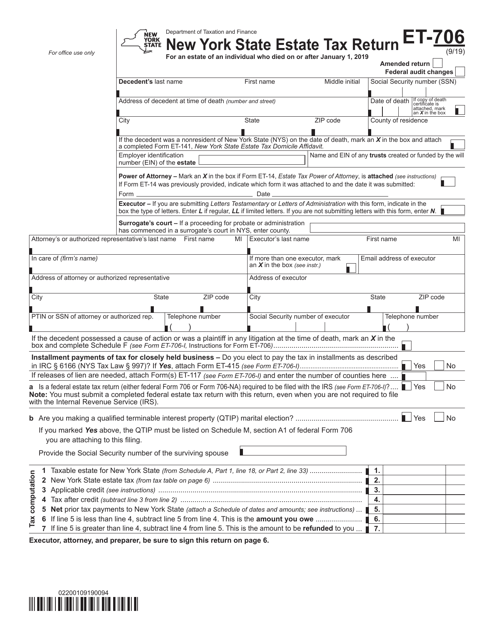

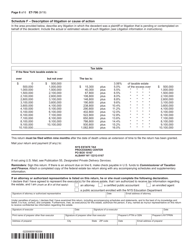

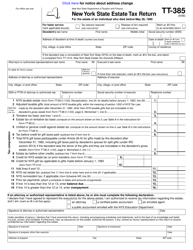

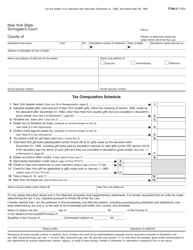

Form ET-706 New York State Estate Tax Return - New York

What Is Form ET-706?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-706?

A: Form ET-706 is the New York State Estate Tax Return.

Q: Who needs to file Form ET-706?

A: Individuals who are the executor or administrator of a New York estate and who need to report and pay estate taxes should file Form ET-706.

