This version of the form is not currently in use and is provided for reference only. Download this version of

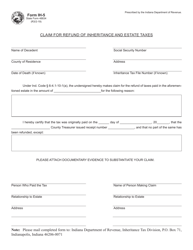

Form REF-1000 (State Form 50854)

for the current year.

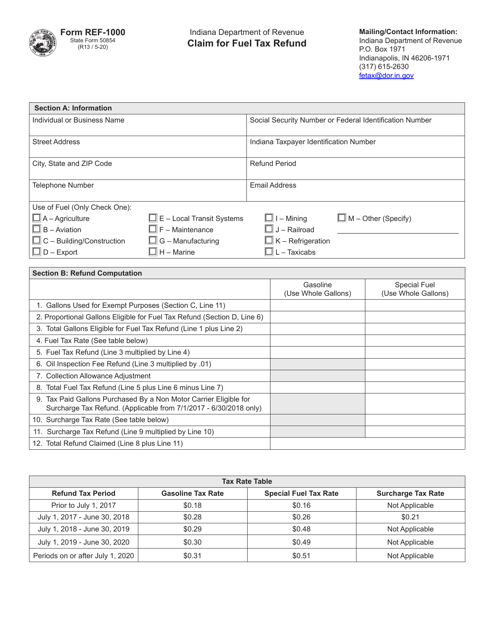

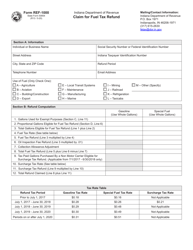

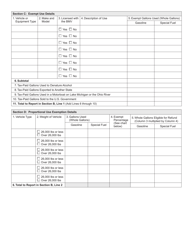

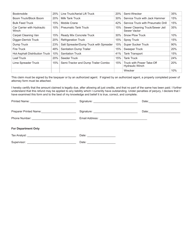

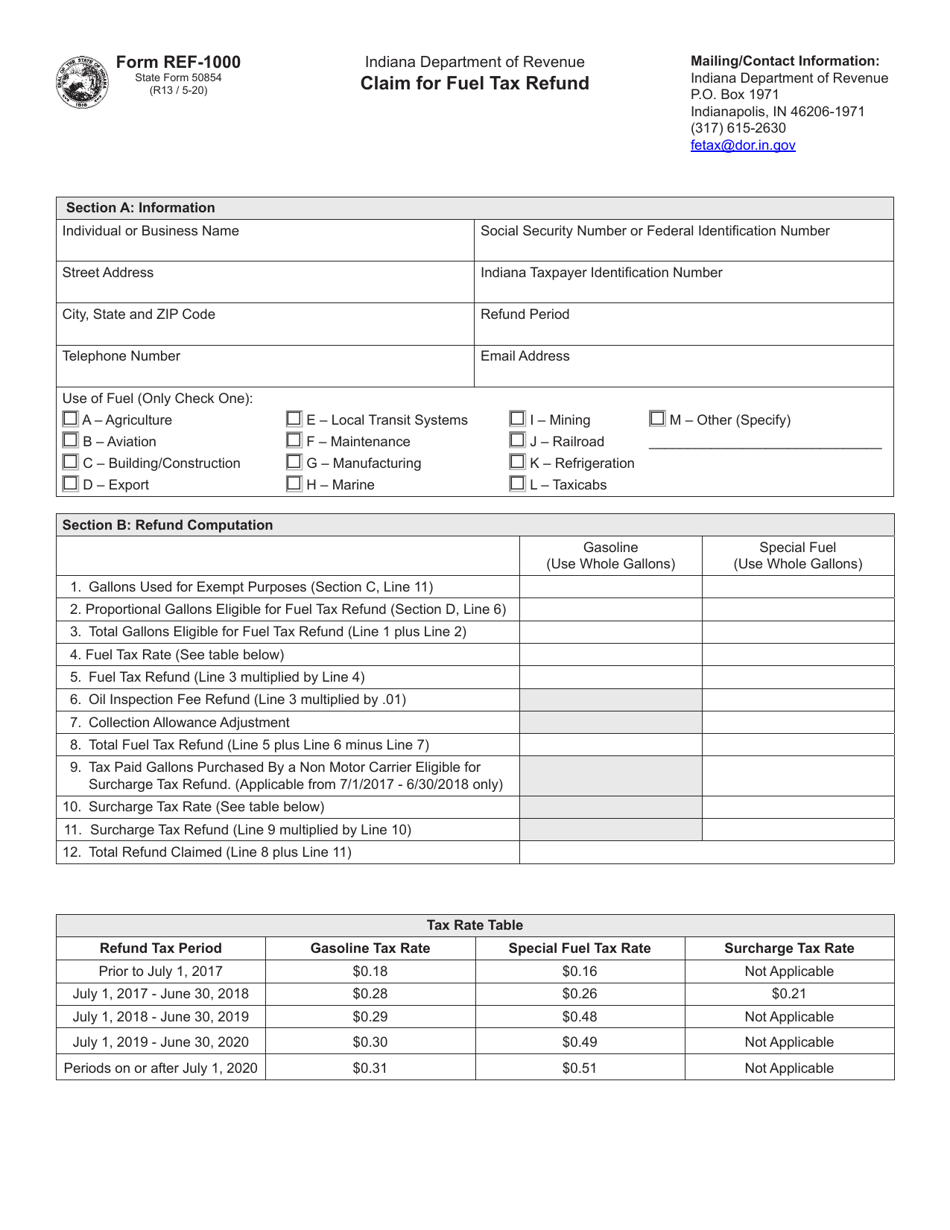

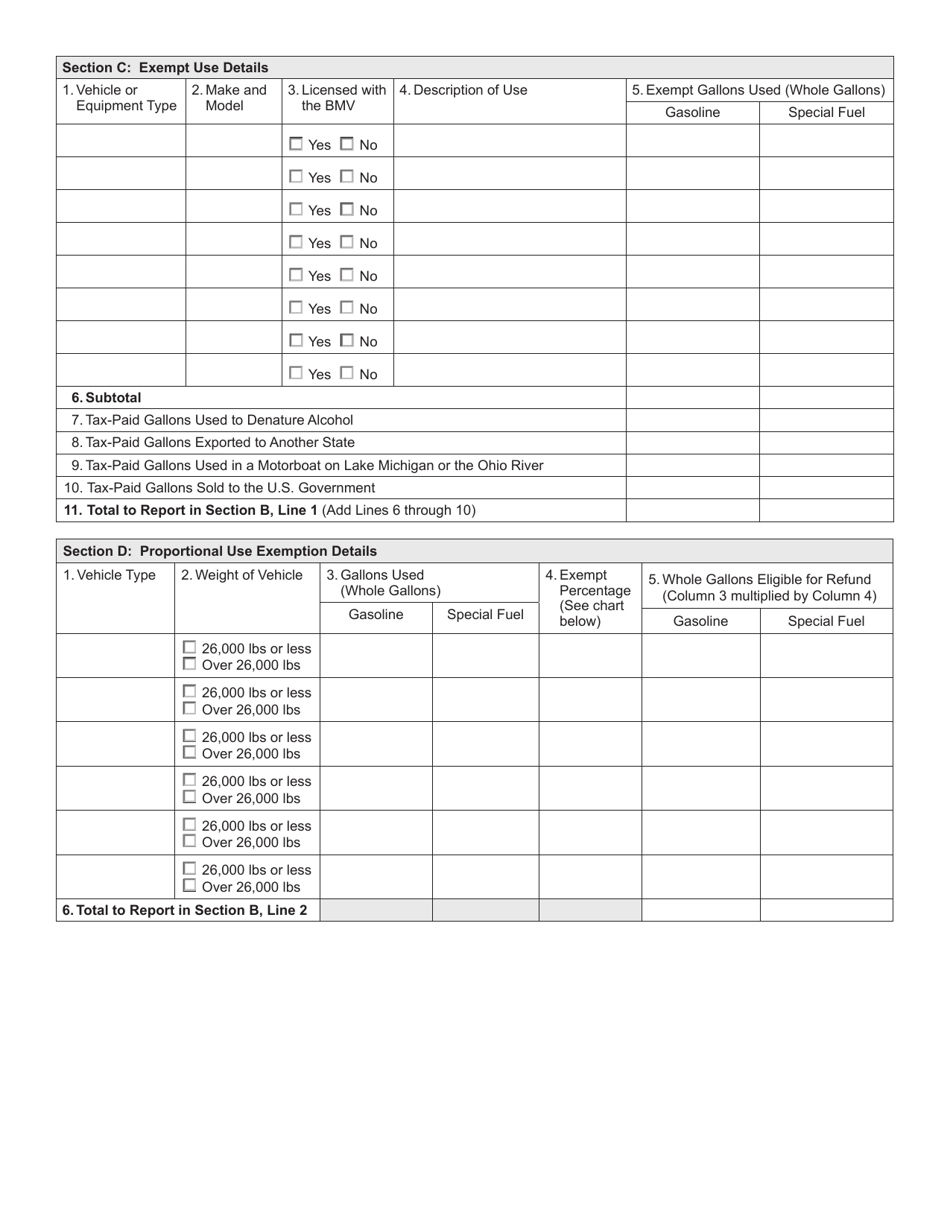

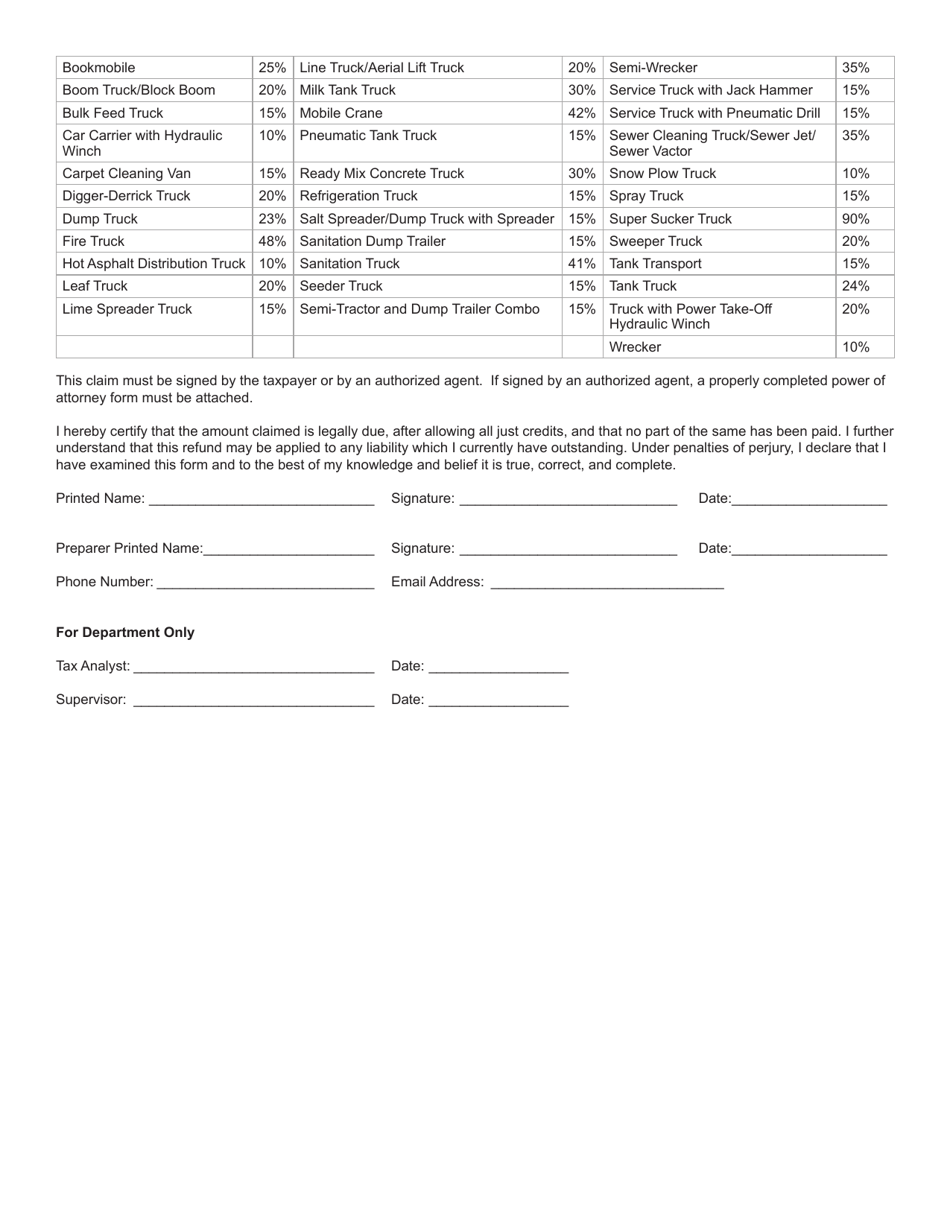

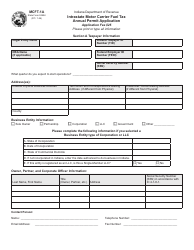

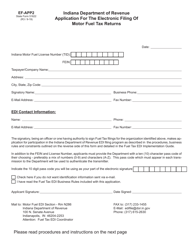

Form REF-1000 (State Form 50854) Claim for Fuel Tax Refund - Indiana

