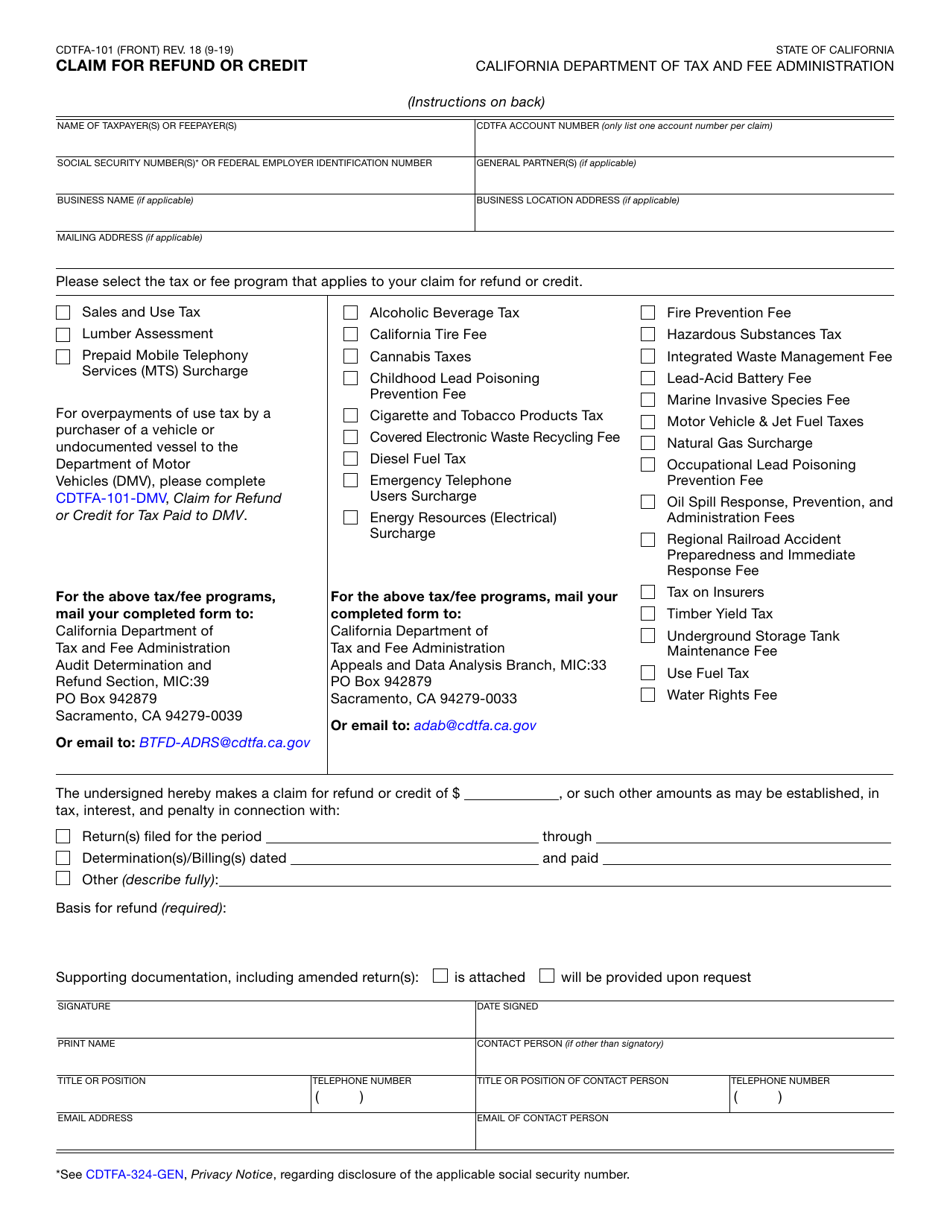

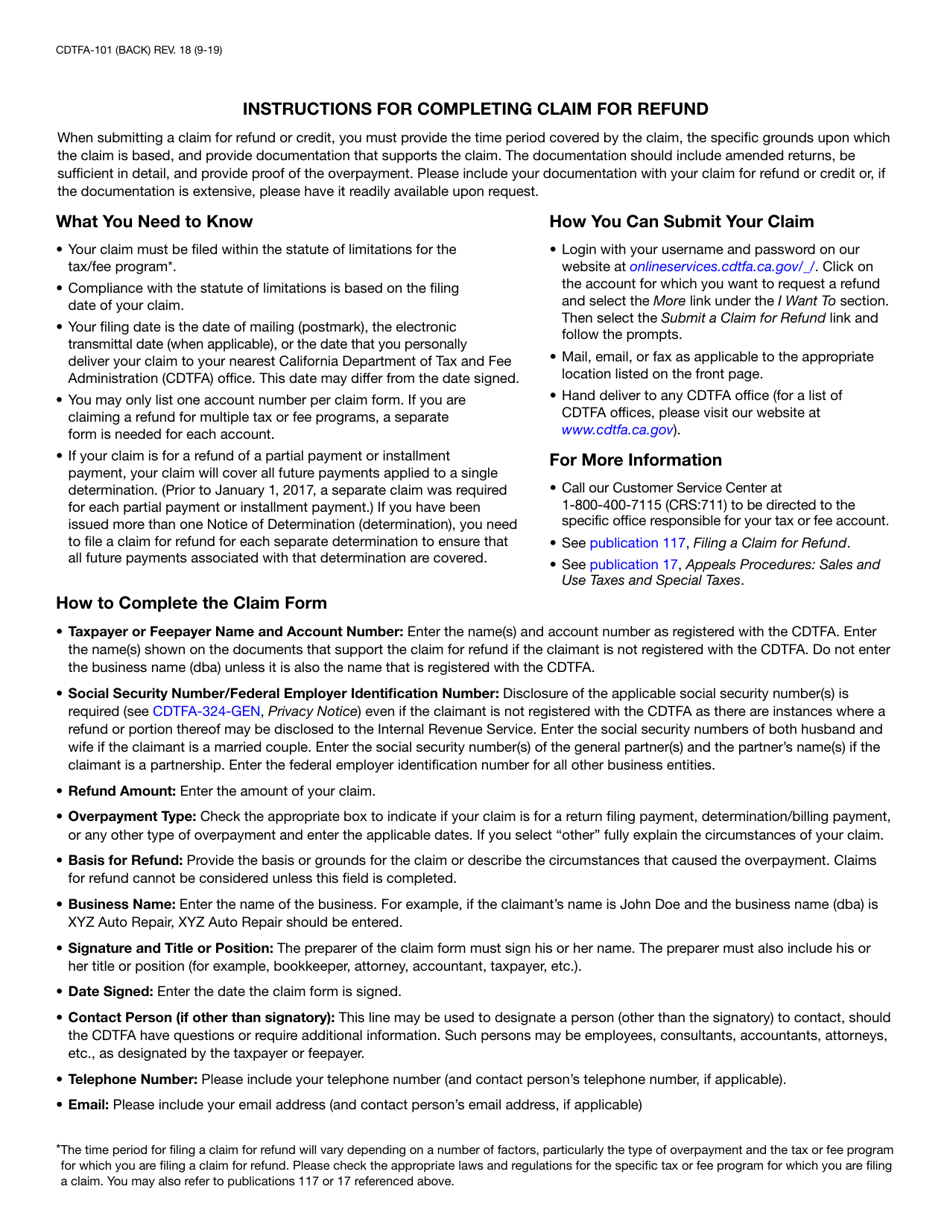

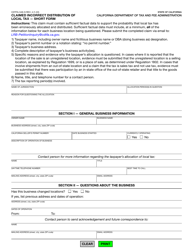

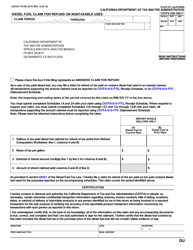

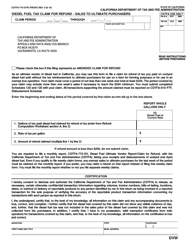

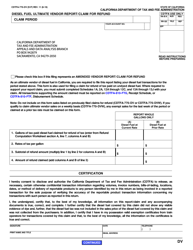

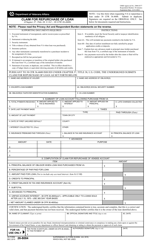

Form CDTFA-101 Claim for Refund or Credit - California

What Is Form CDTFA-101?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-101?

A: Form CDTFA-101 is the claim for refund or credit form used in the state of California.

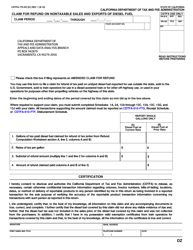

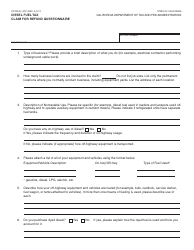

Q: What is the purpose of Form CDTFA-101?

A: The purpose of Form CDTFA-101 is to request a refund or credit for overpaid taxes in California.

Q: Who can use Form CDTFA-101?

A: Individuals, businesses, and organizations that have overpaid taxes in California can use Form CDTFA-101.

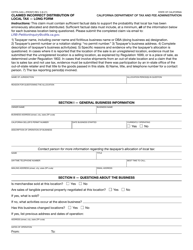

Q: What information do I need to provide on Form CDTFA-101?

A: You will need to provide your contact information, tax account number, details of the overpayment, and any supporting documentation to substantiate your claim on Form CDTFA-101.

Q: Is there a deadline to file Form CDTFA-101?

A: Yes, you must file Form CDTFA-101 within three years from the date of overpayment to claim a refund or credit in California.

Q: What happens after I submit Form CDTFA-101?

A: After you submit Form CDTFA-101, the California Department of Tax and Fee Administration will review your claim and may request additional information or documentation.

Q: How long does it take to receive a refund or credit after filing Form CDTFA-101?

A: The processing time for a refund or credit after filing Form CDTFA-101 varies, but on average, it takes about 8-12 weeks.

Q: Are there any fees associated with filing Form CDTFA-101?

A: No, there are no fees associated with filing Form CDTFA-101 in California.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-101 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.