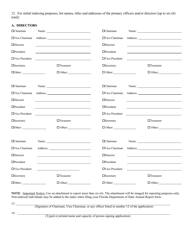

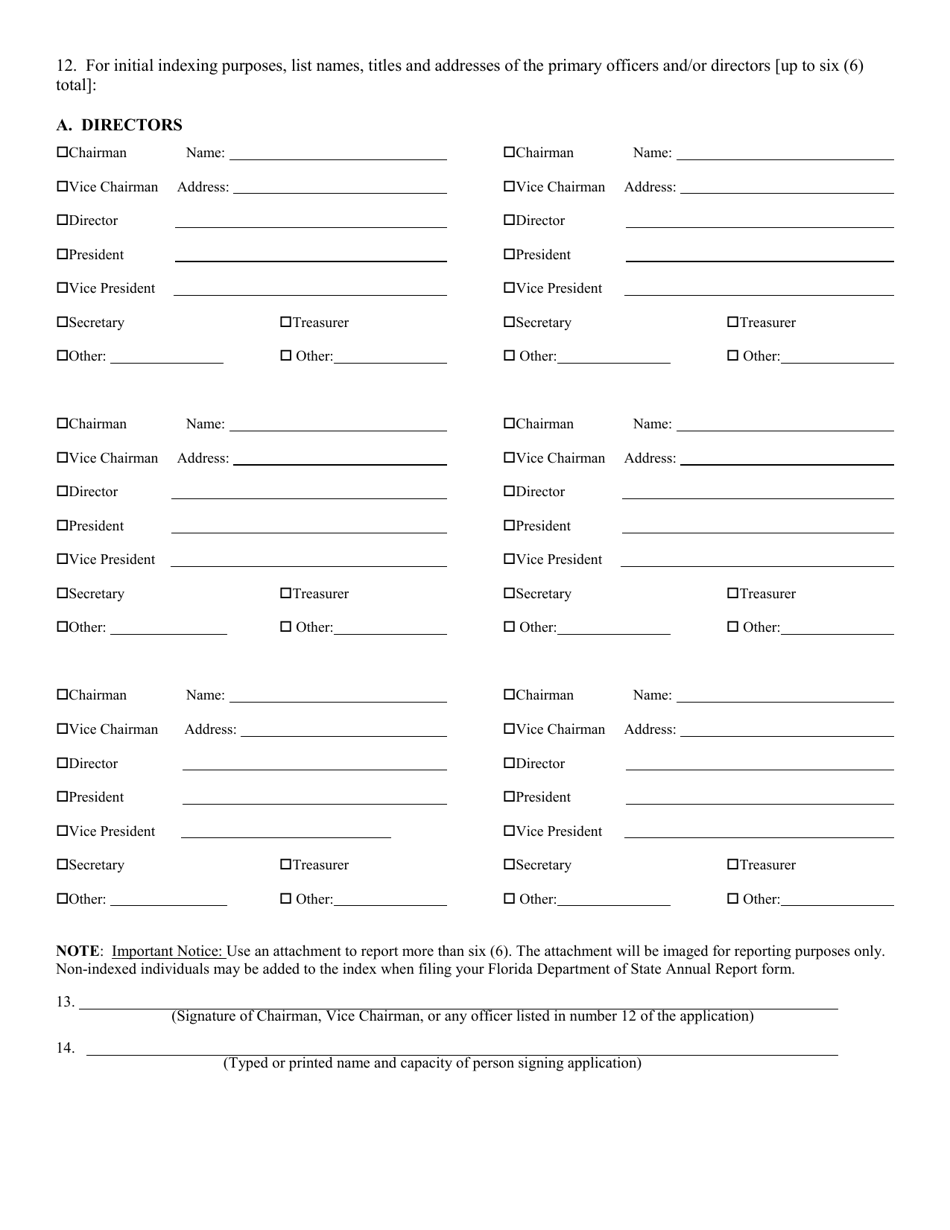

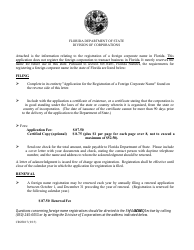

Form CR2E021 Application by Foreign Not for Profit Corporation for Authorization to Conduct Its Affairs in Florida - Florida

What Is Form CR2E021?

This is a legal form that was released by the Florida Department of State (Secretary of State) - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

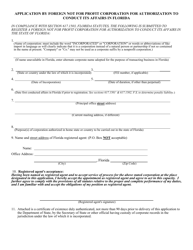

Q: What is Form CR2E021?

