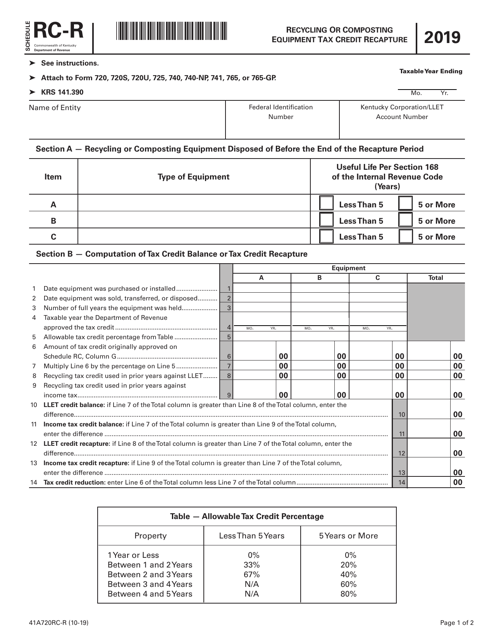

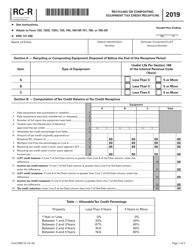

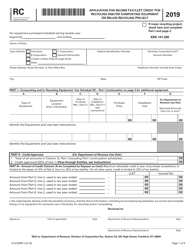

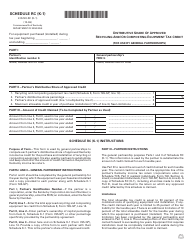

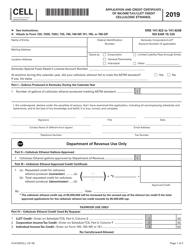

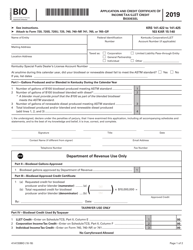

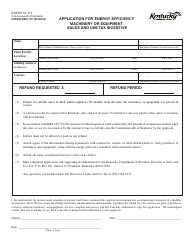

Form 41A720RC-R Schedule RC-R Recycling or Composting Equipment Tax Credit Recapture - Kentucky

What Is Form 41A720RC-R Schedule RC-R?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720RC-R?

