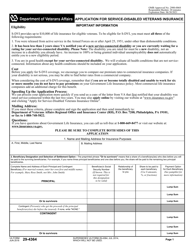

Q: What documentation do I need to include with my application?

A: You will need to include documentation of your disability, such as a letter from the Department of Veterans Affairs, along with your application.

Q: When is the deadline to apply for the Disabled Veterans Property Tax Credit?

A: The deadline to apply for the credit is February 1st of each year.

Q: Is there an income limit to qualify for the Disabled Veterans Property Tax Credit?

A: No, there is no income limit to qualify for the credit.

Q: What benefits do I receive if my application is approved?

A: If your application is approved, you will receive a reduction in the assessed value of your home for property tax purposes.

Q: Can I apply for the Disabled Veterans Property Tax Credit if I rent my home?

A: No, the credit is only available to disabled veterans who own a home in North Dakota.

Q: Can I still receive the credit if I have a mortgage on my home?

A: Yes, having a mortgage does not disqualify you from receiving the credit.

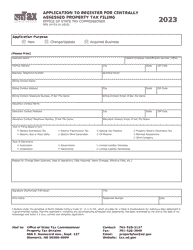

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 24770 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.