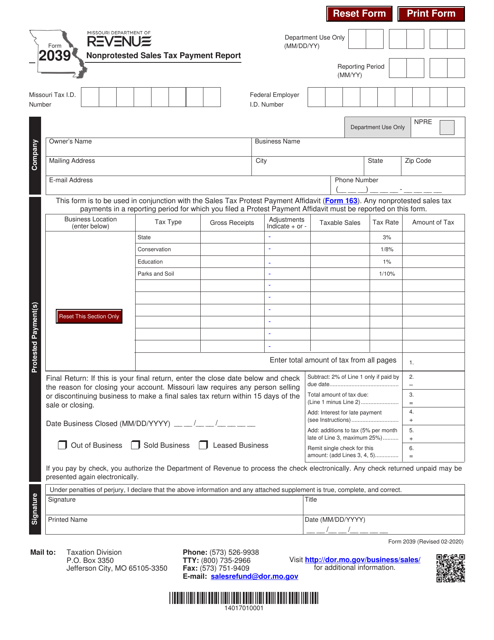

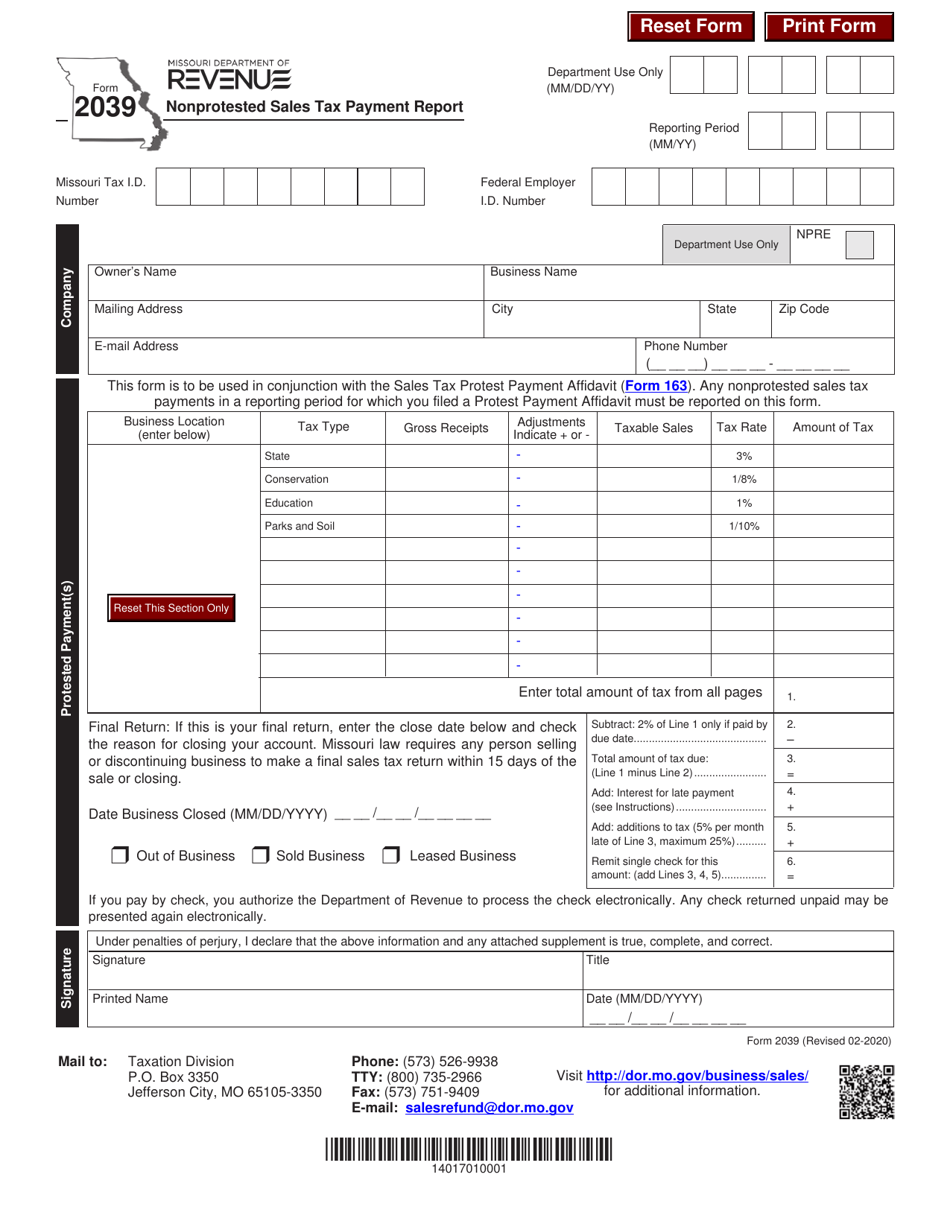

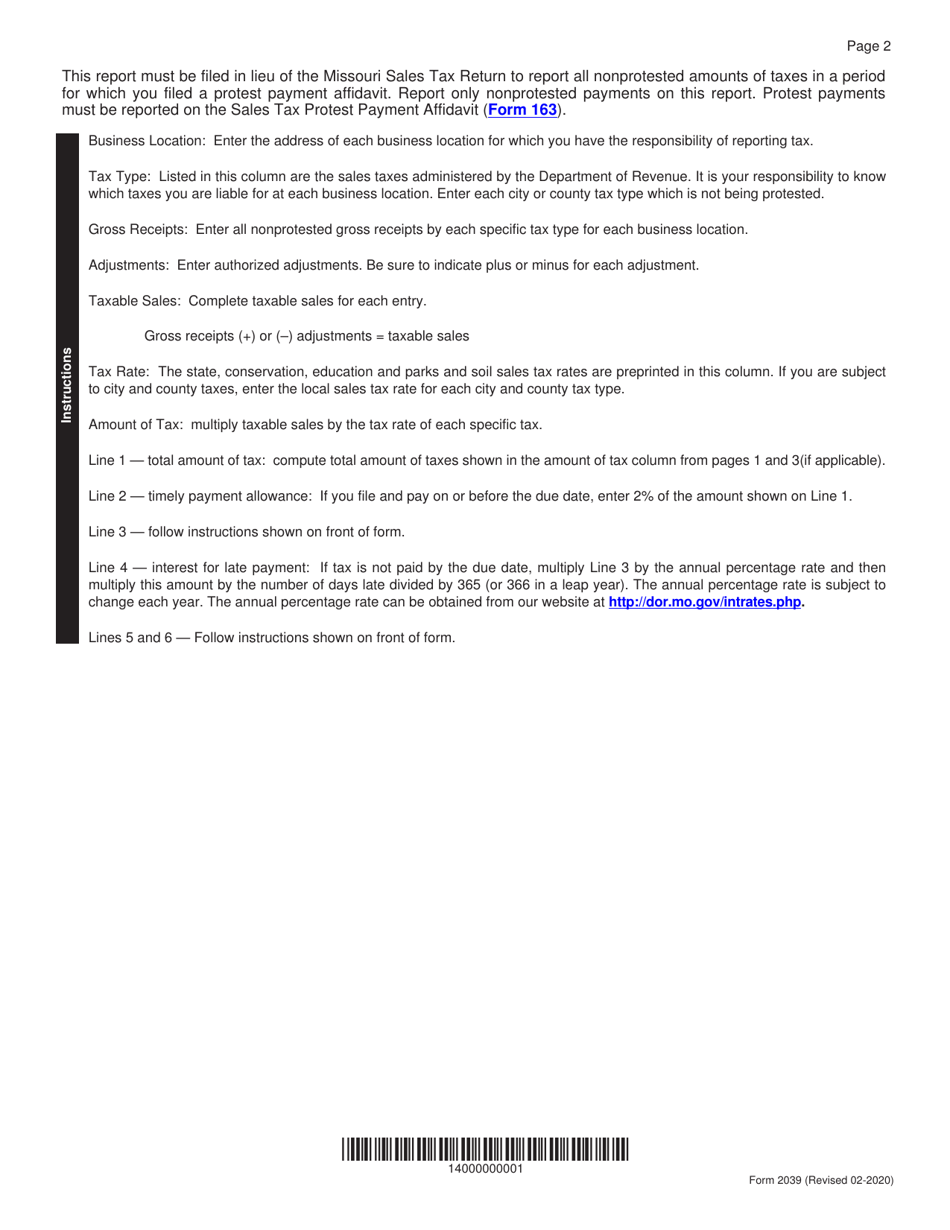

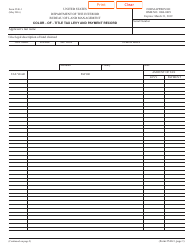

Form 2039 Nonprotested Sales Tax Payment Report - Missouri

What Is Form 2039?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

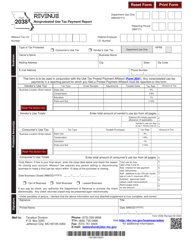

Q: What is Form 2039?

A: Form 2039 is the Nonprotested Sales TaxPayment Report used in Missouri.

Q: Who needs to file Form 2039?

A: Businesses in Missouri that collect and remit sales tax must file Form 2039.

Q: What is the purpose of Form 2039?

A: Form 2039 is used to report and remit sales tax collected by businesses in Missouri.

Q: How often should Form 2039 be filed?

A: Form 2039 should be filed on a monthly basis.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form 2039.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2039 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.