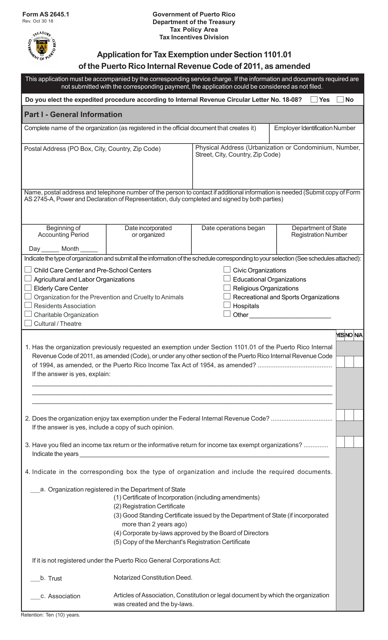

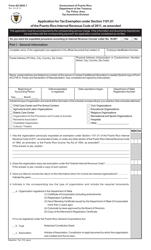

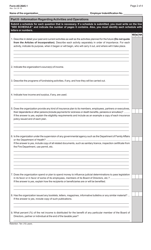

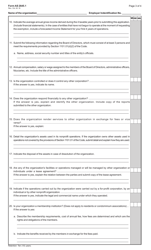

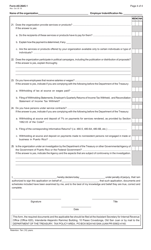

