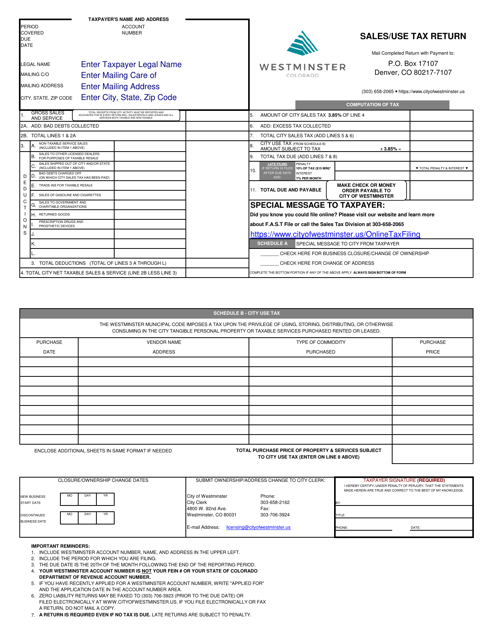

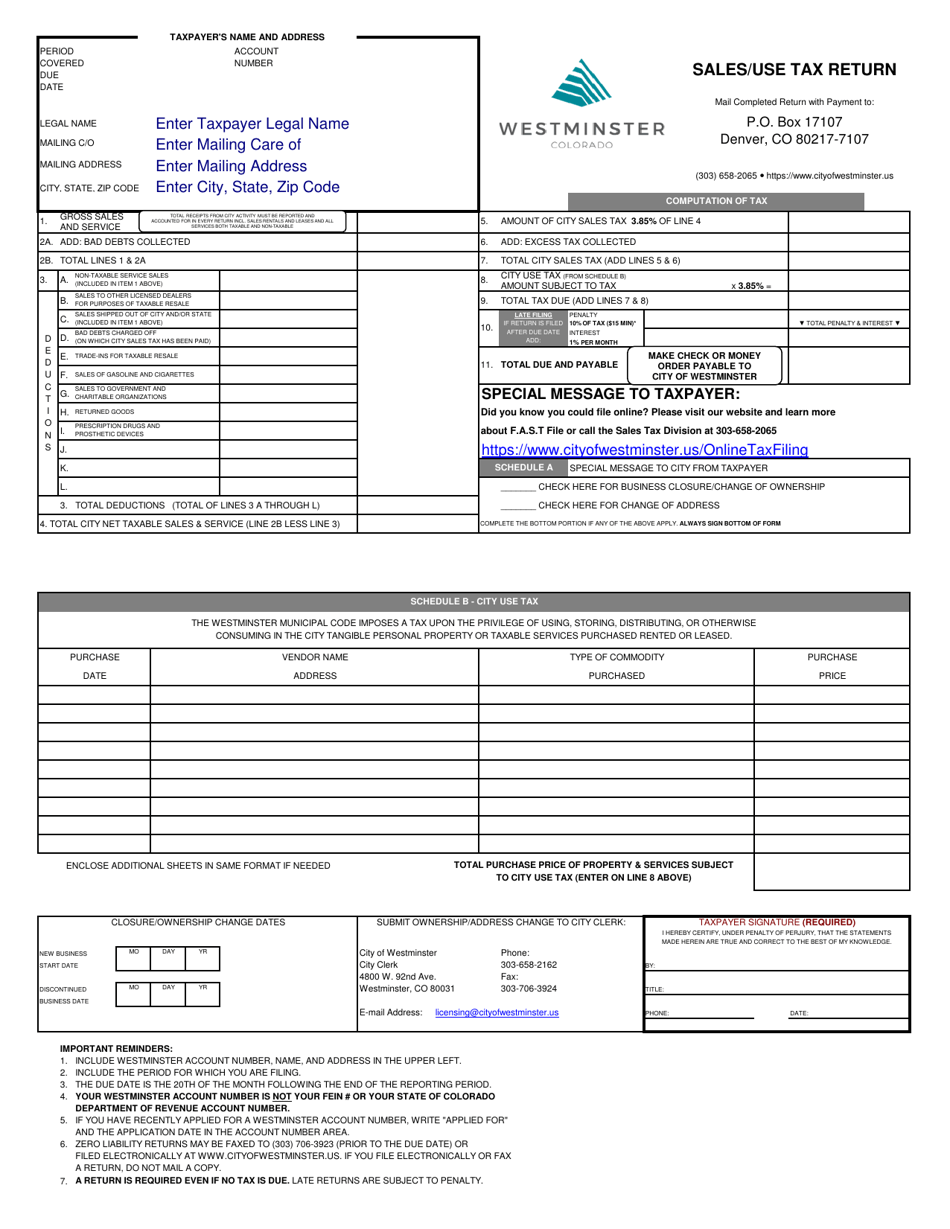

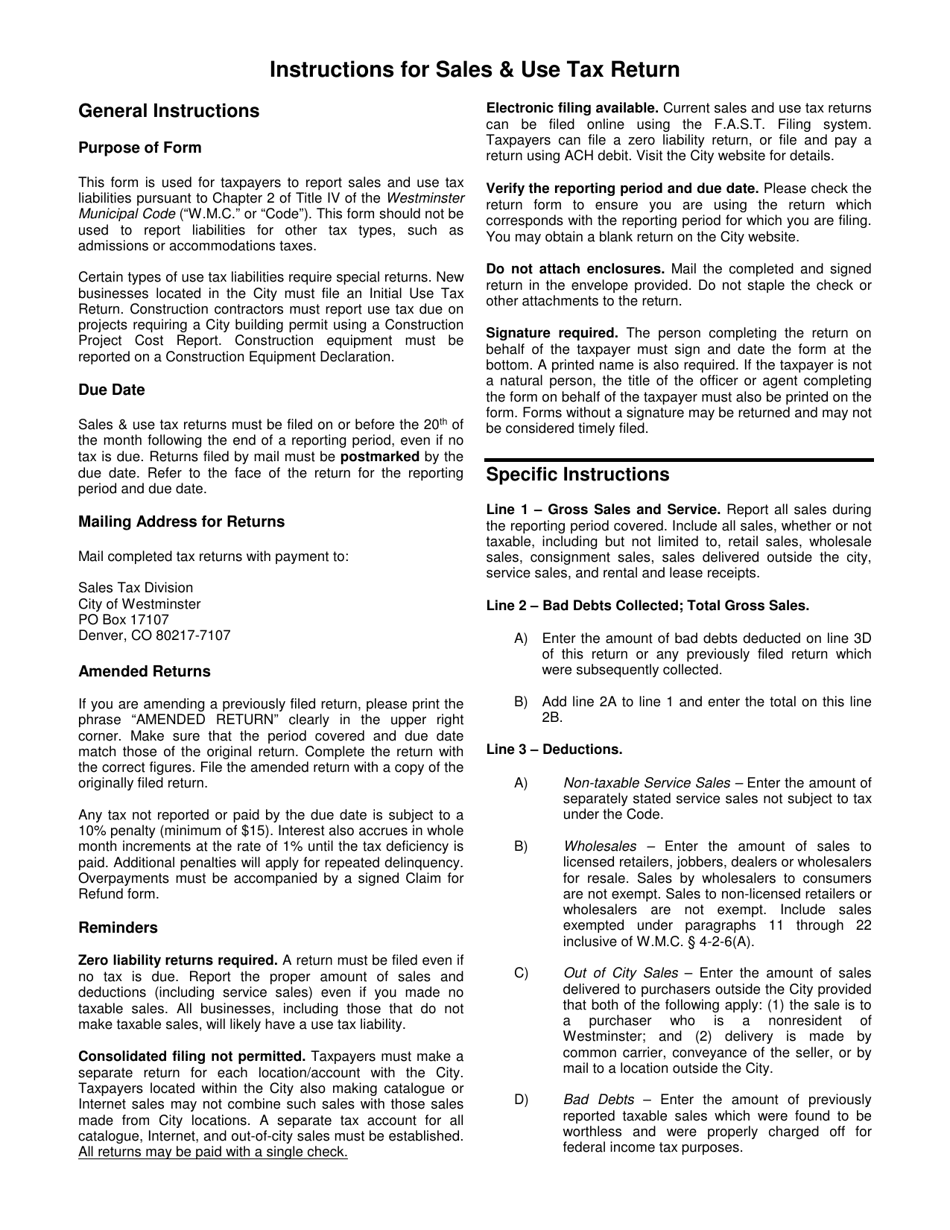

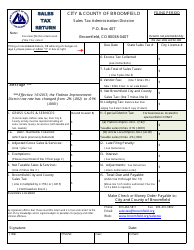

Sales Use Tax Return - City of Westminster, Colorado

Sales Use Tax Return is a legal document that was released by the Finance Department - City of Westminster, Colorado - a government authority operating within Colorado. The form may be used strictly within City of Westminster.

FAQ

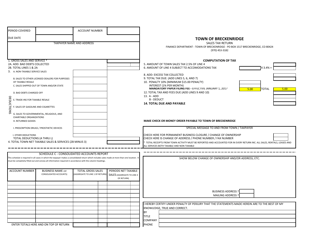

Q: What is the Sales Use Tax Return?

A: The Sales Use Tax Return is a document that businesses in the City of Westminster, Colorado must fill out to report their sales and use tax liability.

Q: Who needs to file the Sales Use Tax Return?

