This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

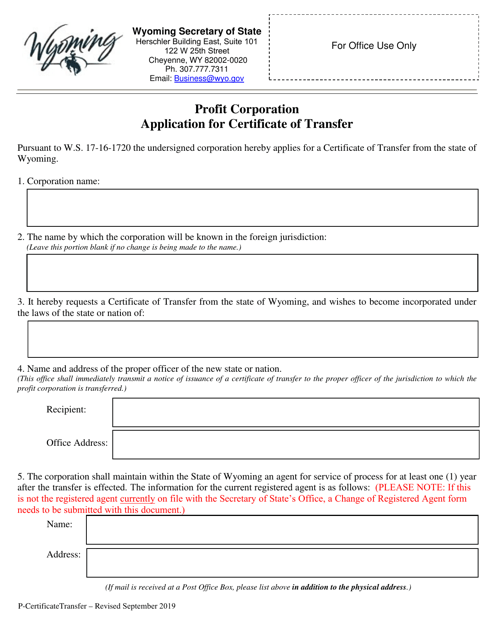

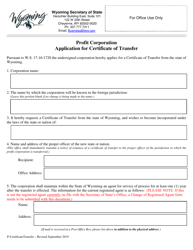

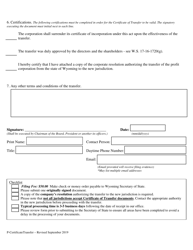

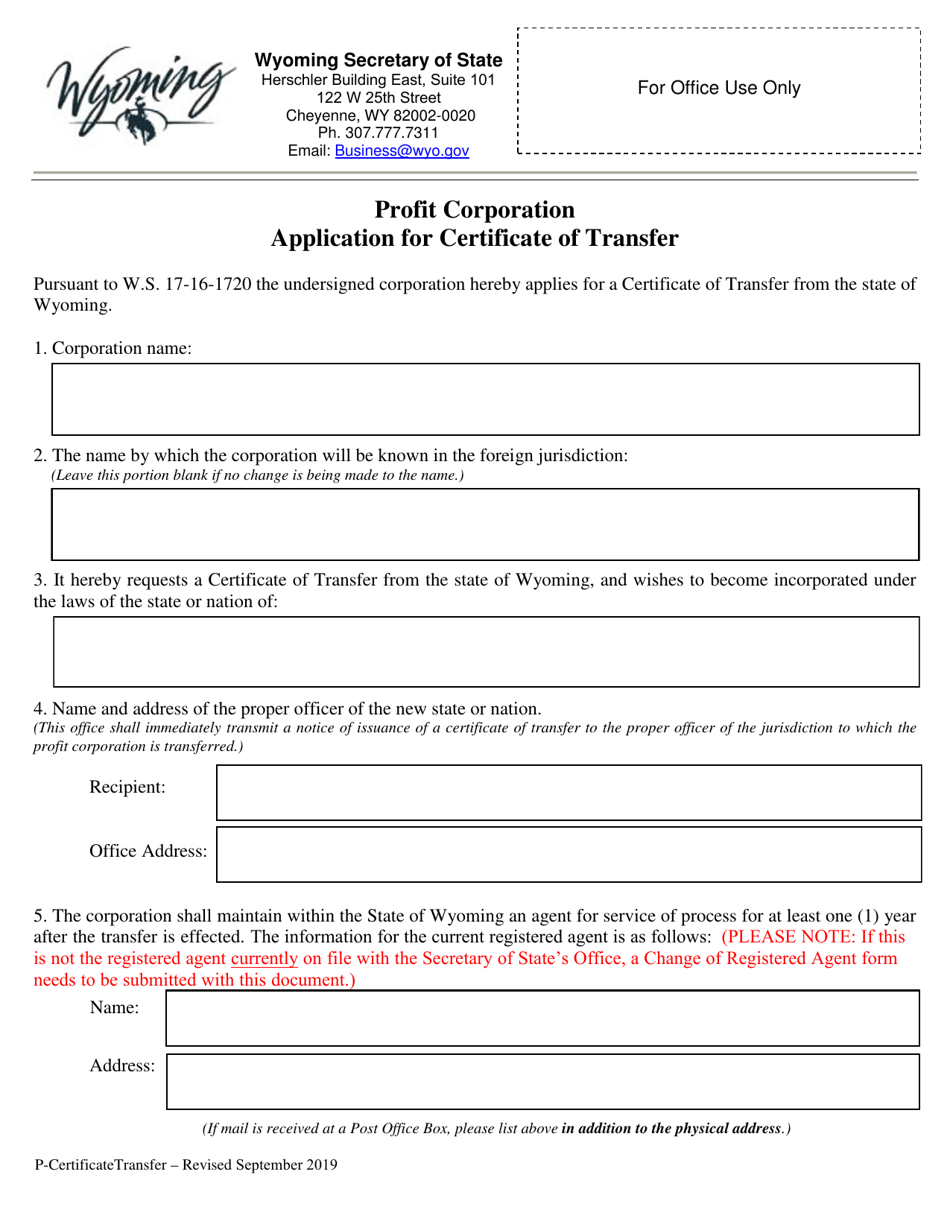

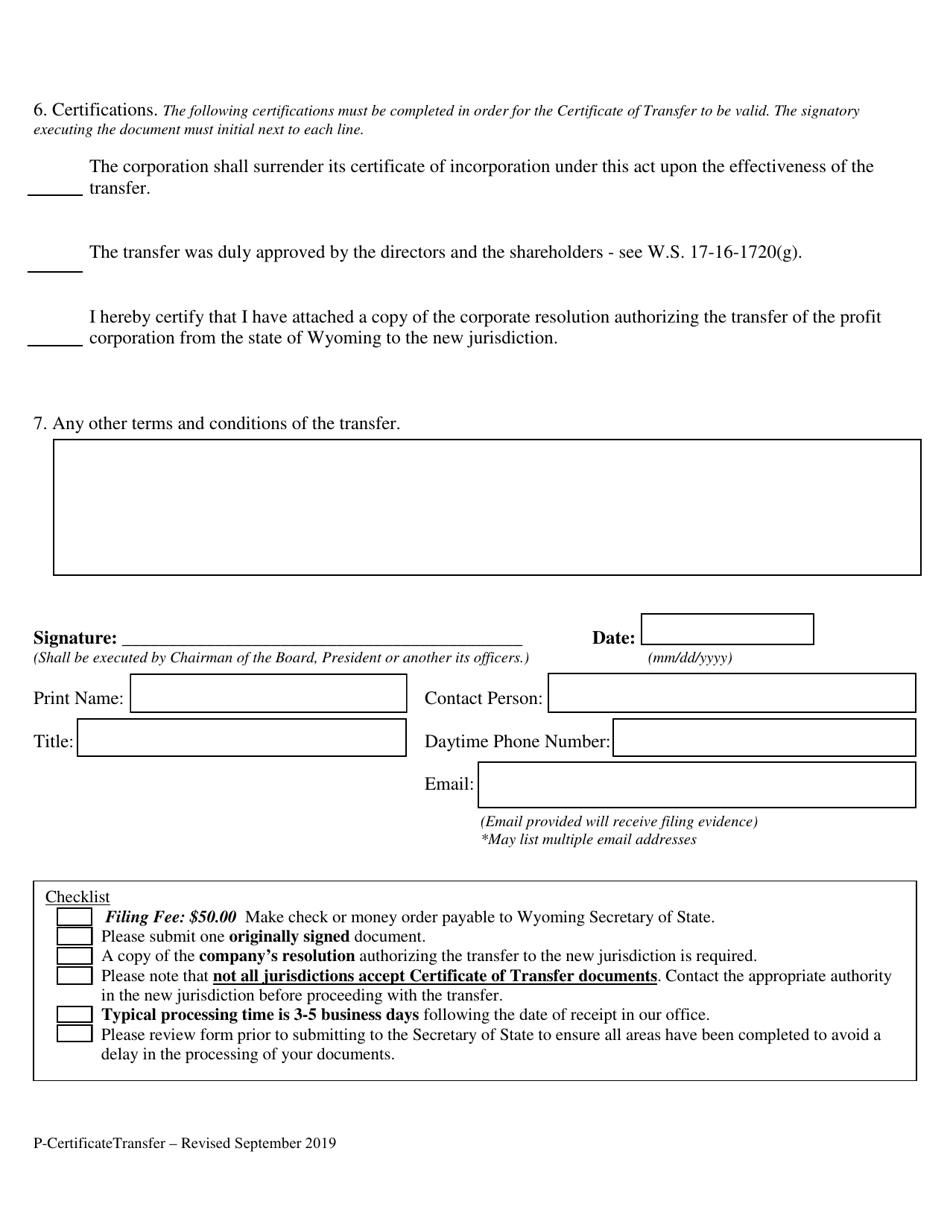

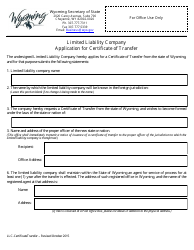

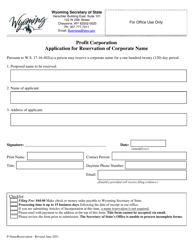

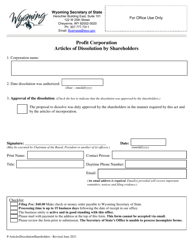

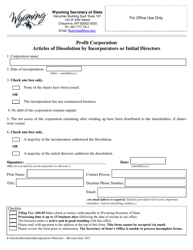

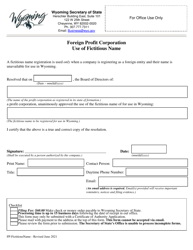

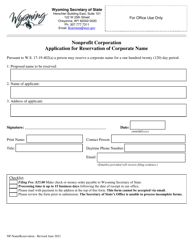

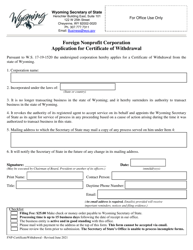

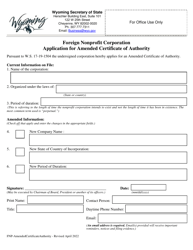

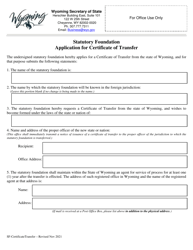

Profit Corporation Application for Certificate of Transfer - Wyoming

Profit Corporation Application for Certificate of Transfer is a legal document that was released by the Wyoming Secretary of State - a government authority operating within Wyoming.

FAQ

Q: What is a Profit Corporation?

A: A profit corporation is a type of business entity that is organized to generate profit for its shareholders or owners.

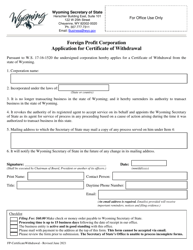

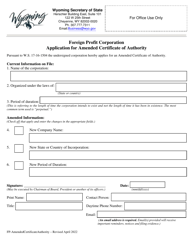

Q: What is the Application for Certificate of Transfer?