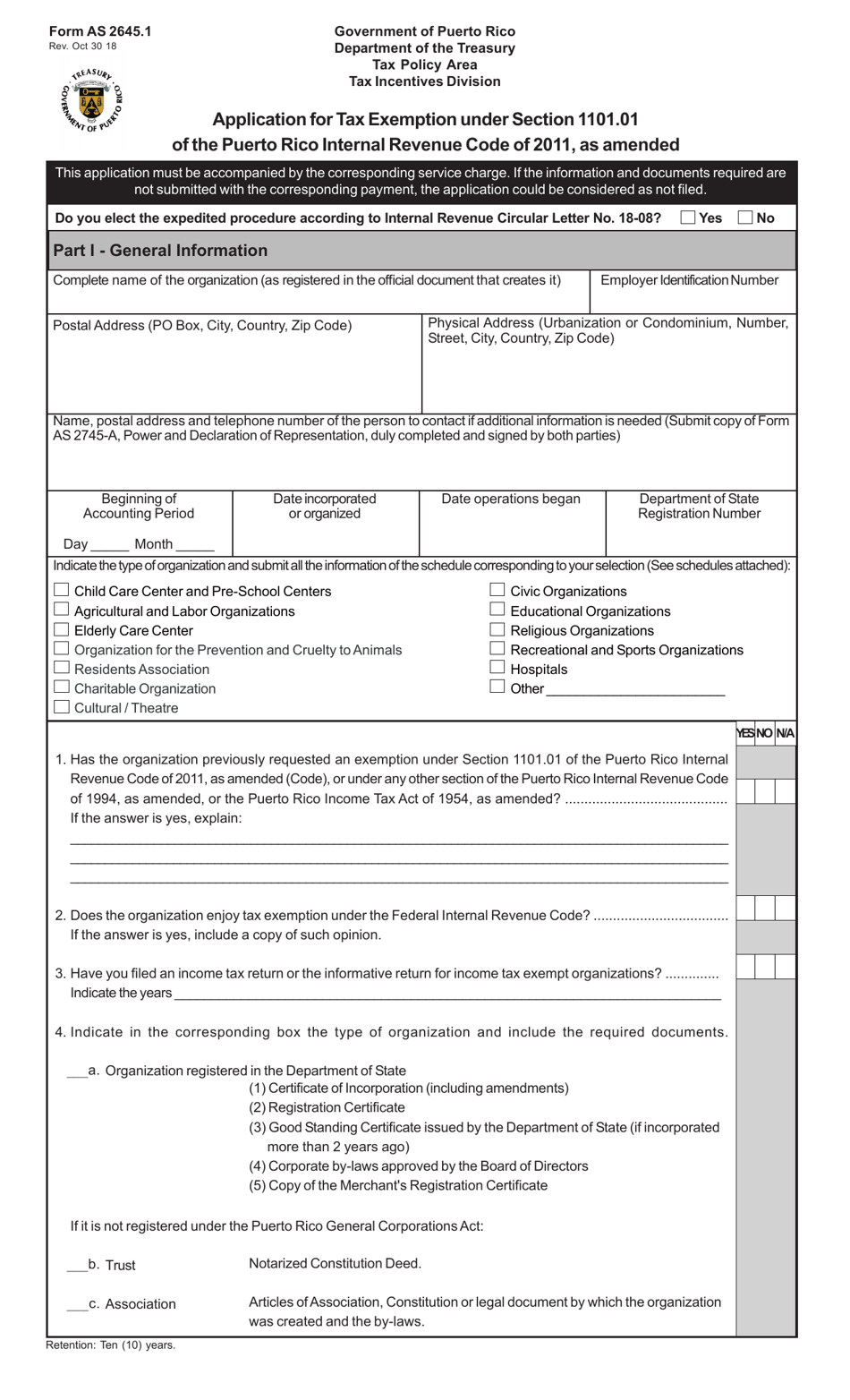

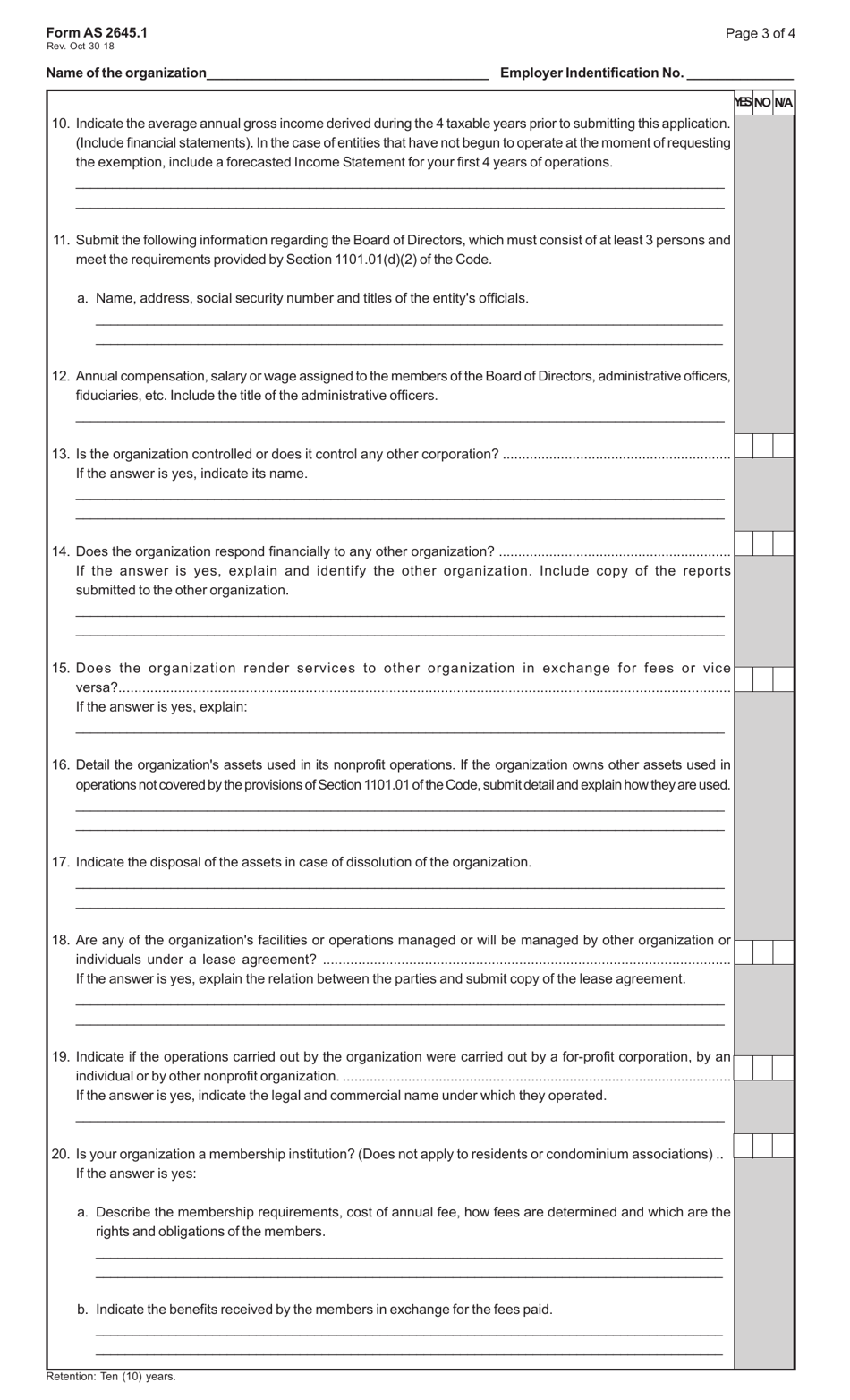

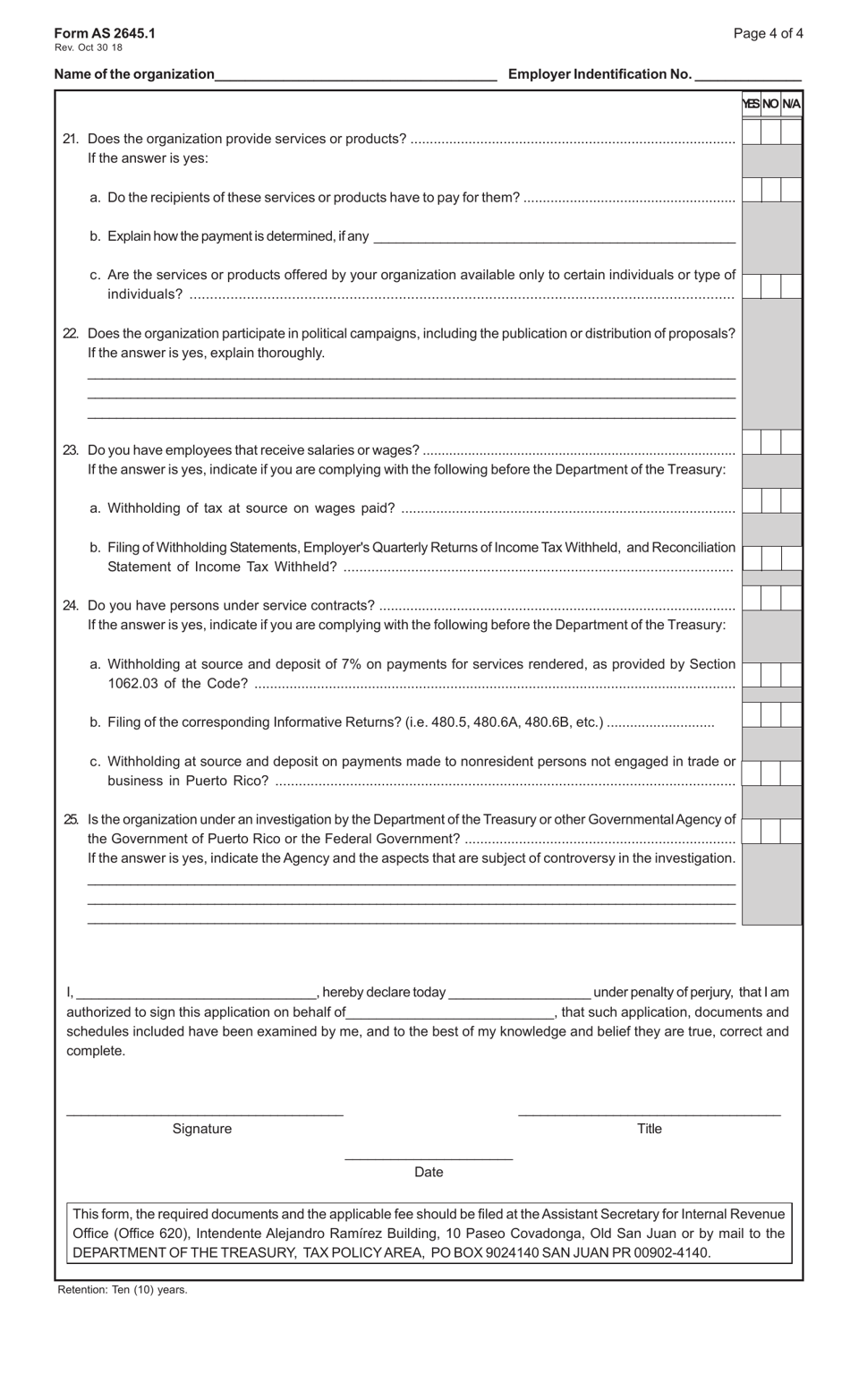

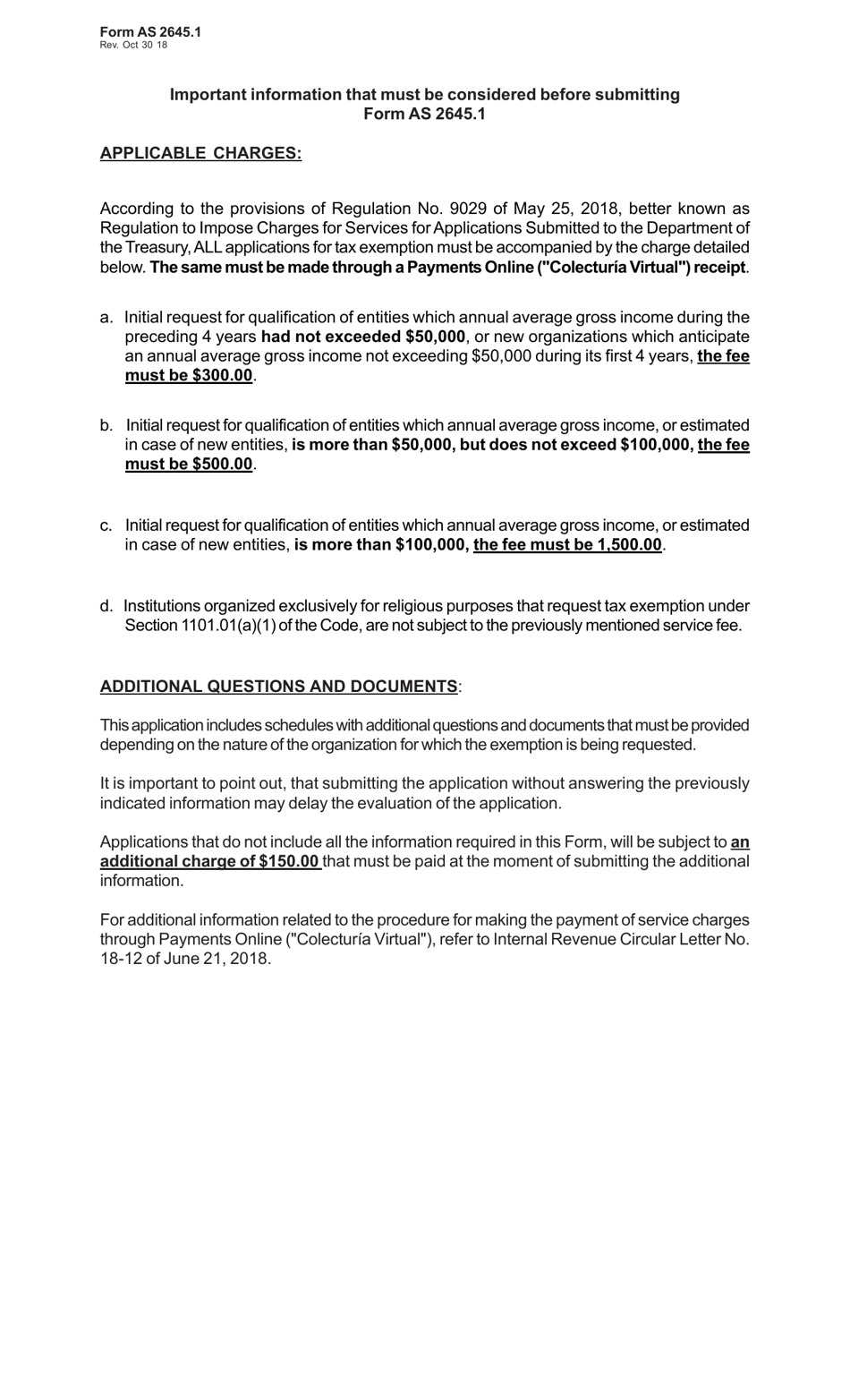

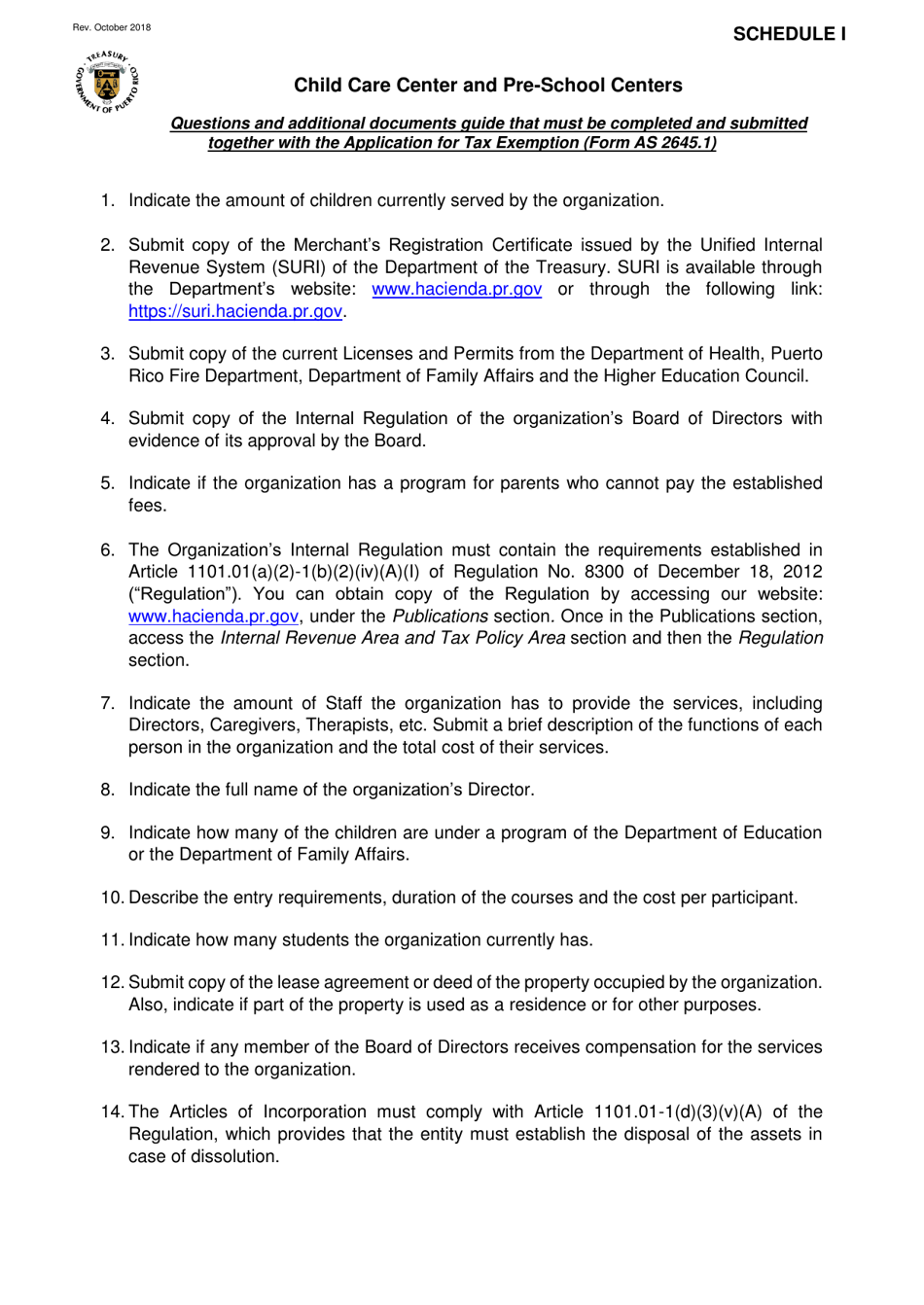

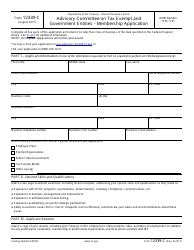

Form AS2645.1 Application for Tax Exemption Under Section 1101.01 of the Puerto Rico Internal Revenue Code of 2011, as Amended - Puerto Rico

What Is Form AS2645.1?

This is a legal form that was released by the Puerto Rico Department of Treasury - a government authority operating within Puerto Rico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AS2645.1?

A: Form AS2645.1 is an application for tax exemption under the Puerto Rico Internal Revenue Code.

Q: Who is eligible to use Form AS2645.1?

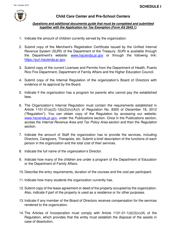

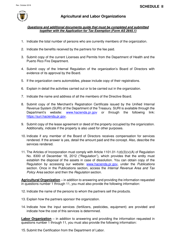

A: Individuals and organizations seeking tax exemption under Section 1101.01 of the Puerto Rico Internal Revenue Code can use this form.

Q: What is the purpose of Form AS2645.1?

A: The purpose of this form is to apply for tax exemption for certain activities, organizations, or projects in Puerto Rico.