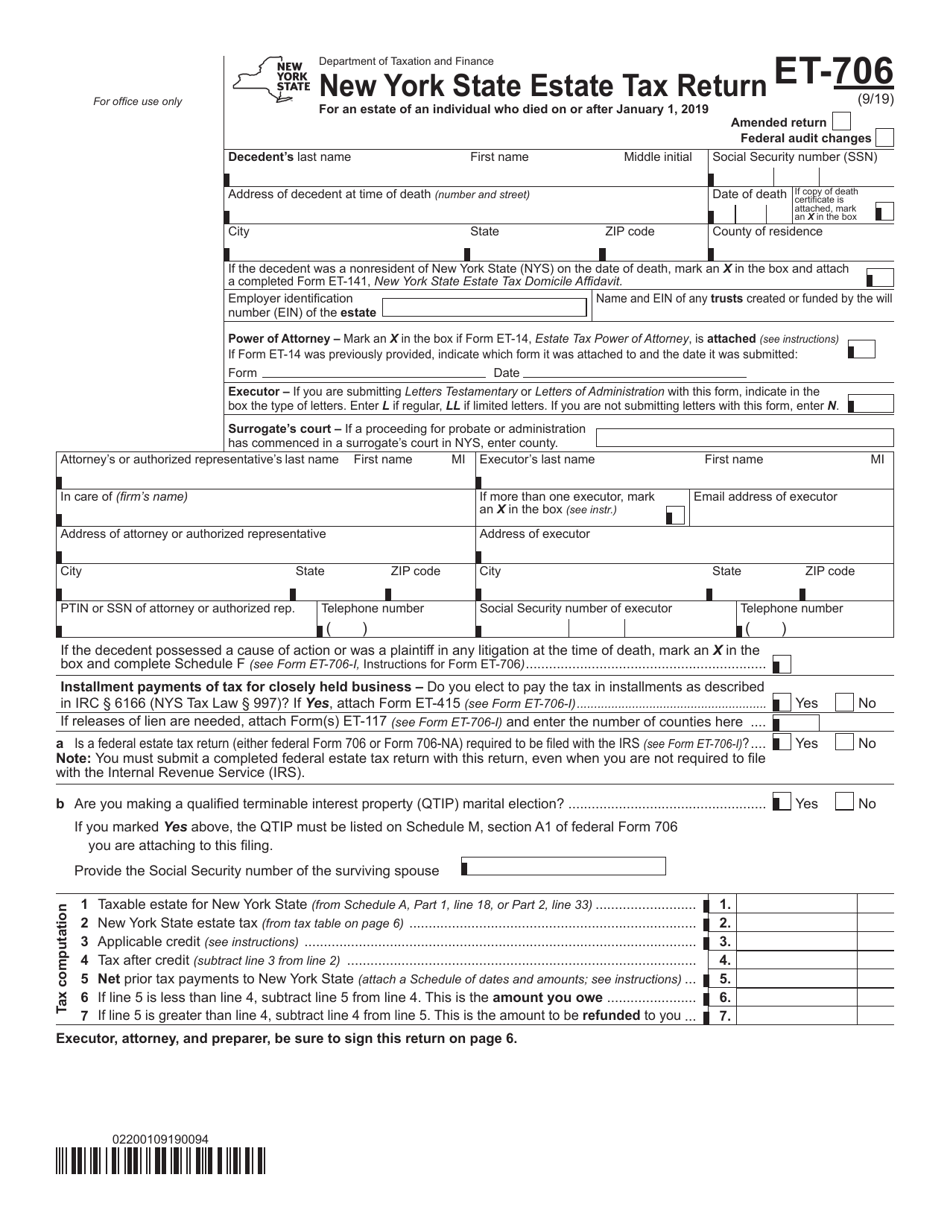

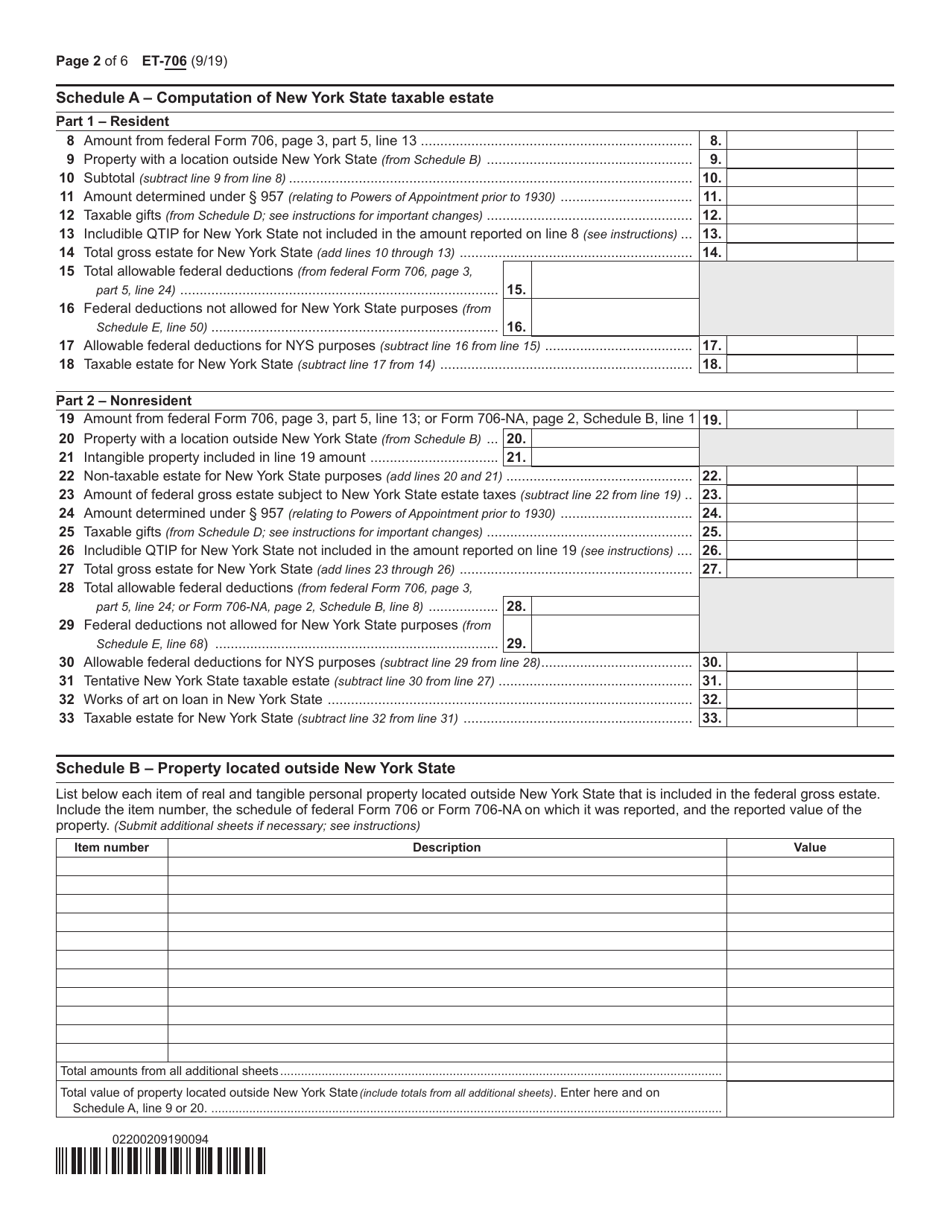

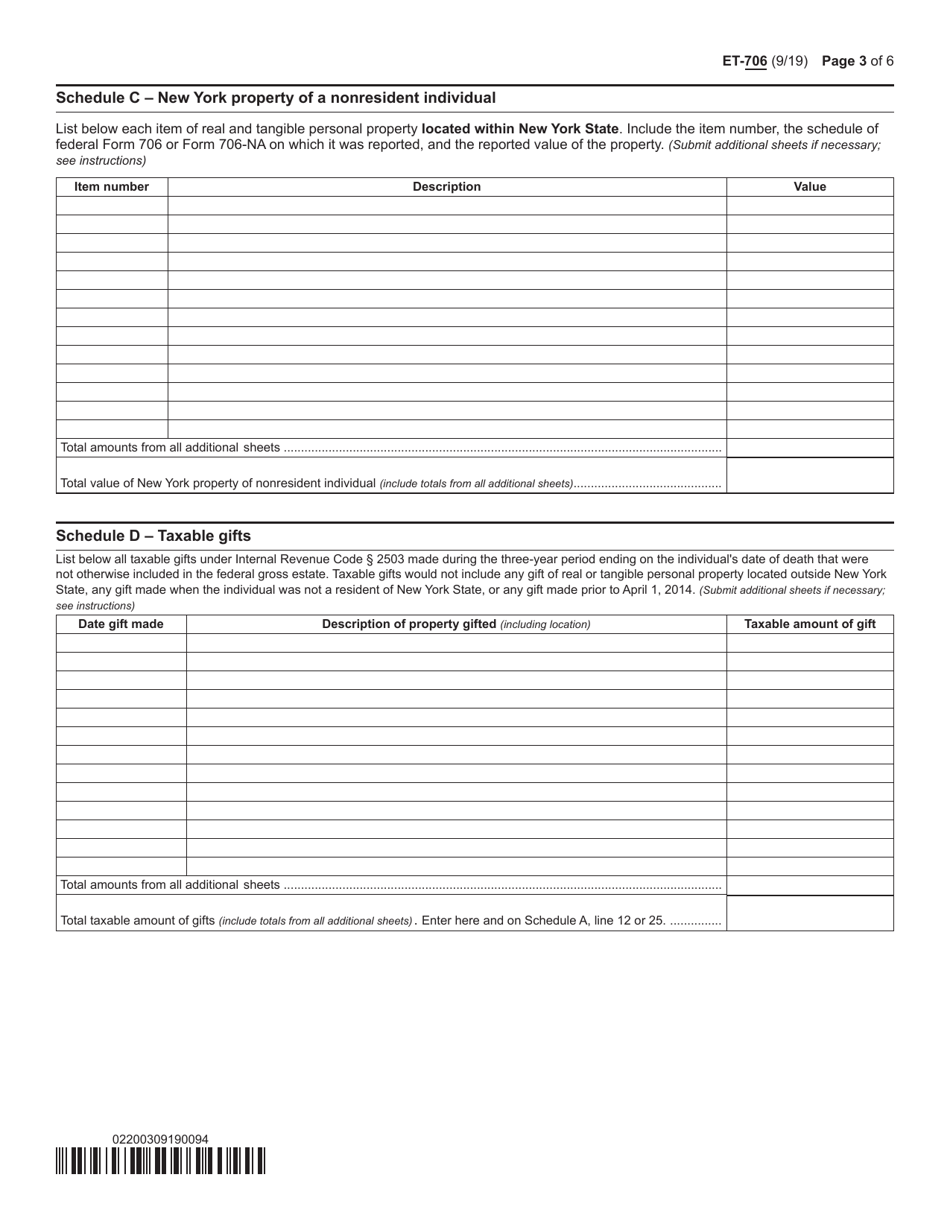