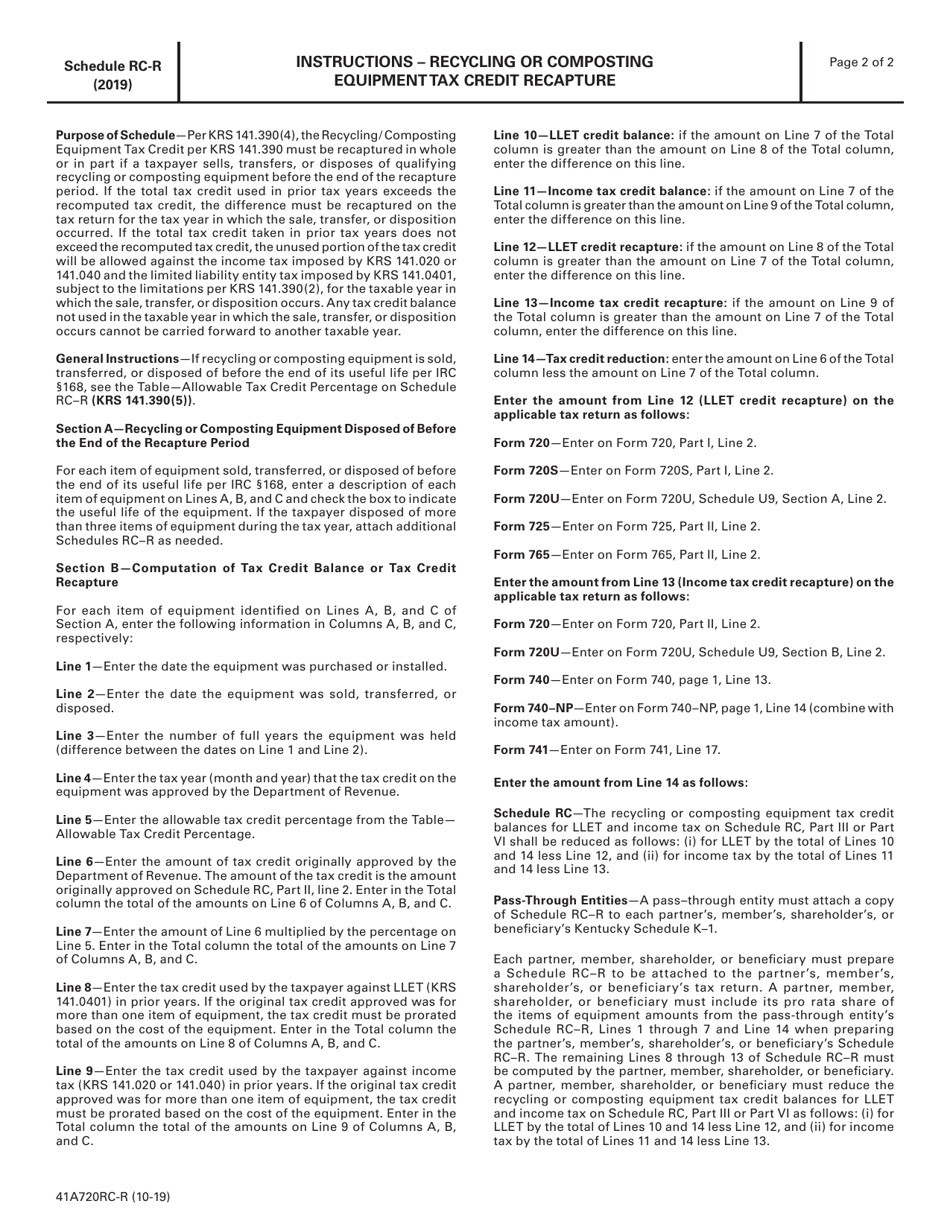

A: Form 41A720RC-R is a tax form used in Kentucky to calculate the tax credit recapture for recycling or composting equipment.

Q: What is the purpose of Schedule RC-R?

A: Schedule RC-R is used to determine the amount of tax credit recapture for recycling or composting equipment.

Q: What is tax credit recapture?

A: Tax credit recapture is the process of reclaiming tax benefits previously claimed.

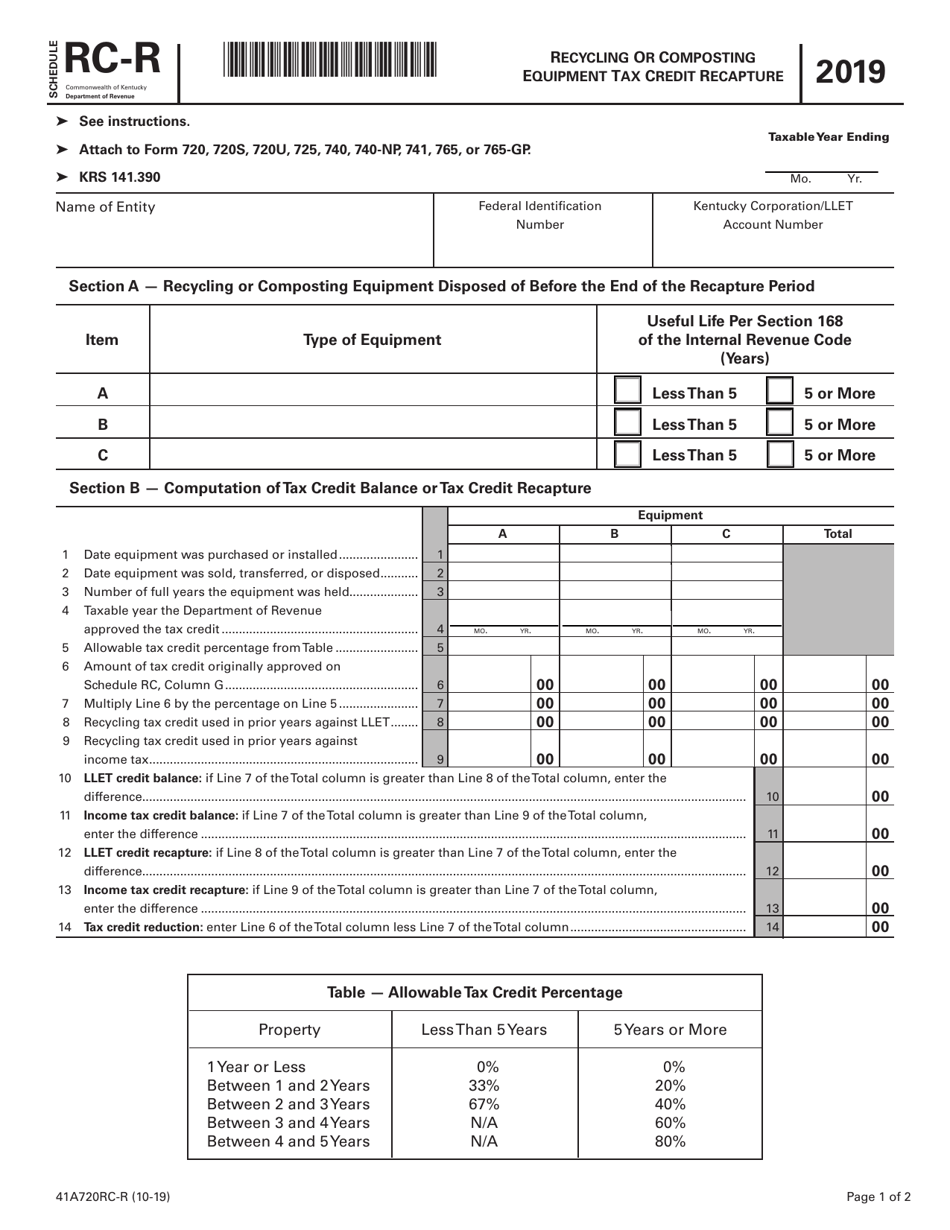

Q: How is the tax credit recapture calculated?

A: The tax credit recapture is calculated by multiplying the tax credit claimed in the previous year by the recapture percentage.

Q: What is the recapture percentage for recycling or composting equipment in Kentucky?

A: The recapture percentage for recycling or composting equipment in Kentucky is 50%.

Q: What documentation is required for Schedule RC-R?

A: You need to attach a copy of the federal form(s) used to claim the original tax credit and any other supporting documentation.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720RC-R Schedule RC-R by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.