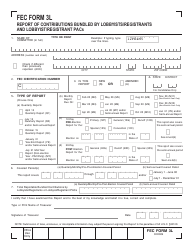

This version of the form is not currently in use and is provided for reference only. Download this version of

Form UC-45

for the current year.

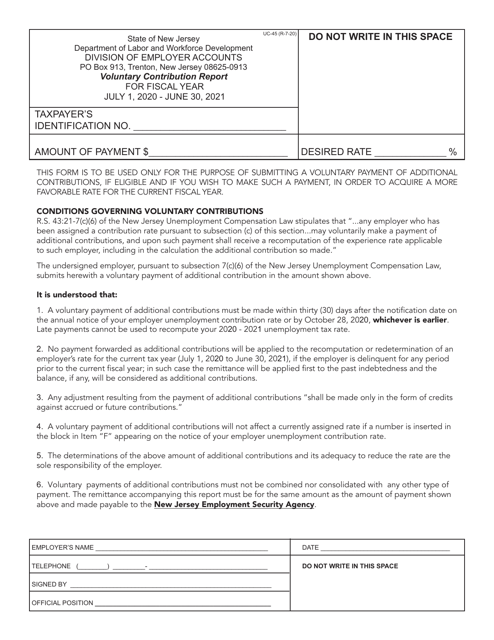

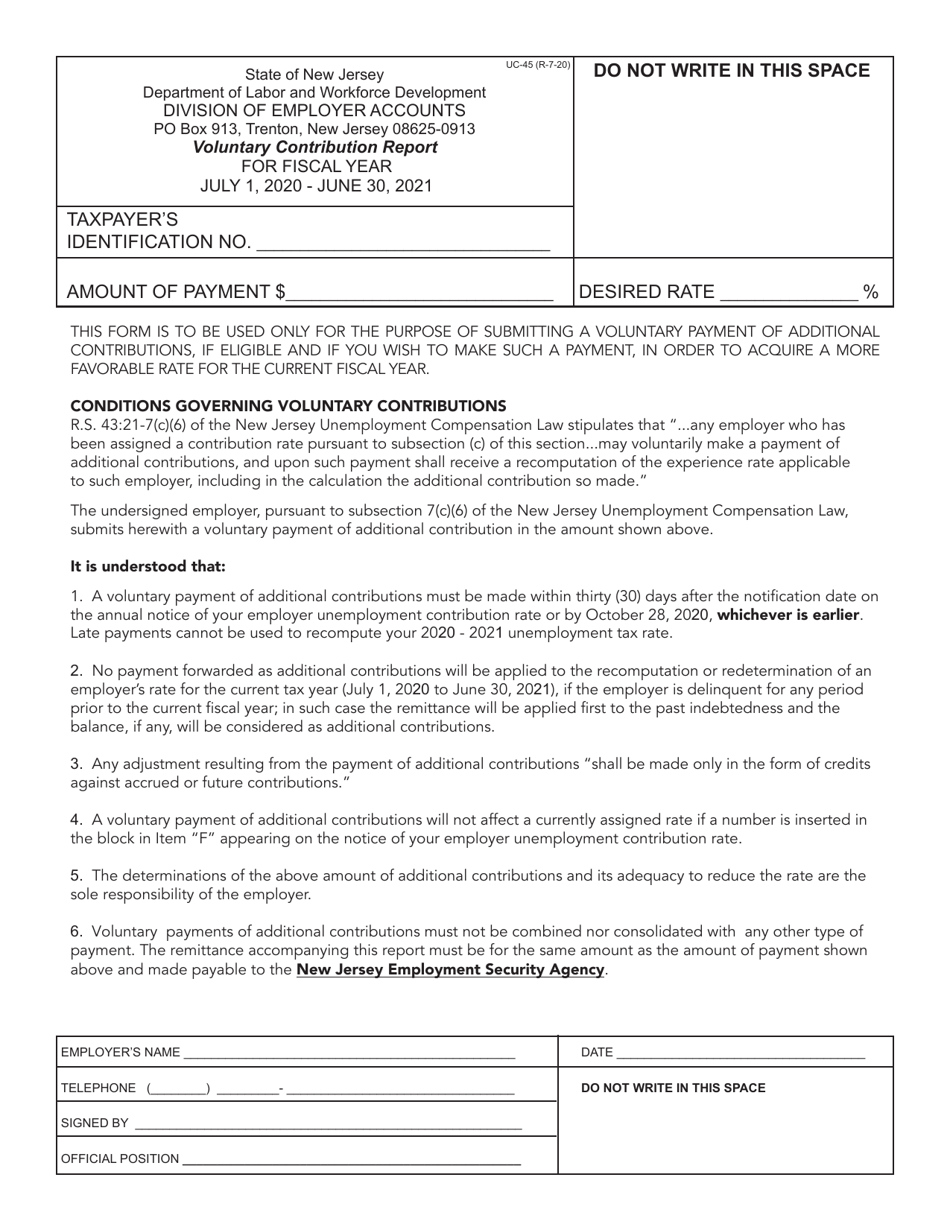

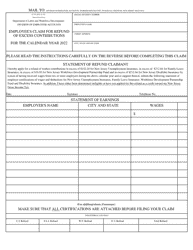

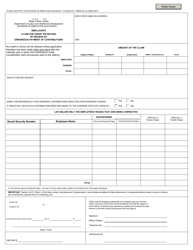

Form UC-45 Voluntary Contribution Report - New Jersey

What Is Form UC-45?

This is a legal form that was released by the New Jersey Department of Labor & Workforce Development - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UC-45?

A: Form UC-45 is the Voluntary Contribution Report used in New Jersey.

