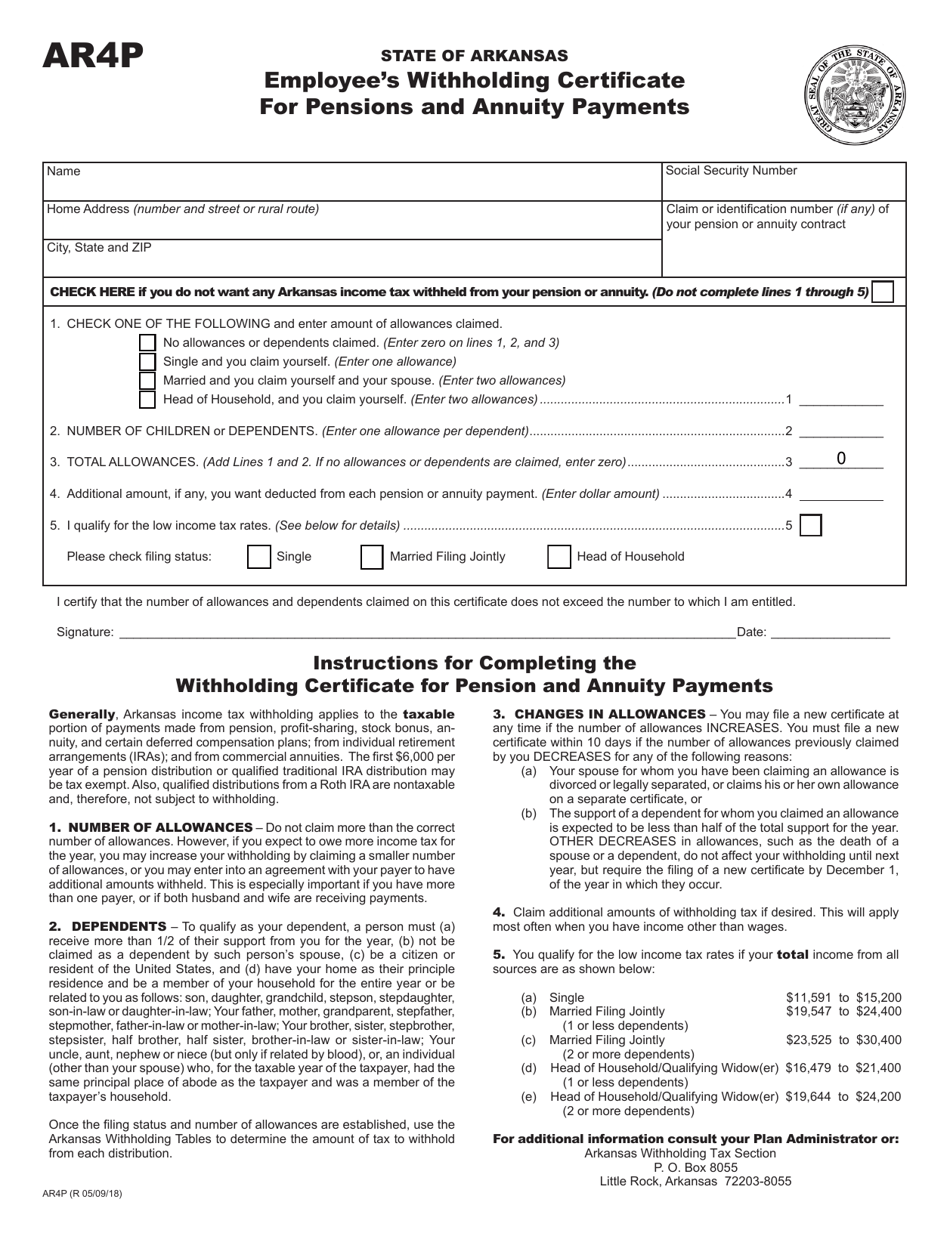

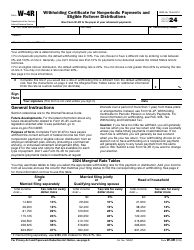

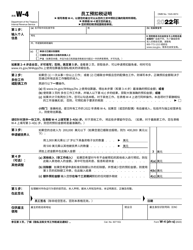

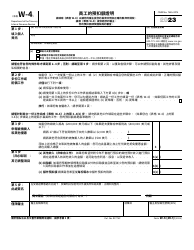

Form AR4P Employee's Withholding Certificate for Pensions and Annuity Payments - Arkansas

What Is Form AR4P?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR4P?

A: Form AR4P is the Employee's Withholding Certificate for Pensions and Annuity Payments in Arkansas.

