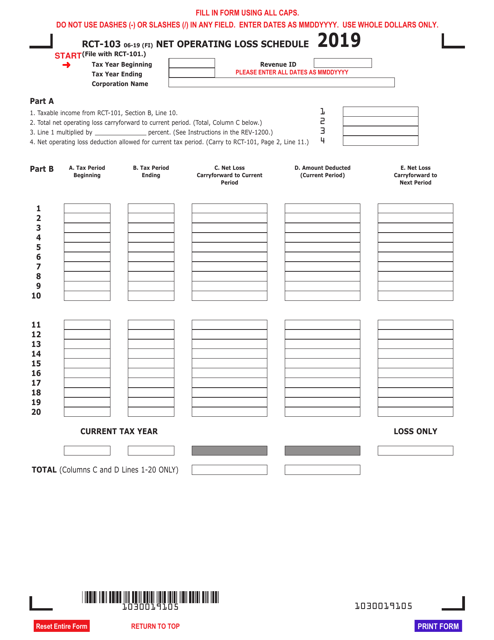

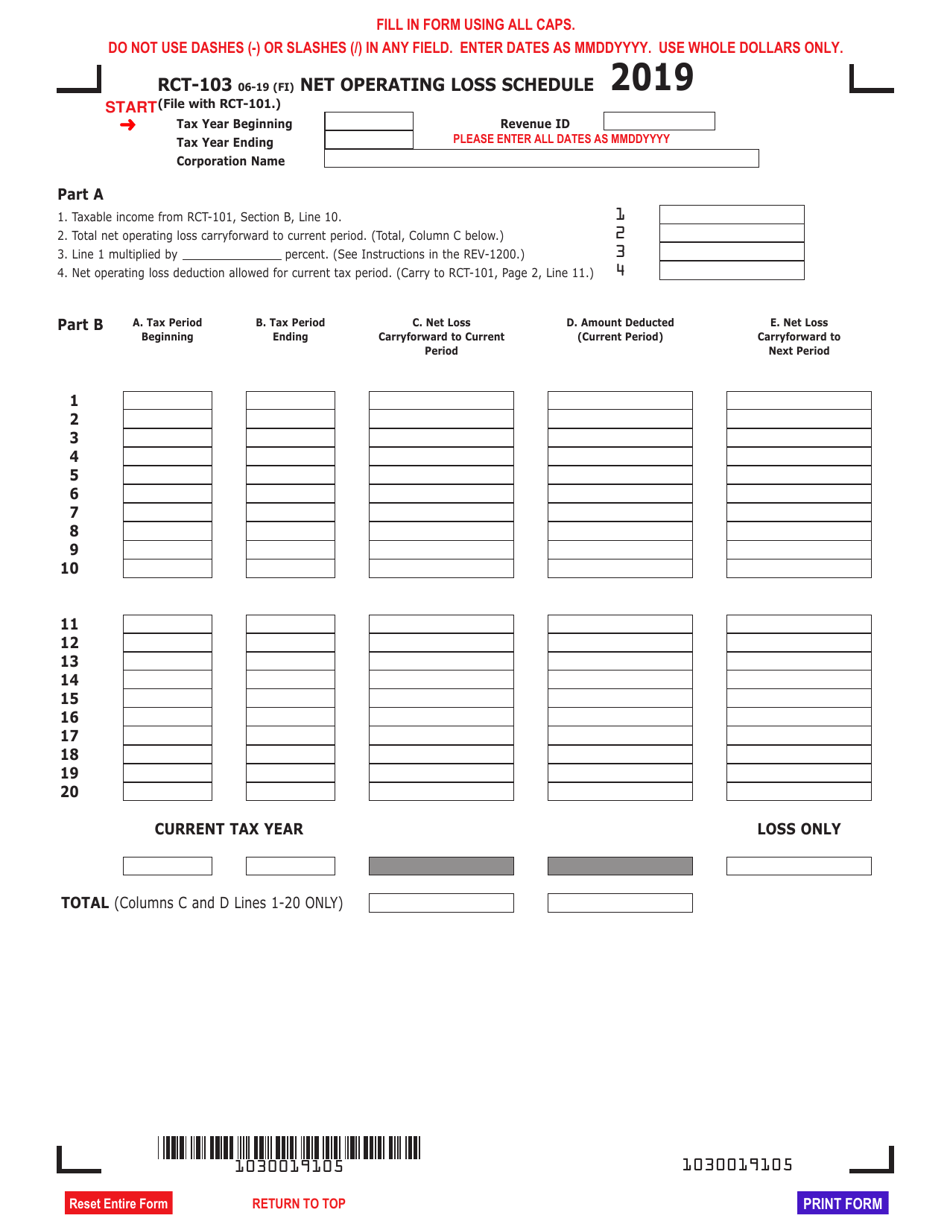

Schedule RCT-103 Net Operating Loss Schedule - Pennsylvania

What Is Schedule RCT-103?

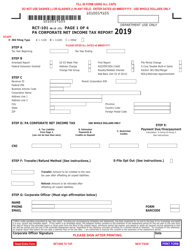

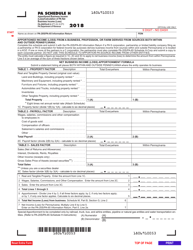

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule RCT-103?

A: Schedule RCT-103 is the Net Operating Loss Schedule for Pennsylvania.

Q: What is a net operating loss?

A: A net operating loss occurs when a business's allowable deductions exceed its taxable income.

Q: Why do I need to file Schedule RCT-103?

A: You need to file Schedule RCT-103 if you have a net operating loss carryforward or carryback in Pennsylvania.

Q: What is a net operating loss carryforward?

A: A net operating loss carryforward is when you can't fully deduct your losses in the current year, so you carry them forward to future years.

Q: What is a net operating loss carryback?

A: A net operating loss carryback is when you apply your current year losses to prior years' taxable income in order to receive a refund.

Q: Is Schedule RCT-103 specific to Pennsylvania?

A: Yes, Schedule RCT-103 is specific to Pennsylvania.

Q: Do I need to file Schedule RCT-103 if I don't have a net operating loss?

A: No, you do not need to file Schedule RCT-103 if you do not have a net operating loss in Pennsylvania.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule RCT-103 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.