This version of the form is not currently in use and is provided for reference only. Download this version of

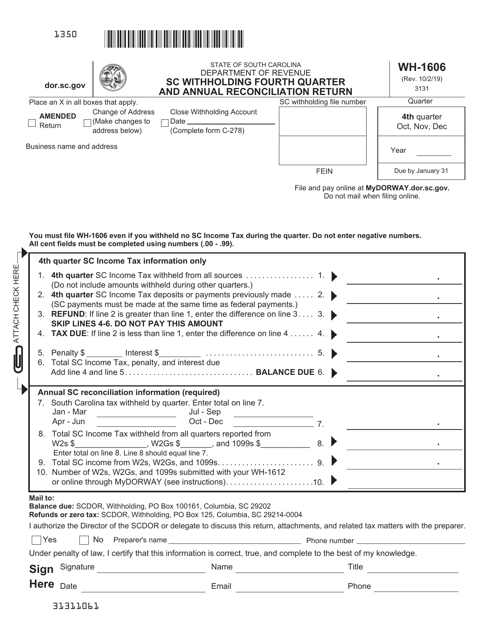

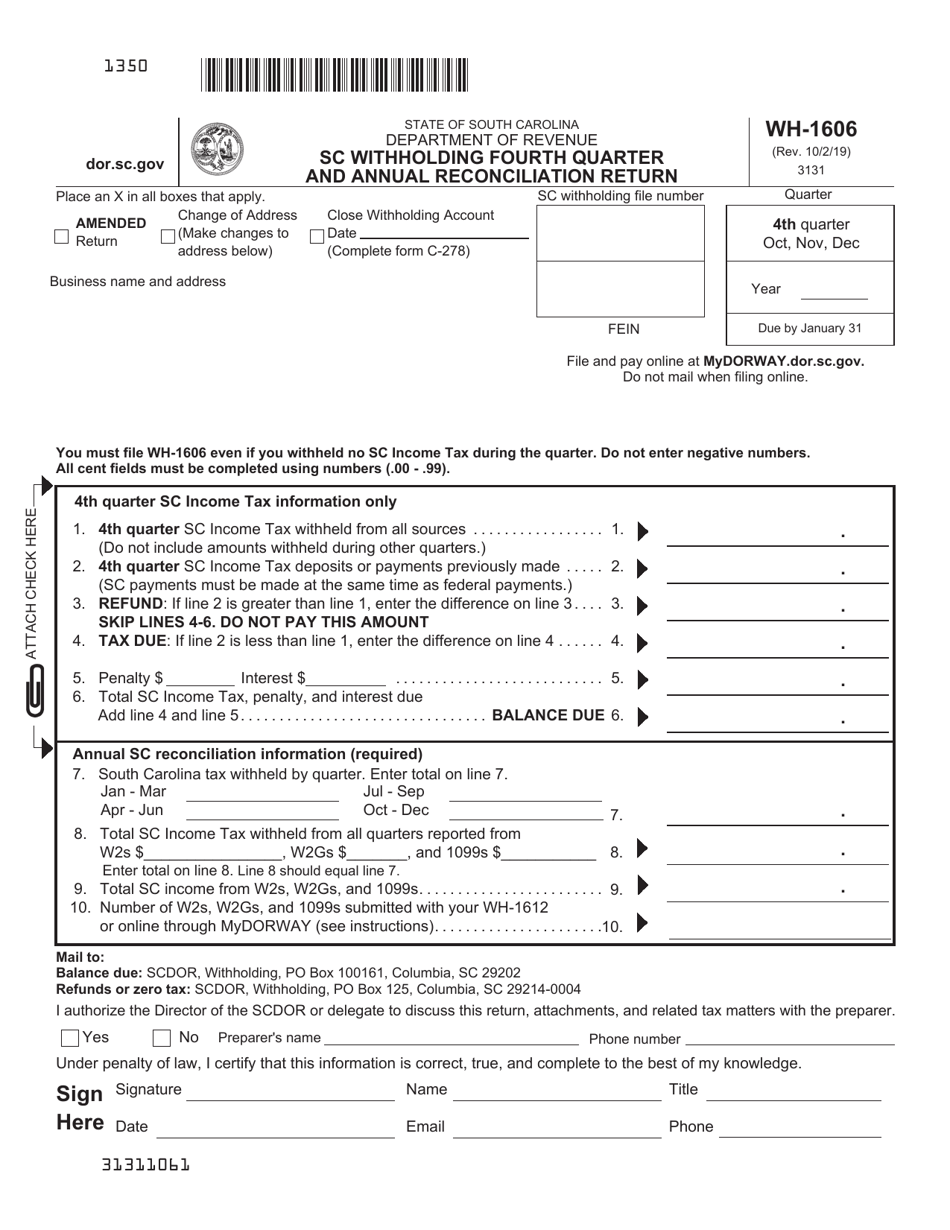

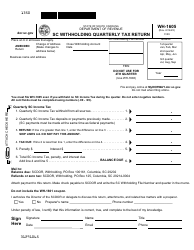

Form WH-1606

for the current year.