A: The Application for Certificate of Transfer is a form that needs to be filed with the state of Wyoming when a profit corporation wants to transfer its jurisdiction of incorporation to Wyoming.

Q: What information is required in the Application for Certificate of Transfer?

A: The application requires information such as the name of the corporation, the current state of incorporation, the proposed effective date of the transfer, and the address of the corporation's registered office in Wyoming.

Q: How much does it cost to file the Application for Certificate of Transfer?

A: The filing fee for the Application for Certificate of Transfer in Wyoming is $100.

Q: Are there any additional requirements for the transfer of a profit corporation to Wyoming?

A: Yes, in addition to filing the Application for Certificate of Transfer, the corporation must also obtain a Certificate of Good Standing from its current state of incorporation, which needs to be submitted with the application.

Q: Can any profit corporation transfer its jurisdiction of incorporation to Wyoming?

A: No, there may be certain eligibility requirements and restrictions that need to be met in order to transfer the jurisdiction of incorporation to Wyoming. It is recommended to consult with legal professionals or the Wyoming Secretary of State for specific requirements.

Q: How long does it take to process the Application for Certificate of Transfer?

A: The processing time varies, but typically it takes a few weeks for the state of Wyoming to review and approve the application.

Q: What happens after the Application for Certificate of Transfer is approved?

A: Once the application is approved, the profit corporation will be considered incorporated in Wyoming and will need to comply with the laws and regulations of that state.

Q: Are there any tax implications for transferring a profit corporation to Wyoming?

A: There may be tax implications associated with transferring the jurisdiction of incorporation. It is recommended to consult with tax professionals for guidance on any tax consequences.

Q: Can I request expedited processing for the Application for Certificate of Transfer?

A: Yes, Wyoming offers expedited processing for an additional fee. The fee for expedited processing varies depending on the requested timeline.

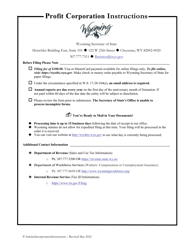

Form Details:

- Released on September 1, 2019;

- The latest edition currently provided by the Wyoming Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Wyoming Secretary of State.