A: Businesses operating in the City of Westminster, Colorado are required to file the Sales Use Tax Return.

Q: When is the Sales Use Tax Return due?

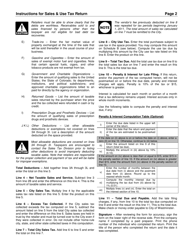

A: The Sales Use Tax Return is due on the 10th day of the month following the reporting period.

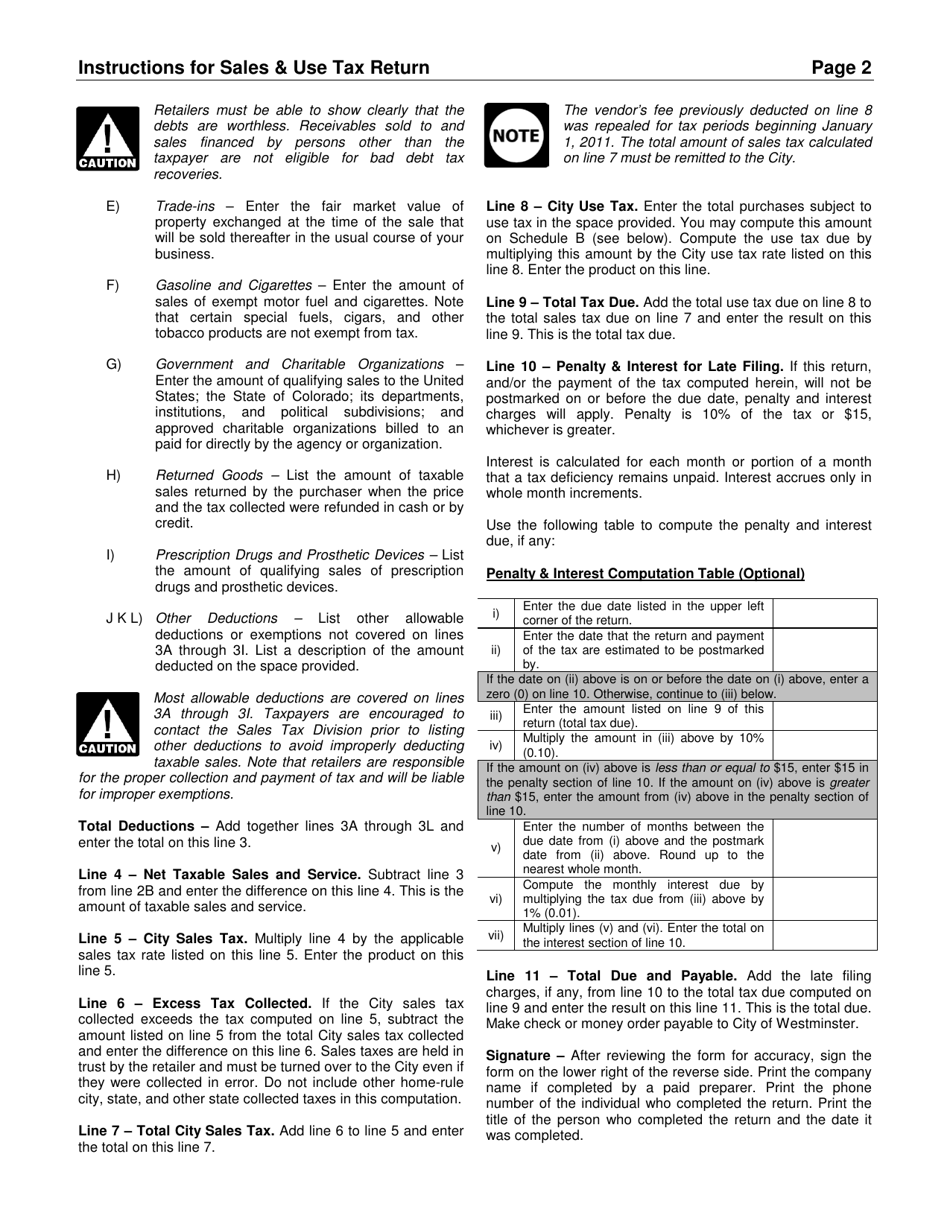

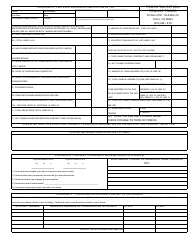

Q: What information do I need to include in the Sales Use Tax Return?

A: You will need to report your total sales, taxable sales, and calculate the amount of sales tax owed.

Q: What is the sales tax rate in the City of Westminster, Colorado?

A: The sales tax rate in the City of Westminster is currently 8.35%.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including interest charges on unpaid taxes.

Form Details:

- The latest edition currently provided by the Finance Department - City of Westminster, Colorado;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Westminster, Colorado.