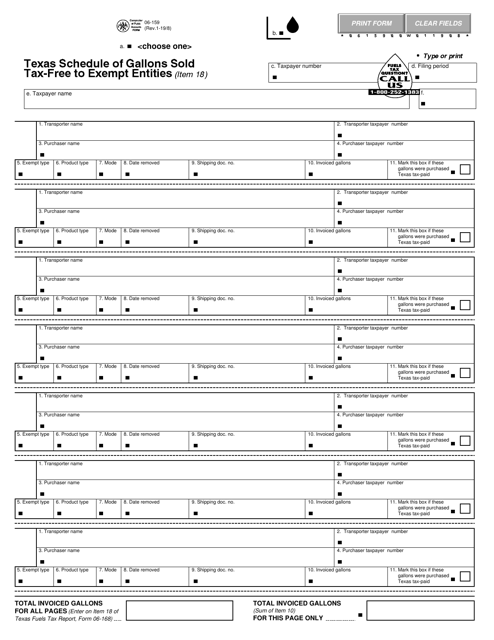

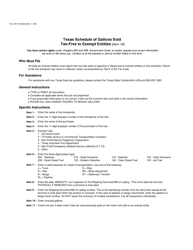

Form 06-159 Texas Schedule of Gallons Sold Tax-Free to Exempt Entities - Texas

What Is Form 06-159?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 06-159?

A: Form 06-159 is the Texas Schedule of Gallons Sold Tax-Free to Exempt Entities.

Q: What is the purpose of Form 06-159?

A: The purpose of Form 06-159 is to report the gallons of fuel sold tax-free to exempt entities in Texas.

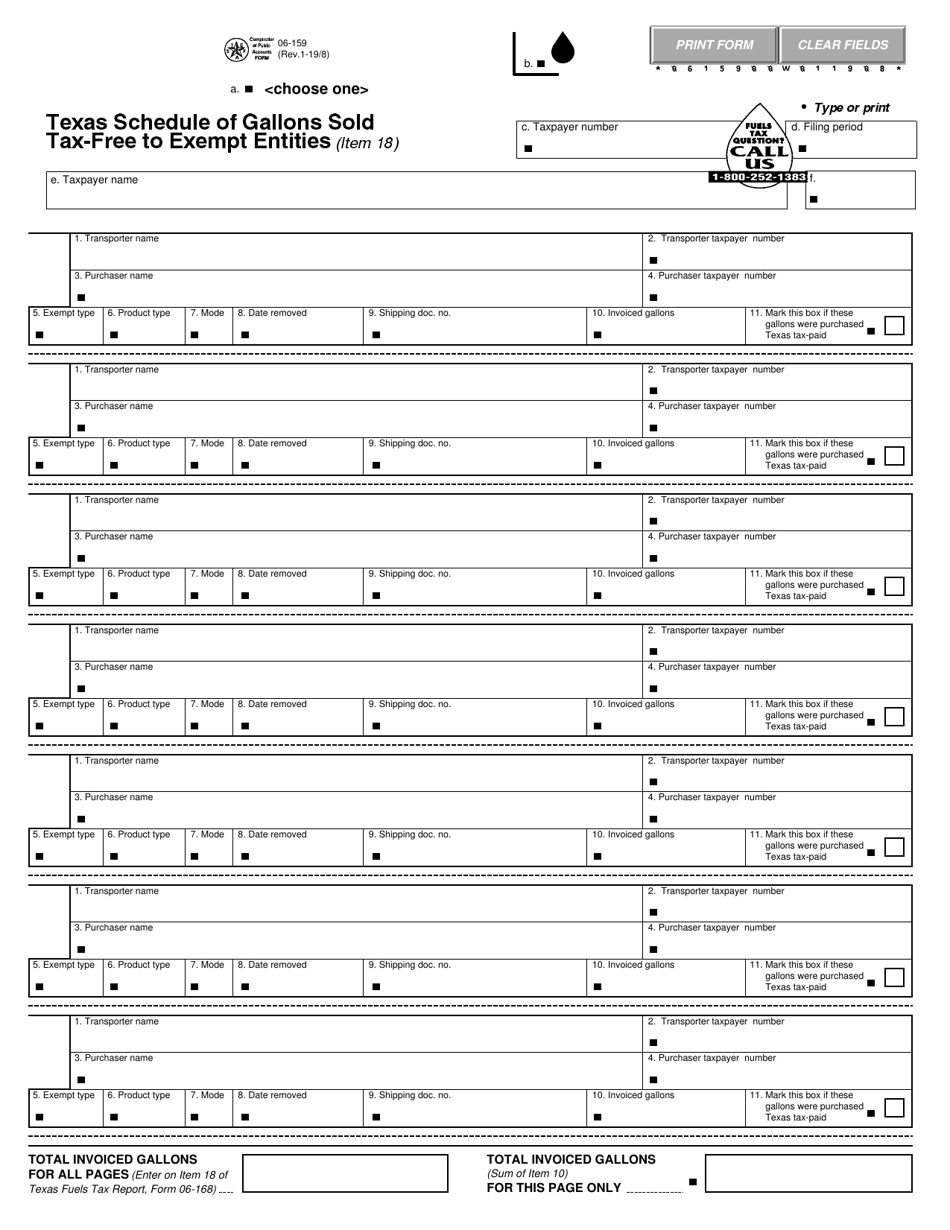

Q: Who needs to file Form 06-159?

A: Fuel distributors in Texas who have made tax-free sales to exempt entities need to file Form 06-159.

Q: What are exempt entities?

A: Exempt entities are organizations or individuals that are exempt from paying certain taxes in Texas.

Q: How do I complete Form 06-159?

A: To complete Form 06-159, you need to provide information about the gallons of fuel sold tax-free to exempt entities during the reporting period.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 06-159 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.