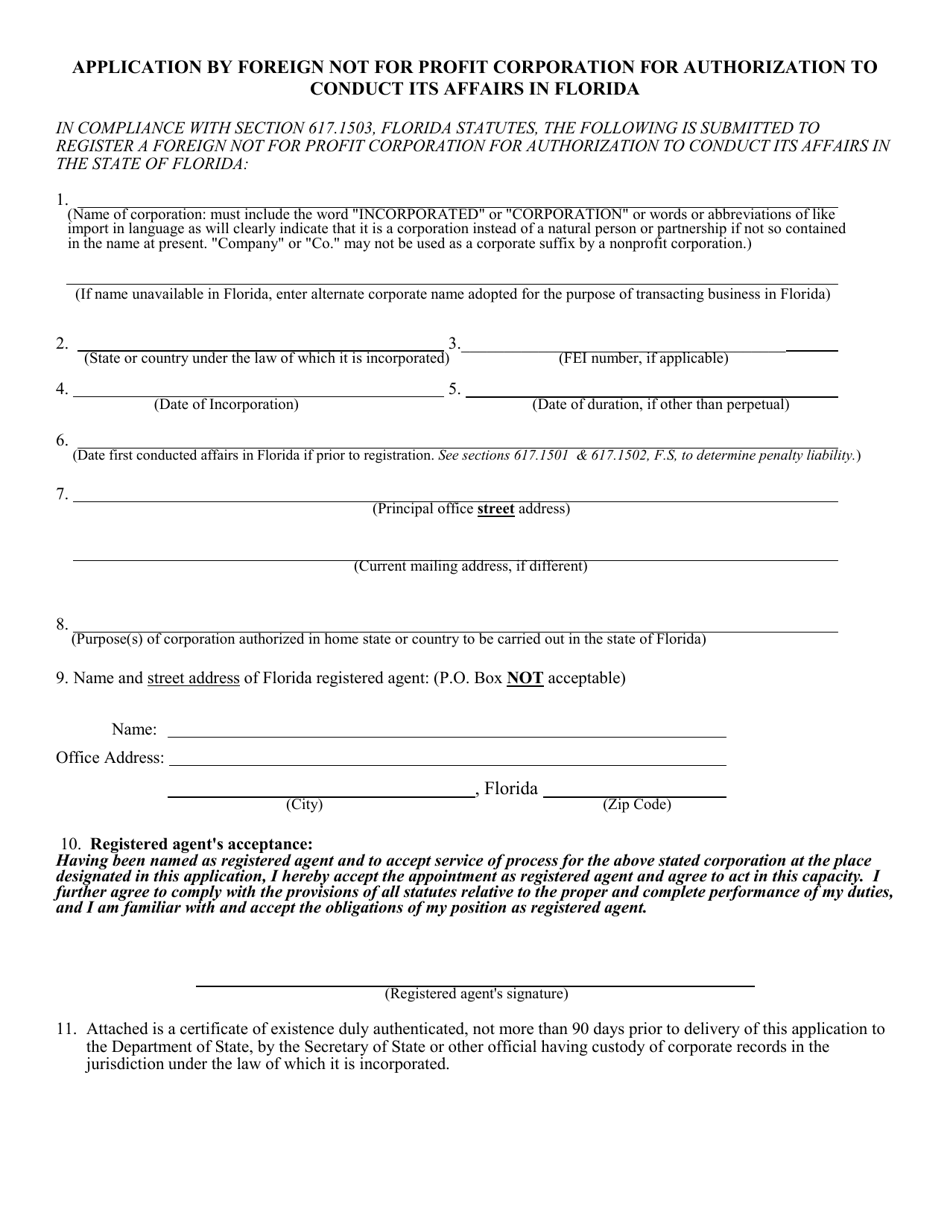

A: Form CR2E021 is an application by a foreign not-for-profit corporation to conduct its affairs in Florida.

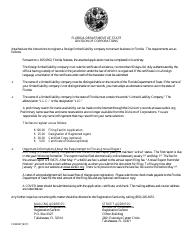

Q: What is a foreign not-for-profit corporation?

A: A foreign not-for-profit corporation is a non-profit organization that is incorporated in a state other than Florida.

Q: Why would a foreign not-for-profit corporation apply to conduct its affairs in Florida?

A: A foreign not-for-profit corporation may apply to conduct its affairs in Florida if they want to expand their operations or establish a presence in the state.

Q: What does it mean to conduct affairs in Florida?

A: To conduct affairs in Florida means to engage in activities such as holding meetings, conducting business transactions, or soliciting donations within the state.

Q: What is the purpose of filing Form CR2E021?

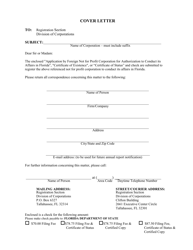

A: The purpose of filing Form CR2E021 is to request authorization from the Florida Secretary of State to conduct affairs in the state.

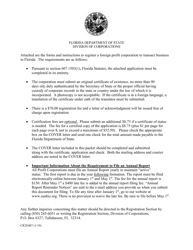

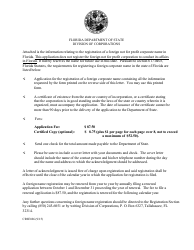

Q: Are there any requirements for a foreign not-for-profit corporation to file Form CR2E021?

