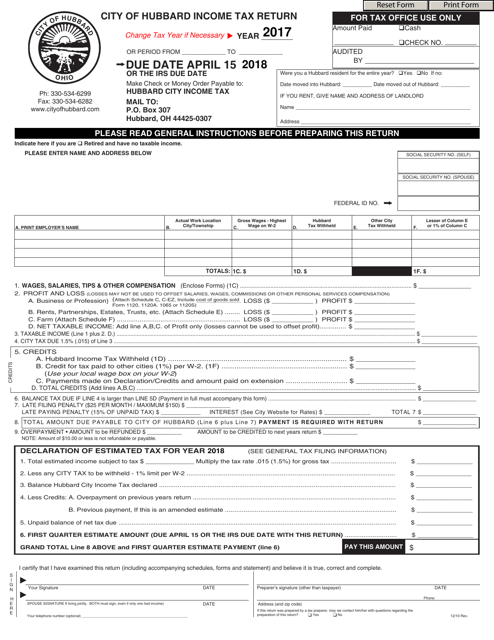

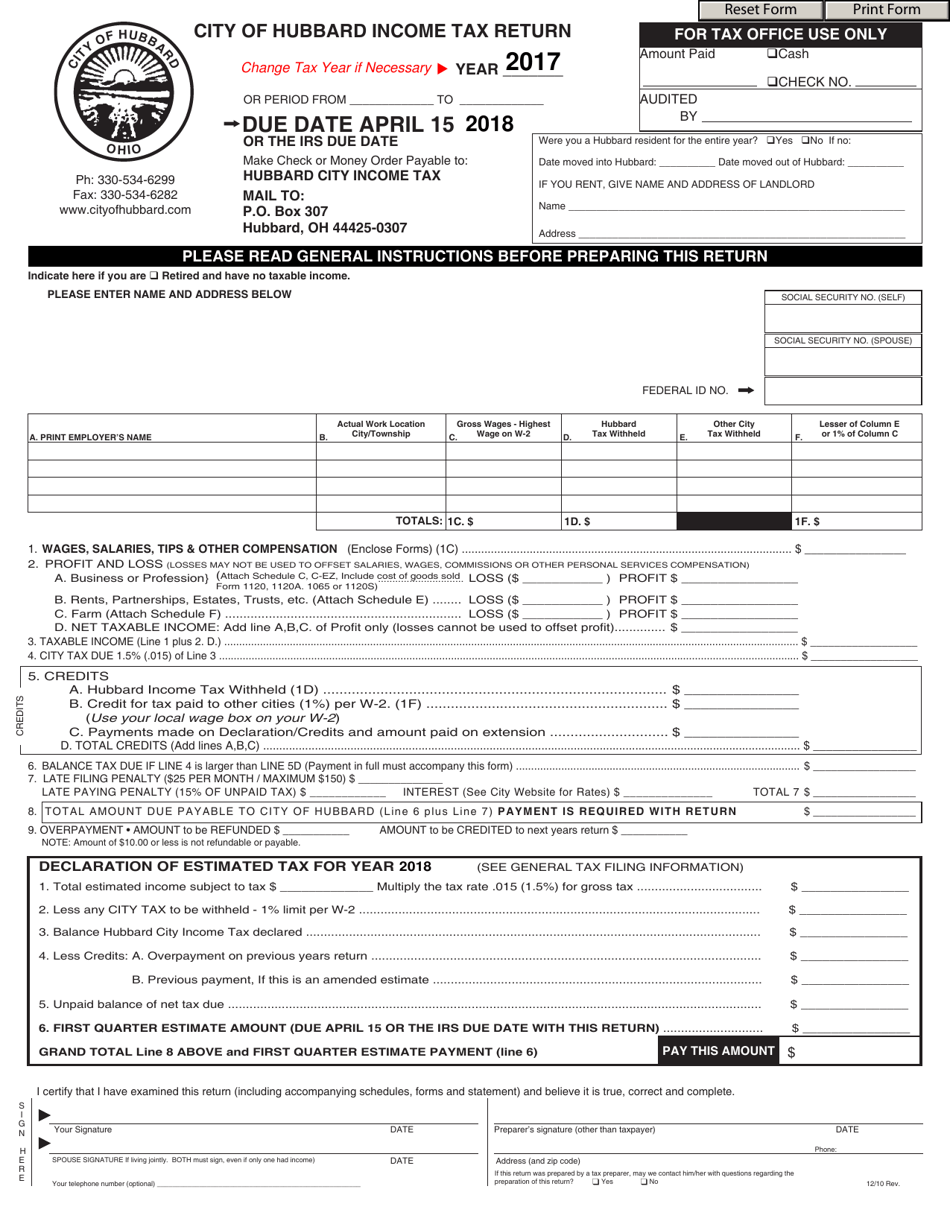

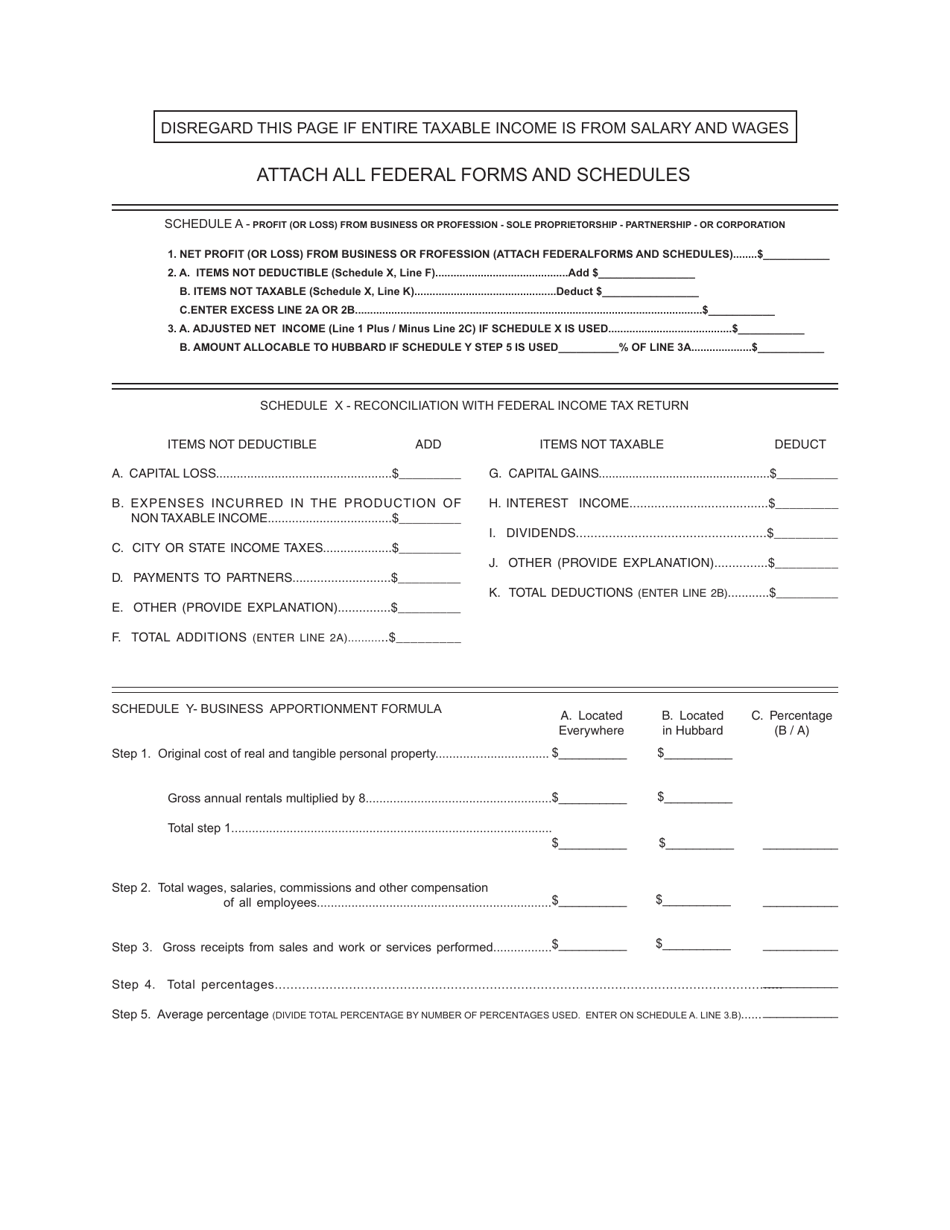

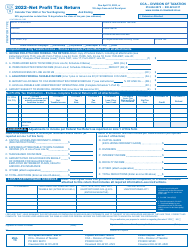

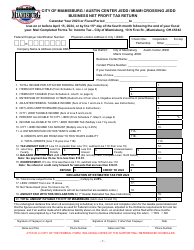

Income Tax Return - City of Hubbard, Ohio

Income Tax Return is a legal document that was released by the Finance Department - City of Hubbard, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Hubbard.

FAQ

Q: Who needs to file an income tax return in the City of Hubbard, Ohio?

A: Residents of Hubbard, Ohio who have earned income need to file an income tax return.

Q: What is the income tax rate in the City of Hubbard, Ohio?

A: The income tax rate in the City of Hubbard, Ohio is 1%.

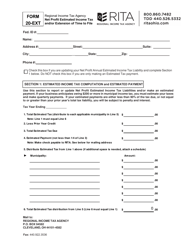

Q: What is the due date for filing income tax returns in the City of Hubbard, Ohio?

A: Income tax returns in the City of Hubbard, Ohio are due on April 15th.

Q: Are there any exemptions or deductions available in the City of Hubbard, Ohio?

A: Yes, there are several exemptions and deductions available in the City of Hubbard, Ohio, including exemptions for senior citizens and certain military personnel.

Q: What happens if I fail to file an income tax return in the City of Hubbard, Ohio?

A: Failure to file an income tax return in the City of Hubbard, Ohio may result in penalties and interest being assessed.

Q: Is there a local earned income tax credit in the City of Hubbard, Ohio?

A: Yes, there is a local earned incometax credit available in the City of Hubbard, Ohio.

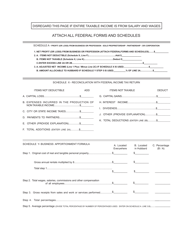

Q: What documents do I need to include with my income tax return in the City of Hubbard, Ohio?

A: You will need to include copies of your federal income tax return and all necessary supporting documents with your income tax return in the City of Hubbard, Ohio.

Q: Who should I contact if I have questions about filing my income tax return in the City of Hubbard, Ohio?

A: You should contact the City Income Tax Office if you have any questions about filing your income tax return in the City of Hubbard, Ohio.

Form Details:

- Released on December 1, 2010;

- The latest edition currently provided by the Finance Department - City of Hubbard, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Hubbard, Ohio.