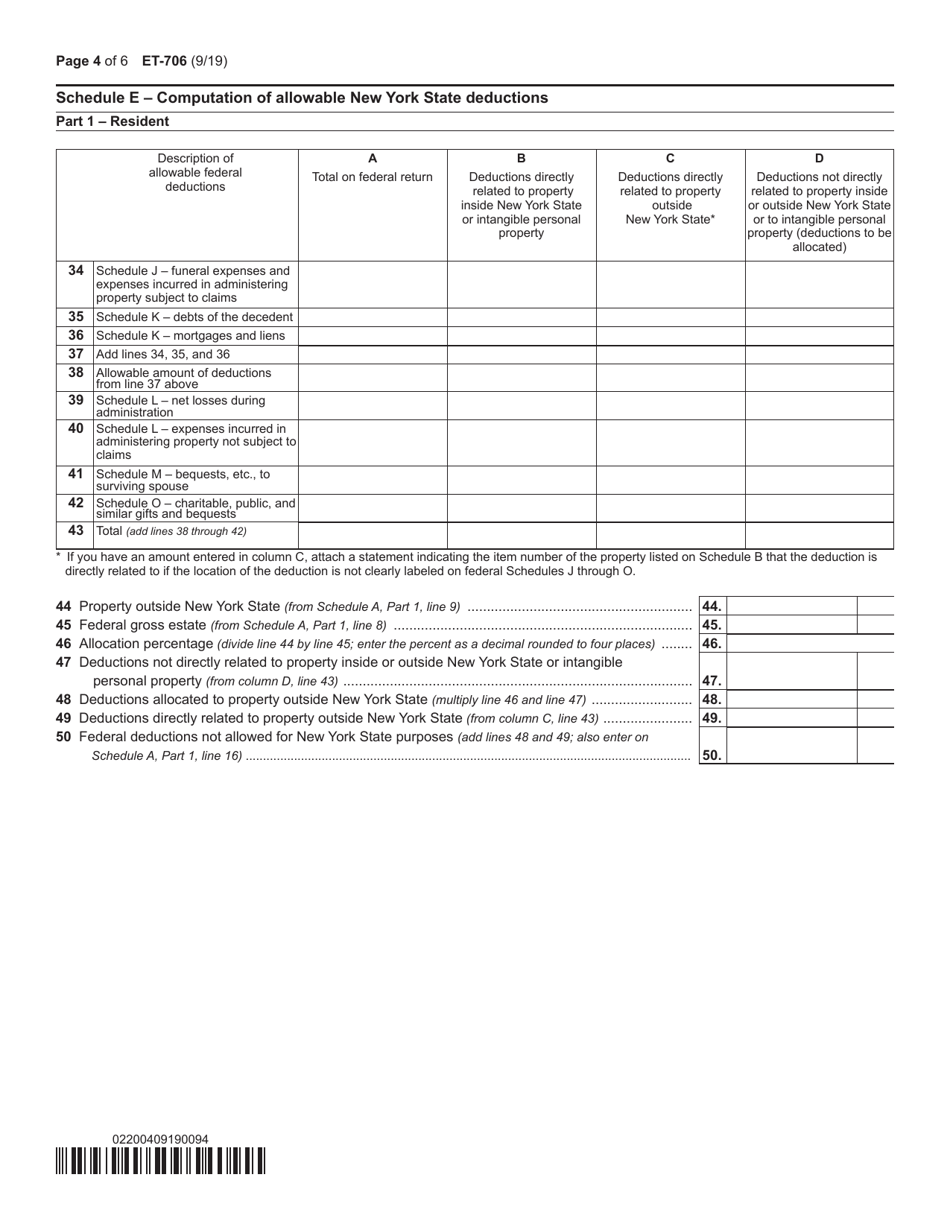

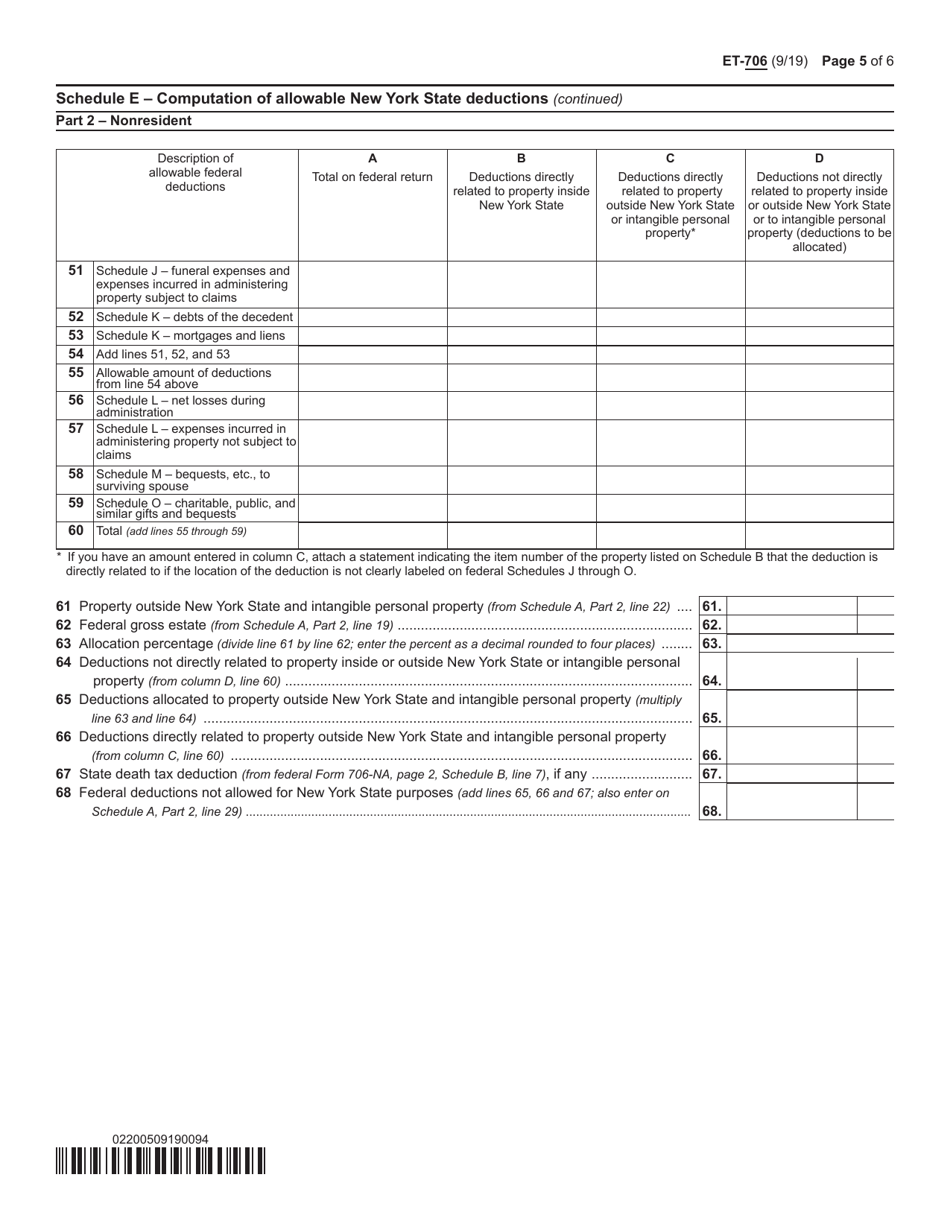

Q: What information is required on Form ET-706?

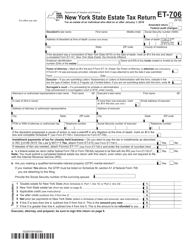

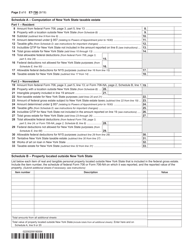

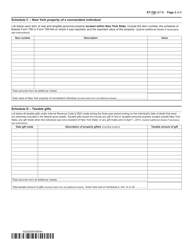

A: Form ET-706 requires information about the deceased person's estate, including their assets, liabilities, and beneficiaries.

