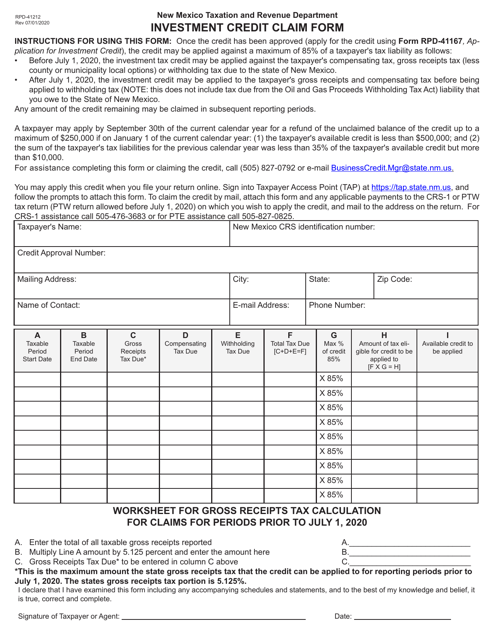

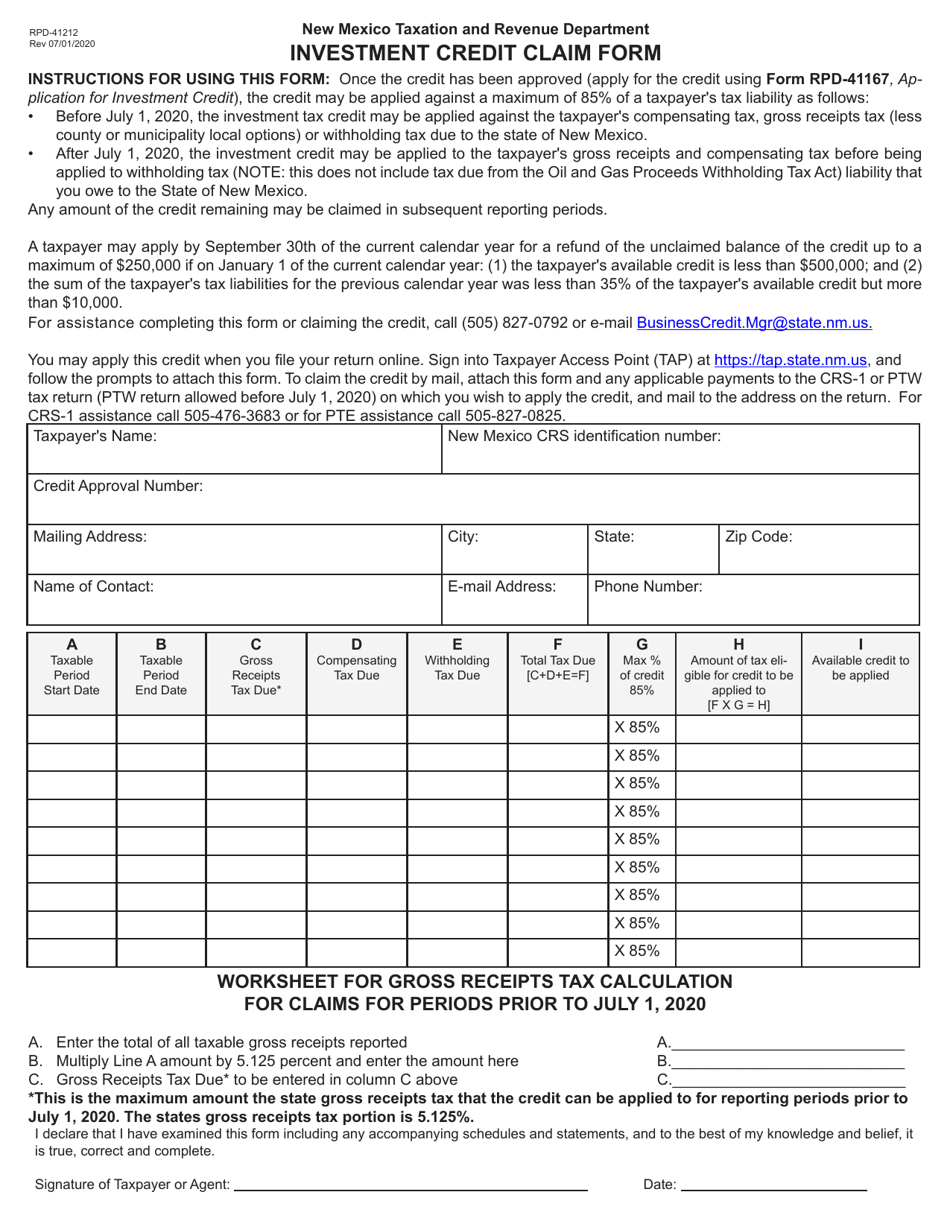

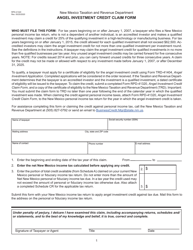

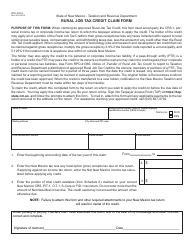

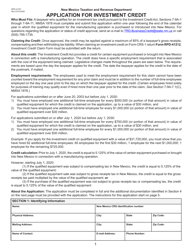

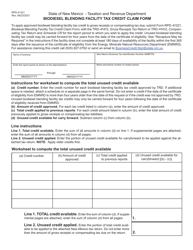

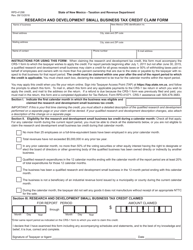

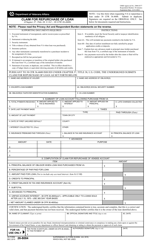

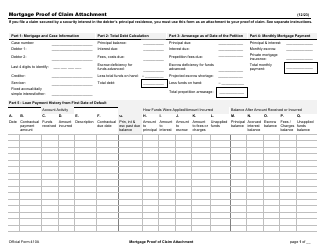

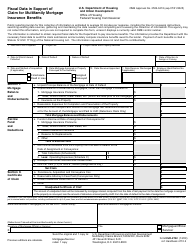

Form RPD-41212 Investment Credit Claim Form - New Mexico

What Is Form RPD-41212?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RPD-41212 form?

A: The RPD-41212 form is the Investment Credit Claim Form in New Mexico.

Q: What is the purpose of the RPD-41212 form?

A: The purpose of the RPD-41212 form is to claim investment credits in New Mexico.

Q: Who needs to fill out the RPD-41212 form?

A: Anyone who wants to claim investment credits in New Mexico needs to fill out the RPD-41212 form.

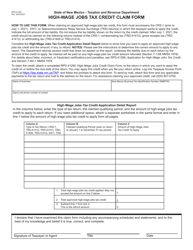

Q: What are investment credits?

A: Investment credits are tax credits that can be claimed for certain investments made in New Mexico.

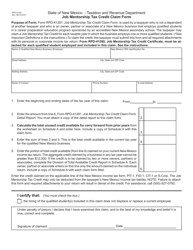

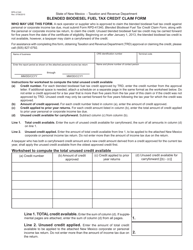

Q: What information do I need to fill out the RPD-41212 form?

A: You will need to provide information about the investments you made in New Mexico, including the amount of the investment and the qualified business activities.

Q: When is the deadline to submit the RPD-41212 form?

A: The deadline to submit the RPD-41212 form is typically the same as the deadline for filing your New Mexico tax return.

Q: Can I submit the RPD-41212 form electronically?

A: Yes, you can submit the RPD-41212 form electronically through the New Mexico Taxpayer Access Point (TAP) system.

Q: Is there a fee to file the RPD-41212 form?

A: There is no fee to file the RPD-41212 form.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41212 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.