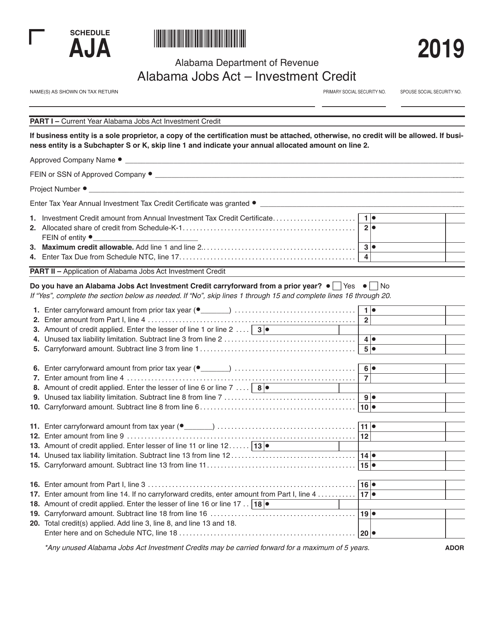

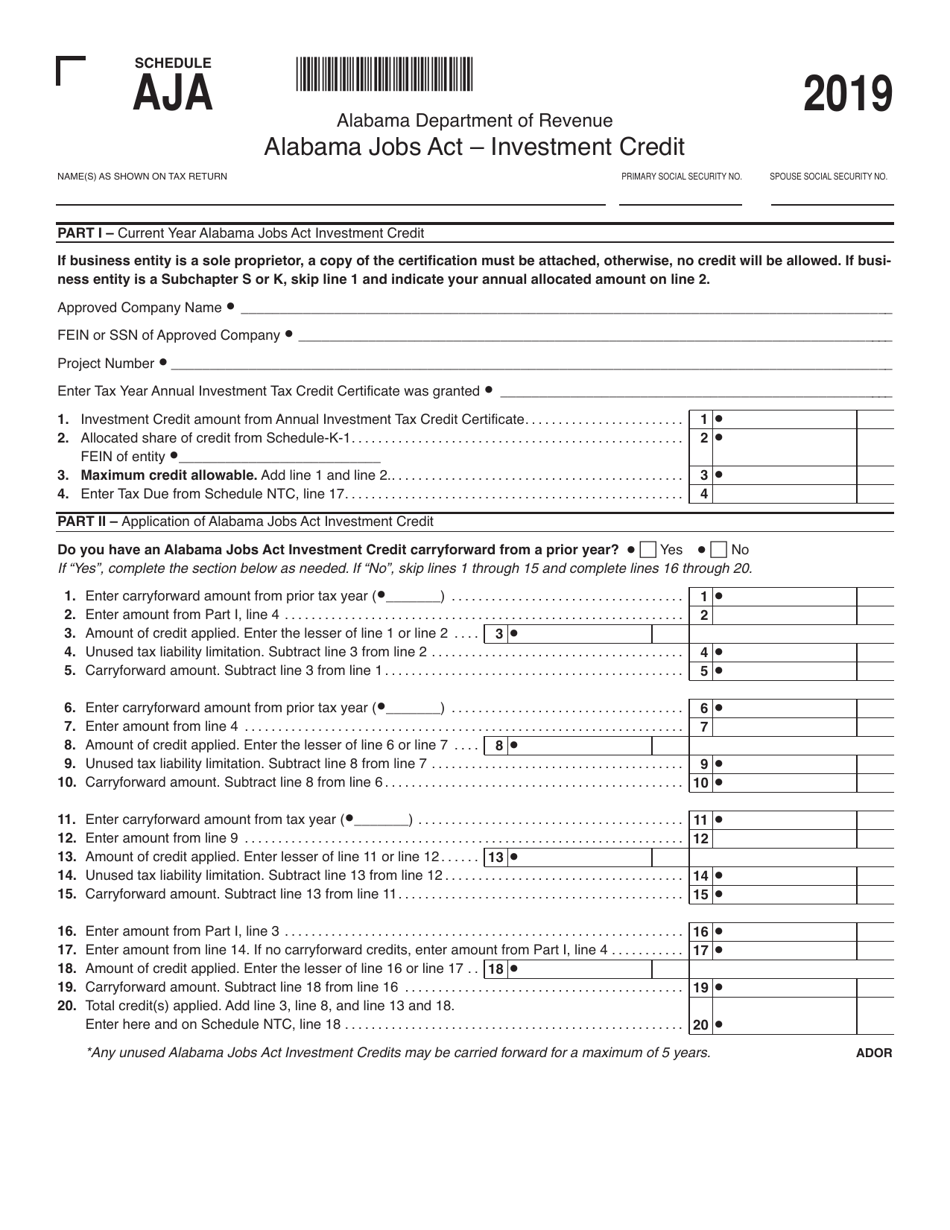

Schedule AJA Alabama Jobs Act - Investment Credit - Alabama

What Is Schedule AJA?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the AJA (Alabama Jobs Act)?

A: The AJA refers to the Alabama Jobs Act, which is a state incentive program aimed at promoting job creation and economic growth in Alabama.

Q: What is the Alabama Investment Credit?

A: The Alabama Investment Credit is a tax credit provided under the AJA to companies that make qualifying investments in approved projects in Alabama.

Q: Who is eligible for the Alabama Investment Credit?

A: Companies that meet certain eligibility criteria, including creating a certain number of jobs and making a minimum investment, can qualify for the Alabama Investment Credit.

Q: What is the purpose of the Alabama Investment Credit?

A: The purpose of the Alabama Investment Credit is to encourage companies to invest in Alabama and stimulate job creation and economic development in the state.

Q: How much is the Alabama Investment Credit?

A: The amount of the Alabama Investment Credit can vary depending on the size of the investment, the number of jobs created, and the location of the project.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule AJA by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.