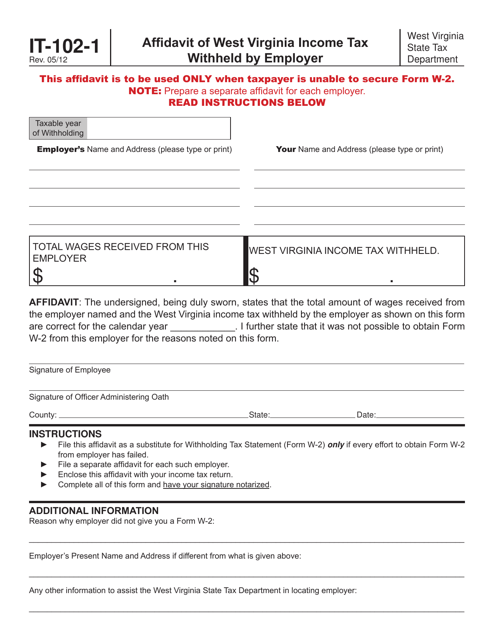

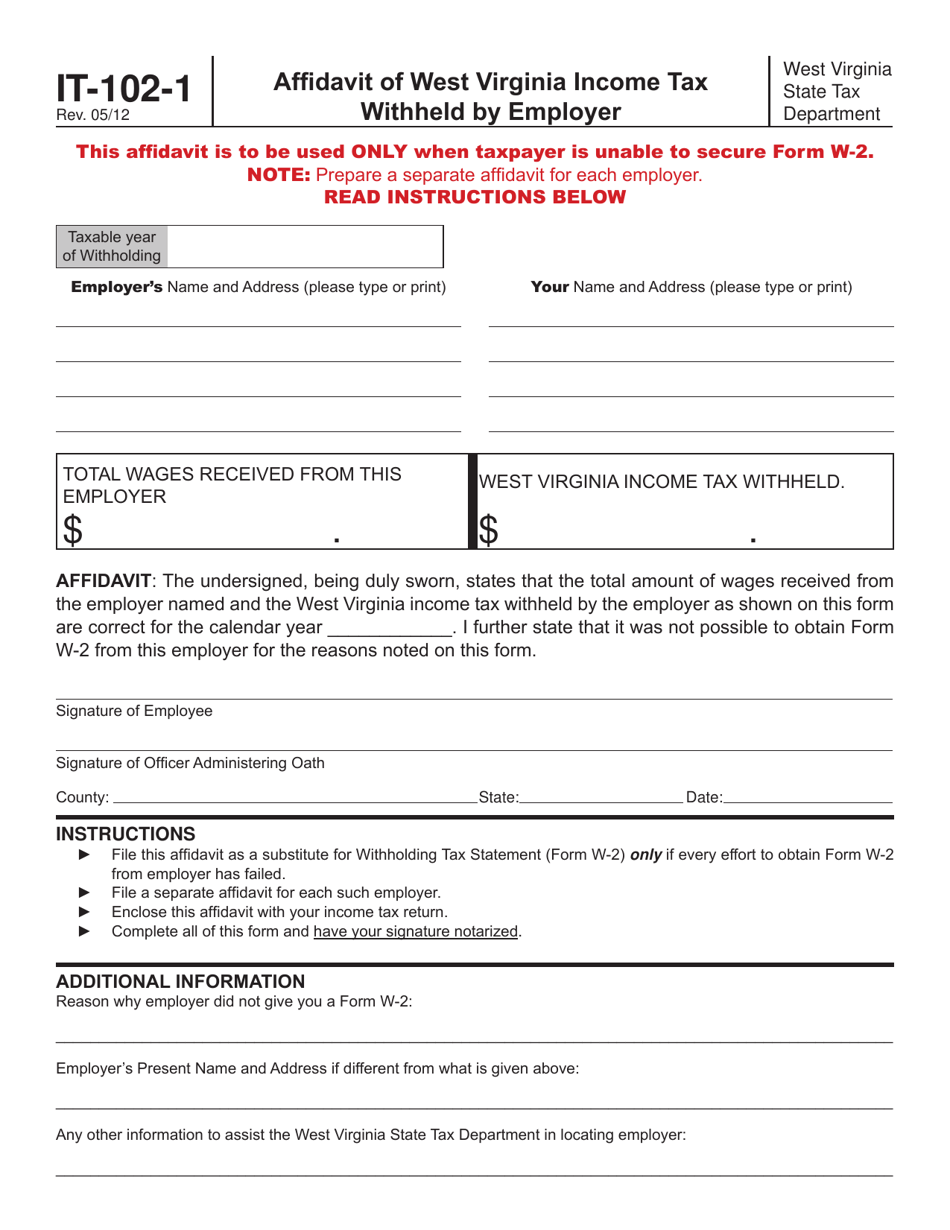

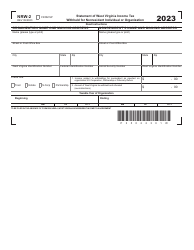

Form IT-102-1 Affidavit of West Virginia Income Tax Withheld by Employer - West Virginia

What Is Form IT-102-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-102-1?

A: Form IT-102-1 is an Affidavit of West Virginia Income Tax Withheld by Employer.

Q: Who should use Form IT-102-1?

A: Employers in West Virginia who have withheld income tax from their employees' wages should use Form IT-102-1.

Q: What is the purpose of Form IT-102-1?

A: The purpose of Form IT-102-1 is to report the total amount of income tax withheld from employees' wages to the West Virginia State Tax Department.

Q: When is Form IT-102-1 due?

A: Form IT-102-1 is due on or before the last day of February following the end of the tax year.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-102-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.