This version of the form is not currently in use and is provided for reference only. Download this version of

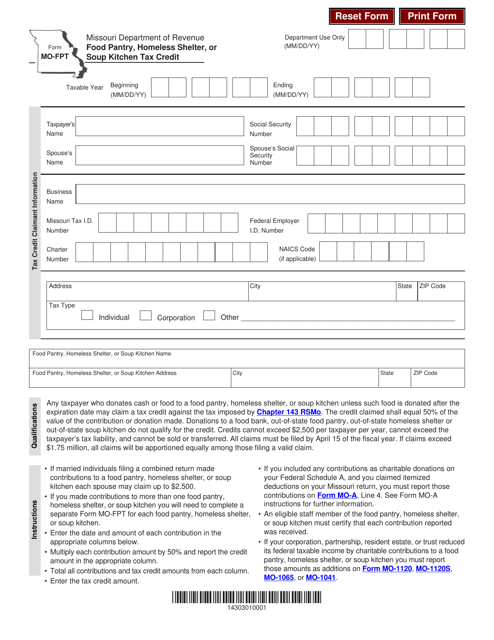

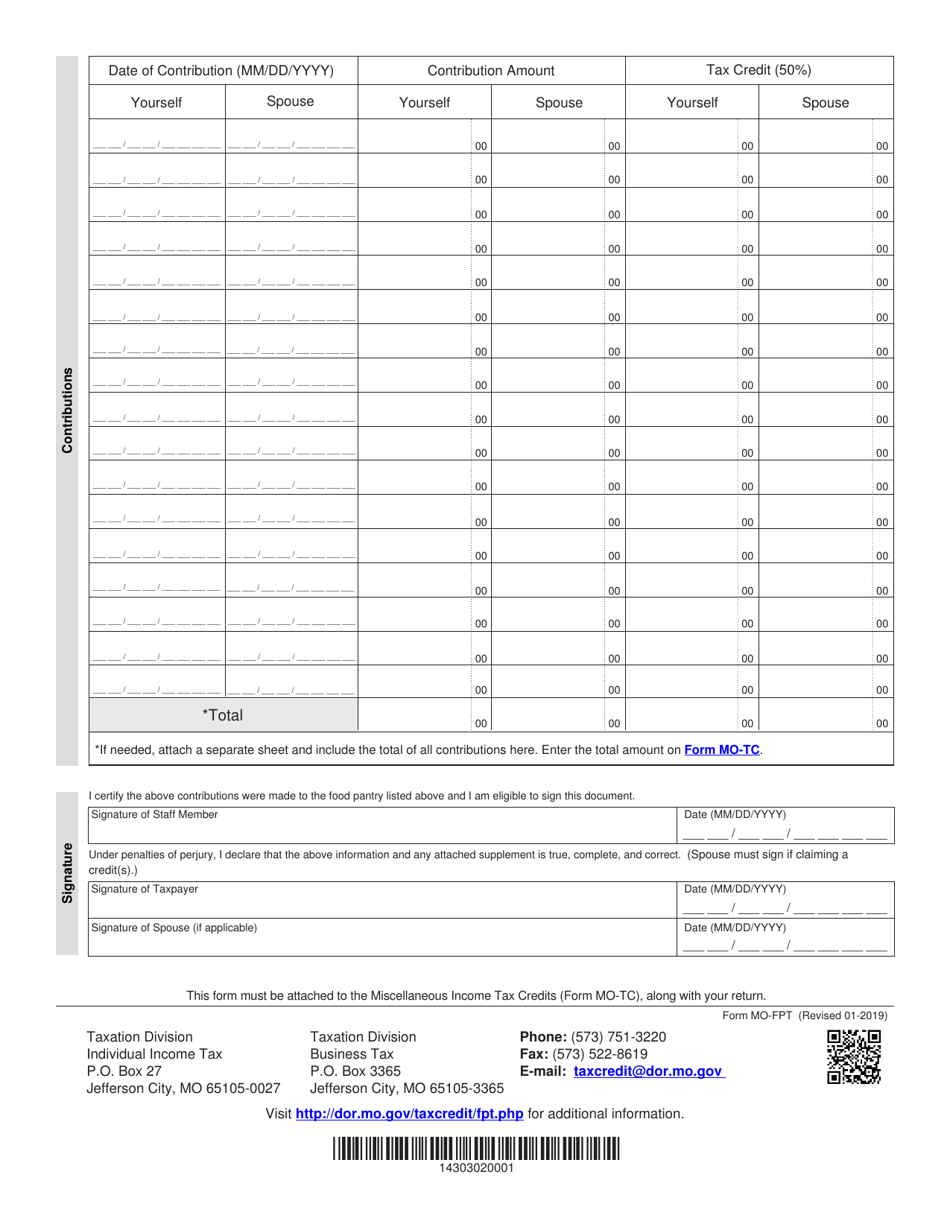

Form MO-FPT

for the current year.