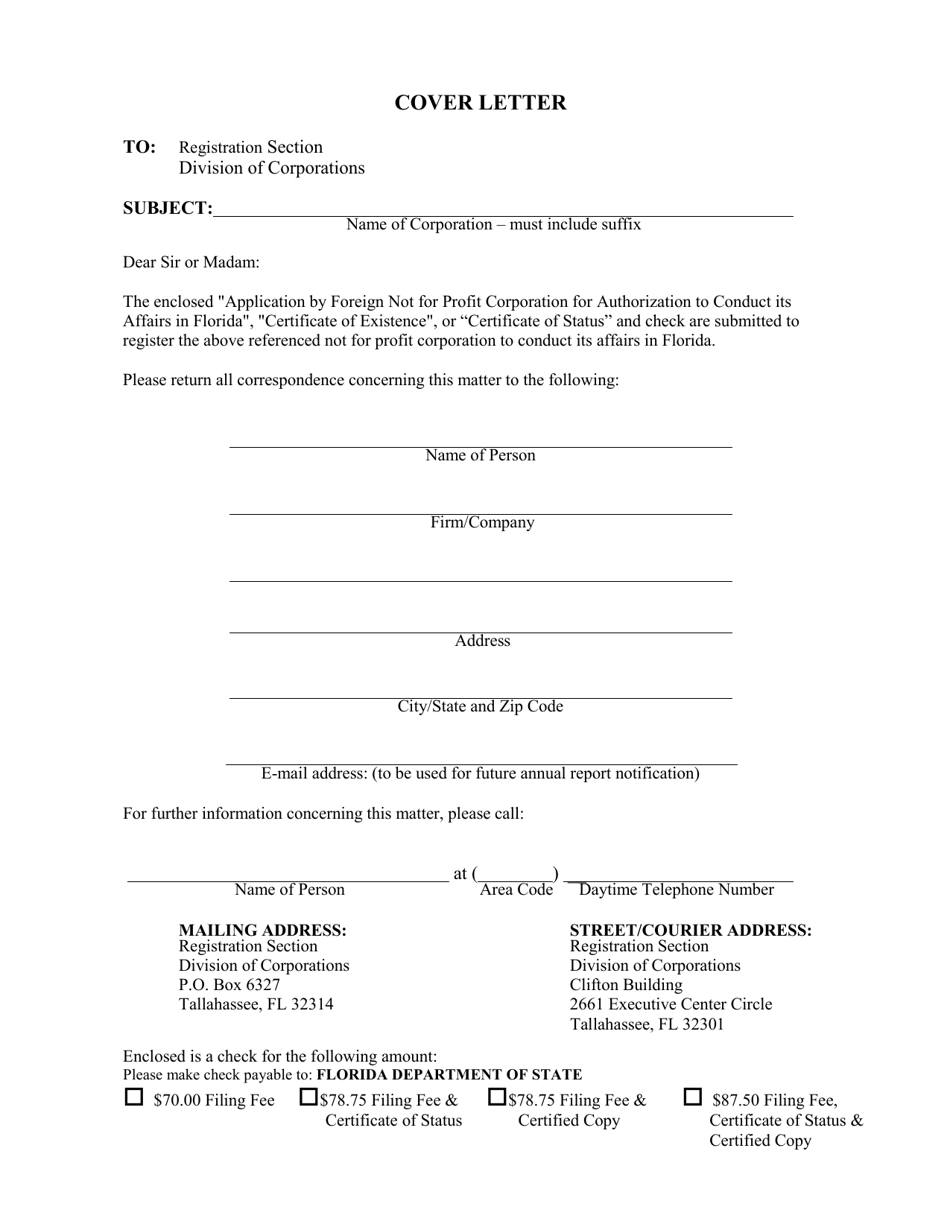

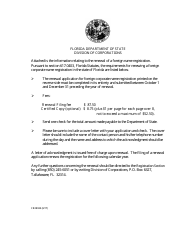

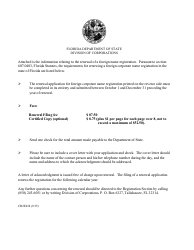

A: Yes, there are certain requirements such as providing a certificate of existence or good standing from the state of incorporation and paying the required filing fee.

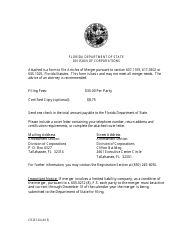

Q: What is the filing fee for Form CR2E021?

A: The filing fee for Form CR2E021 is $70.

Q: Is there a due date for filing Form CR2E021?

A: There is no specific due date for filing Form CR2E021, but it is recommended to file the application as soon as possible after the foreign not-for-profit corporation decides to conduct affairs in Florida.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Florida Department of State (Secretary of State);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR2E021 by clicking the link below or browse more documents and templates provided by the Florida Department of State (Secretary of State).