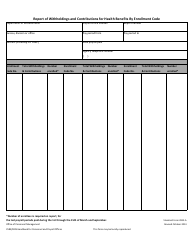

Q: What is the purpose of Form UC-45?

A: The purpose of Form UC-45 is to report voluntary contributions made by employers in New Jersey.

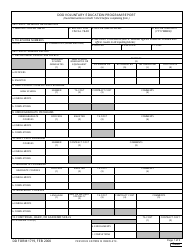

Q: Who needs to file Form UC-45?

A: Employers in New Jersey who make voluntary contributions are required to file Form UC-45.

Q: When is Form UC-45 due?

A: Form UC-45 is due on a quarterly basis, on or before the last day of the month following the end of the quarter.

Q: Is Form UC-45 only for businesses or can individuals also use it?

A: Form UC-45 is specifically for employers in New Jersey who make voluntary contributions, not for individuals.

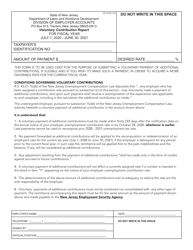

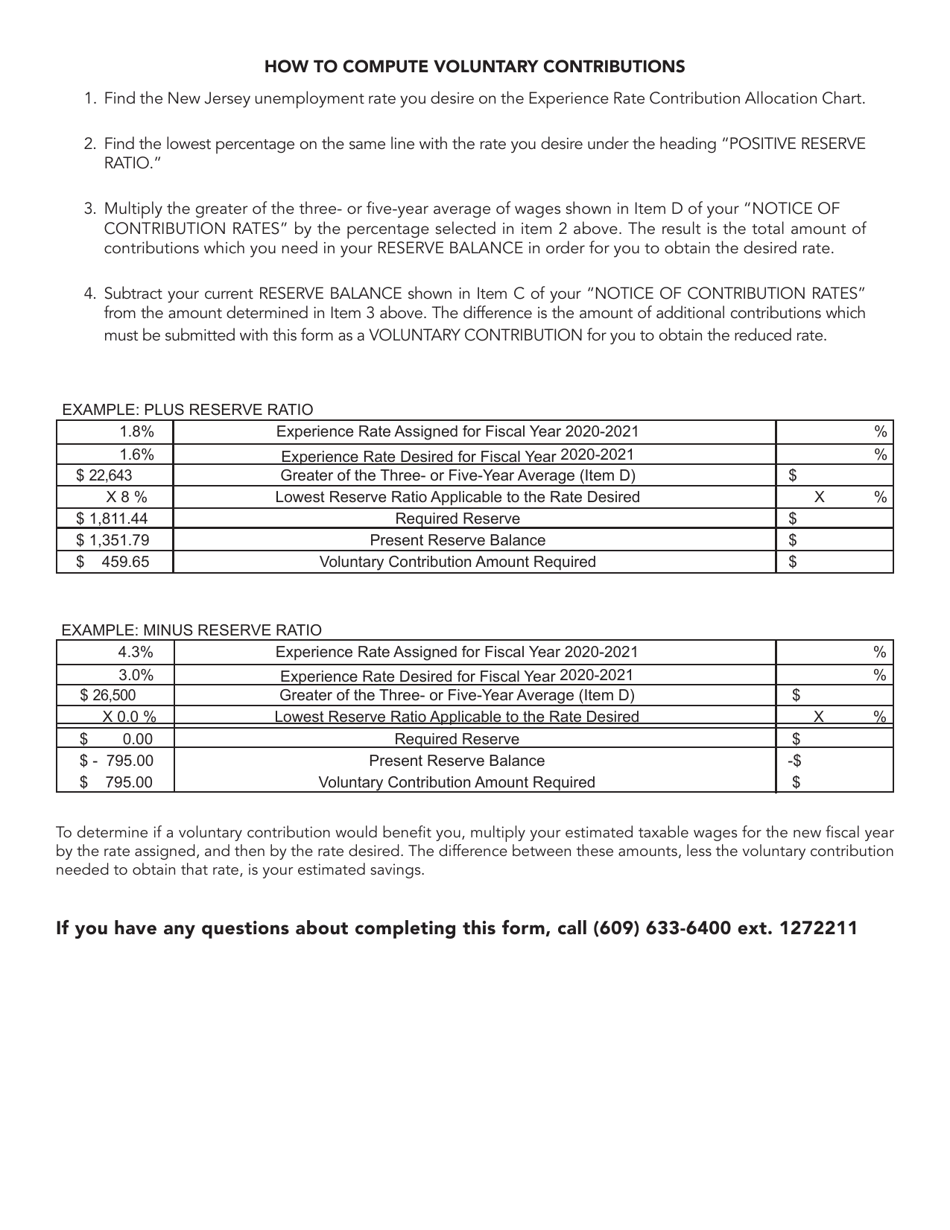

Q: What are voluntary contributions?

A: Voluntary contributions are additional payments made by employers to the New Jersey Unemployment Compensation Fund.

Q: Are voluntary contributions mandatory?

A: No, voluntary contributions are not mandatory. They are optional payments made by employers to the New Jersey Unemployment Compensation Fund.

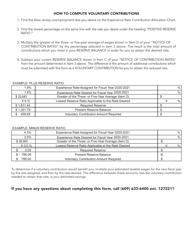

Q: Are there any benefits to making voluntary contributions?

A: Yes, making voluntary contributions can help employers reduce their unemployment tax rate.

Q: Are there any penalties for not filing Form UC-45?

A: Yes, failure to file Form UC-45 or filing it late can result in penalties and interest charges being assessed by the New Jersey Department of Labor and Workforce Development.

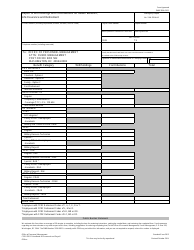

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New Jersey Department of Labor & Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UC-45 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Labor & Workforce Development.