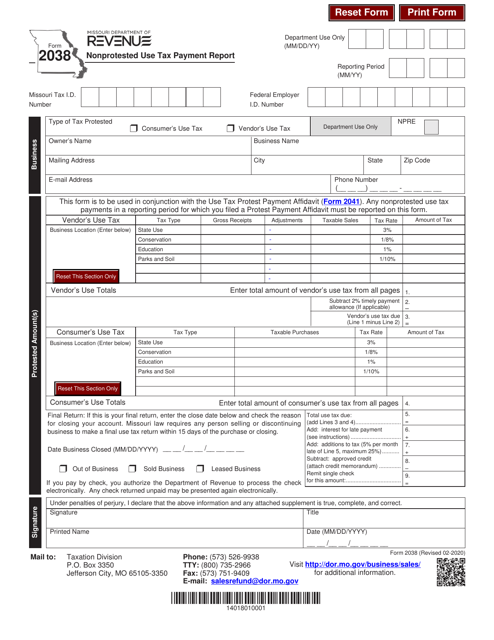

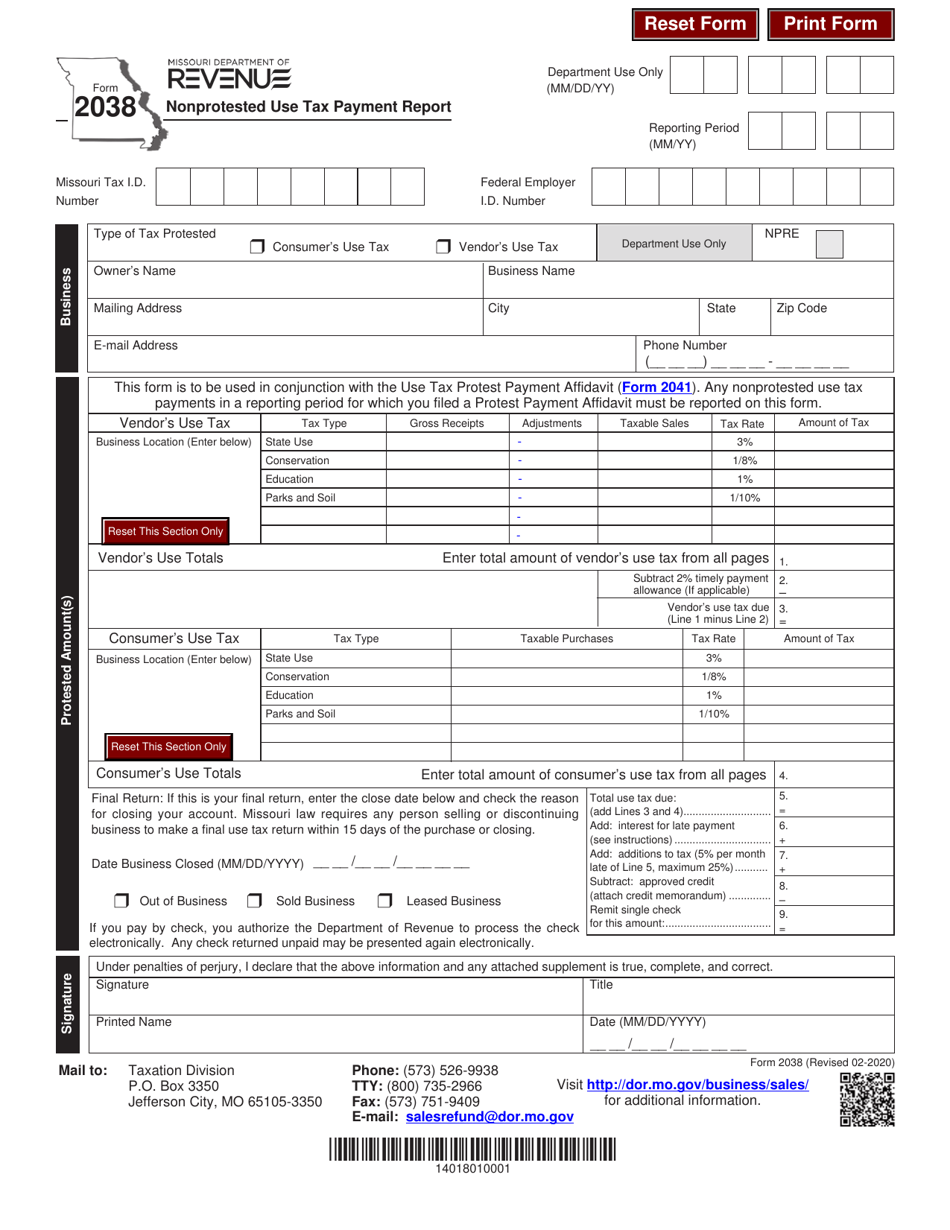

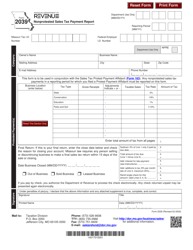

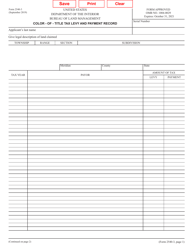

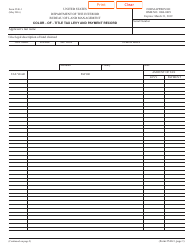

Form 2038 Nonprotested Use Tax Payment Report - Missouri

What Is Form 2038?

