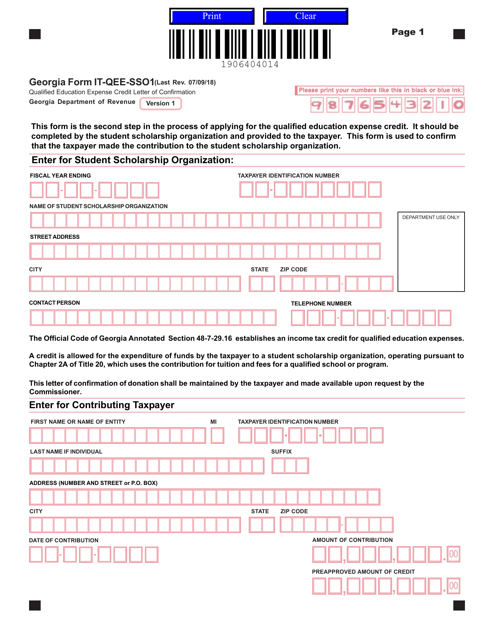

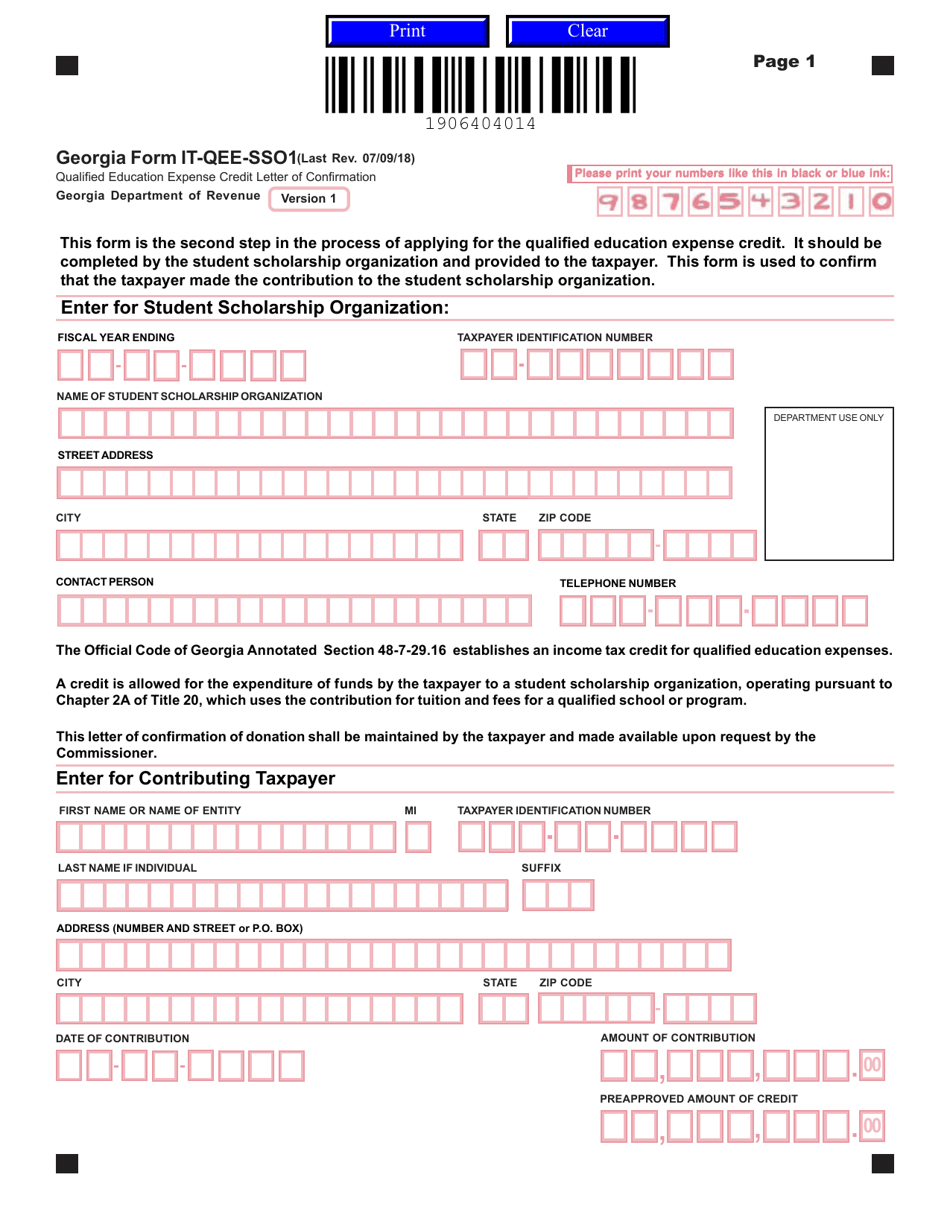

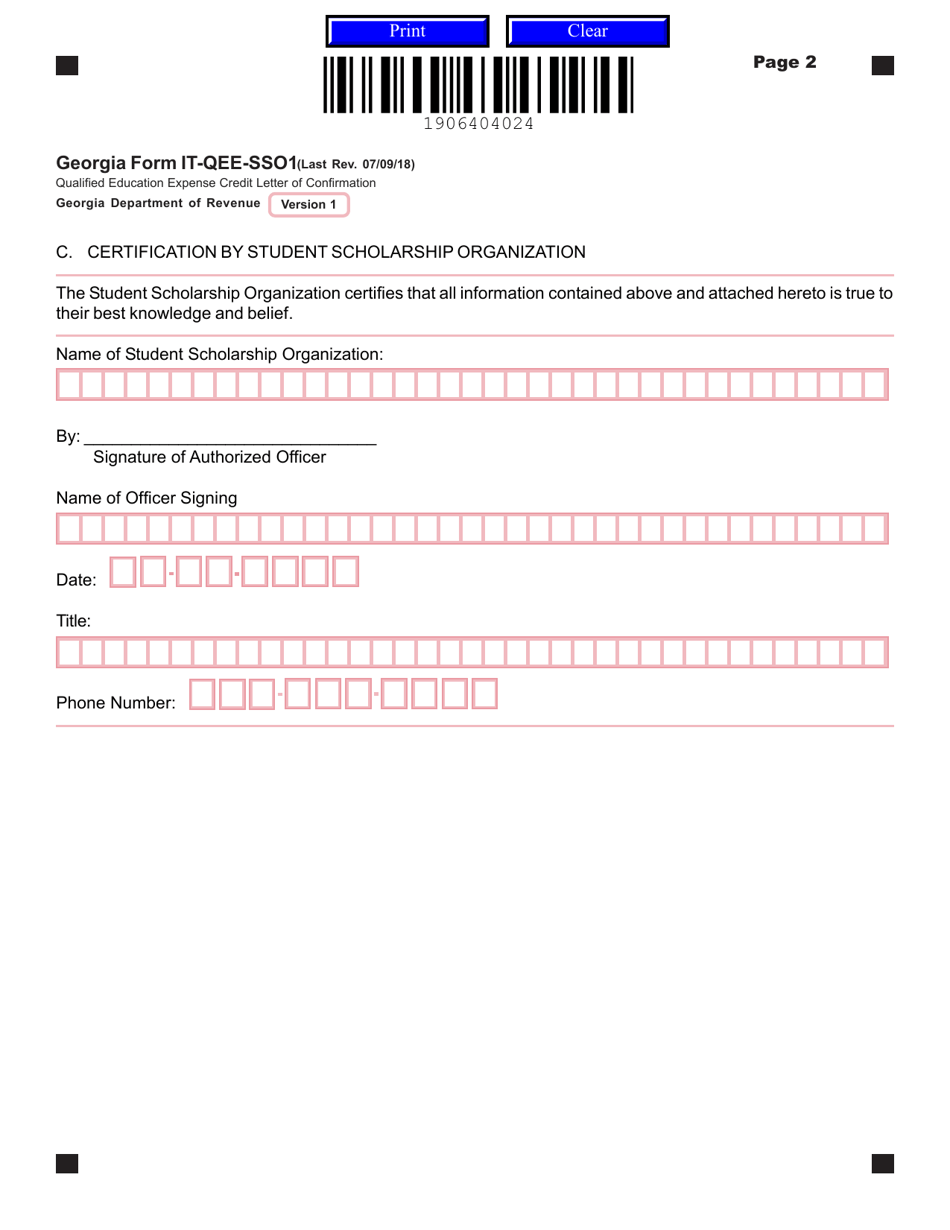

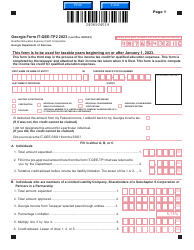

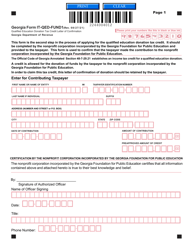

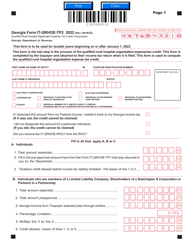

Form IT-QEE-SSO1 Qualified Education Expense Credit Letter of Confirmation - Georgia (United States)

What Is Form IT-QEE-SSO1?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-QEE-SSO1?

A: Form IT-QEE-SSO1 is a Qualified Education Expense Credit Letter of Confirmation, specific to Georgia in the United States.

Q: What is the purpose of Form IT-QEE-SSO1?

A: The purpose of Form IT-QEE-SSO1 is to confirm eligibility for the Qualified Education Expense Credit.

Q: Who is eligible for the Qualified Education Expense Credit?

A: Georgia residents who have made qualified education expense payments.

Q: What are qualified education expenses?

A: Qualified education expenses include tuition, fees, and other expenses related to K-12 education.

Q: Is the Qualified Education Expense Credit available in all states?

A: No, the Qualified Education Expense Credit is specific to Georgia and may not be available in other states.

Q: Are there any income limits or restrictions for claiming the Qualified Education Expense Credit?

A: Yes, there are income limits and other restrictions for claiming the Qualified Education Expense Credit. It is best to consult the instructions and guidelines provided with the form.

Form Details:

- Released on July 9, 2018;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-QEE-SSO1 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.