Form MO-FPT Food Pantry, Homeless Shelter, or Soup Kitchen Tax Credit - Missouri

What Is Form MO-FPT?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

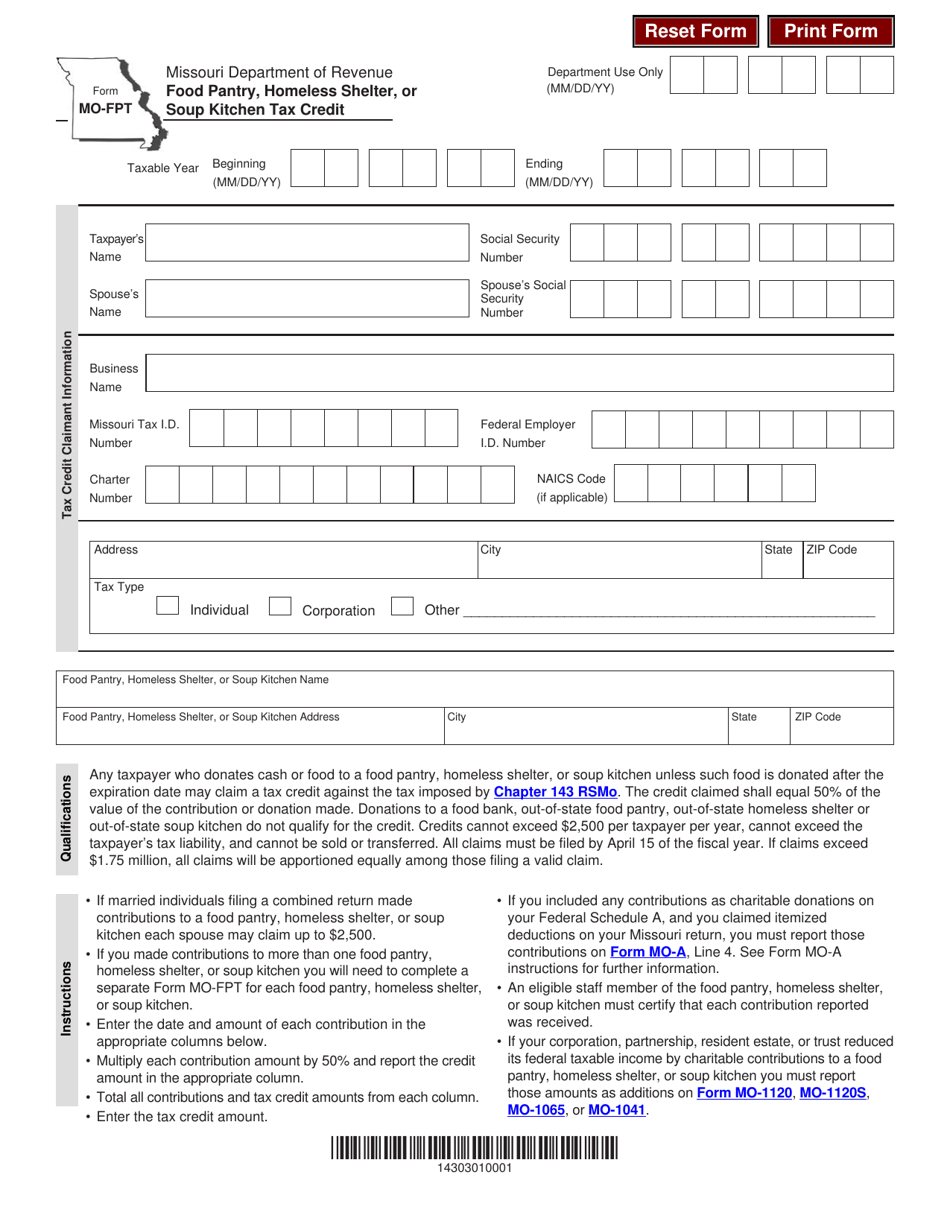

Q: What is the MO-FPT Food Pantry, Homeless Shelter, or Soup Kitchen Tax Credit?

A: The MO-FPT Food Pantry, Homeless Shelter, or Soup Kitchen Tax Credit is a program in Missouri that provides tax credits to individuals or corporations that make qualifying donations to food pantries, homeless shelters, or soup kitchens.

Q: Who is eligible for the MO-FPT Food Pantry, Homeless Shelter, or Soup Kitchen Tax Credit?

A: Individuals or corporations that make qualifying donations to food pantries, homeless shelters, or soup kitchens in Missouri are eligible for the tax credit.

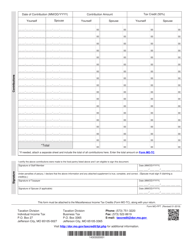

Q: What are the qualifying donations for the tax credit?

A: Qualifying donations include cash, stocks, bonds, and other property given to eligible food pantries, homeless shelters, or soup kitchens in Missouri.

Q: How much is the tax credit?

A: The tax credit is 50% of the amount of the donation, up to a maximum of $2,500 for individuals or $5,000 for corporations.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete Form MO-FPT and include it with your Missouri state tax return.

Q: Is there a limit to the total amount of tax credits that can be claimed?

A: Yes, there is an annual cap on the total amount of tax credits that can be claimed under the MO-FPT program, which is set by the Missouri Department of Economic Development.

Q: Can the tax credit be carried forward or transferred to another taxpayer?

A: No, the tax credit cannot be carried forward to future years or transferred to another taxpayer.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, the tax credit must be claimed in the same year that the donation was made. The specific deadline may vary, so it is important to check the current year's tax instructions or consult a tax professional.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-FPT by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.