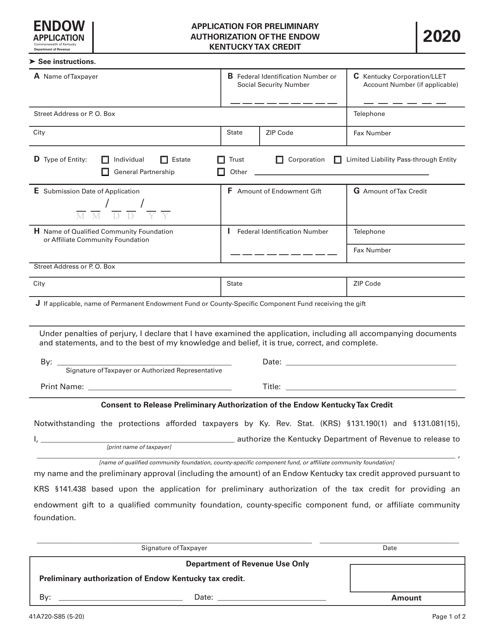

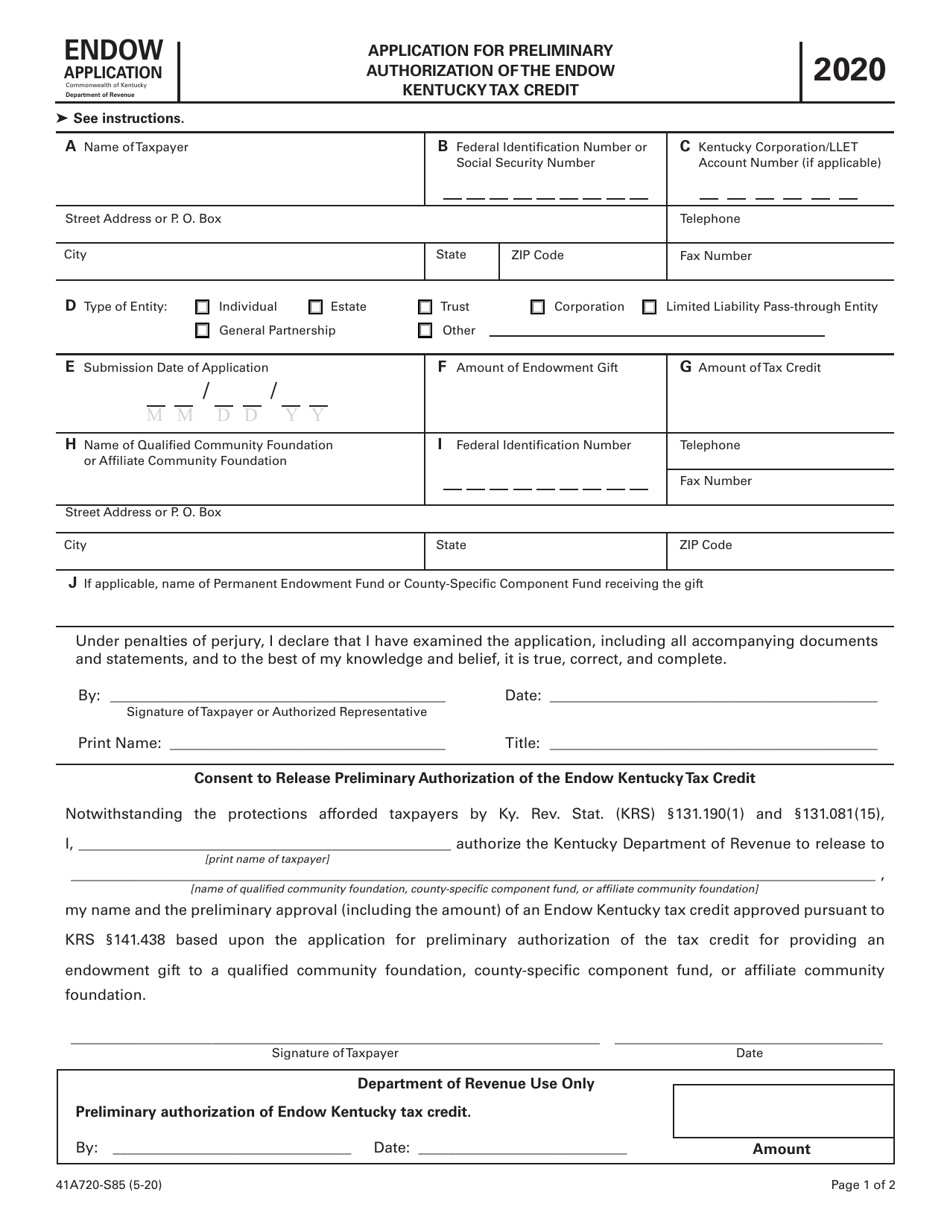

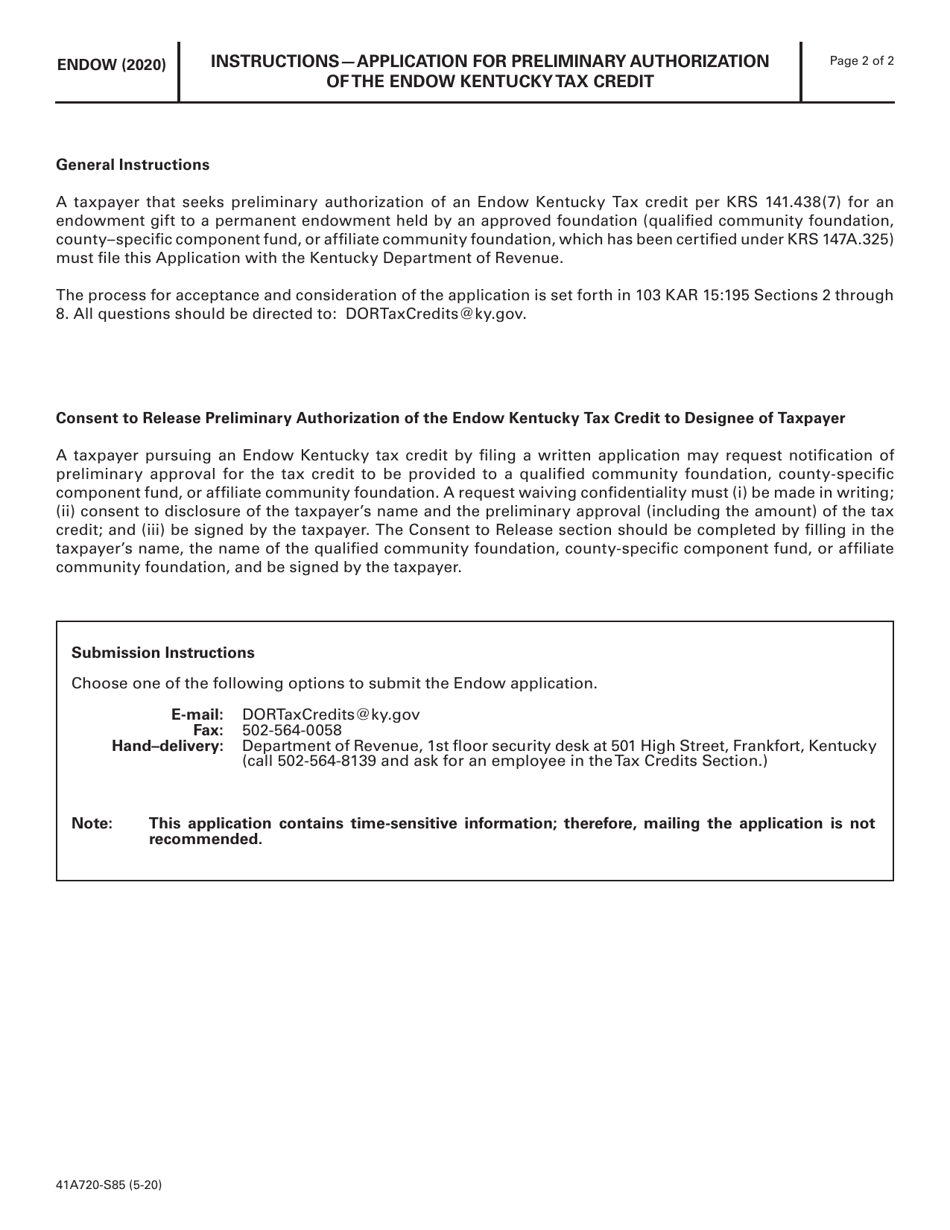

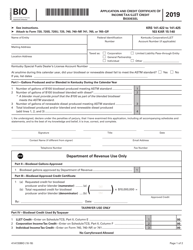

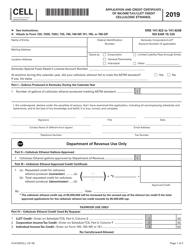

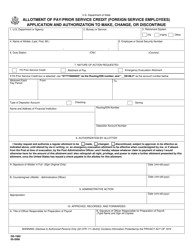

Form 41A720-S85 Application for Preliminary Authorization of the Endow Kentucky Tax Credit - Kentucky

What Is Form 41A720-S85?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 41A720-S85?

A: Form 41A720-S85 is the Application for Preliminary Authorization of the Endow Kentucky Tax Credit.

Q: Who needs to fill out this form?

A: This form needs to be filled out by individuals or businesses who want to apply for the Endow Kentucky Tax Credit.

Q: What is the Endow Kentucky Tax Credit?

A: The Endow Kentucky Tax Credit is a tax credit available to individuals or businesses who make qualified donations to eligible Kentucky community foundations.

Q: What is the purpose of this form?

A: The purpose of this form is to apply for preliminary authorization for the Endow Kentucky Tax Credit.