What Is Form REF-1000 (State Form 50854)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

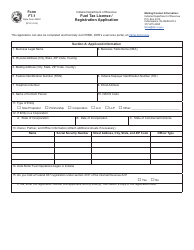

Q: What is Form REF-1000?

A: Form REF-1000 is the Claim for Fuel Tax Refund form in Indiana.

Q: What is the purpose of Form REF-1000?

A: The purpose of Form REF-1000 is to claim a fuel tax refund in Indiana.

Q: What is State Form 50854?

A: State Form 50854 is the form number assigned to Form REF-1000.

Q: Who can use Form REF-1000?

A: Form REF-1000 can be used by individuals and businesses in Indiana who want to claim a refund on fuel tax.

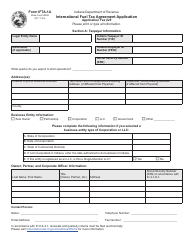

Q: How do I fill out Form REF-1000?

A: You need to provide information about your fuel purchases and usage, as well as other required details specified on the form.

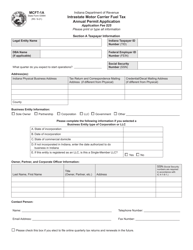

Q: Is there a deadline for submitting Form REF-1000?

A: Yes, the deadline for submitting Form REF-1000 is specified by the Indiana Department of Revenue and may vary.

Q: What documents do I need to include with Form REF-1000?

A: You may be required to include supporting documents such as fuel receipts or other proof of purchase.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REF-1000 (State Form 50854) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.