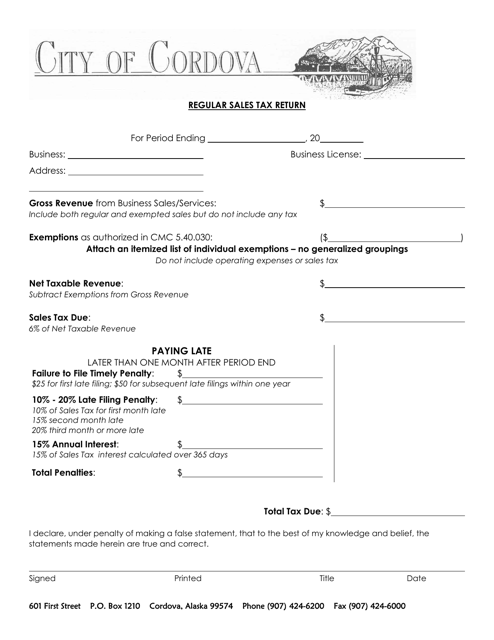

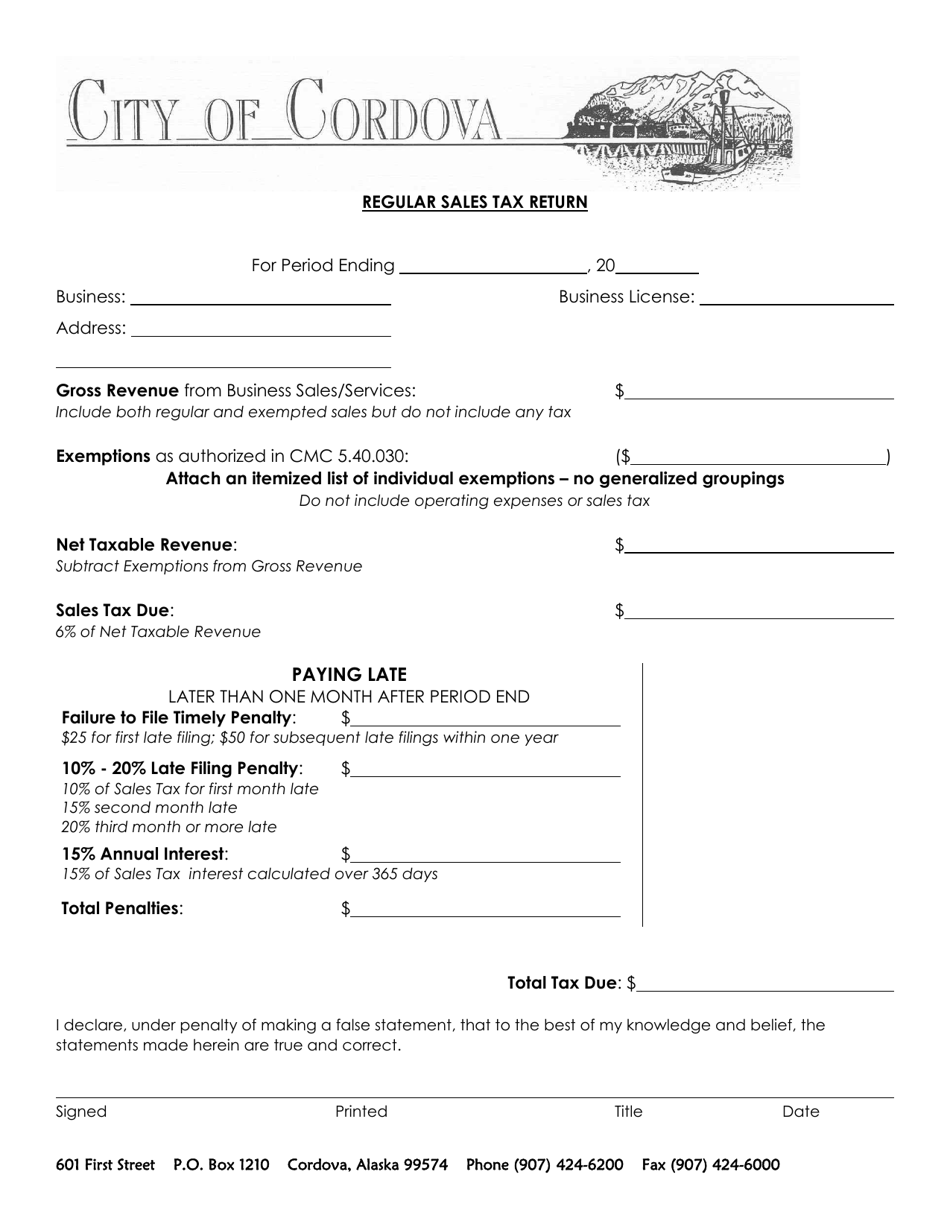

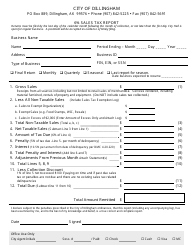

Regular Sales Tax Return - City of Cordova, Alaska

Regular Sales Tax Return is a legal document that was released by the Chamber of Commerce - City of Cordova, Alaska - a government authority operating within Alaska. The form may be used strictly within City of Cordova.

FAQ

Q: What is a regular sales tax return?

A: A regular sales tax return is a form that businesses or individuals must file to report and pay sales tax owed to the City of Cordova, Alaska.

Q: Who needs to file a regular sales tax return in Cordova, Alaska?

A: Any business or individual that sells taxable goods or services within the City of Cordova, Alaska must file a regular sales tax return.

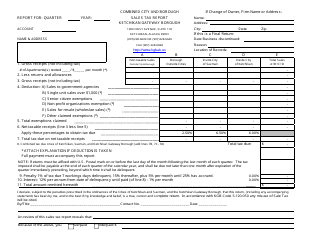

Q: How often do I need to file a regular sales tax return in Cordova, Alaska?

A: Regular sales tax returns in Cordova, Alaska are typically filed on a monthly or quarterly basis, depending on the volume of sales.

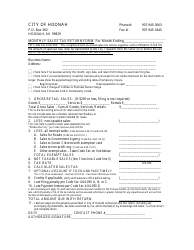

Q: What information is needed to complete a regular sales tax return in Cordova, Alaska?

A: When filing a regular sales tax return in Cordova, Alaska, you will need to provide information such as total sales, taxable sales, and the amount of sales tax collected.

Q: What happens if I don't file a regular sales tax return in Cordova, Alaska?

A: Failure to file a regular sales tax return in Cordova, Alaska can result in penalties, fines, and potential legal consequences.

Q: Can I claim deductions on my regular sales tax return in Cordova, Alaska?

A: Deductions may be allowed on regular sales tax returns in Cordova, Alaska, but it is recommended to consult with a tax professional to ensure eligibility and accuracy.

Form Details:

- The latest edition currently provided by the Chamber of Commerce - City of Cordova, Alaska;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Chamber of Commerce - City of Cordova, Alaska.