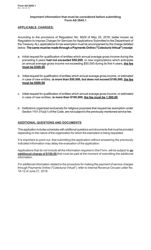

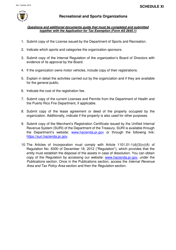

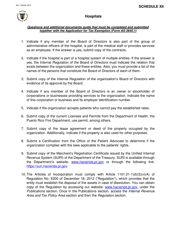

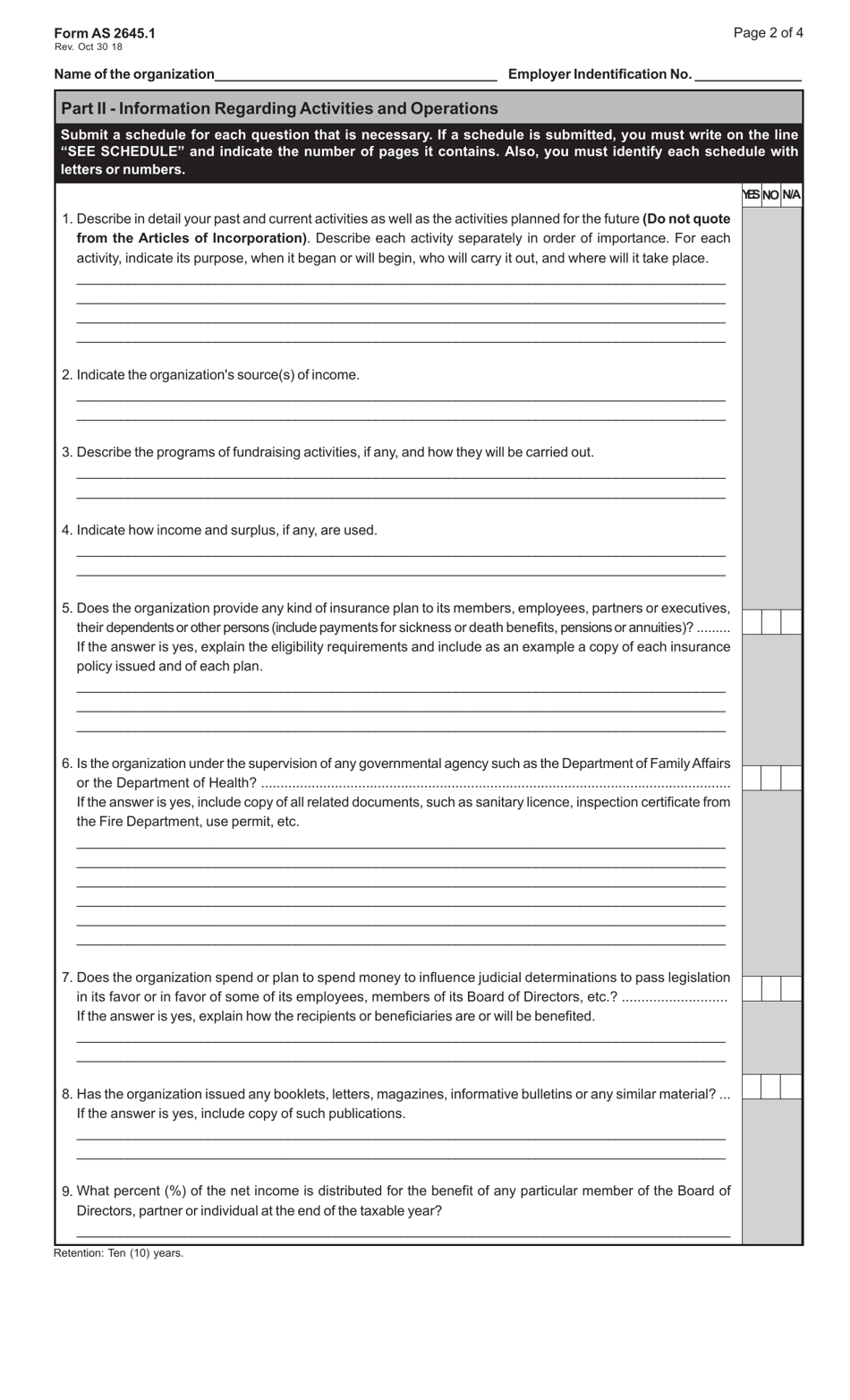

Q: What documents should be included with Form AS2645.1?

A: You need to provide supporting documents such as financial statements, articles of incorporation, bylaws, and other relevant information.

Q: What should I do with the completed Form AS2645.1?

A: Once completed, you should submit the form and supporting documents to the Puerto Rico Department of the Treasury.

Q: Is there a deadline for filing Form AS2645.1?

A: There is no specific deadline mentioned for filing this form. However, it is recommended to submit it in a timely manner.

Q: Can I apply for tax exemption retroactively using Form AS2645.1?

A: Yes, you can apply for tax exemption retroactively, but you will need to provide a detailed explanation and justification for the request.

Q: How long does it take to process Form AS2645.1?

A: The processing time can vary, but it typically takes several weeks to several months for the Puerto Rico Department of the Treasury to review and process the application.

Q: Can I seek professional assistance to complete Form AS2645.1?

A: Yes, you can seek the assistance of a tax professional or accountant to help you accurately complete and submit the form.

Form Details:

- Released on October 30, 2018;

- The latest edition provided by the Puerto Rico Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AS2645.1 by clicking the link below or browse more documents and templates provided by the Puerto Rico Department of Treasury.