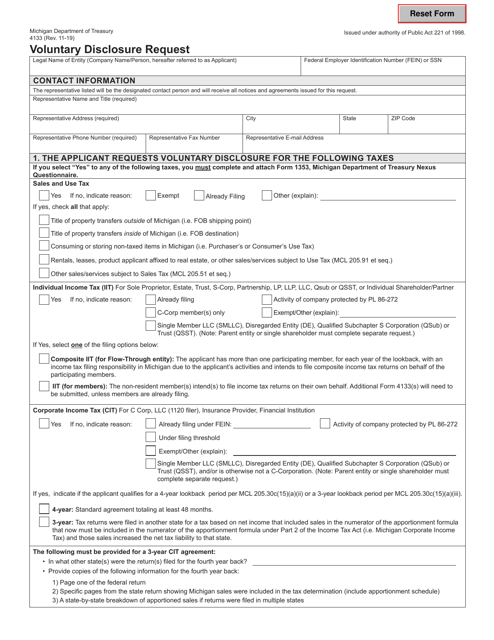

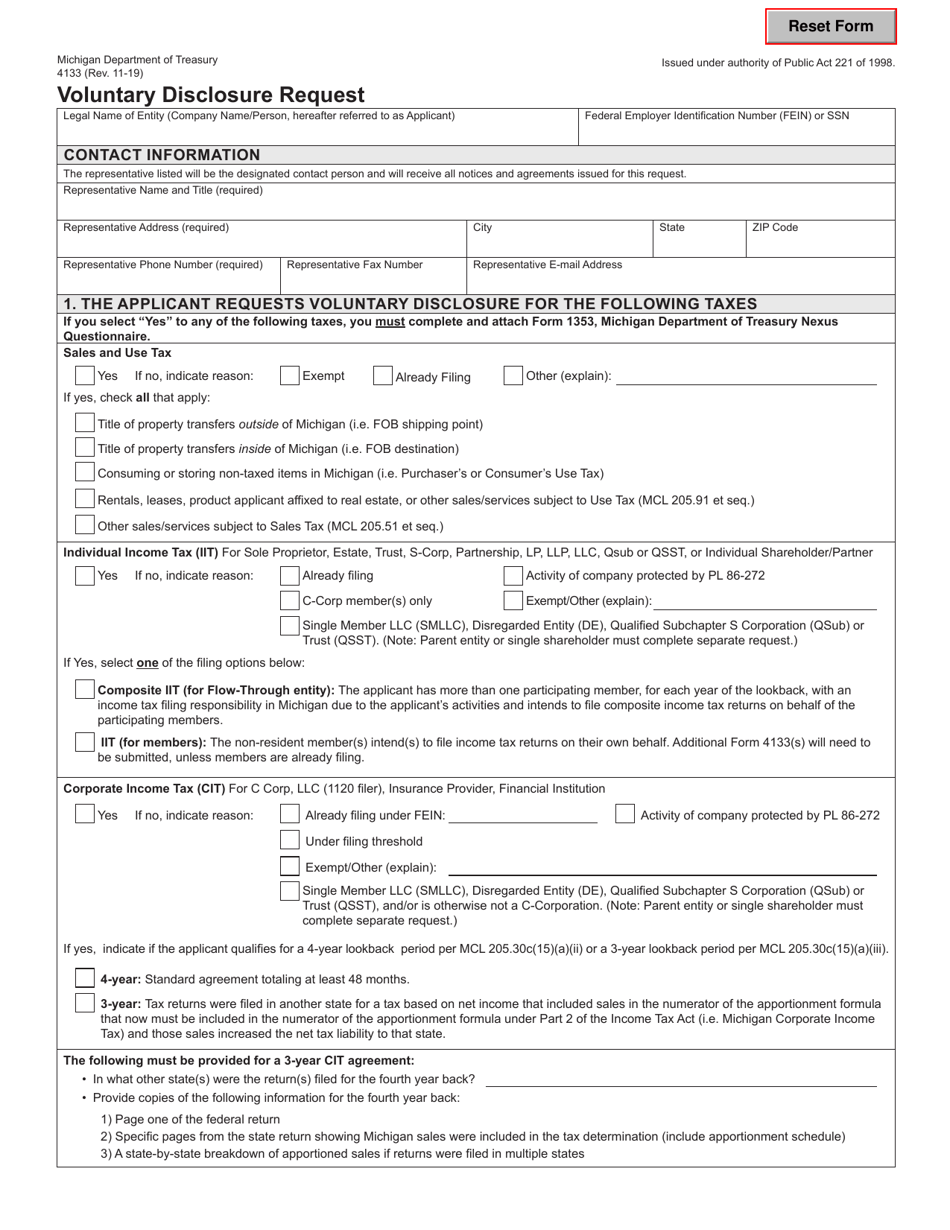

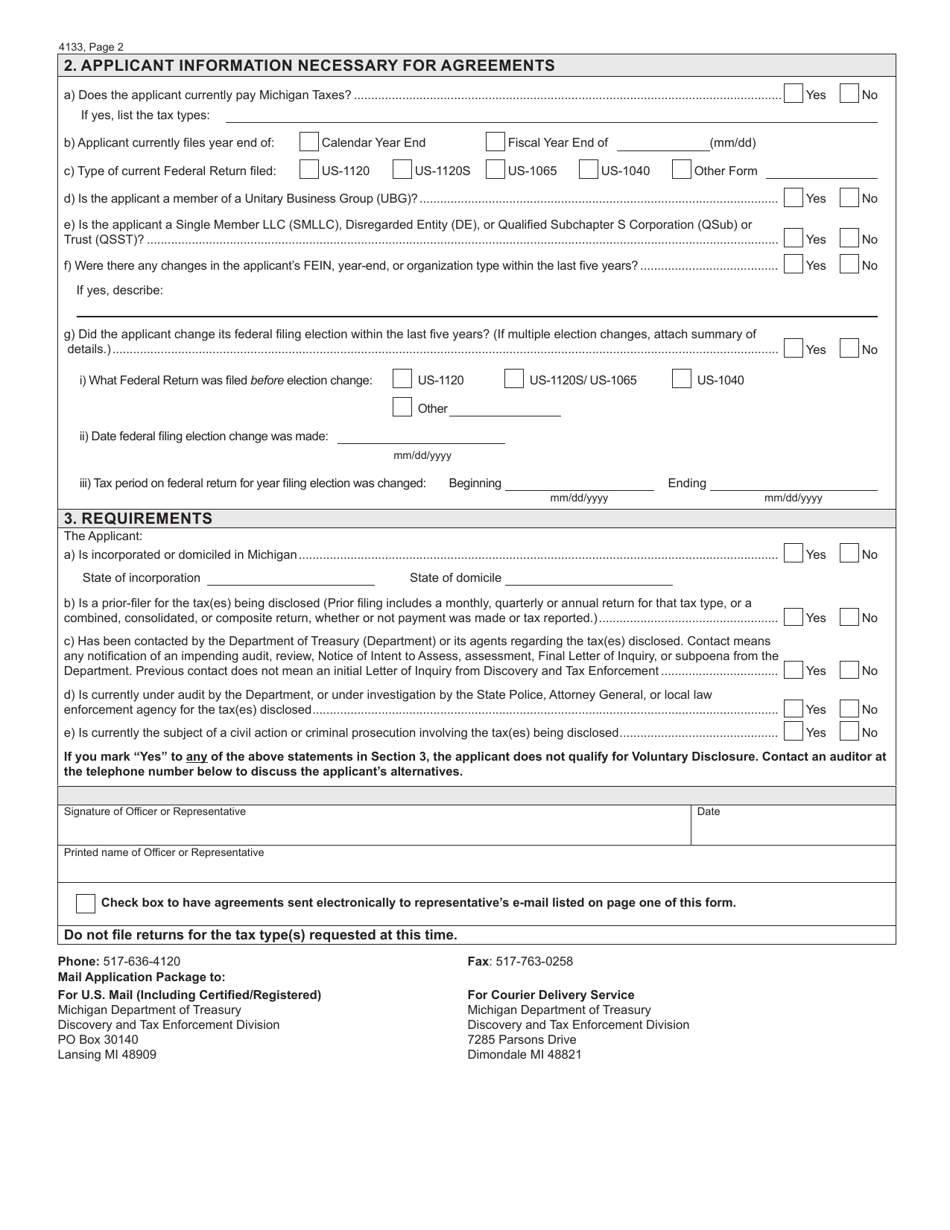

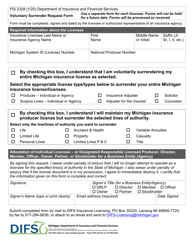

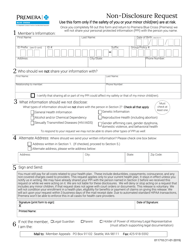

Form 4133 Voluntary Disclosure Request - Michigan

What Is Form 4133?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4133?

A: Form 4133 is a Voluntary Disclosure Request form in Michigan.

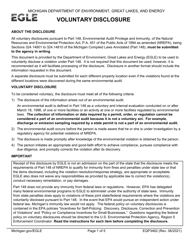

Q: What is a Voluntary Disclosure Request?

A: A Voluntary Disclosure Request is a formal request made by a taxpayer to the tax authorities to disclose previously unreported or underreported tax liabilities.

Q: Who can file Form 4133?

A: Any taxpayer who wants to disclose previously unreported or underreported tax liabilities in Michigan can file Form 4133.

Q: Why would someone file a Voluntary Disclosure Request?

A: A taxpayer may choose to file a Voluntary Disclosure Request to avoid penalties or legal consequences for unreported or underreported tax liabilities.

Q: Are there any benefits to filing a Voluntary Disclosure Request?

A: Yes, by voluntarily disclosing tax liabilities, taxpayers can often receive reduced penalties or the opportunity to enter into a payment plan.

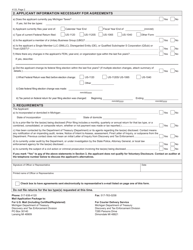

Q: What information is required on Form 4133?

A: Form 4133 requires the taxpayer to provide detailed information about the previously unreported or underreported tax liabilities, including the tax year, type of tax, and the amount owed.

Q: Can I file Form 4133 anonymously?

A: No, Form 4133 requires the taxpayer to provide their contact information.

Q: What happens after filing Form 4133?

A: After filing Form 4133, the tax authorities will review the disclosure and determine the appropriate course of action, which may include assessing penalties or entering into a payment plan with the taxpayer.

Q: Are there any deadlines for filing Form 4133?

A: There are no specific deadlines for filing Form 4133, but it is recommended to file as soon as the taxpayer becomes aware of the unreported or underreported tax liabilities.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4133 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.