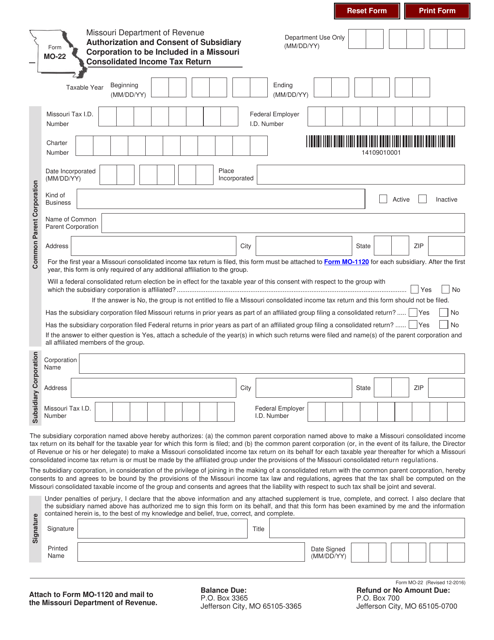

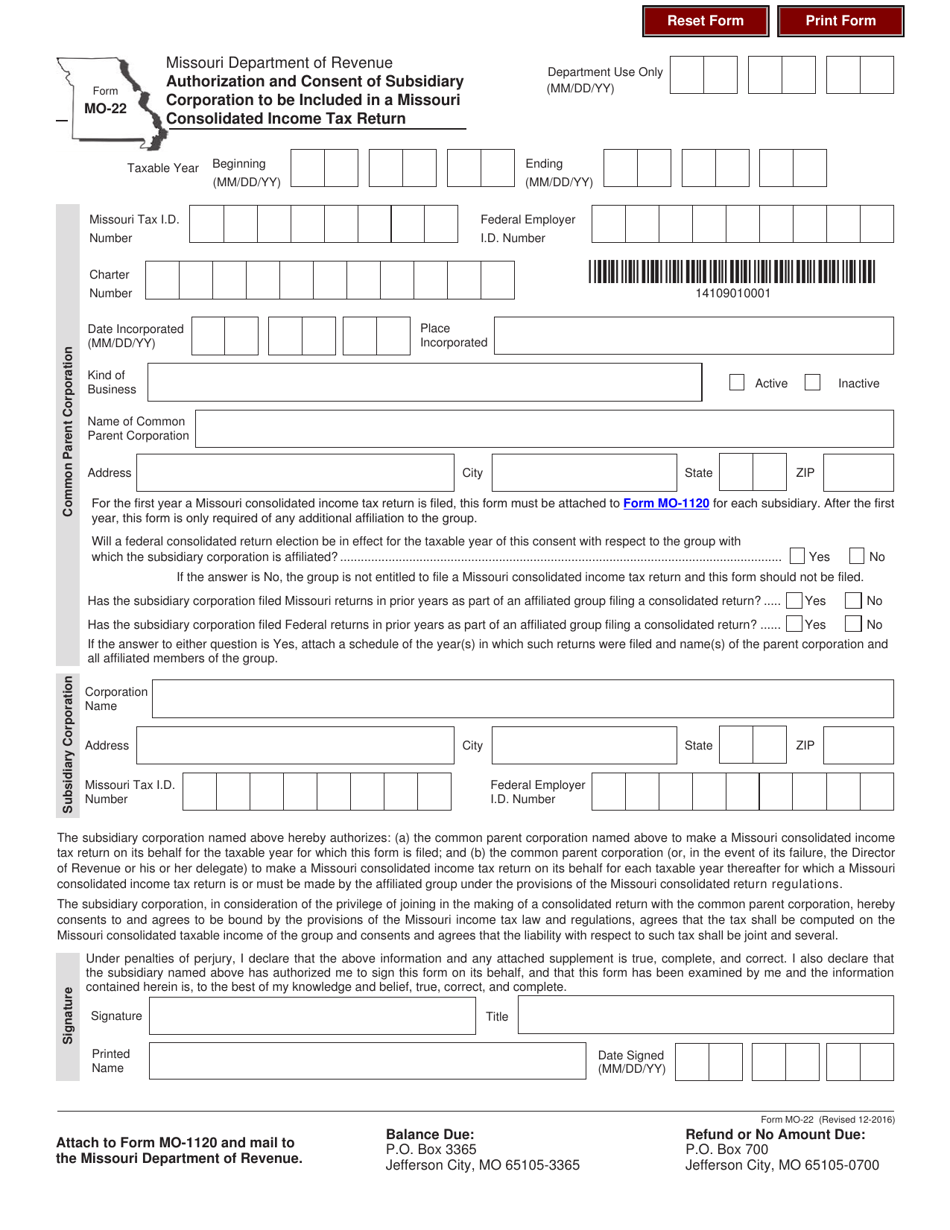

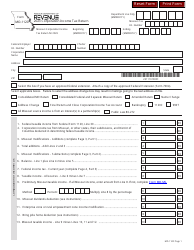

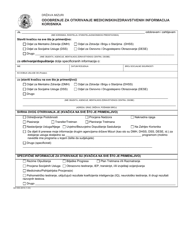

Form MO-22 Authorization and Consent of Subsidiary Corporation to Be Included in a Missouri Consolidated Income Tax Return - Missouri

What Is Form MO-22?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-22?

A: Form MO-22 is Authorization and Consent of Subsidiary Corporation to Be Included in a Missouri Consolidated Income Tax Return.

Q: Who needs to fill out Form MO-22?

A: Subsidiary corporations that want to be included in a Missouri consolidated income tax return need to fill out Form MO-22.

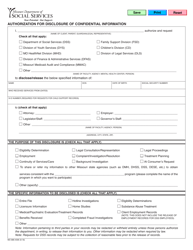

Q: What is the purpose of Form MO-22?

A: The purpose of Form MO-22 is to provide authorization and consent for a subsidiary corporation to be included in a Missouri consolidated income tax return.

Q: Are there any filing fees for Form MO-22?

A: No, there are no filing fees for Form MO-22.

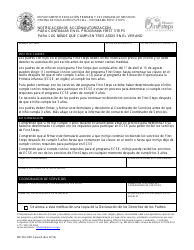

Q: When is Form MO-22 due?

A: Form MO-22 is due on the same date as the consolidated income tax return for the parent corporation.

Q: Is Form MO-22 specific to Missouri?

A: Yes, Form MO-22 is specific to Missouri. It is used for authorization and consent related to Missouri consolidated income tax returns.

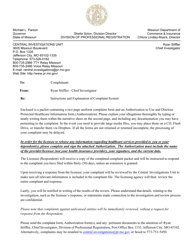

Q: What should I do if I have questions about Form MO-22?

A: If you have any questions about Form MO-22, you can contact the Missouri Department of Revenue for assistance.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-22 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.