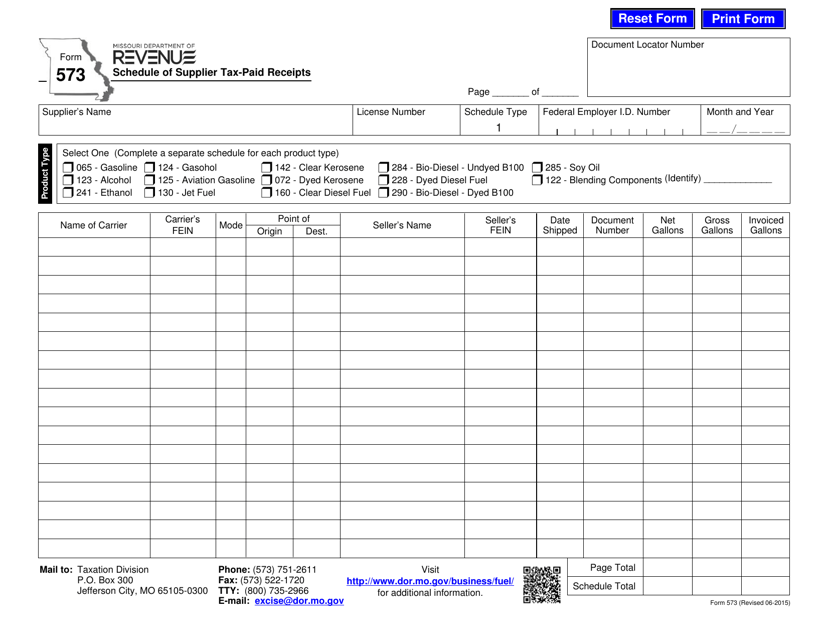

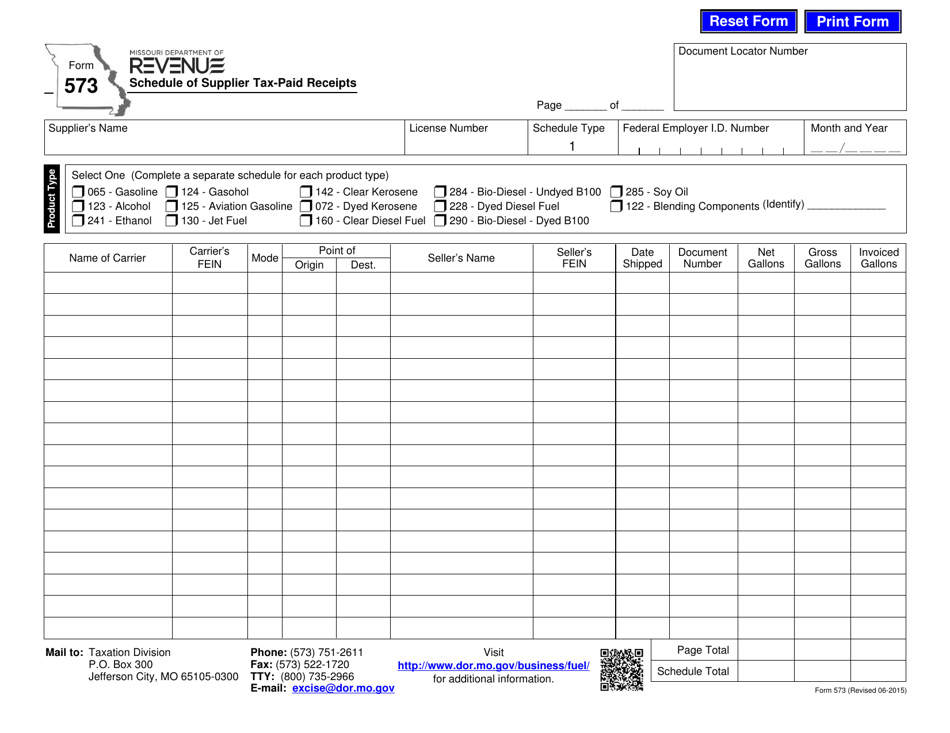

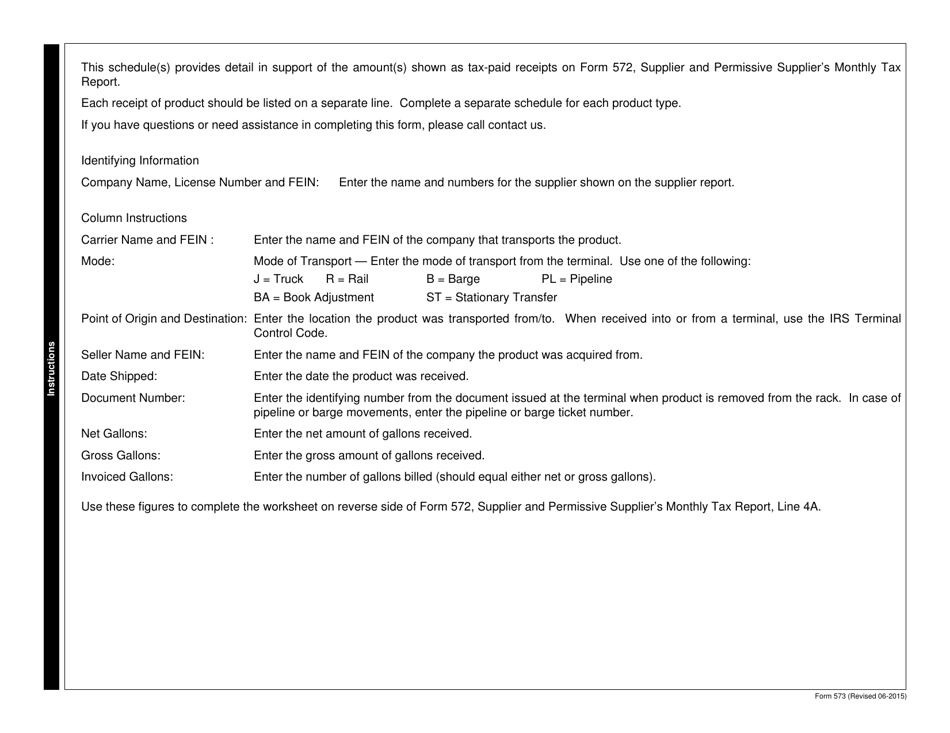

Form 573 Schedule of Supplier Tax-Paid Receipts - Missouri

What Is Form 573?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 573?

A: Form 573 is a Schedule of Supplier Tax-Paid Receipts.

Q: What is the purpose of Form 573?

A: The purpose of Form 573 is to report tax-paid receipts made to suppliers in the state of Missouri.

Q: Who needs to file Form 573?

A: Any taxpayer who has tax-paid receipts from suppliers in Missouri needs to file Form 573.

Q: When is Form 573 due?

A: Form 573 is due on or before the 20th day of the month following the end of the quarter.

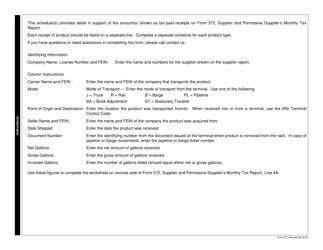

Q: What information do I need to complete Form 573?

A: You will need information about your tax-paid receipts and the suppliers you made purchases from.

Q: Are there any penalties for late filing of Form 573?

A: Yes, there may be penalties for late filing or failure to file Form 573.

Q: Can I claim a refund for tax-paid receipts on Form 573?

A: No, Form 573 is only used to report tax-paid receipts, not to claim refunds.

Q: Do I need to include supporting documents with Form 573?

A: No, you do not need to include supporting documents with Form 573, but you should keep them for your records.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 573 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.