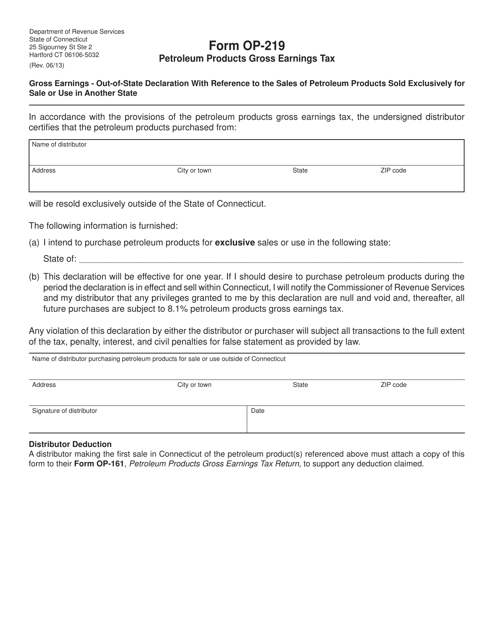

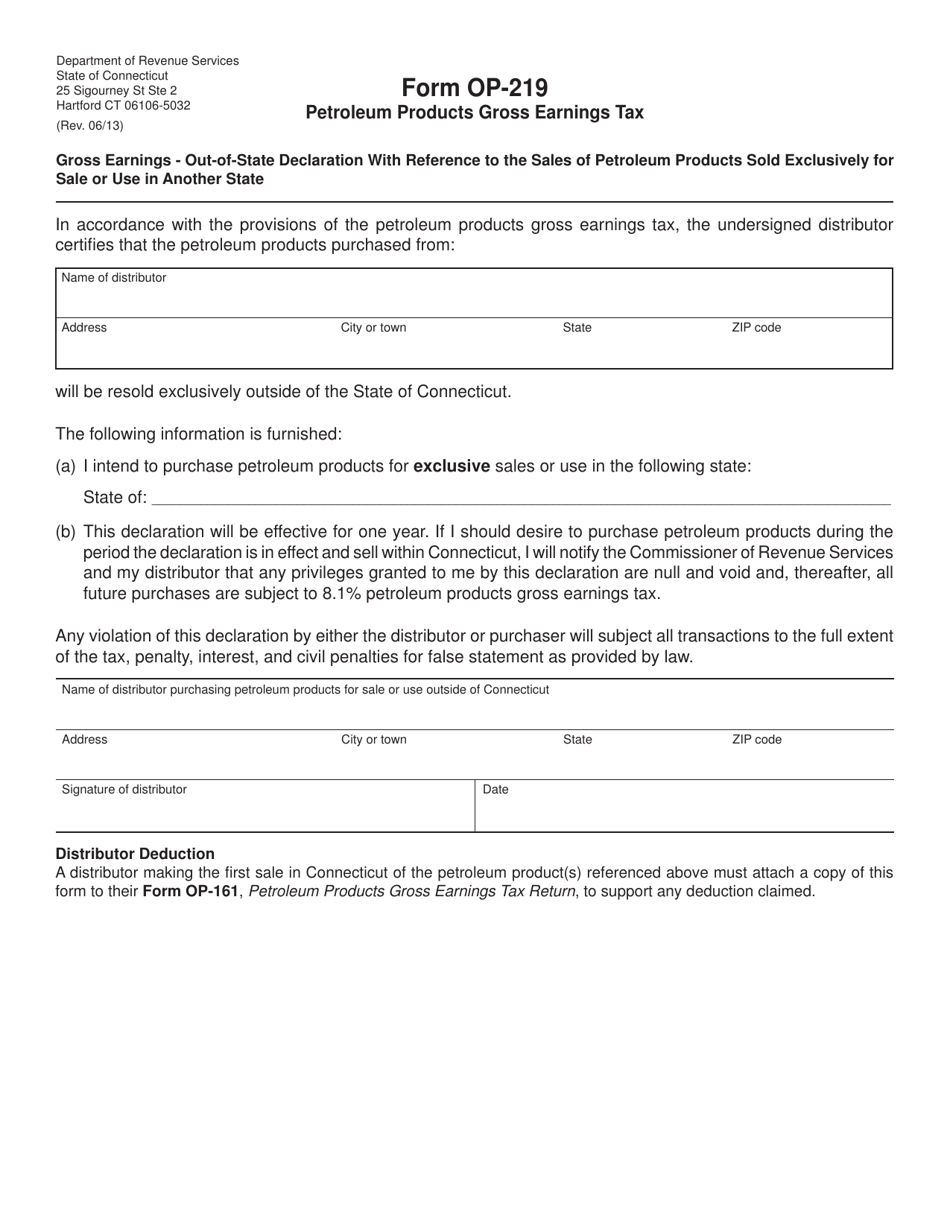

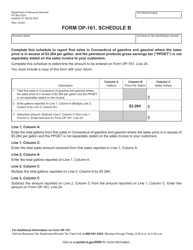

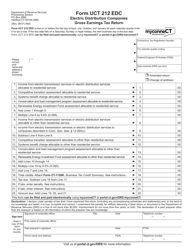

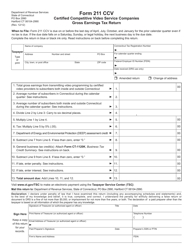

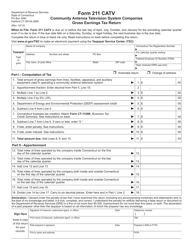

Form OP-219 Petroleum Products Gross Earnings Tax - Connecticut

What Is Form OP-219?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OP-219?

A: Form OP-219 is the form used to report and pay the Petroleum Products Gross Earnings Tax in Connecticut.

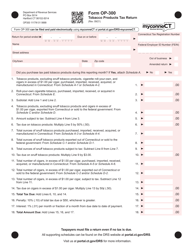

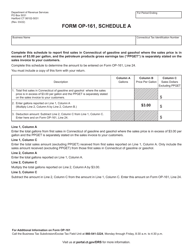

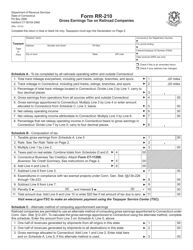

Q: What is the Petroleum Products Gross Earnings Tax?

A: The Petroleum Products Gross Earnings Tax is a tax imposed on the gross earnings from petroleum products in Connecticut.

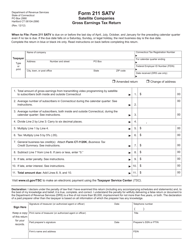

Q: Who needs to file Form OP-219?

A: Any business or individual engaged in the sale of petroleum products in Connecticut needs to file Form OP-219.

Q: When does Form OP-219 need to be filed?

A: Form OP-219 must be filed on a quarterly basis, with the due dates being April 30, July 31, October 31, and January 31.

Q: How is the tax calculated?

A: The tax is calculated based on the gross earnings from petroleum products at a rate of 7.5%.

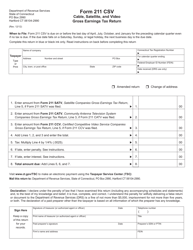

Q: Are there any exemptions or deductions available?

A: Yes, there are exemptions and deductions available. For more information, refer to the instructions provided with Form OP-219.

Q: What happens if I don't file Form OP-219?

A: Failure to file Form OP-219 or pay the tax can result in penalties and interest being imposed.

Q: Can I file Form OP-219 electronically?

A: Yes, electronic filing is available for Form OP-219.

Q: Is there a minimum threshold for filing Form OP-219?

A: Yes, if you have less than $1,000 in gross earnings from petroleum products, you are not required to file Form OP-219.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-219 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.