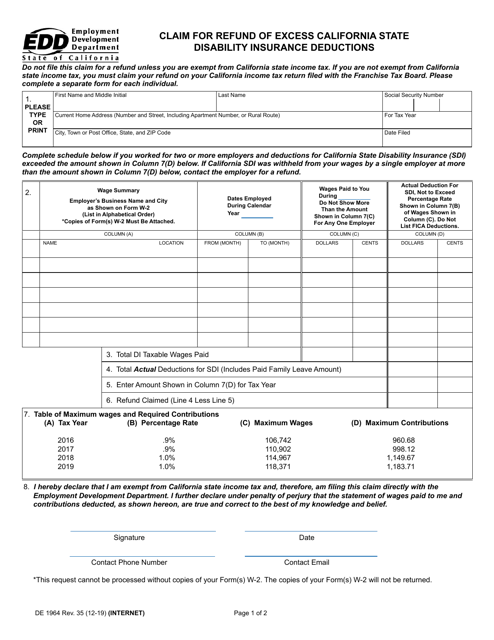

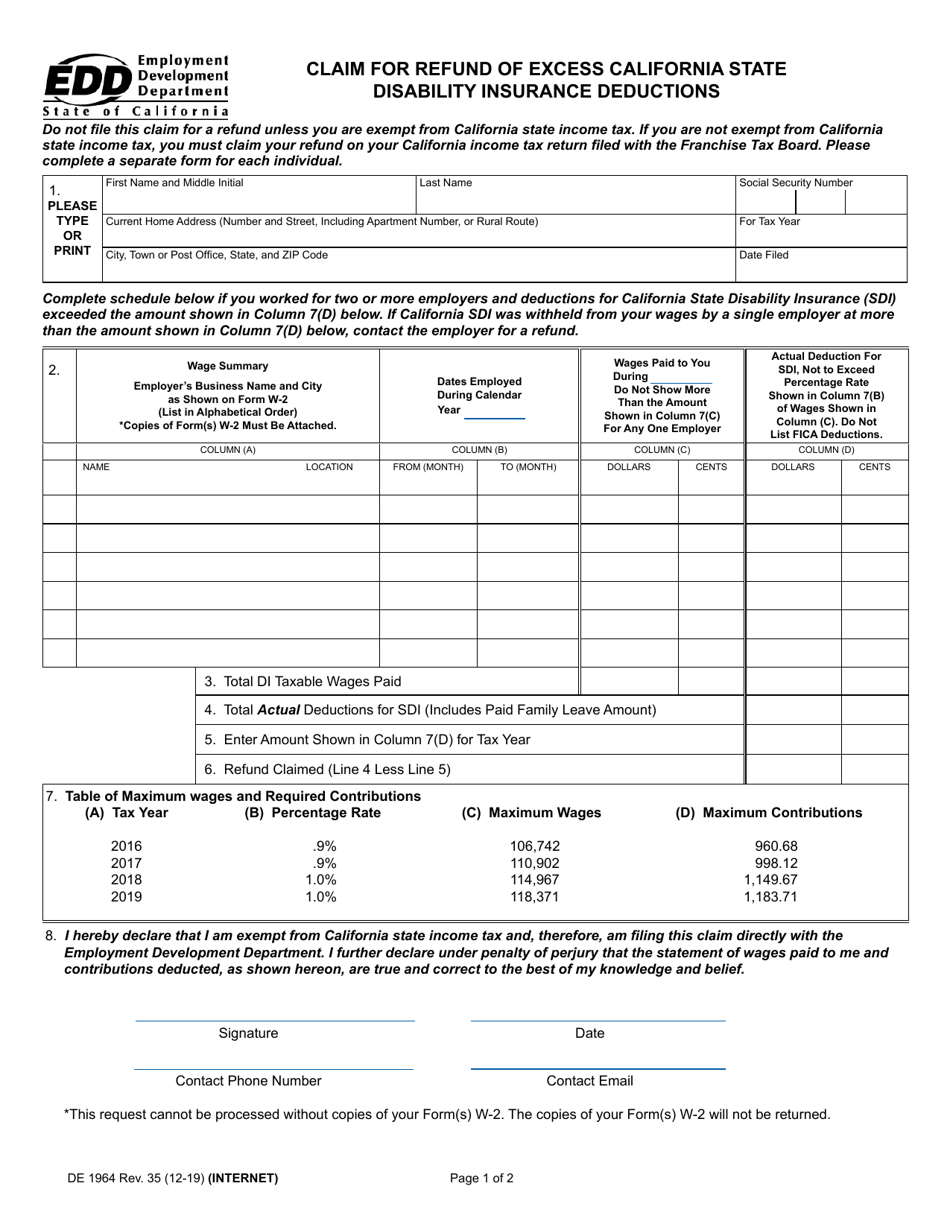

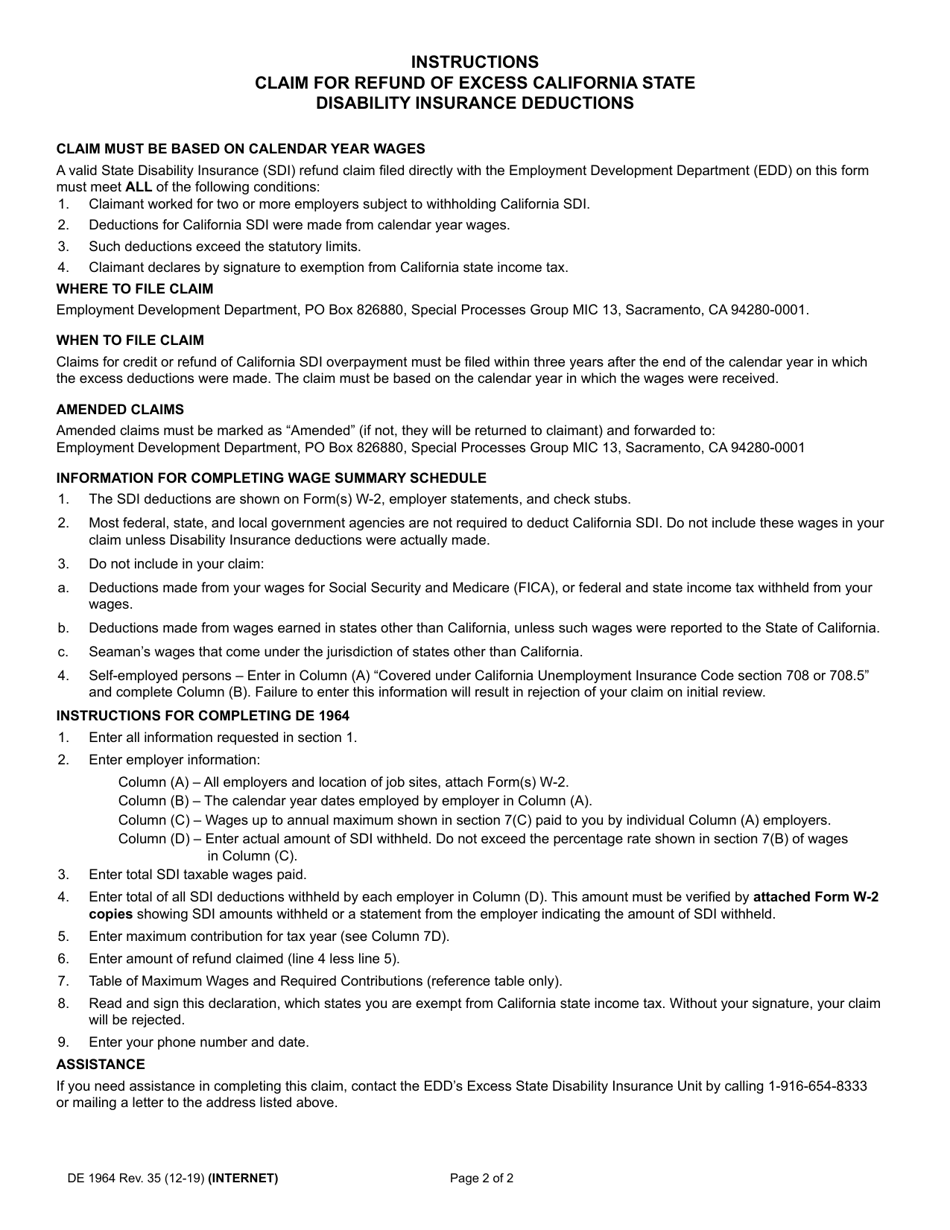

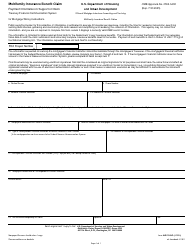

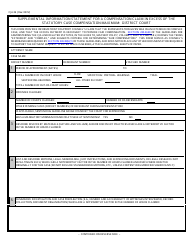

Form DE1964 Claim for Refund of Excess California State Disability Insurance Deductions - California

What Is Form DE1964?

This is a legal form that was released by the California Employment Development Department - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DE1964?

A: Form DE1964 is the Claim for Refund of Excess California State Disability Insurance Deductions.

Q: What is the purpose of Form DE1964?

A: The purpose of Form DE1964 is to claim a refund for any excess California State Disability Insurance (SDI) deductions that were withheld from your wages.

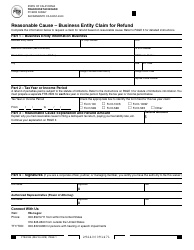

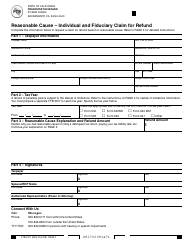

Q: Who can use Form DE1964?

A: Form DE1964 can be used by individuals who had excess California State Disability Insurance deductions withheld from their wages and want to claim a refund.

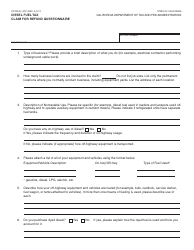

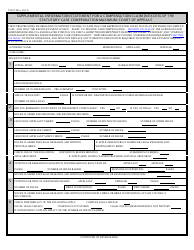

Q: How do I fill out Form DE1964?

A: To fill out Form DE1964, you will need to provide your personal information, including your name, address, Social Security number, and employer's information. You will also need to provide details about the excess SDI deductions, such as the amount withheld and the period in which it was withheld.

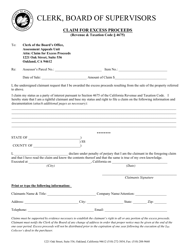

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the California Employment Development Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE1964 by clicking the link below or browse more documents and templates provided by the California Employment Development Department.