This version of the form is not currently in use and is provided for reference only. Download this version of

Form 4

for the current year.

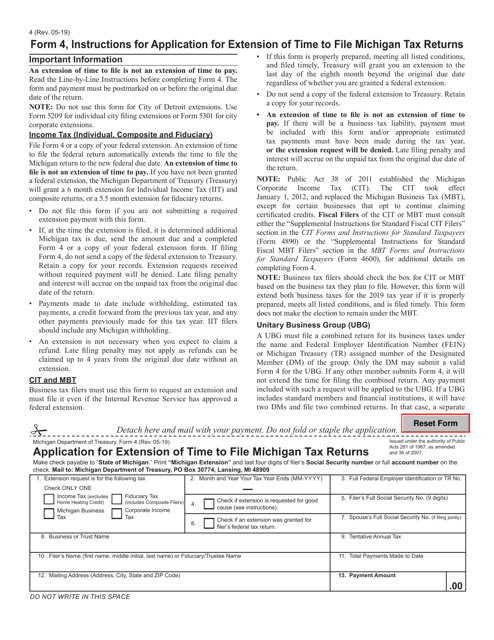

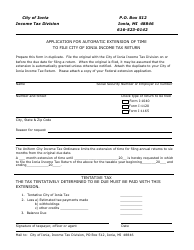

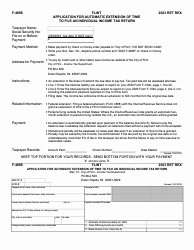

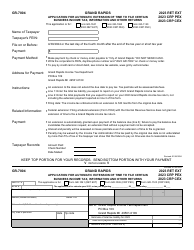

Form 4 Application for Extension of Time to File Michigan Tax Returns - Michigan

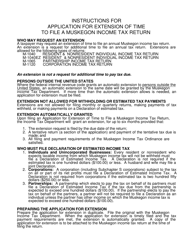

What Is Form 4?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4?

A: Form 4 is an application for extension of time to file Michigan tax returns.

Q: Who should use Form 4?

A: Individuals or businesses who need more time to file their Michigan tax returns should use Form 4.

Q: What is the purpose of Form 4?

A: The purpose of Form 4 is to request an extension of time to file Michigan tax returns.

Q: How do I fill out Form 4?

A: You need to provide your personal or business information, estimate your tax liability, and explain the reason for requesting an extension on Form 4.

Q: When is Form 4 due?

A: Form 4 is due on the same date as the original Michigan tax return, usually April 15th for individuals.

Q: Is there a penalty for filing Form 4 late?

A: Yes, there may be penalties for filing Form 4 late. It is important to submit the form before the original due date to avoid penalties.

Q: How long does the extension granted by Form 4 last?

A: The extension granted by Form 4 generally lasts for 6 months. However, it is still important to pay any estimated tax liability by the original due date to avoid penalties.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.