Q: Who needs to complete Form AR4P?

A: Individuals who receive pension and annuity payments in Arkansas need to complete Form AR4P.

Q: What is the purpose of Form AR4P?

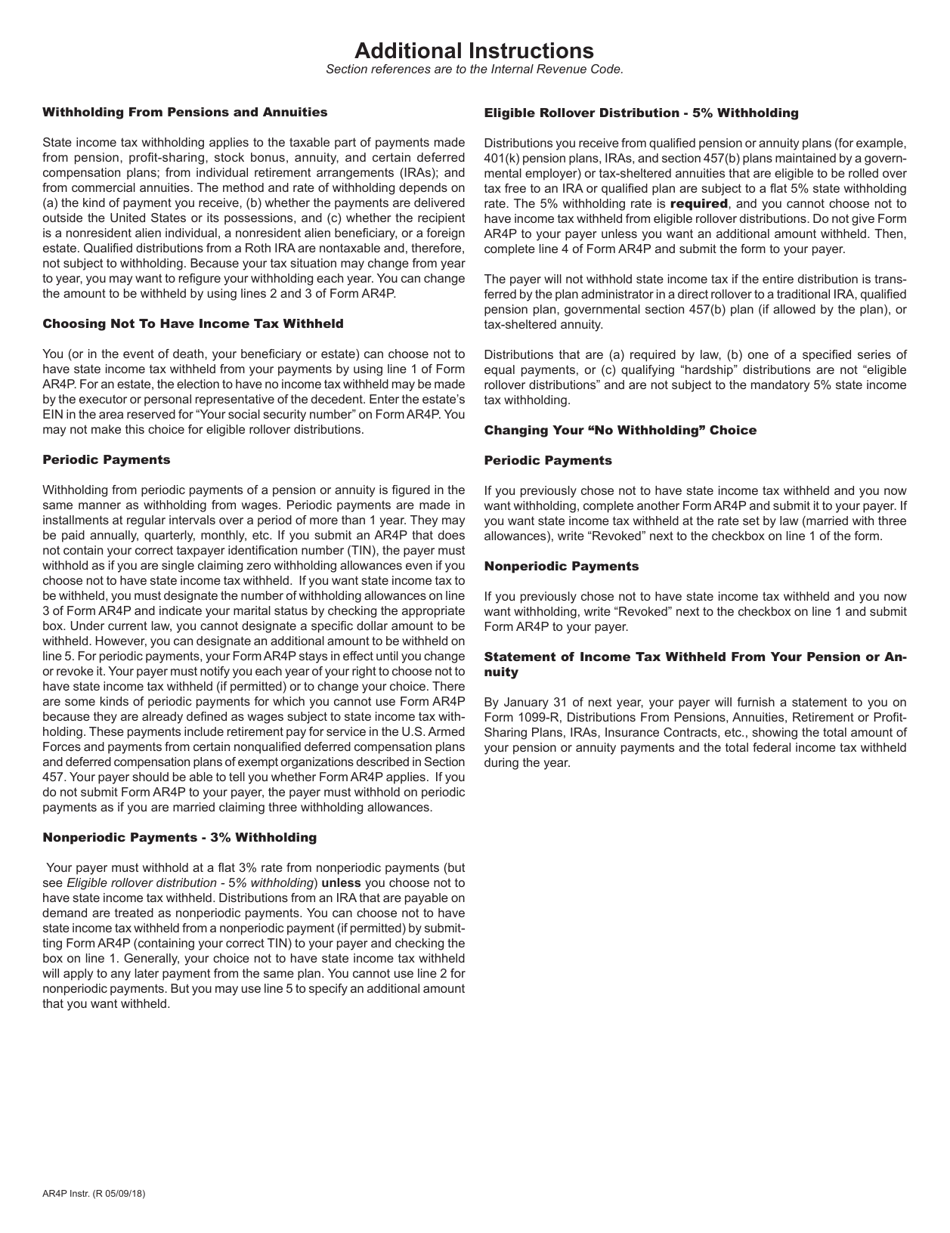

A: Form AR4P is used to determine the amount of state income tax to withhold from pension and annuity payments in Arkansas.

Q: How do I fill out Form AR4P?

A: You need to provide your personal information, including your name, social security number, and address, and indicate your filing status and withholding allowances.

Q: When should I submit Form AR4P?

A: You should submit Form AR4P to the entity paying your pension or annuity as soon as possible.

Q: Is Form AR4P only for Arkansas residents?

A: No, Form AR4P is also required for nonresidents who receive pension and annuity payments from Arkansas sources.

Form Details:

- Released on May 9, 2018;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR4P by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.