Q: Is there a deadline to submit this form?

A: Yes, the form must be submitted by June 30th of the year for which the tax credit is being claimed.

Q: Are there any fees associated with this form?

A: Yes, there is a $25 fee for processing this form.

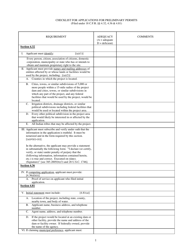

Q: What documents do I need to include with this form?

A: You need to include a copy of the letter from the Kentucky Cabinet for Economic Development granting preliminary authorization for the credit.

Q: Can I submit this form electronically?

A: No, this form must be submitted by mail.

Q: How long does it take to receive a response for this form?

A: The Kentucky Department of Revenue typically responds within 30 days of receiving the form.

Q: Can I claim this tax credit on my federal tax return?

A: No, the Endow Kentucky Tax Credit is only applicable for Kentucky state tax purposes.

Q: Can I carry forward any unused tax credits?

A: Yes, any unused tax credits can be carried forward for up to 5 years.

Q: Can I transfer the tax credit to someone else?

A: No, the tax credit is not transferable to another taxpayer.

Q: Are there any limitations on the amount of tax credits that can be awarded?

A: Yes, the total amount of tax credits awarded statewide cannot exceed $1 million per calendar year.

Q: What if my donation is not authorized for the tax credit?

A: If your donation is not authorized for the tax credit, you will receive a denial letter and the fee will not be refunded.

Q: Is there a limit on the total tax credits that can be claimed?

A: Yes, the total tax credits claimed statewide cannot exceed $10 million per calendar year.

Q: What happens if I submit this form after the deadline?

A: If the form is submitted after the deadline, it will not be processed and the tax credit will not be granted.

Q: Can I apply for this tax credit every year?

A: Yes, you can apply for the Endow Kentucky Tax Credit on an annual basis, as long as funds are available.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720-S85 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.