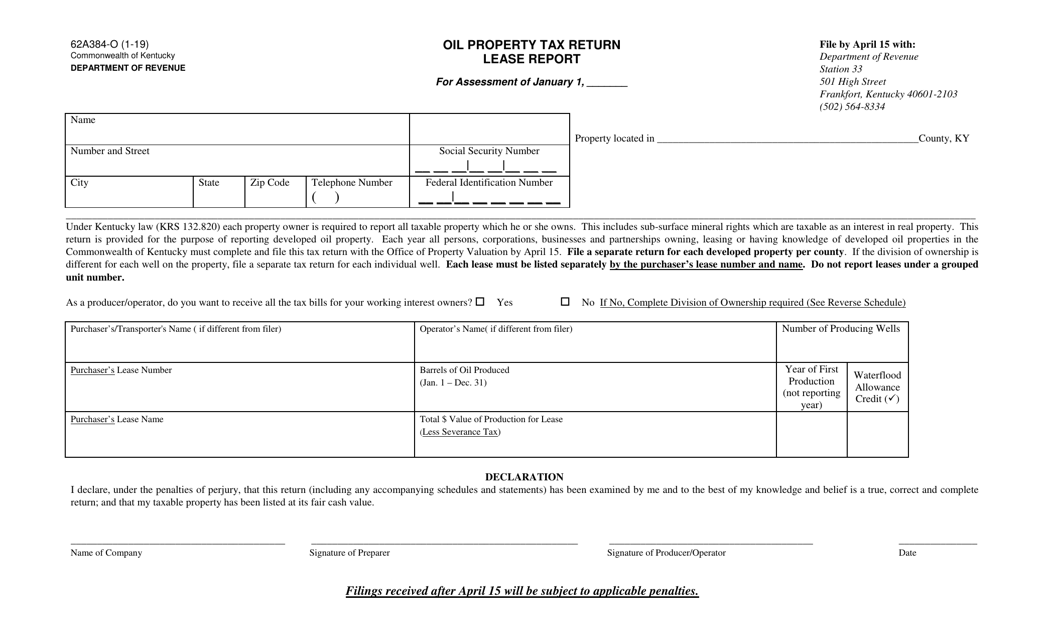

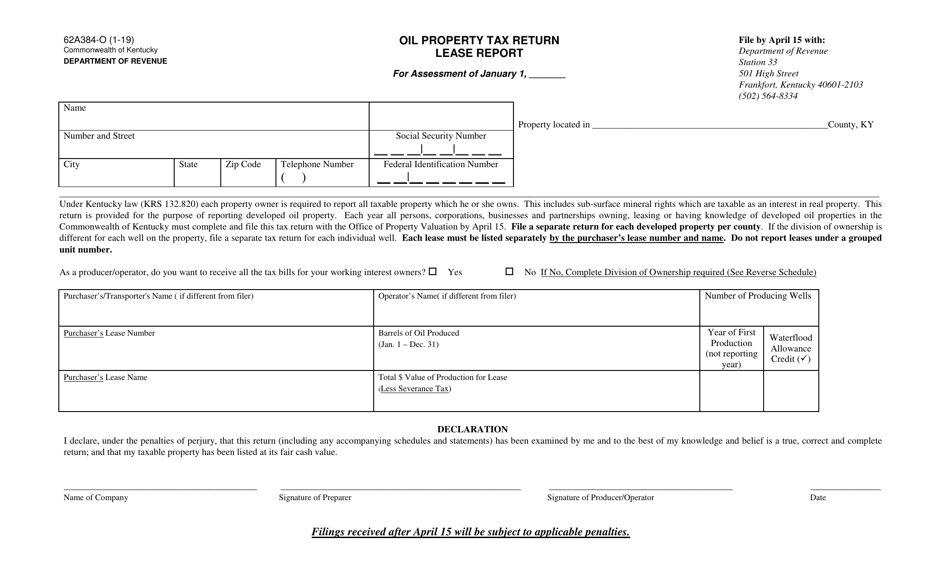

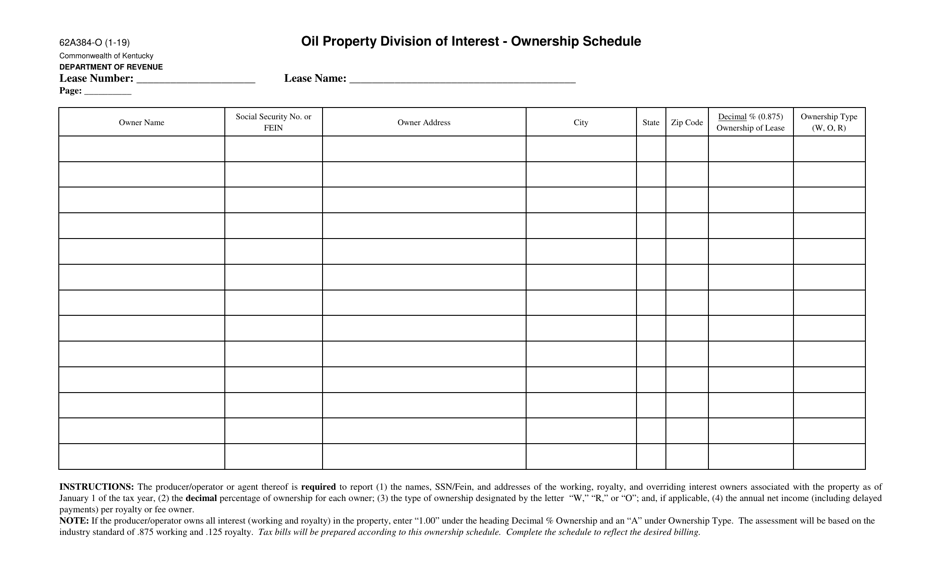

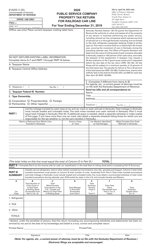

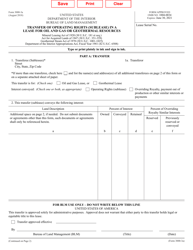

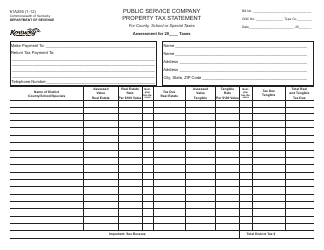

Form 62A384-O Oil Property Tax Return Lease Report - Kentucky

What Is Form 62A384-O?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 62A384-O?

A: Form 62A384-O is the Oil Property Tax Return Lease Report in Kentucky.

Q: Who needs to file Form 62A384-O?

A: The owners or operators of oil properties in Kentucky need to file Form 62A384-O.

Q: What is the purpose of Form 62A384-O?

A: The purpose of Form 62A384-O is to report lease information and calculate the tax liability on oil properties in Kentucky.

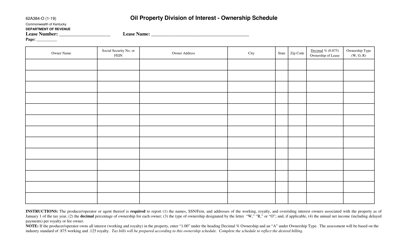

Q: What information is required on Form 62A384-O?

A: Form 62A384-O requires information such as lease number, production information, lease holder information, and tax calculations.

Q: When is Form 62A384-O due?

A: Form 62A384-O is due on or before the 20th day of the month following the end of the quarter.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 62A384-O by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.