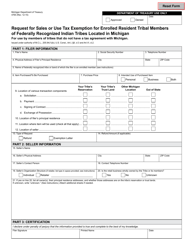

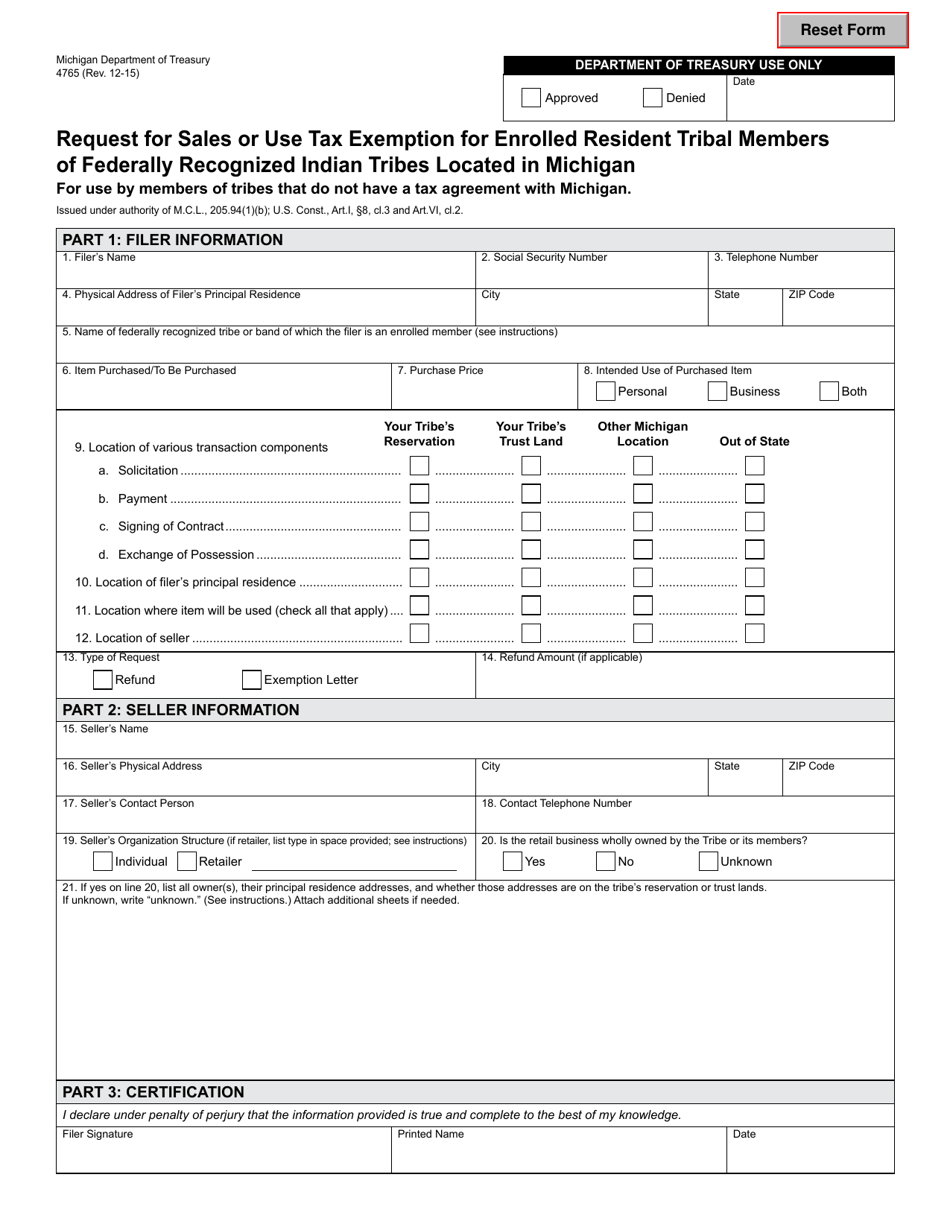

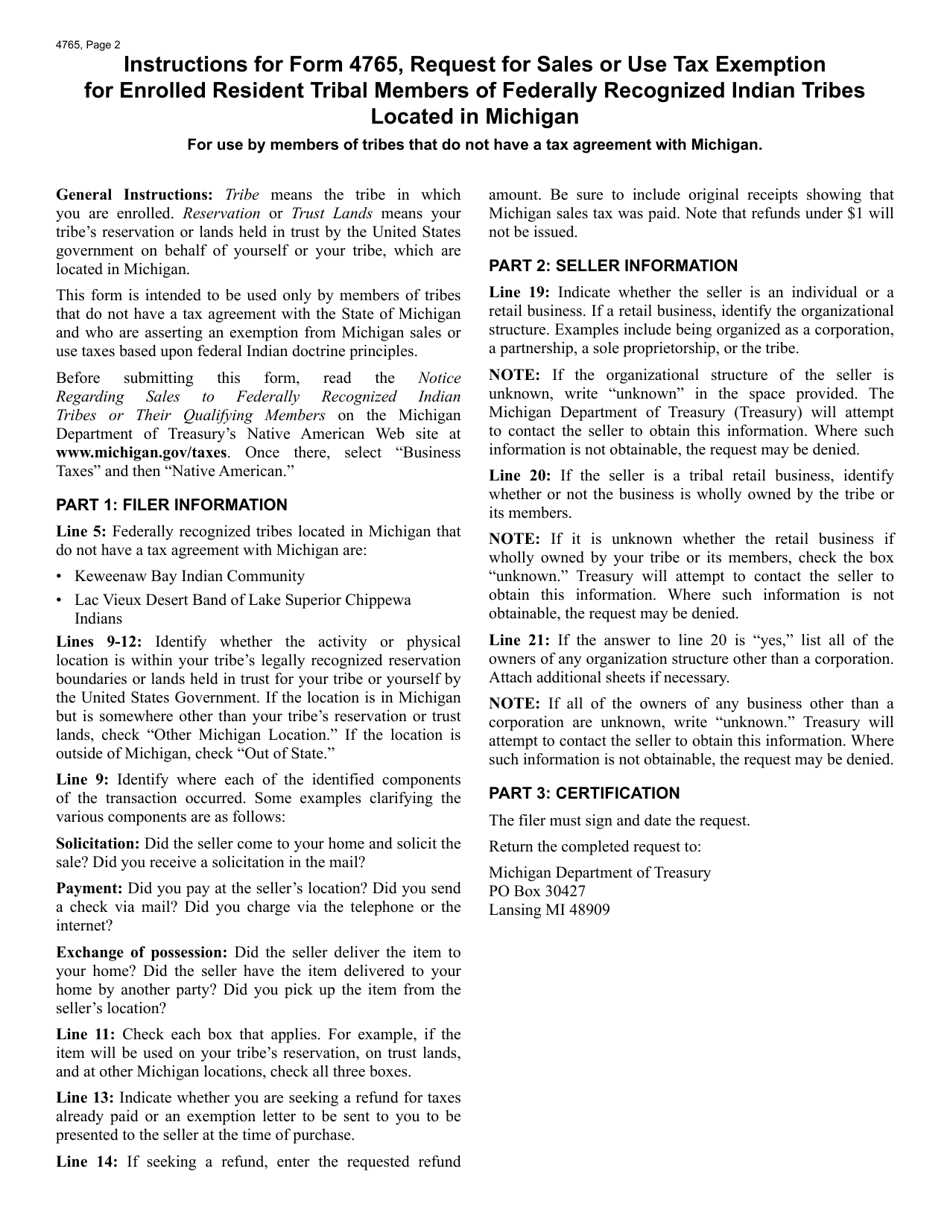

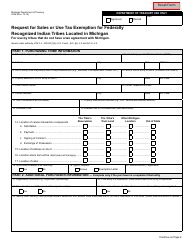

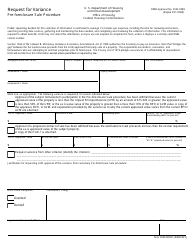

Form 4765 Request for Sales or Use Tax Exemption for Enrolled Resident Tribal Members of Federally Recognized Indian Tribes Located in Michigan - Michigan

What Is Form 4765?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4765?

A: Form 4765 is a form used to request sales or use tax exemption for enrolled resident tribal members of federally recognized Indian tribes located in Michigan.

Q: Who can use Form 4765?

A: Form 4765 can be used by enrolled resident tribal members of federally recognized Indian tribes located in Michigan who want to claim a sales or use tax exemption.

Q: What is the purpose of Form 4765?

A: The purpose of Form 4765 is to provide a means for enrolled resident tribal members to claim sales or use tax exemption in Michigan.

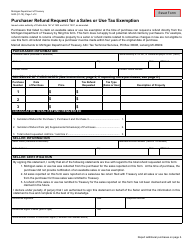

Q: How do I fill out Form 4765?

A: To fill out Form 4765, you will need to provide your personal information, tribal information, and details about the purchase or use of the exempt property.

Q: Is there a deadline for submitting Form 4765?

A: Yes, Form 4765 must be submitted within 60 days of the purchase or use of the exempt property.

Q: Are there any conditions for claiming the exemption?

A: Yes, to claim the exemption, you must be an enrolled resident tribal member of a federally recognized Indian tribe located in Michigan and the property must be used for purposes specified in the form.

Q: What should I do with Form 4765 once it is filled out?

A: Once you have filled out Form 4765, you need to submit it to the Michigan Department of Treasury.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4765 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.