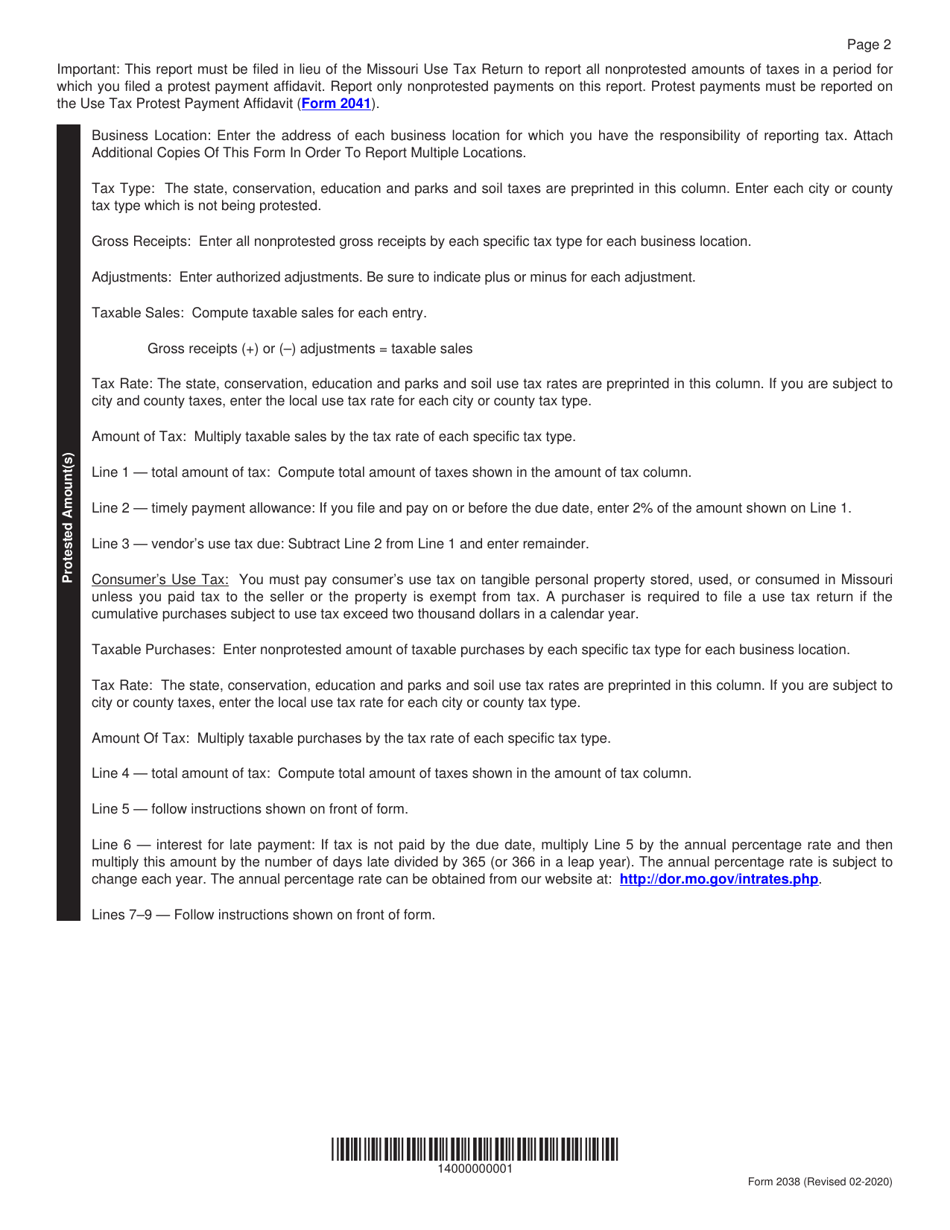

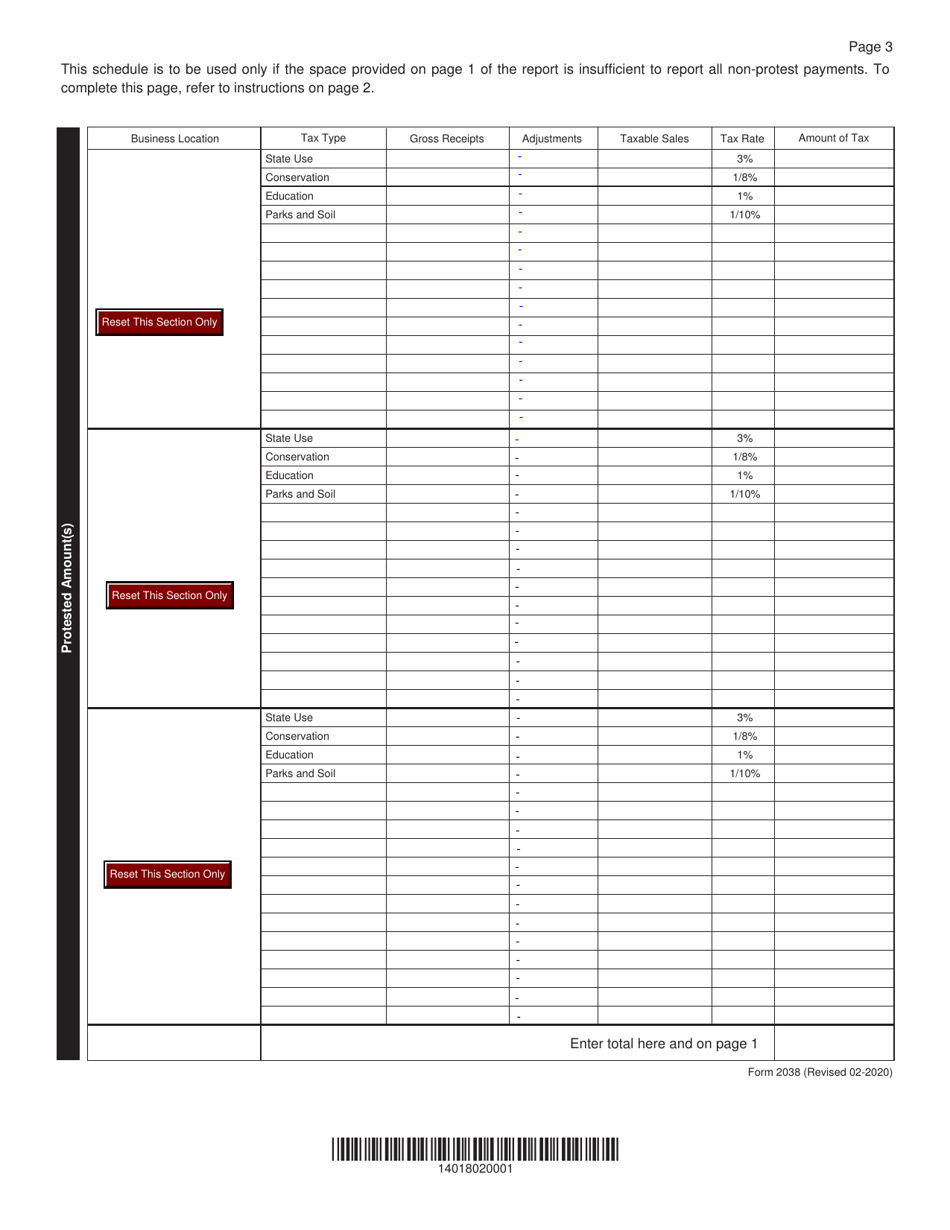

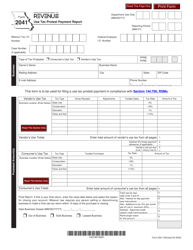

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2038?

A: Form 2038 is a Nonprotested Use Tax Payment Report.

Q: What is the purpose of Form 2038?

A: The purpose of Form 2038 is to report and pay nonprotested use tax in Missouri.

Q: What is nonprotested use tax?

A: Nonprotested use tax is the tax owed on tangible personal property used in Missouri that was purchased from out-of-state vendors and not subject to Missouri sales tax.

Q: Who needs to file Form 2038?

A: Any person or business that owes nonprotested use tax in Missouri needs to file Form 2038.

Q: When is Form 2038 due?

A: Form 2038 is due on or before the 20th day of the month following the end of the reporting period.

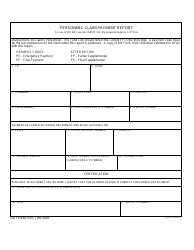

Q: What information do I need to complete Form 2038?

A: You will need to provide your name, address, tax identification number, and the amount of nonprotested use tax owed.

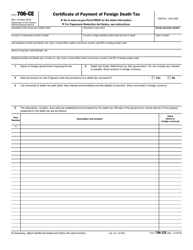

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2038 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.