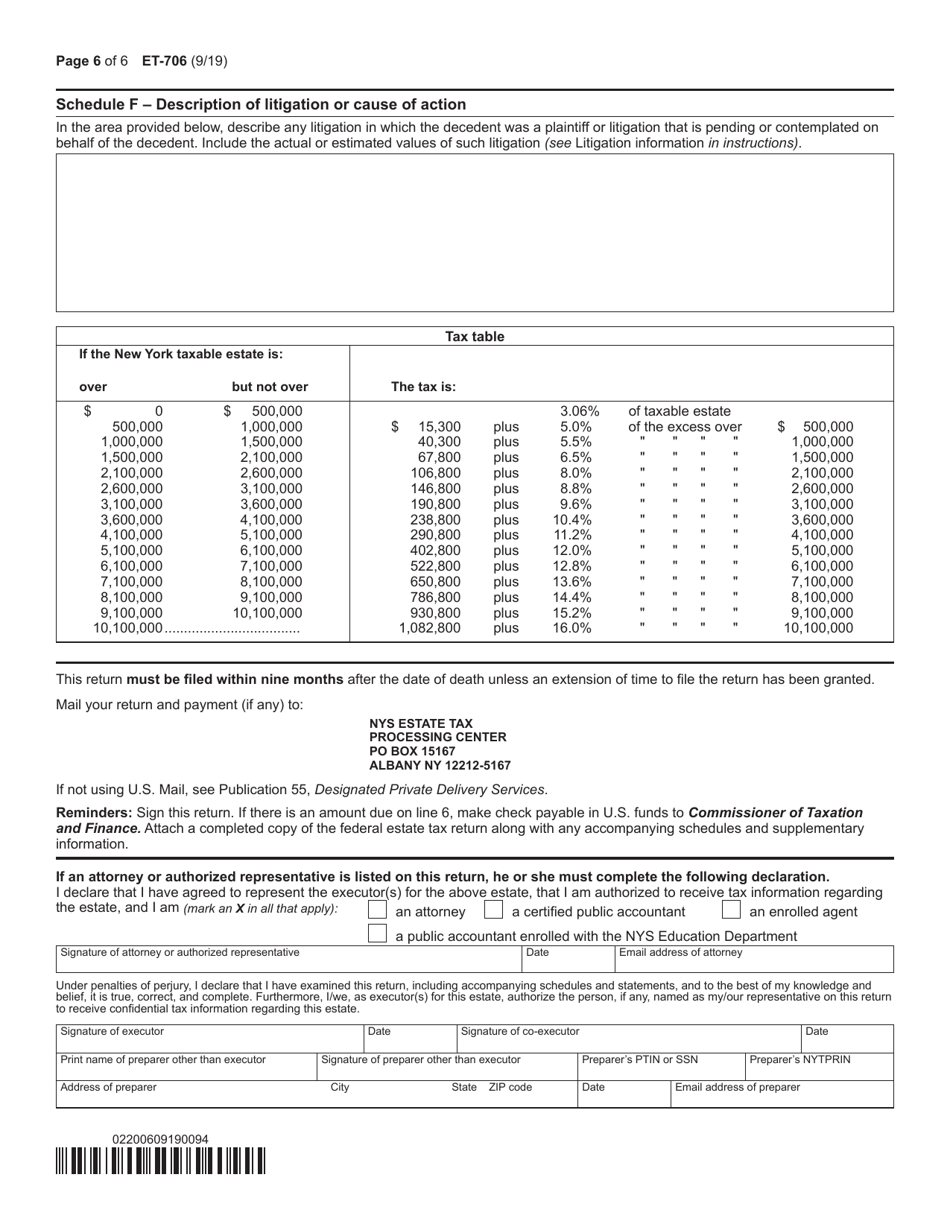

Q: When is the deadline to file Form ET-706?

A: The deadline to file Form ET-706 is generally within nine months after the decedent's date of death.

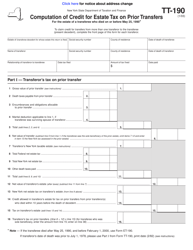

Q: Are there any exemptions or credits available for New York estate taxes?

A: Yes, there are certain exemptions and credits available, such as the spousal exemption and the charitable deduction. Consult the instructions for Form ET-706 for more details.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ET-706 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.