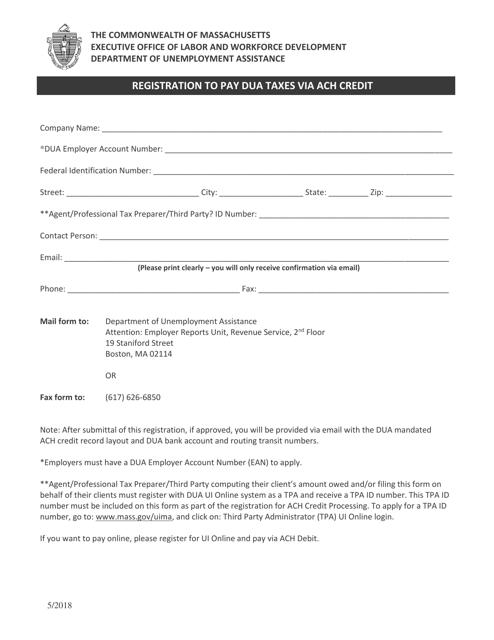

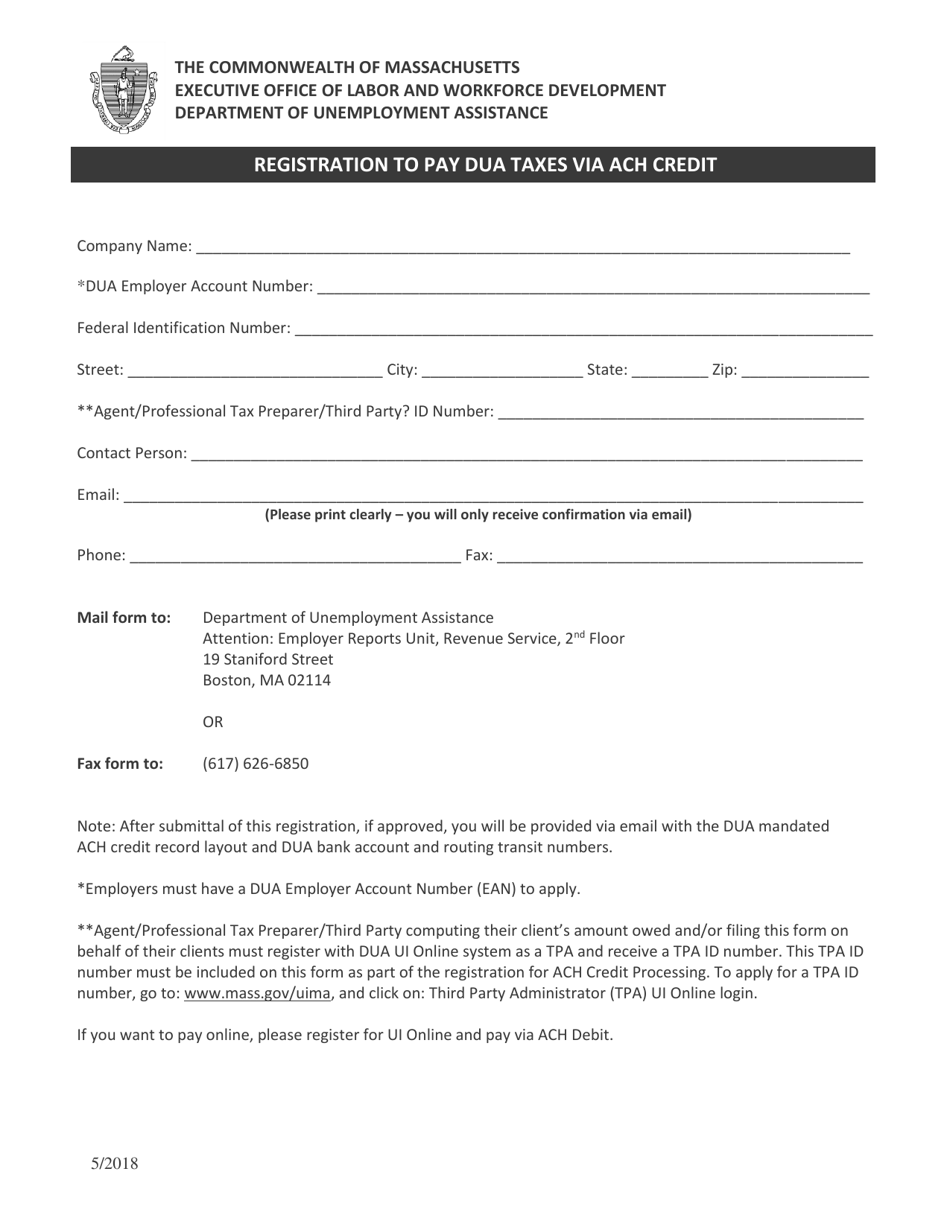

Registration to Pay Dua Taxes via ACH Credit - Massachusetts

Registration to Pay Dua Taxes via ACH Credit is a legal document that was released by the Massachusetts Department of Unemployment Assistance - a government authority operating within Massachusetts.

FAQ

Q: What is ACH Credit?

A: ACH Credit stands for Automated Clearing House Credit. It is an electronic transfer of funds from one bank account to another.

Q: What are Dua Taxes?

A: Dua Taxes are taxes that are required to be paid in Massachusetts. They include taxes related to unemployment compensation.

Q: Why would I choose to pay Dua Taxes via ACH Credit?

A: Paying Dua Taxes via ACH Credit provides a convenient and secure method of payment, and eliminates the need for paper checks.

Q: Is there a fee for paying Dua Taxes via ACH Credit?

A: No, there is no additional fee for paying Dua Taxes via ACH Credit.

Q: Can I use ACH Credit to pay taxes in other states?

A: ACH Credit availability for paying taxes may vary by state. It is best to check with the tax authorities in the state where you need to pay taxes.

Q: Can I cancel or change a payment made via ACH Credit?

A: Once a payment has been submitted via ACH Credit, it cannot be canceled or changed. It is important to double-check your payment details before submitting.

Q: Is ACH Credit the only way to pay Dua Taxes?

A: No, there are other payment options available, such as credit card, debit card, and electronic funds withdrawal.

Form Details:

- Released on May 1, 2018;

- The latest edition currently provided by the Massachusetts Department of Unemployment Assistance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Unemployment Assistance.