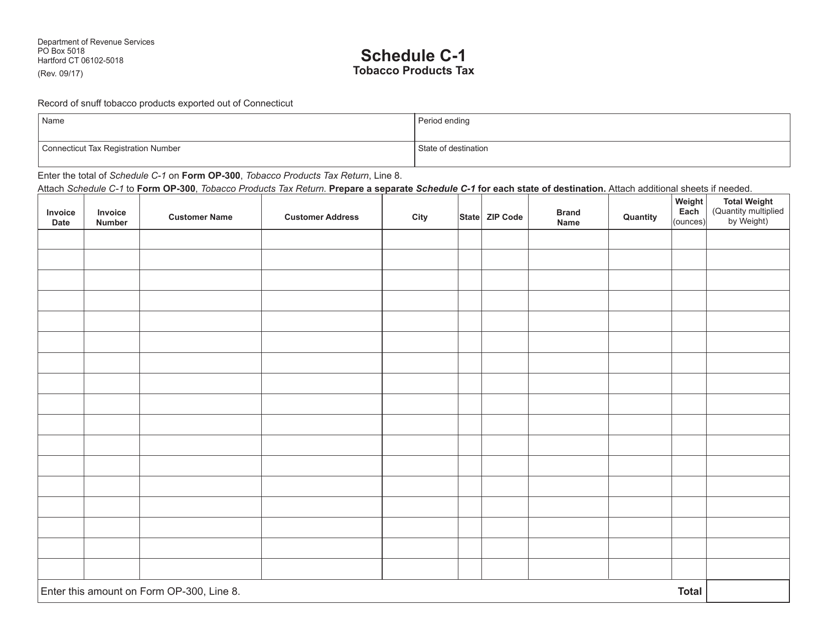

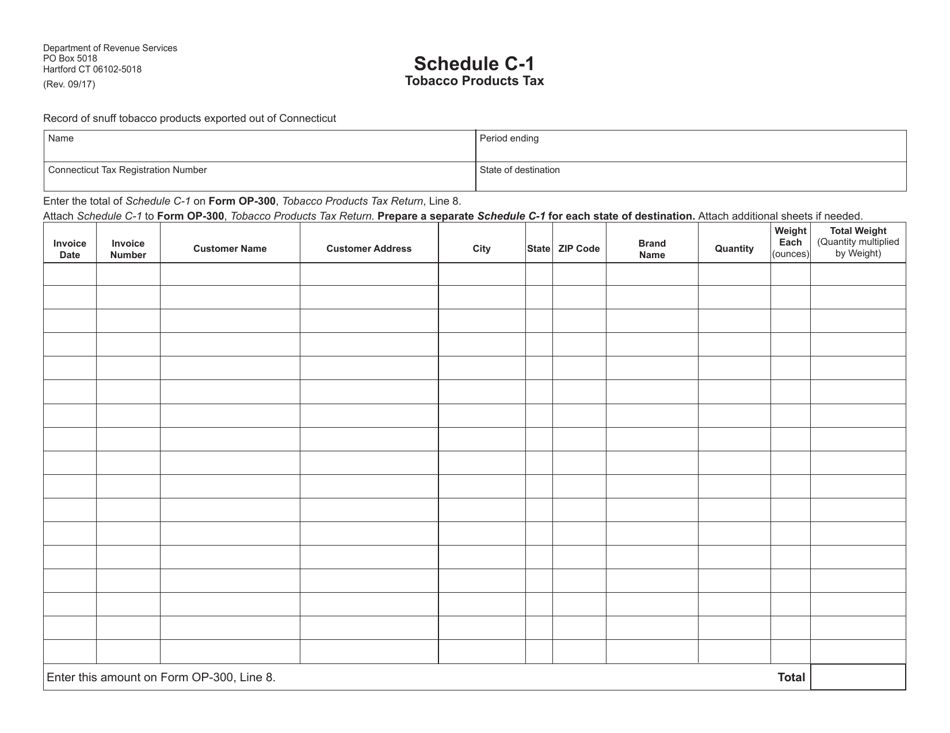

Schedule C-1 Tobacco Products Tax - Record of Snuff Tobacco Products Exported out of Connecticut - Connecticut

What Is Schedule C-1?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule C-1?

A: Schedule C-1 is a tax record for snuff tobacco products exported out of Connecticut.

Q: What is the purpose of Schedule C-1?

A: The purpose of Schedule C-1 is to track and document the export of snuff tobacco products.

Q: Which specific tobacco products does Schedule C-1 apply to?

A: Schedule C-1 applies specifically to snuff tobacco products.

Q: What kind of information is recorded on Schedule C-1?

A: Schedule C-1 records information about the exported snuff tobacco products, including quantity, value, and destination.

Q: Why is it important to keep a record of snuff tobacco products exported out of Connecticut?

A: Keeping a record of snuff tobacco products exported out of Connecticut is important for tax purposes and to ensure compliance with regulations.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule C-1 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.