Form WH-1606 Sc Withholding Fourth Quarter and Annual Reconciliation Return - South Carolina

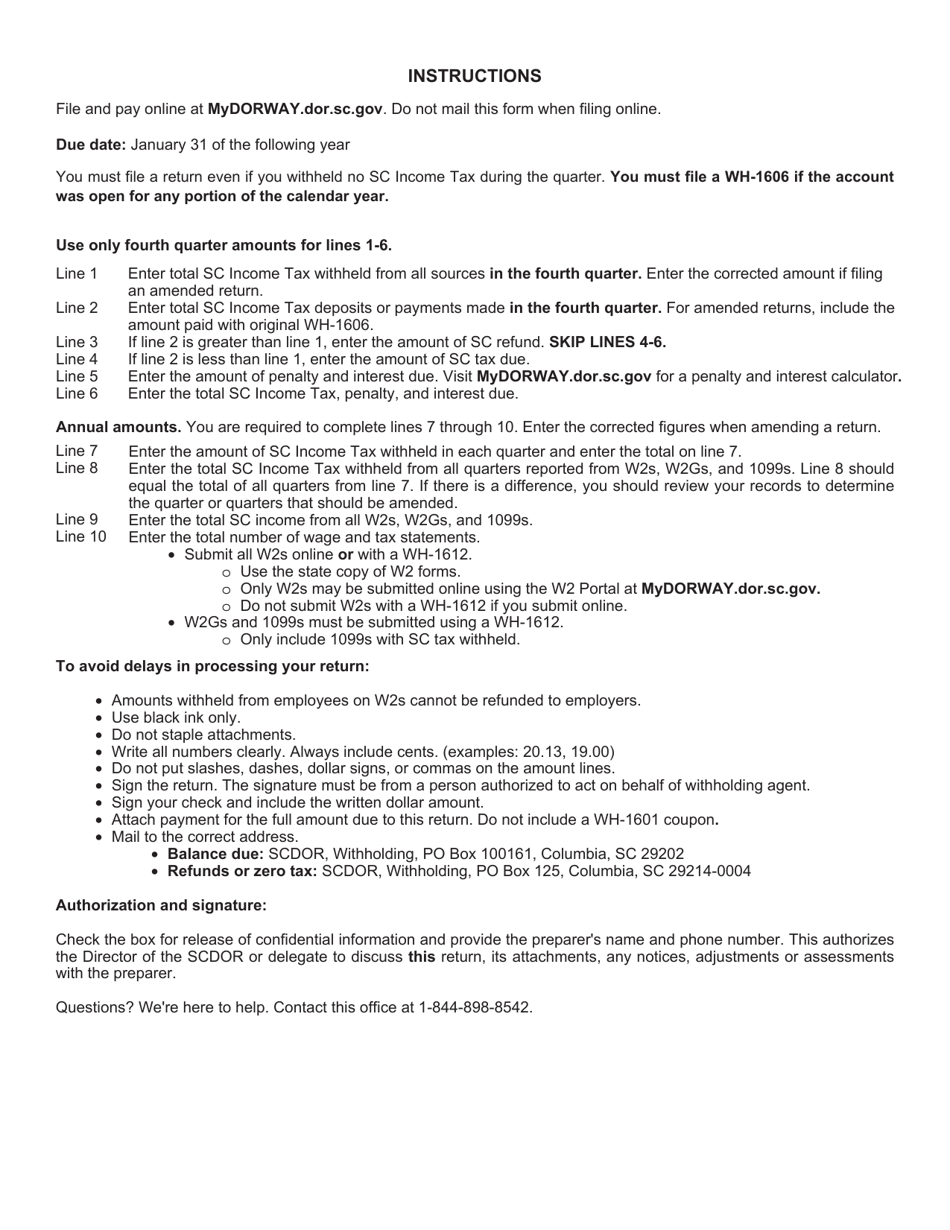

What Is Form WH-1606?

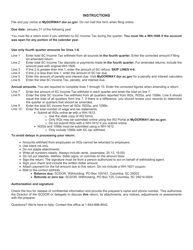

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WH-1606 SC?

A: Form WH-1606 SC is the Withholding Fourth Quarter and Annual Reconciliation Return for South Carolina.

Q: What is the purpose of Form WH-1606 SC?

A: The purpose of Form WH-1606 SC is to report withholding taxes for the fourth quarter and annual period in South Carolina.

Q: When is Form WH-1606 SC due?

A: Form WH-1606 SC is due on or before January 31st of the following year.

Q: Who needs to file Form WH-1606 SC?

A: Employers in South Carolina who have employees and withhold state income taxes need to file Form WH-1606 SC.

Q: Are there any penalties for late filing of Form WH-1606 SC?

A: Yes, there are penalties for late filing of Form WH-1606 SC. It is important to file the form on time to avoid penalties.

Form Details:

- Released on October 2, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WH-1606 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.